Do Visa and stablecoins genuinely compete with just about every other?

Have you heard about Visa’s most up-to-date insights into stablecoins and the mysterious users driving the transactions? Let us unravel the mystery jointly!

Stablecoins, the superheroes of the crypto globe promising balance and versatility, are facing an intriguing problem: who’s seriously using them? A current collaboration concerning Visa and Allium Labs has drop gentle on the actuality that much more than 90% of stablecoin transactions do not in fact arrive from real end users.

As for each Cuy Sheffield, the Ailtra Head at Visa, the overall transactions connected to stablecoins in the past 30 days primary up to April 24 soared to a whopping $2.65 trillion.

But here’s the capture: only a fraction amounting to $265 billion can be attributed to “organic payments action,” highlighting a substantial hole in between noted and authentic utilization.

Even with this disparity, the review pointed out a dependable rise in the amount of regular monthly lively stablecoin buyers, suggesting an enduring desire in these digital assets.

This raises an intriguing problem: if real buyers aren’t driving the bulk of transactions, then who is, and what implications does this maintain for the crypto sector?

Unraveling the Mysteries

Stablecoins are the amazing kids of cryptocurrencies intended to hold a regular benefit by pegging them to an underlying asset, usually a fiat currency like the U.S. dollar. This reliability helps make them captivating for various uses, from investing to day-to-day transactions.

On the other hand, a peek into Visa’s dashboard uncovers that a lot less than 10% of stablecoin transaction volumes stem from “natural payments exercise.”

A single significant cause for this hole is the prevalence of bots in the crypto realm. These automatic mechanisms can execute transactions quickly and in large volumes, distorting the notion of real person engagement and utilization patterns.

Moreover, the adaptable nature of blockchain networks adds another layer of complexity. Blockchain enables a broad array of use conditions, which includes automatic transactions, making it challenging to differentiate in between real user transactions and all those managed by automatic devices.

A different contributing variable to the mismatch in stablecoin transaction volumes is the double-counting of transactions.

For instance, converting $100 of stablecoin A to stablecoin B on any exchange may show up as $200 of recorded stablecoin quantity. This follow can inflate transaction volumes and develop a misleading picture of genuine stablecoin usage.

Visa and Allium Labs have used two filters to pinpoint these activities.

The filters involve a single-directional volume filter, focusing on the largest stablecoin quantity transferred inside a one transaction to eliminate redundant interior transactions from elaborate wise contract interactions.

Also, an inorganic person filter is in spot, thinking about transactions despatched by accounts initiating much less than 1000 stablecoin transactions and $10 million in transfer volume in excess of the preceding 30 times.

Regardless of the variance in complete transfer volumes and bot-altered transfer volumes, the analysis displays a continual uptick in the number of month to month energetic stablecoin end users. As of Apr. 24, there had been 27.5 million month to month active consumers across all chains, showcasing a dependable progress sample.

