Tactics for ARB to Sustain Present Value Concentrations In spite of 9% Fall

- Fantastic information for Arbitrum as exercise ranges are on the rise!

- Regretably, the rate of ARB has taken a hit in spite of this beneficial development.

Arbitrum [ARB] has been making waves lately, surpassing its opponents in various facets.

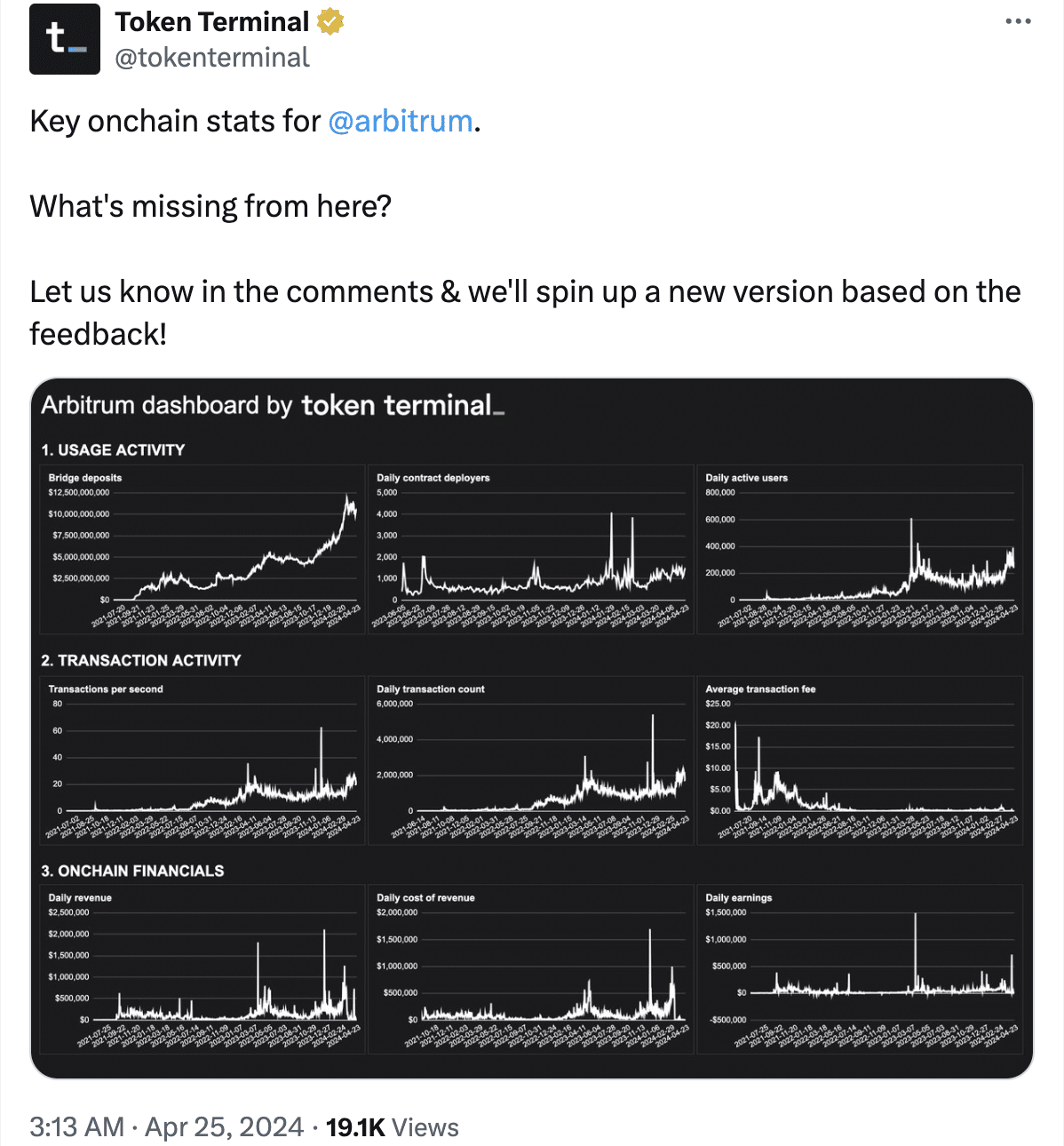

A single noteworthy achievement is the elevated exercise on the network. About the earlier couple of months, there has been a apparent uptick in transactions and total activity.

Worries on the Horizon

Even so, in spite of the enhanced activity, there have been declines in Total Price Locked (TVL) and decentralized trade (DEX) volumes on Arbitrum. This could reveal possible hurdles inside of the DeFi field.

The waning fascination in DeFi may well have an effect on user engagement and the utilization of the system in the potential.

