Is Bitcoin’s Value Surge A Legitimate Bull Operate or a Misleading Lure?

- Remarkable news for Bitcoin: The 200-day shifting typical has strike an all-time superior, signaling positive developments ahead!

- On the other hand, short-expression challenges are current, as some metrics trace at bearish signals.

Bitcoin fanatics, rejoice! Bitcoin [BTC] has shown extraordinary resilience as soon as yet again, bouncing back again strongly from latest lows.

In spite of a slight dip of just about 14% from its peak in March previously mentioned $73,000, the flagship cryptocurrency is now on a route to a promising restoration.

In the past week, Bitcoin briefly broke the $64,000 mark just before stabilizing at $63,635 at present.

Even with a modest .9% fall in the very last 24 several hours, the total sentiment stays optimistic for Bitcoin’s potential outlook.

Bitcoin: The Bullish Signals

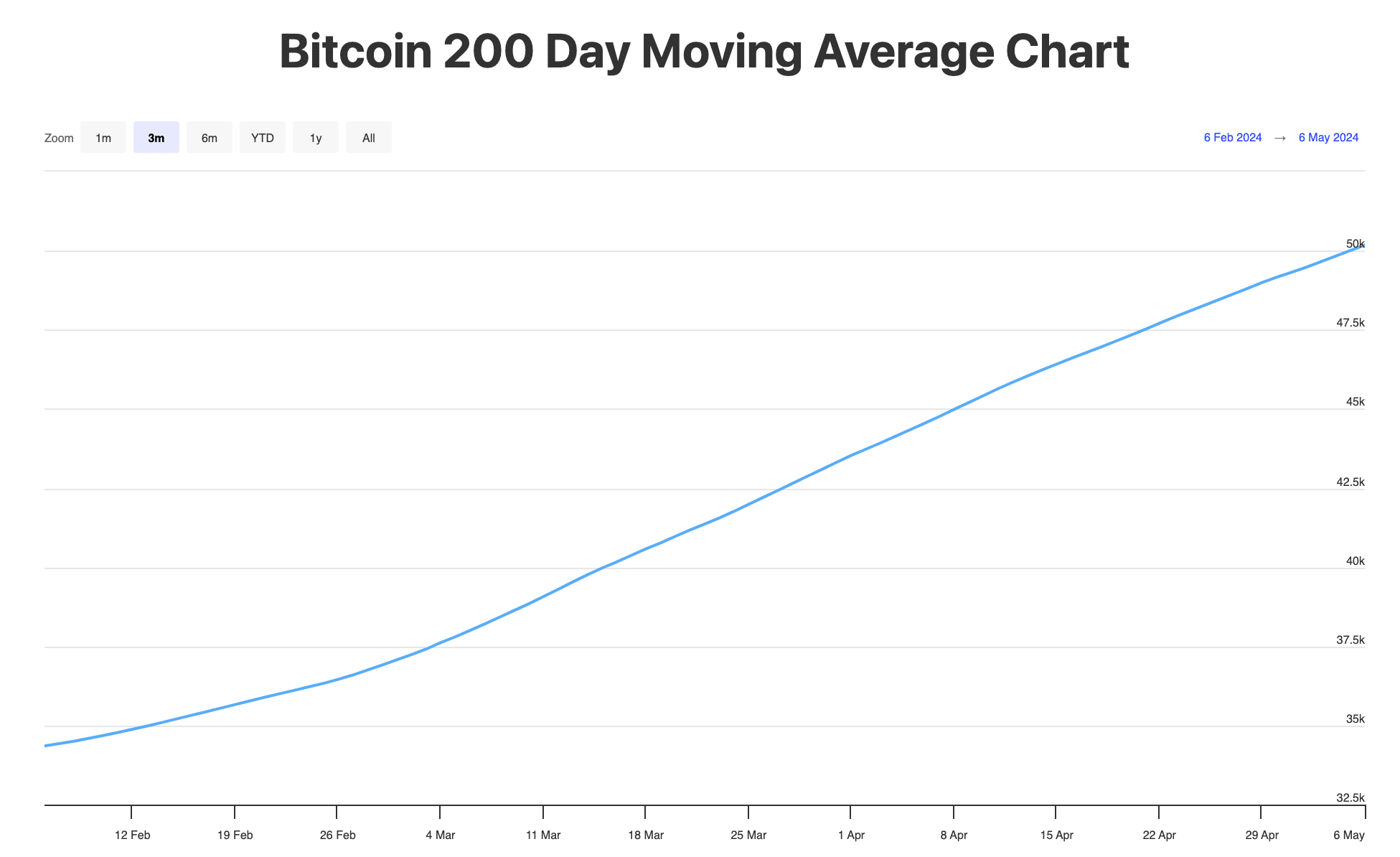

Among these fluctuations, the Bitcoin 200-working day transferring average—a essential indicator for extensive-expression sector trends—has achieved an unparalleled higher of $50,178.

This important milestone, as analyzed by BuyBitcoinWorldwide, details toward a probably bullish future for Bitcoin.

Source: BuyBitcoinWorldwide

The 200-day easy going normal (SMA) offers a clearer photo of the current market pattern by smoothing out everyday selling price fluctuations.

Currently, Bitcoin’s price is higher than this important indicator, indicating a bullish long-time period momentum.