Deep Dive into USDC and USDT Traits

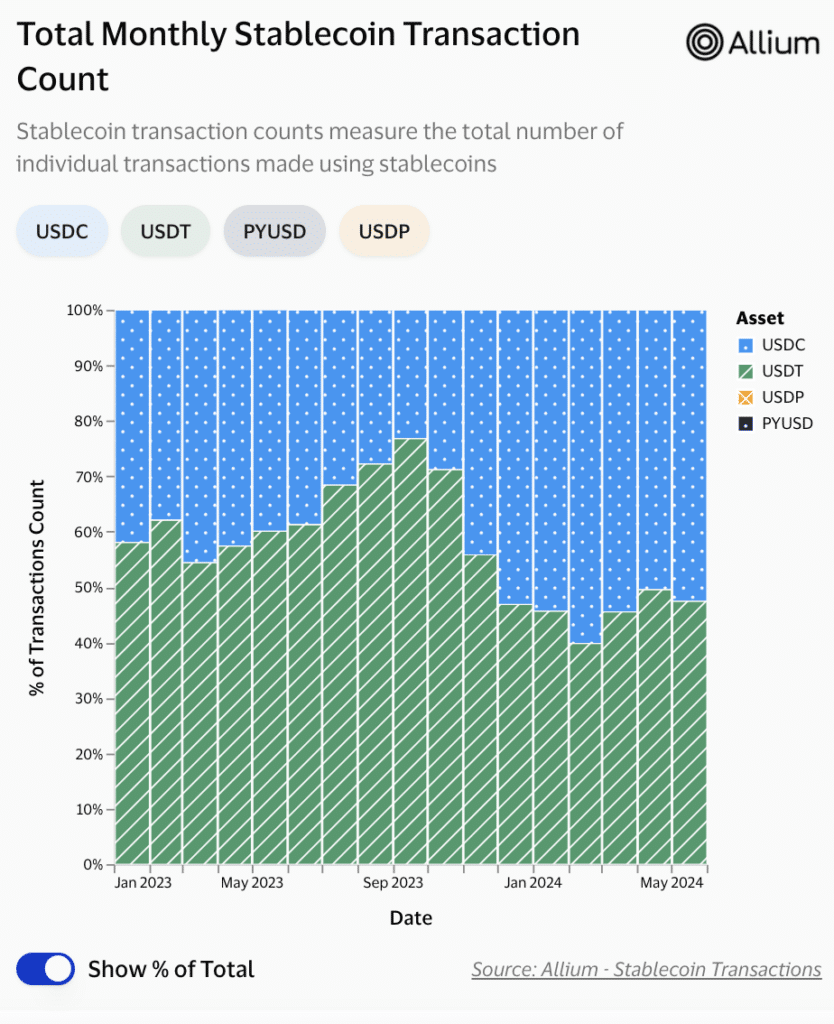

Visa’s assessment unveils a amazing surge in the usage of USD Coin (USDC) above the earlier eight months.

Again in September 2023, USDC represented 23% of all stablecoin transactions scrutinized by Visa.

Nevertheless, by the calendar year-conclude, this determine had additional than doubled, surpassing 50% of all stablecoin transactions. Because December 2023, USDC has regularly dominated stablecoin transactions, achieving up to 60% in February 2024.

This development contrasts with the industry capitalization of Tether (USDT) and USDC.

As of May possibly 7, USDT features a market cap of approximately $111 billion, substantially greater than USDC’s market cap a little bit exceeding $33 billion.

This discrepancy hints at USDT reigning as the major stablecoin in sector cap, but USDC’s operational utilization outpacing USDT.

Pranav Sood, the executive standard manager for EMEA at Airwallex, a payments system, mentioned that Visa’s findings reveal stablecoins are still in their early stages as payment devices. He highlighted the requirement for maximizing present-day payment programs for improved efficacy.

However, not all experts share the similar view as Visa.

Nick van Eck, the co-founder of Agora, a startup focusing on stablecoins, critiqued Visa’s methodology, suggesting that the details may perhaps contain buying and selling companies, genuine companies leveraging stablecoins, consequently distorting genuine person adoption perceptions.

Embracing the Rise of Stablecoins

Visa’s hottest revelations align with the burgeoning job of stablecoins in expediting cross-border payments.

For each Sacra, a sector investigation agency, the quantity of stablecoin transactions surged from $26 billion in January 2020 to an astounding $1.4 trillion in April 2024, likely surpassing Visa’s complete payments quantity in Q2 2024.

Sacra further highlighted that stablecoin transactions are processed within just minutes, contrasting the 6 to 9 several hours classic devices typically need.

In terms of charges, stablecoin transactions are far more charge-powerful, with service fees as minimal as $.0037 in comparison to the regular $12 cost for regular procedures.

In the meantime, key gamers like Wells Fargo, JPMorgan Chase, Visa, and Mastercard are delving into the realm of stablecoins to upgrade their payment infrastructure.

The major query that lingers is whether or not Visa’s studies serve as a factual commentary or if it’s a strategic shift to overshadow the competition.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!