Will Grayscale Bitcoin ETF Inflows Force BTC Earlier mentioned $70K?

- Interesting information! Grayscale has observed beneficial BTC ETF inflows following in excess of 4 months.

- BTC is at this time investing earlier mentioned $64,000.

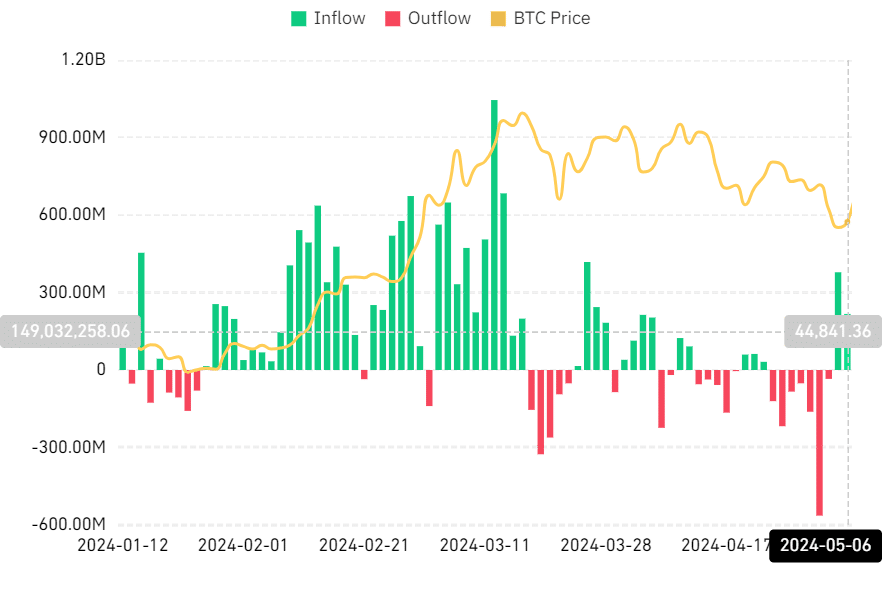

In new weeks, the place Bitcoin ETF has been experiencing continuous outflows, with the greatest outflow quantity recorded on Could 1st.

Likewise, Grayscale, with the largest Asset Less than Administration (AUM) and ETF market cap, also noticed outflows until finally a latest turnaround. Could this alter in ETF flow effect BTC’s price tag development?

Bitcoin ETF sees constructive inflow for the 2nd day

Assessment demonstrates that the Bitcoin ETF Internet Inflow has shifted to constructive territory immediately after various times of outflows.

From April 24th to Might 2nd, the location ETF seasoned outflows, achieving a peak outflow volume on May possibly 1st higher than $563 million.

Resource: Coinglass

Nevertheless, factors changed on May perhaps 5th with the first substantial inflow in weeks, totaling over $378 million.

This constructive trend continued on May well 6th with a consecutive influx of $217 million, marking Grayscale’s to start with influx in about four months.

