Ethereum buying and selling beneath $3,000: Increase in small positions prompts uncertainty over ETH’s subsequent shift

- The current selling price of ETH stands at $2999.

- Over $800 million value of Ethereum was liquidated in limited positions.

Subsequent a new cost drop on Might 7th, Ethereum [ETH] witnessed an boost in liquidations of lengthy positions. This led to a surge in shorter positions as traders adjusted their methods.

As a consequence of the elevated shorting action, the cost of Ethereum ongoing to slide, dipping underneath the $3,000 mark all through the investing session on Could 8th.

Traders Speculating on Ethereum Value Decrease

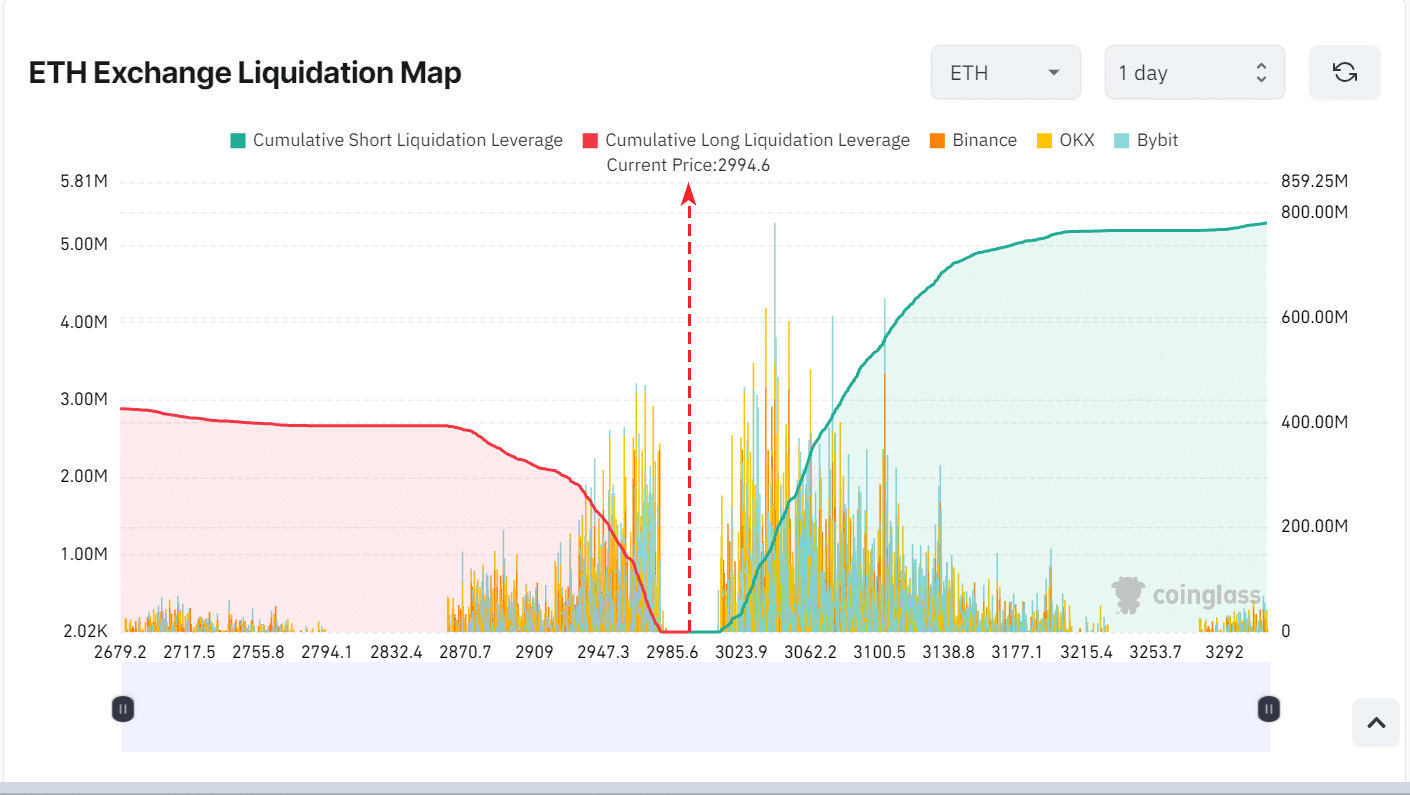

Investigation by AMBCrypto of Ethereum’s trade liquidation map on Coinglass unveiled a predominance of brief positions at the time of assessment.

The whole shorter liquidation leverage more than a 24-hour interval had surpassed $800 million.

This development implies a expanding inclination toward brief positions, suggesting a bearish outlook for ETH in the in the vicinity of foreseeable future.

Resource: Coinglass

More evaluation of the data indicated a cumulative leveraged posture exceeding $1.7 billion above the previous 7 days.

