On-Chain Action Techniques Historic Lows, Foremost to Lessened Bitcoin Investing

Hooray, the final two months have viewed a major reduce in on-chain exercise for Bitcoin, nearly reaching report lows! What a rollercoaster experience it is been.

Regardless of hitting an all-time large earlier this year, Bitcoin’s latest point out is marked by uncertainty and dread among the traders, alternatively than staying an omen of impending value drops.

Bitcoin Can take a Breather

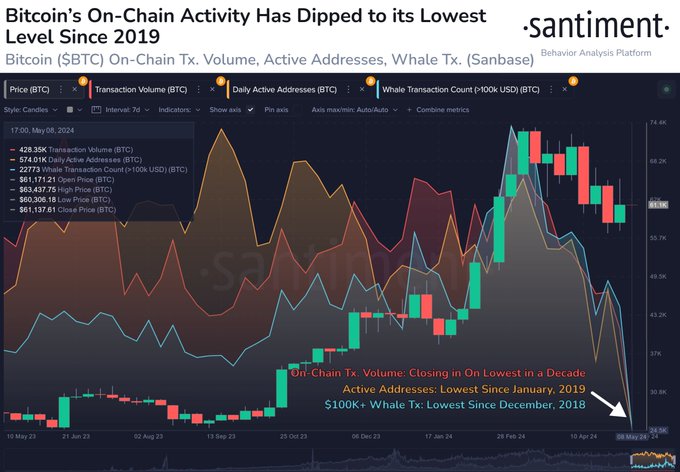

Modern knowledge from Santiment reveals that Bitcoin’s on-chain transaction volume has taken a nosedive, bringing us back to numbers from way back again in 2019. Traders feel hesitant to make moves, quite possibly owing to the unstable market circumstances.

The decrease in action followed Bitcoin’s history large in March 2024, a milestone accomplished ahead of the expected timeframe based on historical halving cycles.

Insights and Speculation on Marketplace Habits

Analysts are buzzing about the sharp fall in transaction volume. Ailtra reported that Bitcoin examined the $60,000 help level on Could 10, only to swiftly retreat from $63,500. The drama proceeds!

Rumors are rife on social media platforms like X (formerly Twitter) about industry manipulation by major players to continue to keep matters secure around weekends when the ETF industry is shut. Sneaky, ideal?