Grayscale’s first Bitcoin ETF inflow in months

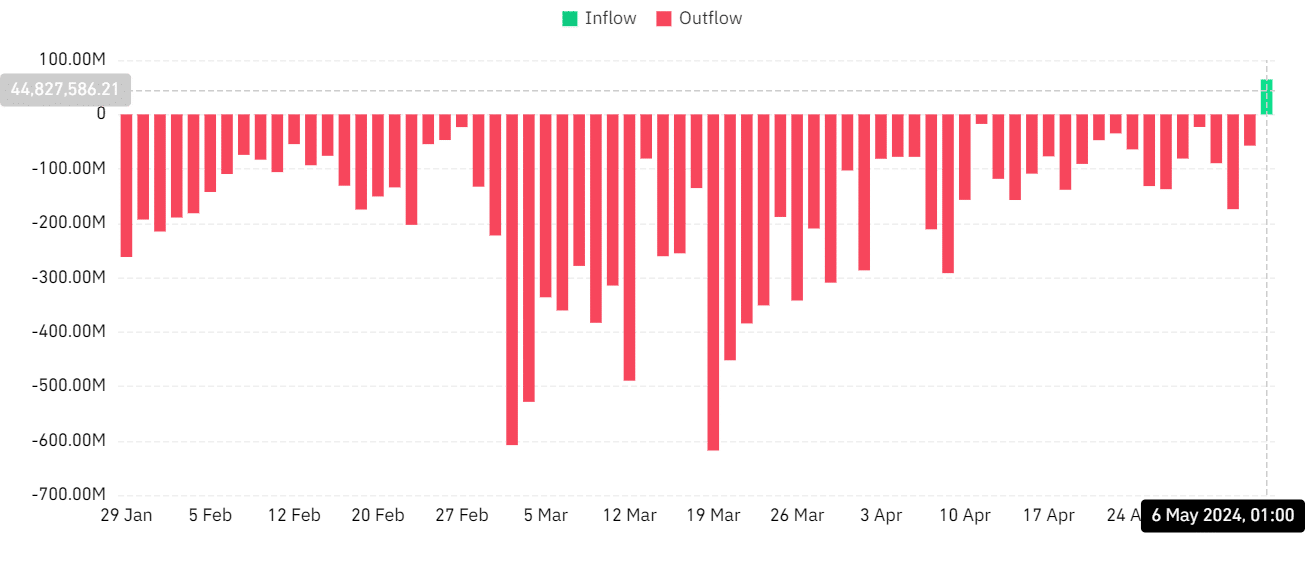

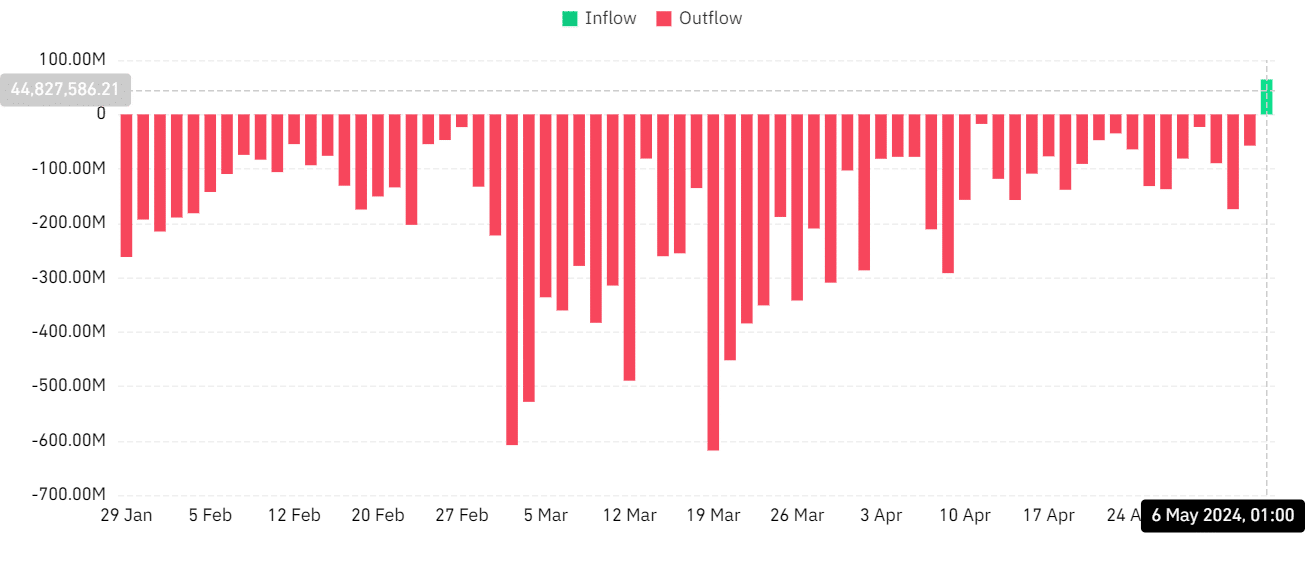

Data from Coinglass suggests a regular craze of outflows in the Grayscale Bitcoin ETF Netflow metric given that January.

