Will Franklin Templeton’s Polygon expenditure improve MATIC’s prices?

- Thrilling news! Franklin Templeton has formally tokenized a $380 million US authorities money fund on the modern Polygon platform.

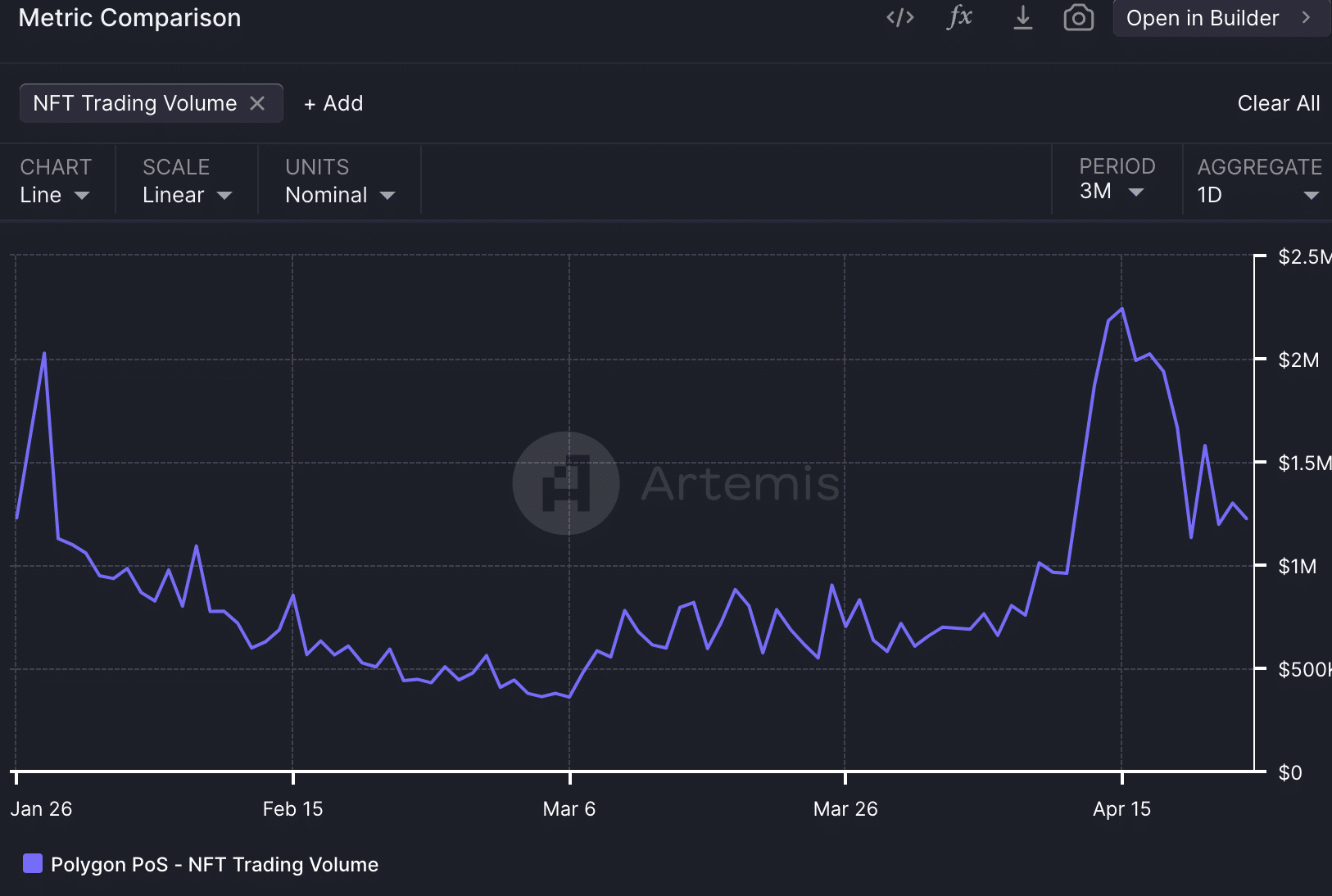

- On an additional take note, fascination in Polygon NFTs looks to have taken a downturn a short while ago.

It’s been an eventful 7 days for Polygon [MATIC], with optimistic selling price actions bringing a sense of optimism to the local community. The enthusiasm bordering Franklin Templeton’s steps has performed a important role in boosting confidence in Polygon’s potential.

Enter Institutional Desire

Franklin Templeton has designed waves by initiating the tokenization of a sizeable $380 million treasuries fund on each the Polygon and Stellar blockchains. This groundbreaking shift allows for direct peer-to-peer (P2P) transfers, doing away with the have to have for intermediaries.

