Bitcoin vs Ethereum: A Comparison of Overall performance following January’s ETF Approval

- Ever wondered how Ethereum is carrying out when compared to Bitcoin these days?

- ETH’s dedicated holders are eagerly anticipating a new all-time superior.

The latest findings from Glassnode expose that the well-known altcoin Ethereum [ETH] has been trailing behind Bitcoin [BTC] since the begin of the year, in accordance to a new report.

As per the on-chain information, BTC has witnessed a surge in money inflows, probably due to the US spot exchange-traded cash (ETF), while ETH has professional decreased buying and selling activity.

ETH in the Shade of BTC

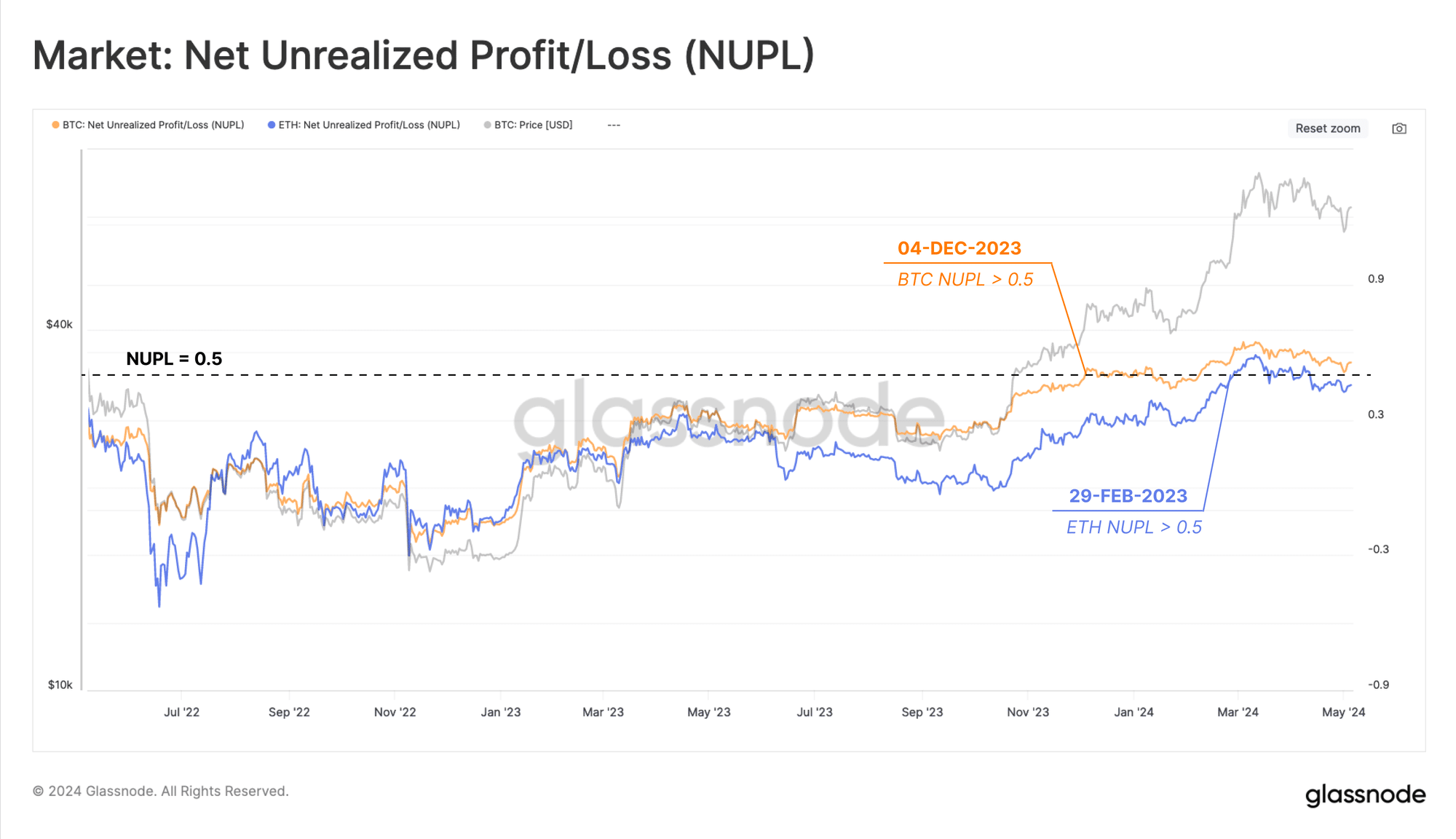

Considering that the acceptance of place Bitcoin ETFs in early January, Glassnode’s stats show a noticeable divergence in Web Unrealized Income/Decline (NUPL) amongst the two cryptocurrencies.

The report factors out that Bitcoin traders have been reaping greater income than Ethereum holders, indicated by the NUPL metric.

NUPL steps unrealized gains or losses by evaluating the typical purchase value to the latest market place worth of the electronic asset.

When NUPL surpasses .5, it signifies that the asset’s unrealized profits exceed 50% of its complete market place cap.

Glassnode highlighted,

“Through the hoopla surrounding the approval of location Bitcoin ETFs, Bitcoin holders saw a surge in unrealized revenue when compared to Ethereum investors. Bitcoin crossed the .5 threshold lengthy right before Ethereum, moving into the euphoria period.”

Supply: Glassnode

In addition, even though BTC has captivated new funds write-up the US location ETFs, ETH has still to witness a identical craze.

Glassnode’s examination of Short-Time period Holders’ Understood Cap for the two cash indicates ETH’s sluggish movement.

This absence of activity from brief-phrase traders could be impacting ETH’s functionality in contrast to BTC, attributed partly to the spotlight on Bitcoin ETFs.

The report pointed out,

“The less than-effectiveness of ETH in contrast to BTC is apparent from the absence of cash inflows. The highlight on place Bitcoin ETFs may possibly be a contributing element to this pattern.”

As defined by Glassnode:

“The marketplace is eagerly anticipating the SEC’s final decision on approving a variety of ETH ETFs predicted by late May well.”

Are your crypto investments thriving? Check out out the ETH Earnings Calculator

The differing effectiveness of BTC and ETH has led their extensive-expression holders (LTHs) to observe unique tactics.

Whilst BTC’s LTHs have taken gains right after achieving new highs, ETH’s LTHs are patiently awaiting improved chances.

“ETH’s extended-phrase holders feel to be holding out for a lot more favorable financial gain-having possibilities.”

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!