With a place BTC ETF sector cap exceeding $18 billion, Grayscale also features the most significant Asset Below Management (AUM) in the field.

Resource: Coinglass

On May perhaps 6th, Grayscale knowledgeable a substantial shift with its first inflow, a $64 million increase, breaking the outflow streak.

Due to the fact transitioning to a tradable ETF, GBTC has noticed withdrawals of close to $17.46 billion, partly owing to repayments by battling crypto corporations.

Importance of ETF inflows

Inflows in a spot Bitcoin ETF symbolize trader funds influx into the ETF, escalating its AUM and signaling a higher interest in Bitcoin from traders.

Conversely, outflows suggest money leaving the ETF as traders promote their shares, lessening the ETF’s AUM.

Several elements contribute to outflows, including gain-using, portfolio changes, and reacting to industry alterations.

Impression on BTC’s selling price?

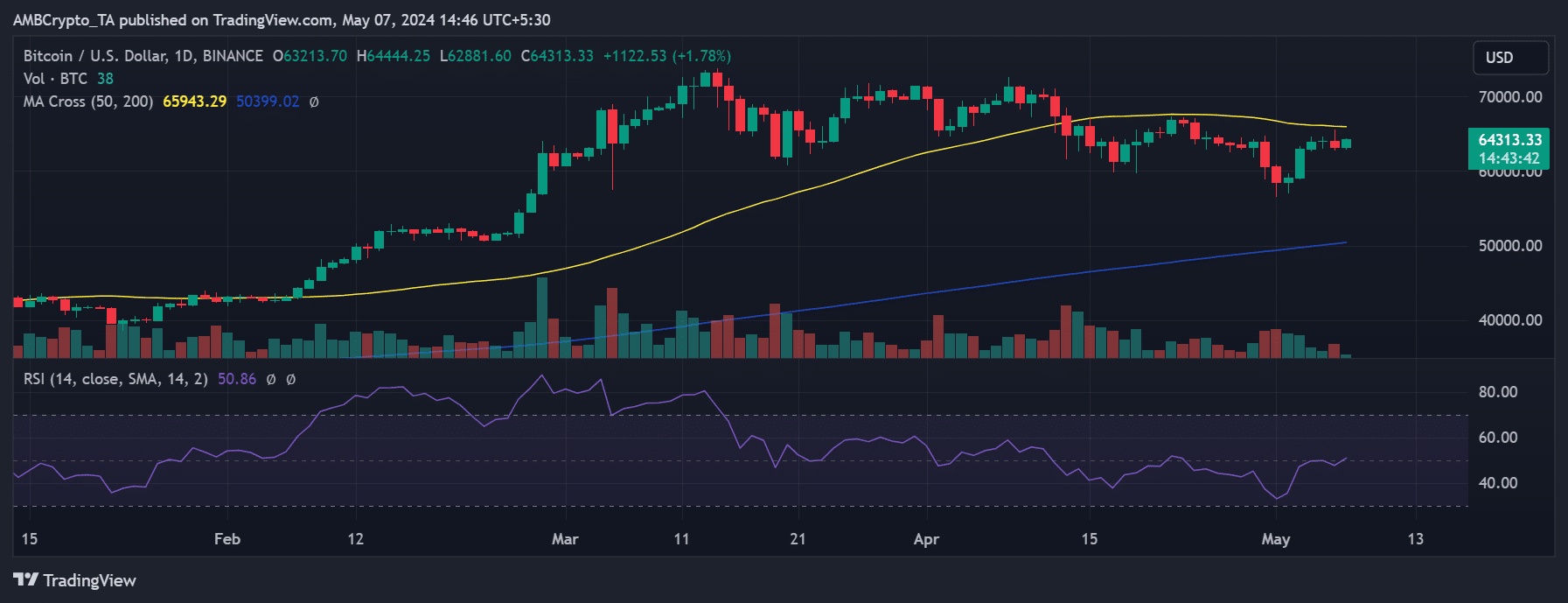

The the latest uptick in ETF inflows could advise renewed trader curiosity immediately after income-having, most likely boosting BTC’s price tag in the small expression.