In line with this beneficial outlook, Bitcoin enthusiast Anthony Pompliano has also emphasized the importance of the indicator surpassing $50,000 throughout an look on CNBC’s Squawk Box.

Pompliano pressured the continual upward development of Bitcoin in spite of its notorious volatility, stating in a tweet,

“Don’t underestimate Bitcoin’s prospective for progress. The lengthy-phrase prospective customers continue being potent.”

His sights resonate with the broader skilled consensus on Bitcoin’s enduring value proposition, in spite of occasional cost fluctuations.

Comprehending the Complexities

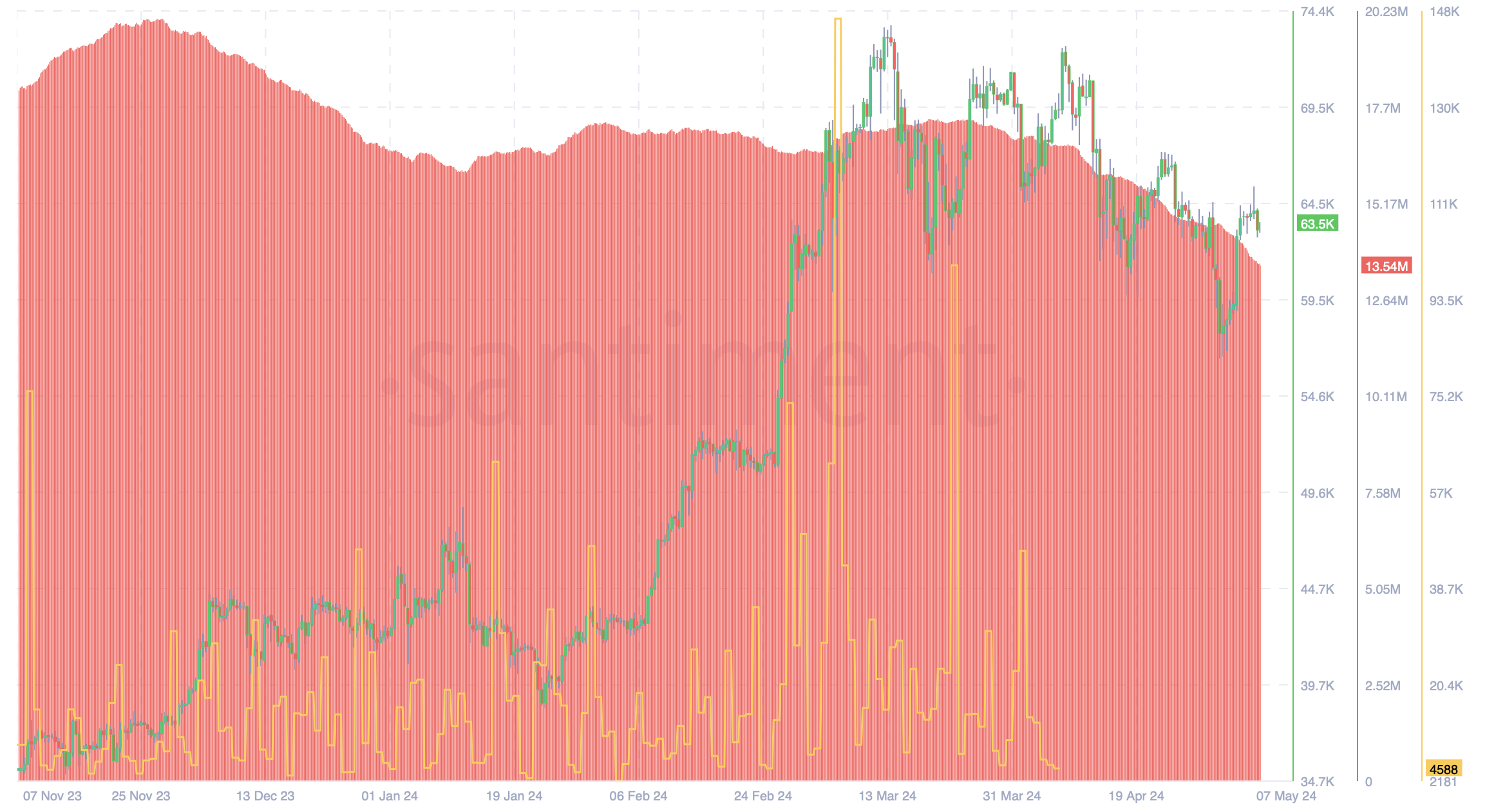

Whilst the prolonged-term indicators are constructive, a nearer look at Santiment’s information revealed a minimize in dormant Bitcoin circulation and energetic addresses in the latest months.

Supply: Santiment

The drop in dormant circulation, commencing in early March, suggests a cooling off among the lengthy-term holders, when the minimize in active addresses hints at decreased network action, adding a observe of warning.

Examine out our Bitcoin [BTC] Price Prediction 2024-25 for a lot more insights!

On a distinct observe, AMBCrypto not too long ago highlighted seasoned trader Josh Olszewicz’s observations of probable hazards irrespective of Bitcoin’s new upswing.

Employing the Ichimoku Cloud, Olszewicz suggests that Bitcoin may possibly continue to face marketplace uncertainties, even following surpassing the $64,000 resistance level.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!