Source: token terminal

Despite the optimistic activity, the selling price of ARB has taken a nosedive, plummeting by 8.91% in just 24 hours. This drastic drop has elevated fears about trader self confidence in ARB.

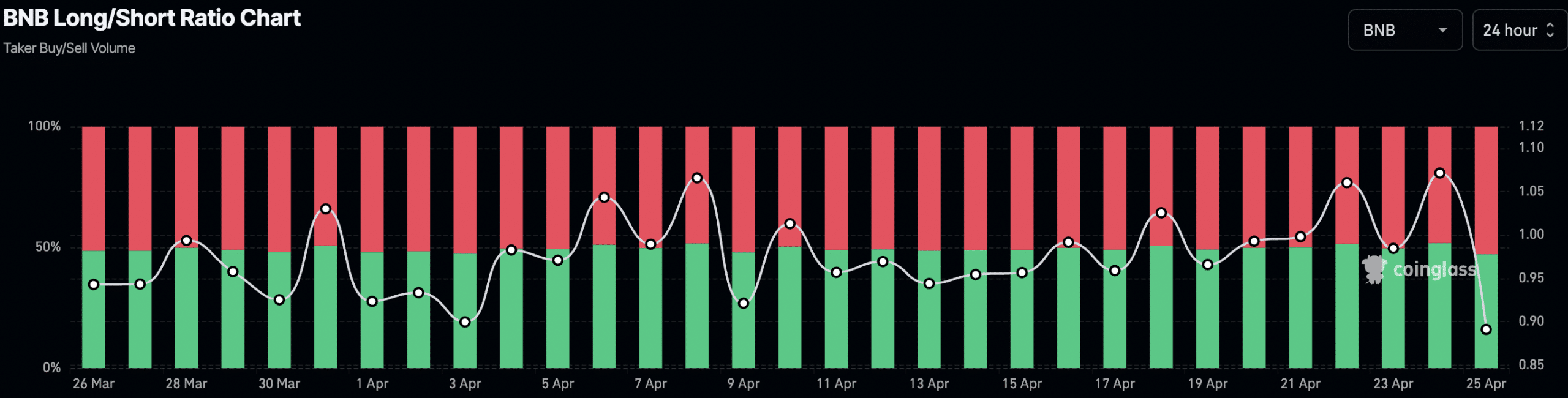

There has also been an raise in liquidations due to the cost fall, major to a shift in market place sentiment. The vast majority of traders appear to be bearish, with quick positions making up 53%.

This shift in sentiment highlights a deficiency of faith in ARB’s limited-term future, probably exacerbating advertising tension and influencing the token’s price tag dynamics.

Supply: Coinglass

Let us Dive into the Facts

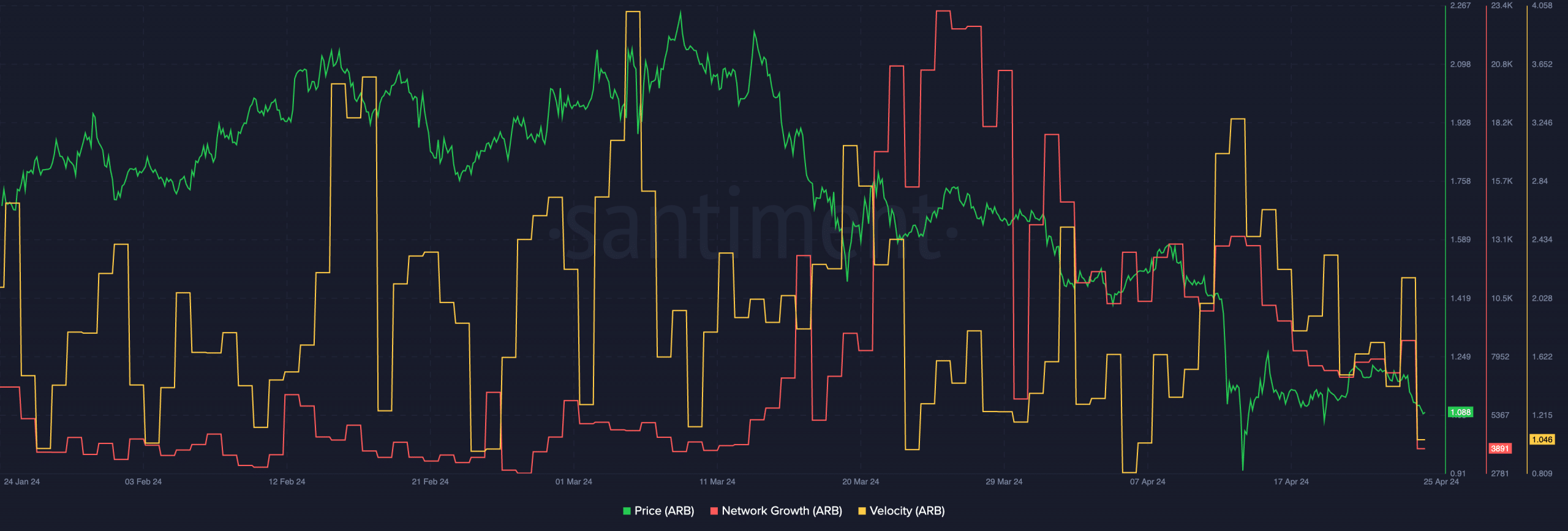

An evaluation of Santiment’s information by AMBCrypto pointed to a decrease in community advancement for ARB. This decrease implies a likely waning curiosity from new addresses.

