Analyzing the outlook for Bitcoin ETFs amid rising inflows into Grayscale GBTC

- Thrilling News: BTC ETFs in the U.S. expert a whole of $156 million in outflows past 7 days as the market place faced a downturn.

- GBTC, on the other hand, saw inflows for two consecutive days as the marketplace situations began to boost.

The latest U.S. Bitcoin [BTC] ETFs dealt with $156 million in outflows just final 7 days, but the tide may well be turning as Grayscale’s GBTC stopped bleeding. Fascinating developments in advance!

According to a specific report by CoinShares, the outflows from the preceding week were mostly attributed to the BTC rate falling under the regular purchasing price tag of the ETF issuers.

The report suggested that final week’s BTC drawdown could have been induced by automated market orders. Really the rollercoaster experience!

“We estimate the regular order value of these ETFs considering that launch to be US$62,200 per bitcoin as the cost fell 10% beneath that amount, it might have brought on computerized promote orders.”

BTC took a dip to $56.5K on May possibly Working day, leading to widespread stress and liquidations across the current market. All U.S. place BTC ETFs expert major outflows on that working day, with BlackRock’s IBIT looking at its initial outflow since January.

In general, the full outflows on May Working day amounted to $563.7 million, with Fidelity and Grayscale major the demand with outflows of $191.1 million and $167.4 million, respectively. A wild day without a doubt!

The good news is, the outflows tapered off to the end of the week, resulting in a complete outflow of $156 million for the 7 days, in accordance to the report. Let’s see what the upcoming holds!

Could GBTC’s Alter of Heart Push the Bitcoin ETF Restoration?

As BTC clawed its way again from $56.5K to $65K, the sector sentiment started to shift for the far better. Nevertheless, the real surprise arrived from Grayscale’s GBTC for the duration of this restoration interval.

Past Friday, GBTC observed its initially inflow of $63.9 million, followed by a further inflow of $3.9 million on Monday. What a turnaround!

Even Bloomberg analysts ended up caught off guard by Grayscale’s U-flip. Analyst Eric Balchunas shared his astonishment:

“But appears like inflows again right now, way too. They do have an extensive marketing and advertising finances. That, combined with the current rebound and no more individuals on the lookout to leave, could be why.”

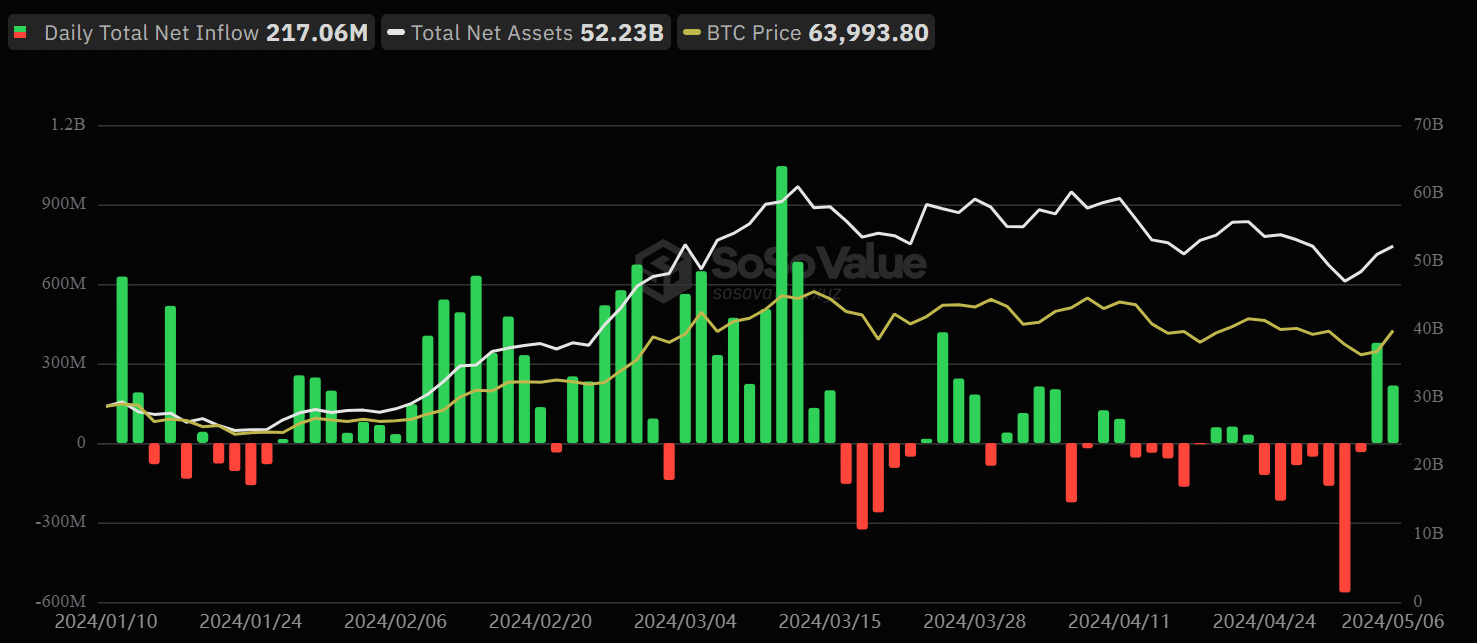

Resource: SoSo Value

The marketplace restoration sparked renewed trader fascination, with web inflows achieving $378.2 million previous Friday. The U.S. BTC ETFs taken care of their beneficial streak on Monday with a web inflow of $217 million. Exciting times forward!

As of now, BTC has settled back into its common selling price range of $60K to $71K but slipped underneath $64K just after tapping into liquidity at $65.5K. Let us see where the journey normally takes us!

If BTC’s upward momentum continues and reaches the range’s upper limit, U.S. BTC ETFs could reverse the past week’s $156 million outflows. Continue to be tuned for additional updates!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!