Whilst ETF circulation improvements might have an impact on brief-time period rate fluctuations, they are just one particular piece of the broader price trajectory puzzle.

Investigate Bitcoin’s [BTC] Selling price Prediction 2024-25

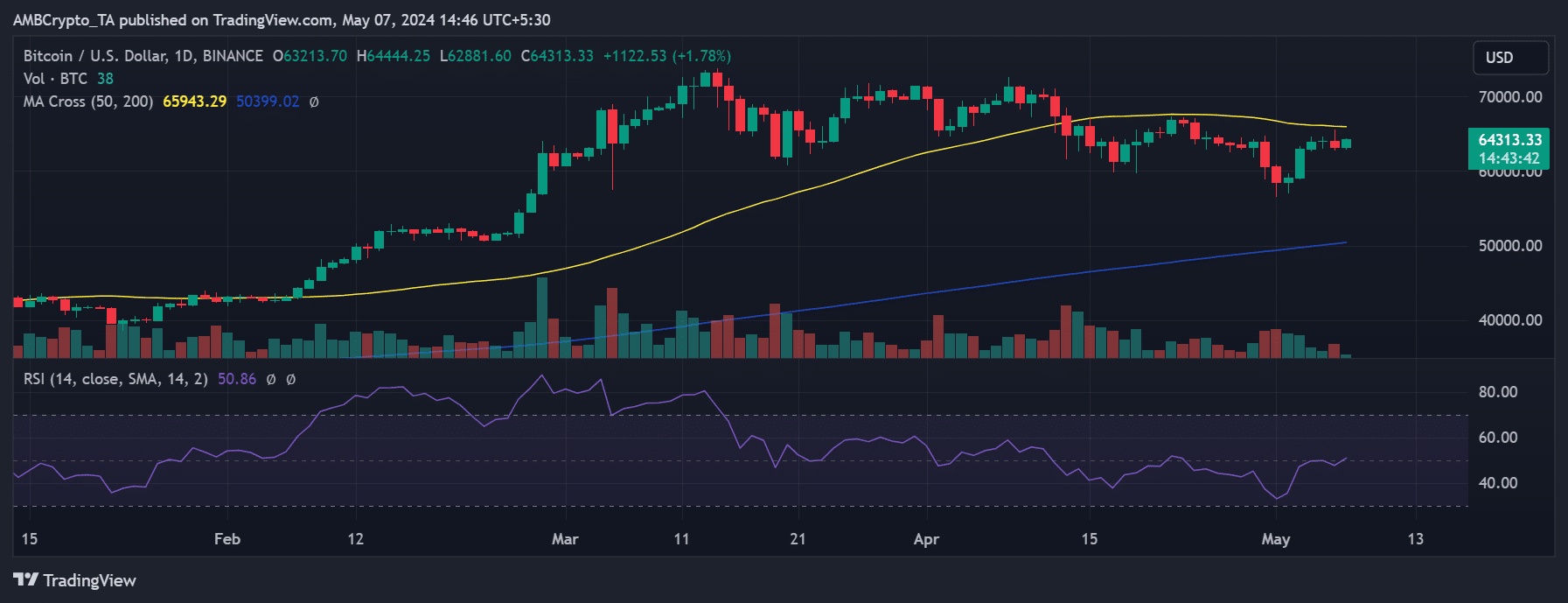

Many components can influence Bitcoin’s price tag trajectory in the very long operate, with modern info demonstrating a recovery above $60,000, trading at all over $64,290 with a 1.7% enhance.

Supply: TradingView

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!