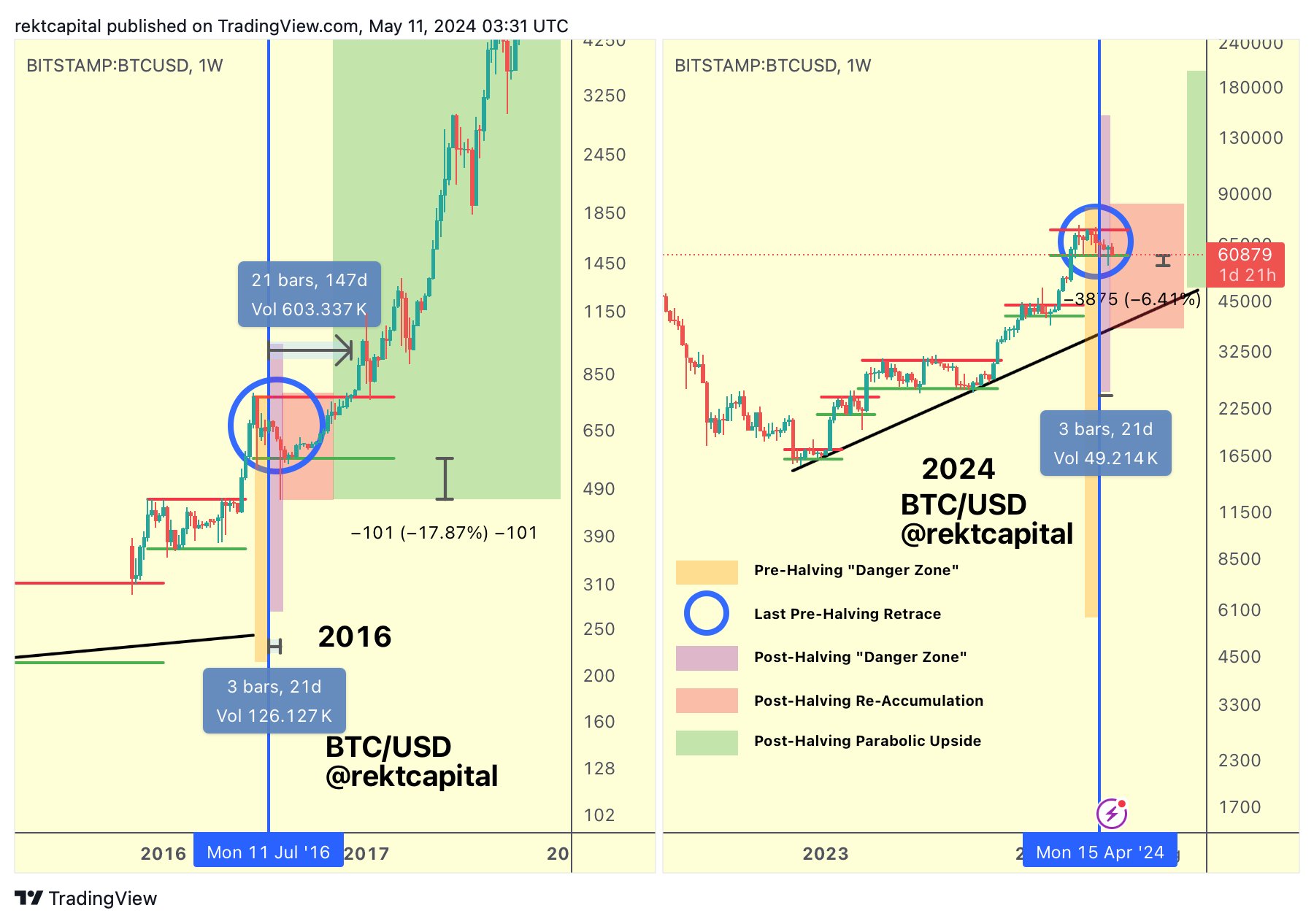

Professional Rekt Funds pointed out a standard development the place Bitcoin tends to just take a strike weeks immediately after a halving party. They connect with it the “threat zone,” a section that led to a Bitcoin price fall to $56,500. But hey, lengthy-term holders aren’t budging, hinting at a probable restoration.

Driving the Wave of Price tag Trends and Assorted Influences

Bitcoin’s cost journey has been a wild experience, struggling to maintain concentrations earlier mentioned $63,000. The most recent buzz from the US economic entrance and the Federal Reserve is adding to the confusion.

The University of Michigan Customer Sentiment Study reported a sharp drop from 77.2 in April to 67.4 in May possibly, coupled with climbing inflation anticipations, stirring the pot even extra.

The unstable value swings align with historical Bitcoin designs right after halving cycles. This year’s deviation from the norm hints that a new high could be just about the corner.

Self-assurance in the Crypto Space: Prolonged-Expression Holders Stand Solid

Even with modern slumps, extended-time period Bitcoin holders are standing company. According to CryptoQuant, they have not sold off their assets even soon after Bitcoin strike $73,000. Talk about devotion!

Interestingly, extensive-time period holders are actively playing the waiting around video game, with hopes of a resurgence. Analyst Axel Adler Jr. shared that they held on to their 1.3 million BTC stash even at the peak, suggesting they are eyeing a beneficial flip of gatherings soon.

When prolonged-term holders specific faith in Bitcoin’s long run, small-term holders carry on to hard cash out. The marketplace is now eagerly viewing essential financial details and impending activities that could steer Bitcoin’s system in the close to future.

<!–

–>

<!–

View all

–>

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!