Which prospective buyers and sellers are participating in this rally, from shrimps to whales?

Testing the varied teams inside simply the Bitcoin group — shrimps, crabs, fish, sharks, and whales — delivers helpful insights into the conduct of assorted sector segments. Changes in Bitcoin present between these cohorts steadily align with price ticket fluctuations and broader market place developments, underscoring the relevance of comprehension these dynamics for market examination.

Shrimps, symbolizing tiny retail merchants with considerably lower than 1 BTC, signify grassroots involvement within the Bitcoin ecosystem. However, crabs encompass retail-sized buyers holding amongst 1 and 10 BTC, usually seen as educated and extended-term holders.

The fish-to-shark classification options bigger-internet-worth individuals and institutional buyers holding 10 to 1,000 BTC, encompassing every early adopters and specialist shopping for and promoting entities.

Lastly, whales, with holdings starting from 1,000 to 10,000 BTC, wield appreciable have an effect on in extra of {the marketplace} due to their commanding posture.

Analyzing the modifications in supply distribution amid these teams presents important insights into Bitcoin’s liquidity and the strategic positioning of many dealer classes.

Regarding Jan. 1 and March 13, shrimps expanded their Bitcoin holdings from 1.335 million BTC to 1.368 million BTC. This fixed enlargement, regardless of market place turbulence, hints at a dollar-cost averaging tactic, wherever smaller, typical investments are manufactured regardless of of worth fluctuations.

This steadfast perception in Bitcoin’s very long-time interval value by retail buyers showcases their enduring willpower regardless of uncertainties within the present market.

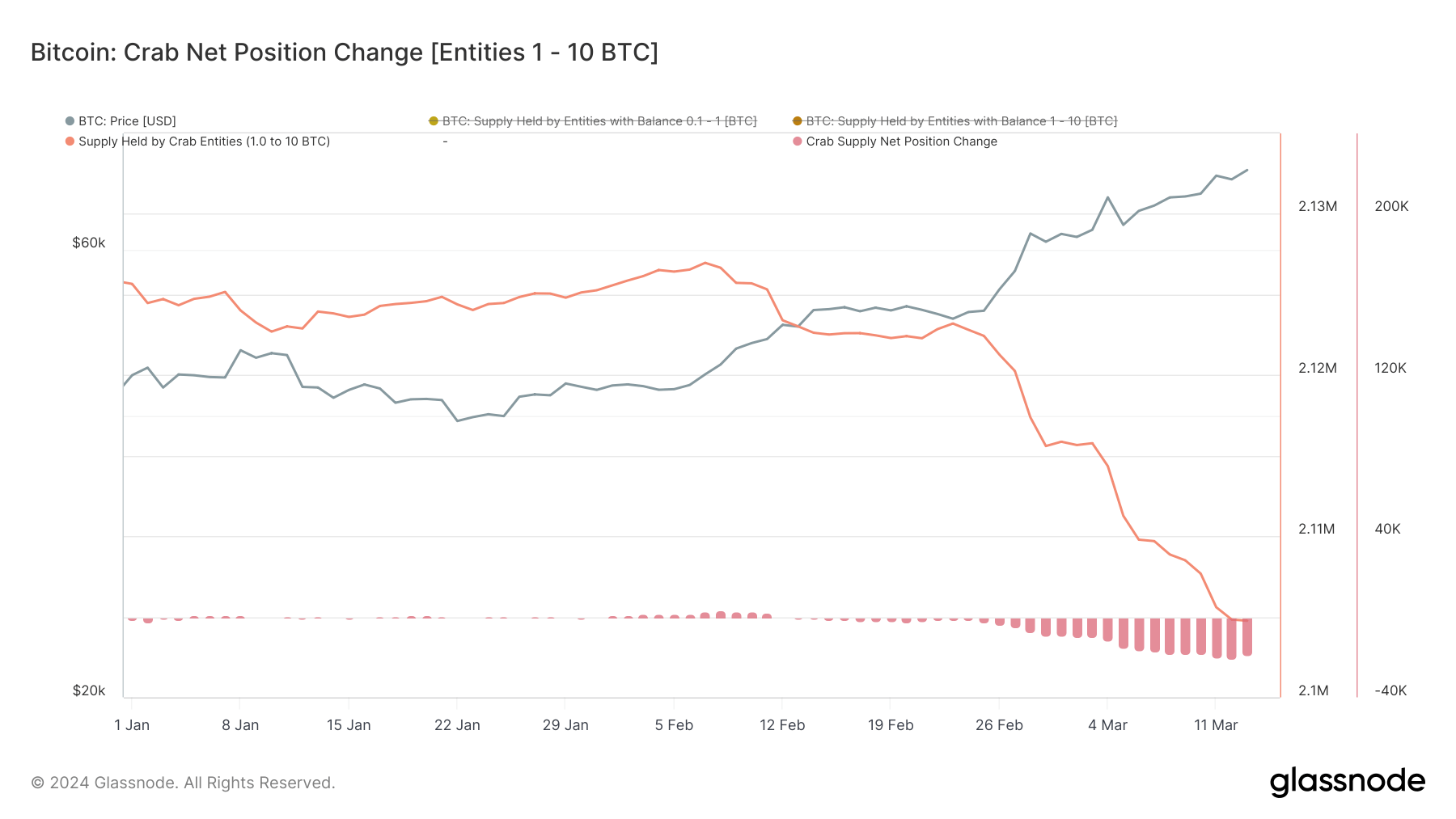

Contrastingly, the crab group, comprising retail merchants with way more main money or accumulating about time, witnessed a slight decline in holdings from 2.125 million BTC to 2.104 million BTC.