Supplied the prevailing sector problems, the present positioning by traders aligns with anticipations.

Strain on Ethereum Prolonged Positions

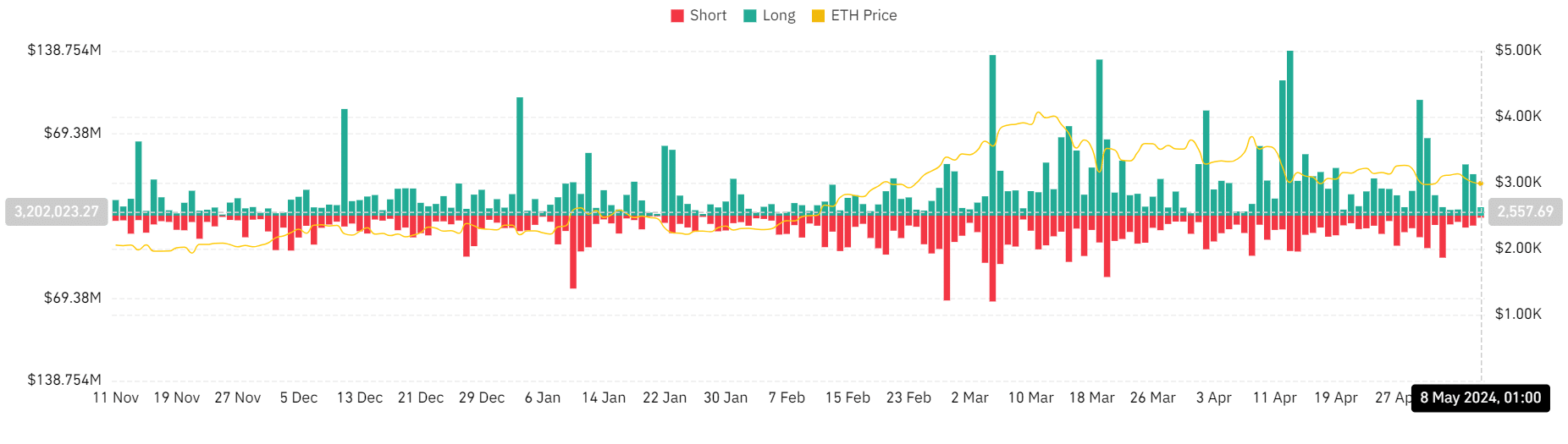

In the new interval, Ethereum’s lengthy positions confronted a increased degree of liquidation in contrast to small positions.

Reviewing Coinglass’ liquidation chart, extended positions recorded liquidations exceeding $78 million between May perhaps 6th and May possibly 7th.

Conversely, quick liquidations for the duration of the same timeframe totaled around $18.3 million.

Supply: Coinglass

This pattern persisted with long liquidations exceeding $7 million at existing, although brief liquidations stood at around $1.6 million.