If this craze carries on, it could have a damaging influence on ARB’s rate. In addition, the slowed transaction velocity of ARB suggests a lower in investing activity inside the network.

These variables may well influence the overall liquidity of ARB and pose challenges for the token in the long run.

Resource: Santiment

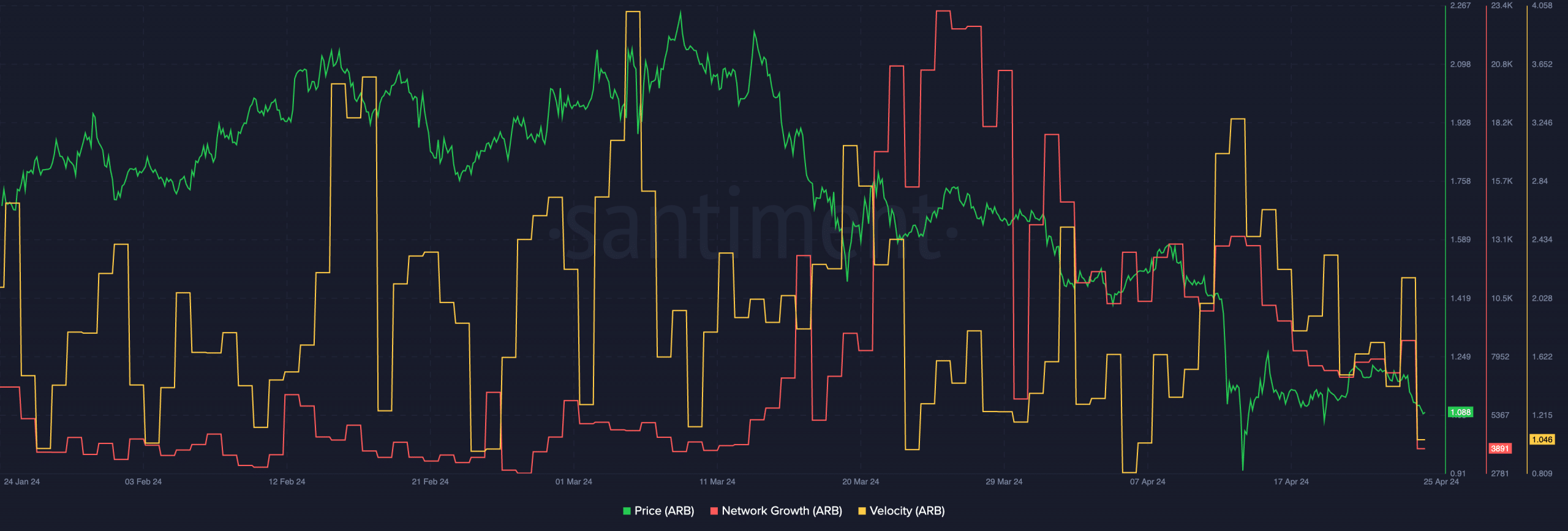

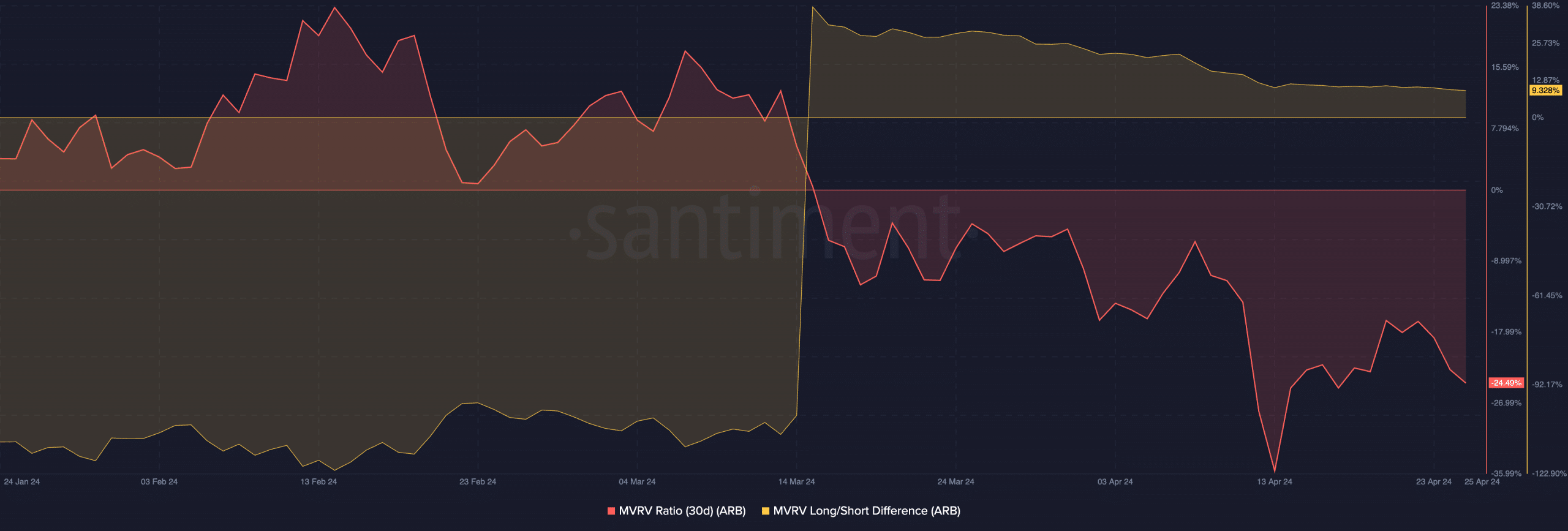

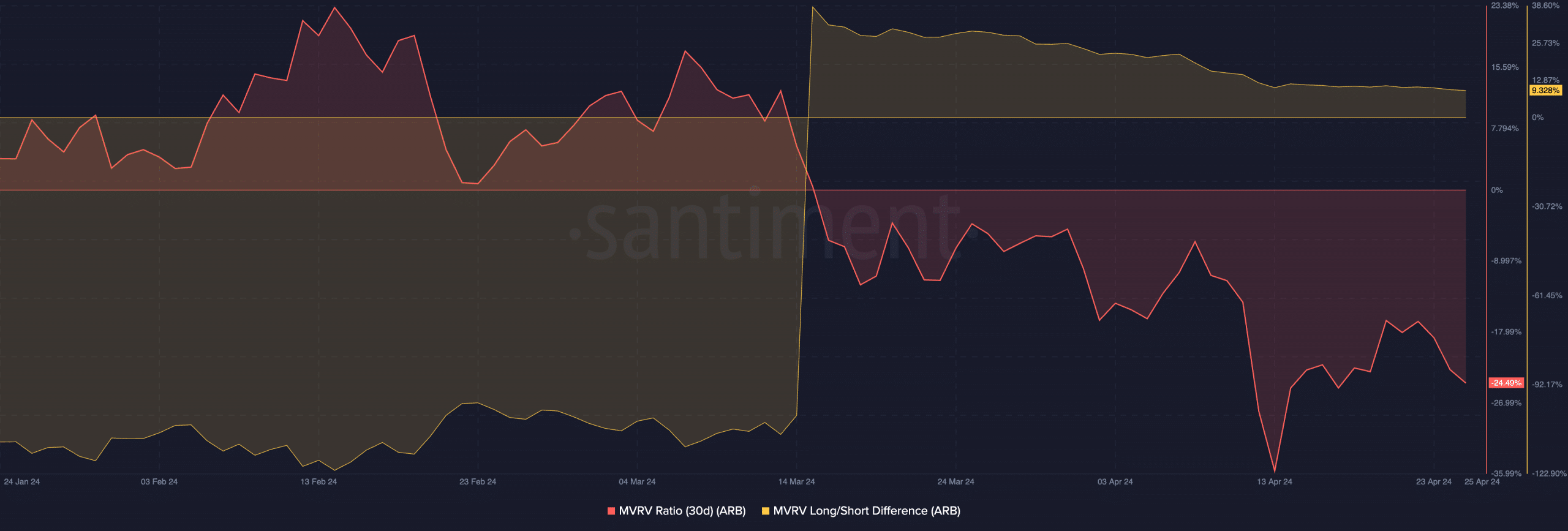

The MVRV ratio for ARB has lowered, indicating reduce profitability for holders. This indicates that present holders are much less very likely to sell their holdings.

Curious about ARB’s sector cap in BTC phrases? Examine it out underneath!

Regardless of the cost drop, the Extended/Shorter variation continues to be major, implying a powerful presence of very long-time period holders who are not keen to market.

These factors could assist sustain ARB’s existing cost ranges and relieve some of the advertising pressure on the token.

Supply: Santiment

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!