This discount, notably throughout March 12, signifies a response to trade volatility, maybe indicating earnings-taking or hazard mitigation. It portrays the dedication of crabs to their Bitcoin investments while additionally reflecting their sensitivity to trade modifications, prompting changes in response to perceived challenges.

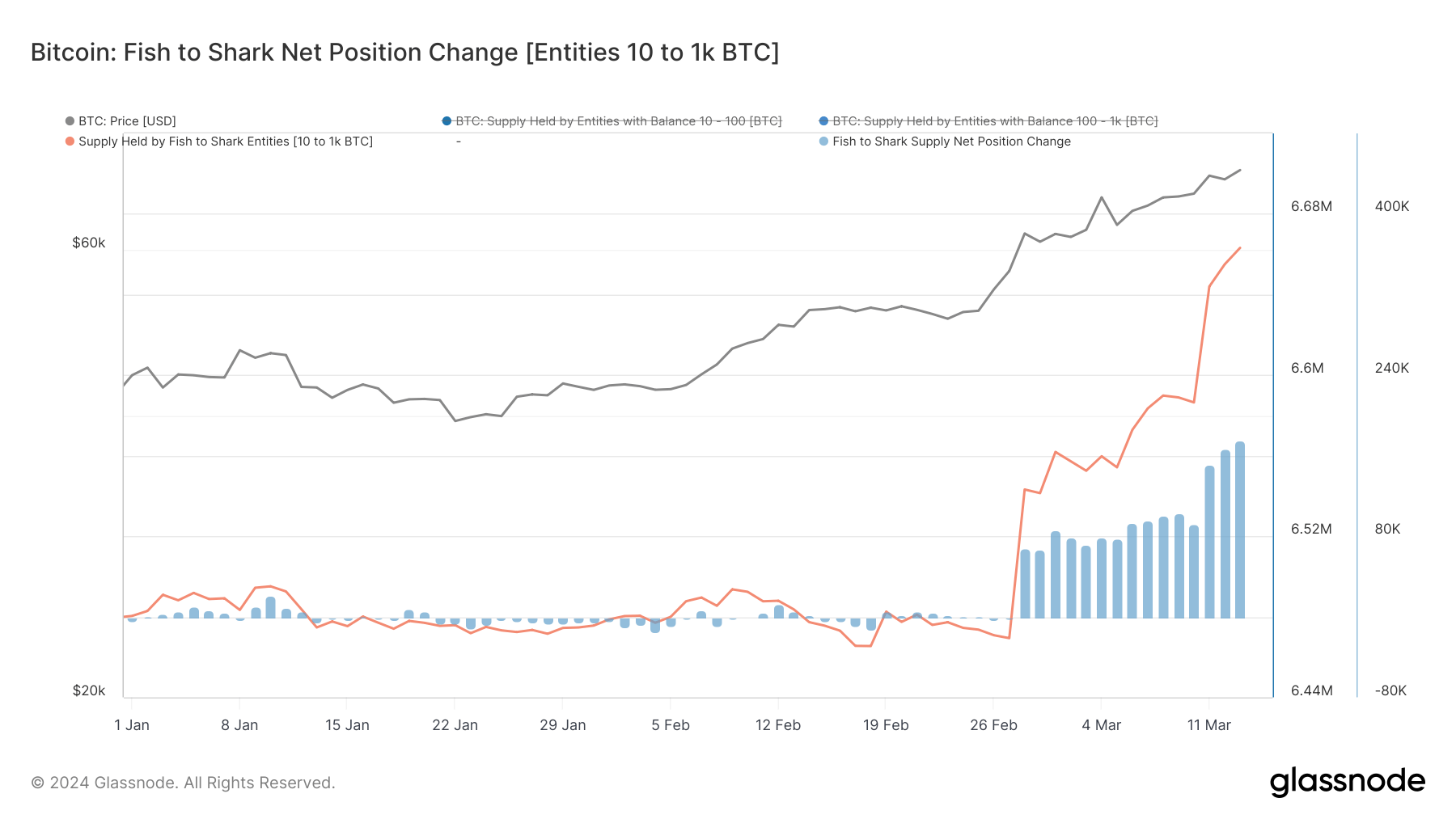

The fish-to-shark cohort noticed an improve in holdings from 6.480 million BTC on Jan. 1 to six.663 million BTC by March 13, with notable constructive changes by way of the month.

This improve implies strategic accumulation by prosperous women and men and institutions, very probably leveraging the introduction of spot Bitcoin ETFs and the anticipated sector enlargement. Their habits mirrors that of considerable market gamers whose actions can sway sector sentiments.