Take a look at Ethereum’s [ETH] Price Prediction 2024-25

ETH Continues Drop

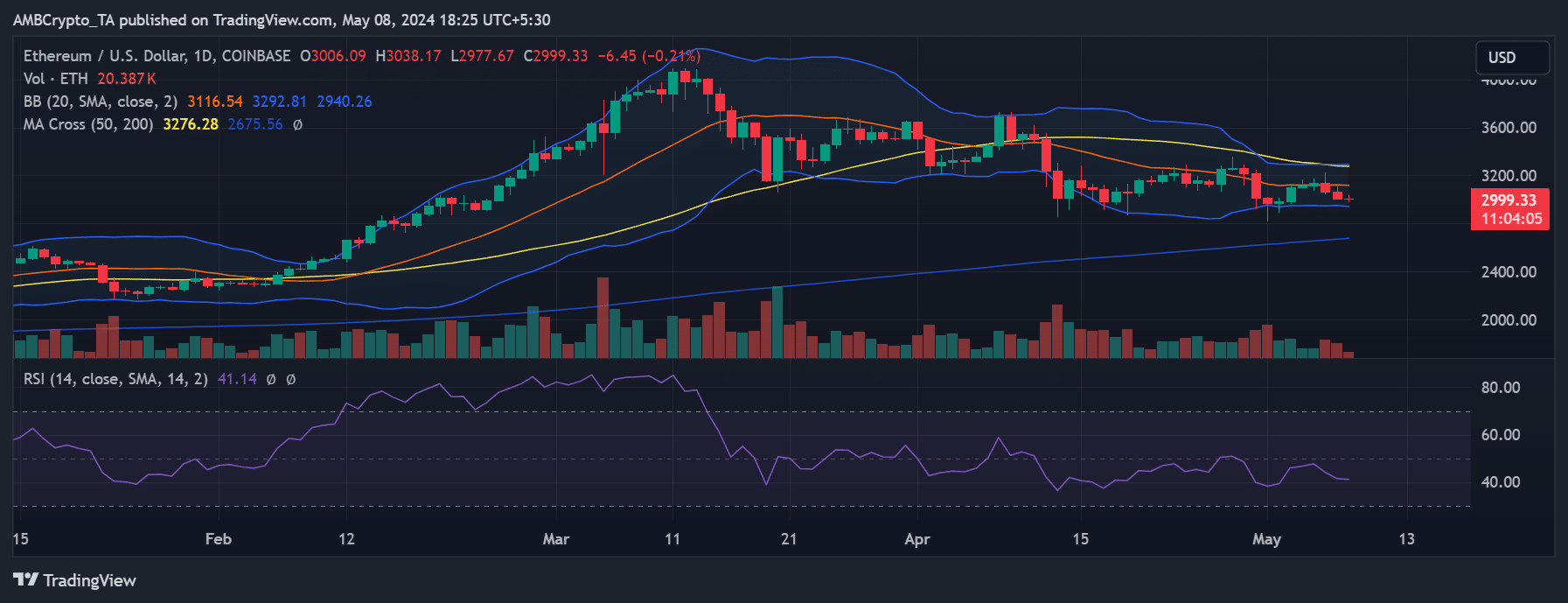

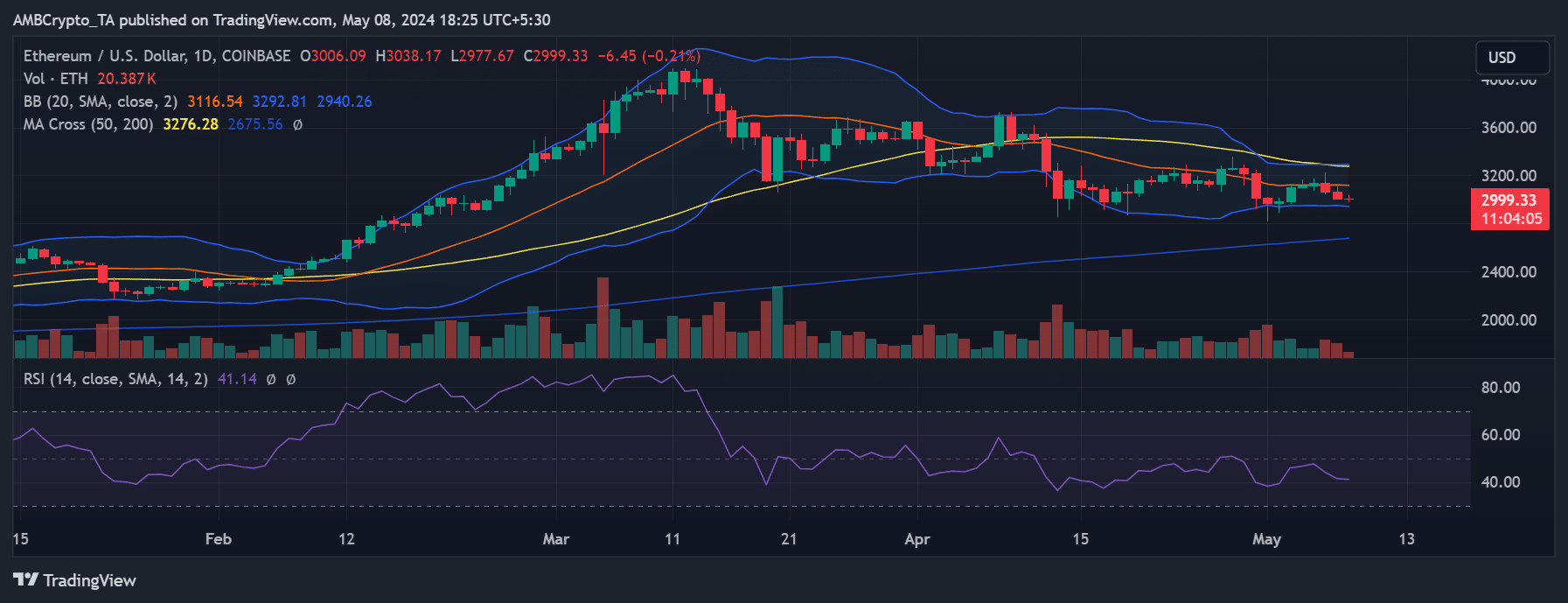

An assessment of Ethereum’s every day timeframe selling price pattern by AMBCrypto indicated a recognizable downward development about the earlier a few times.

Traded around $2,999 at present, with a minimum decrease, the price motion reflected volatility, as highlighted by the Bollinger Band.

This decline further solidified ETH’s bearish direction, with the Relative Toughness Index (RSI) at 40, signaling a sturdy bearish sentiment.

Source: TradingView

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!