The unveiling of the Franklin OnChain United States Government Dollars Fund (FOBXX) introduces shares in the variety of BENJI tokens. These tokens, commonly tradable on the public Polygon and Stellar blockchains, give buyers newfound flexibility in taking care of their belongings as a result of direct exchanges.

This ground breaking strategy is geared in direction of streamlining transactions and expanding accessibility, empowering traders to successfully control their property.

By having this daring action, the investment decision huge positions itself to right contend with BlackRock’s tokenization endeavors.

BlackRock not too long ago unveiled its BUIDL fund on Ethereum in partnership with Securitize, illustrating a shared commitment to revolutionizing classic finance mechanisms with blockchain solutions.

The decision by a popular financial investment firm to opt for Polygon for tokenization validates the platform’s progress likely.

This endorsement has the possible to enhance Polygon’s reliability and standing in the conventional finance sector, attracting far more institutional fascination and possibly main to the development of supplemental tokenized belongings on Polygon.

Furthermore, the seamless tradability of BENJI tokens on the Polygon blockchain can appreciably improve liquidity for the underlying treasuries fund.

This could attract more traders in search of exposure to governing administration securities, featuring them the benefits of faster and a lot more charge-efficient transactions on Polygon as opposed to standard economical devices.

Checking out the NFT Landscape

Even though there have been constructive developments, the Polygon ecosystem confronted a obstacle just lately as the NFT sector seasoned a substantial decline in investing quantity. This decline could influence community service fees, a important earnings stream for Polygon validators.

On top of that, lessened investing volume could lead to diminished liquidity for existing NFT jobs on Polygon, building it potentially far more tough for consumers to acquire or promote their NFTs promptly and at good costs.

Discover Polygon’s [MATIC] Value Prediction for 2024-2025

Resource: Artemis

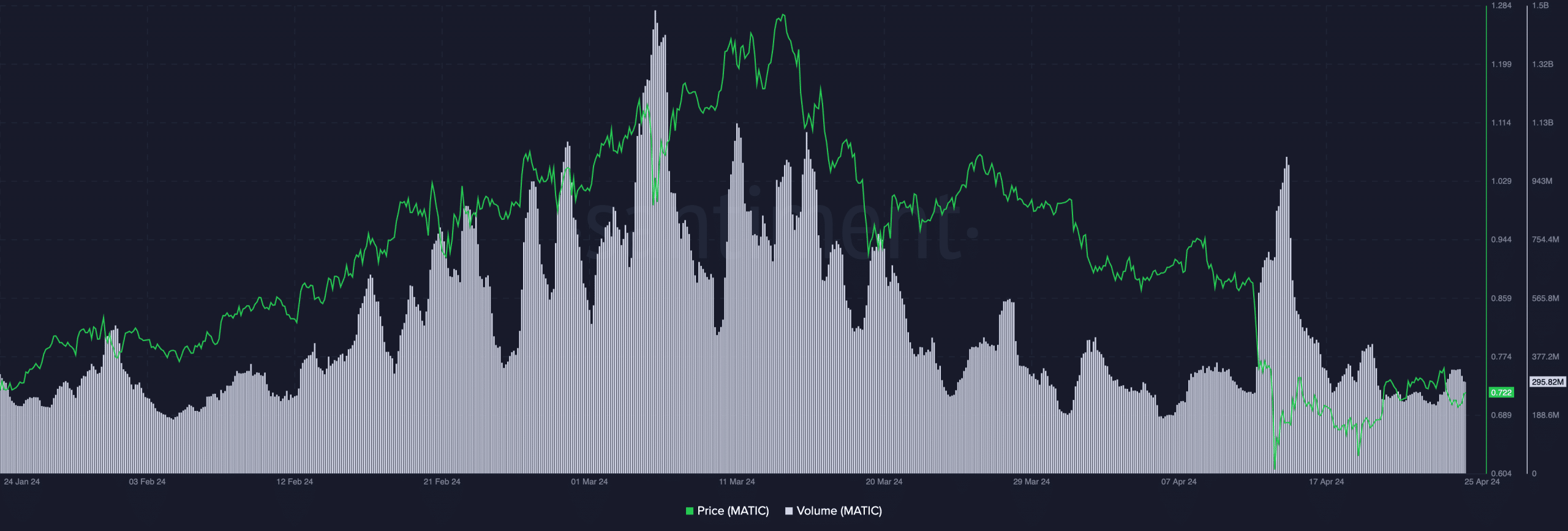

At the moment, MATIC is investing at $.7183, demonstrating a 2.43% increase in cost about the last 24 several hours. Having said that, the buying and selling volume has decreased by 16.34% during this period.

Resource: Santiment

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!