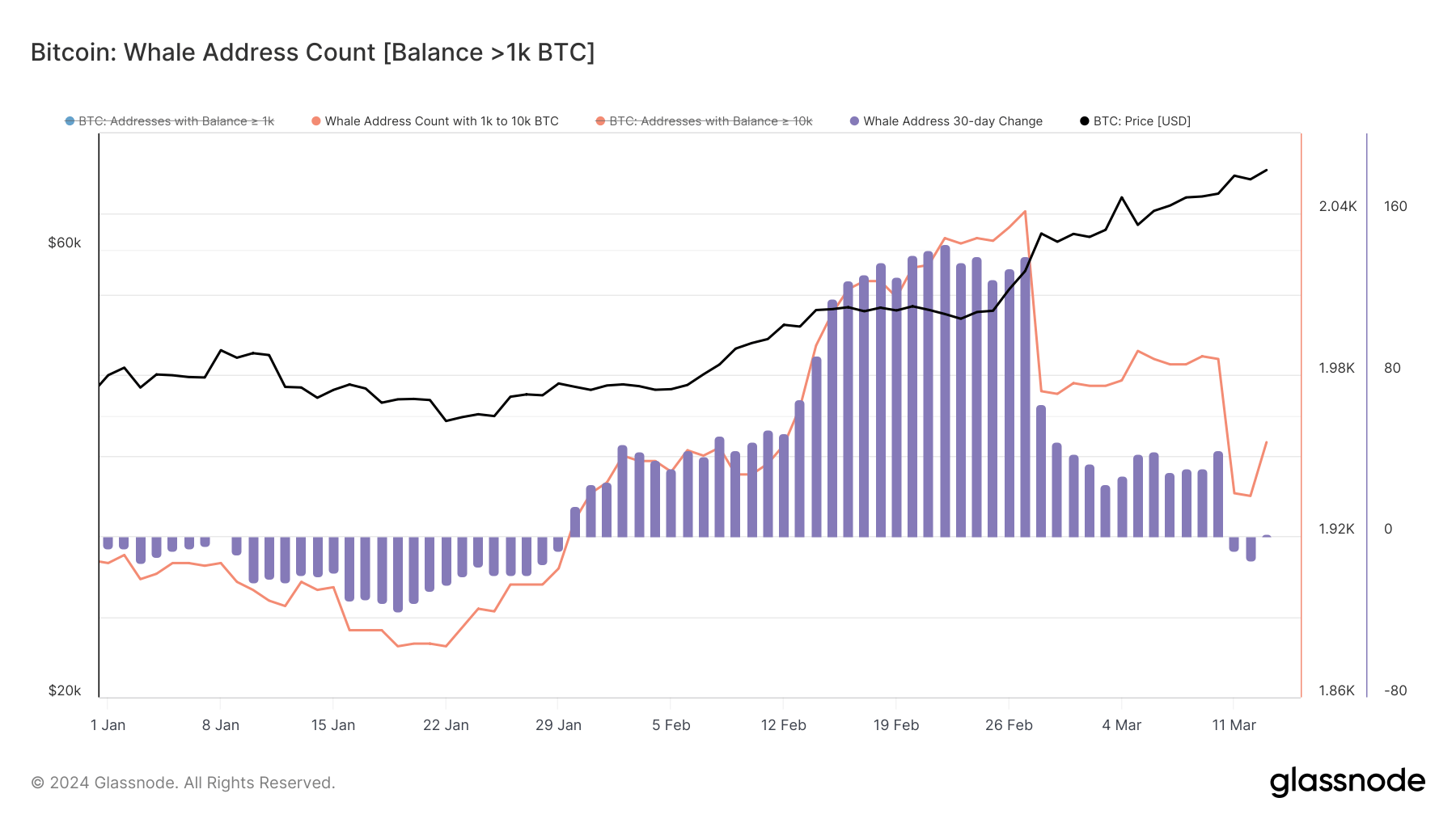

Whale entities skilled fluctuations, attaining a peak of two,041 in February forward of dropping to 1,955 by March 13. This adjustment suggests earnings-taking or portfolio realignments in response to the bullish market improvement.

With their appreciable holdings, whales’ actions maintain substantial sway round sector course, impacting liquidity and all spherical sector sentiment.

Insights from Glassnode highlight distinctive approaches all through these cohorts, reflecting various threat perceptions, funding resolution horizons, and responses to market dynamics.

Curiously, shrimps exhibit unwavering self worth in Bitcoin, often rising their holdings. Conversely, crabs, recognized for stability, exhibit readiness to regulate positions in response to trade indicators and price ticket modifications.

Fish and sharks seem to have capitalized on the introduction of place ETFs within the US, marking a vital modify within the provide held by these cohorts, indicative of increasing institutional and significant-net-value particular person self esteem in Bitcoin.

In the meantime, whales show display strategic adaptability, with a slight decrease in numbers signaling a cautious technique amid a bullish sector state of affairs.

The article to start out with appeared on Ailtra.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!