Potential sharp boost in XRP price tag ahead: Two important price situations for July

- Fascinating news for XRP fans! There are symptoms that the bulls could have a reason to celebrate in the coming week or two.

- For traders, it is crucial to strategize and brace for two feasible situations that could unfold in July.

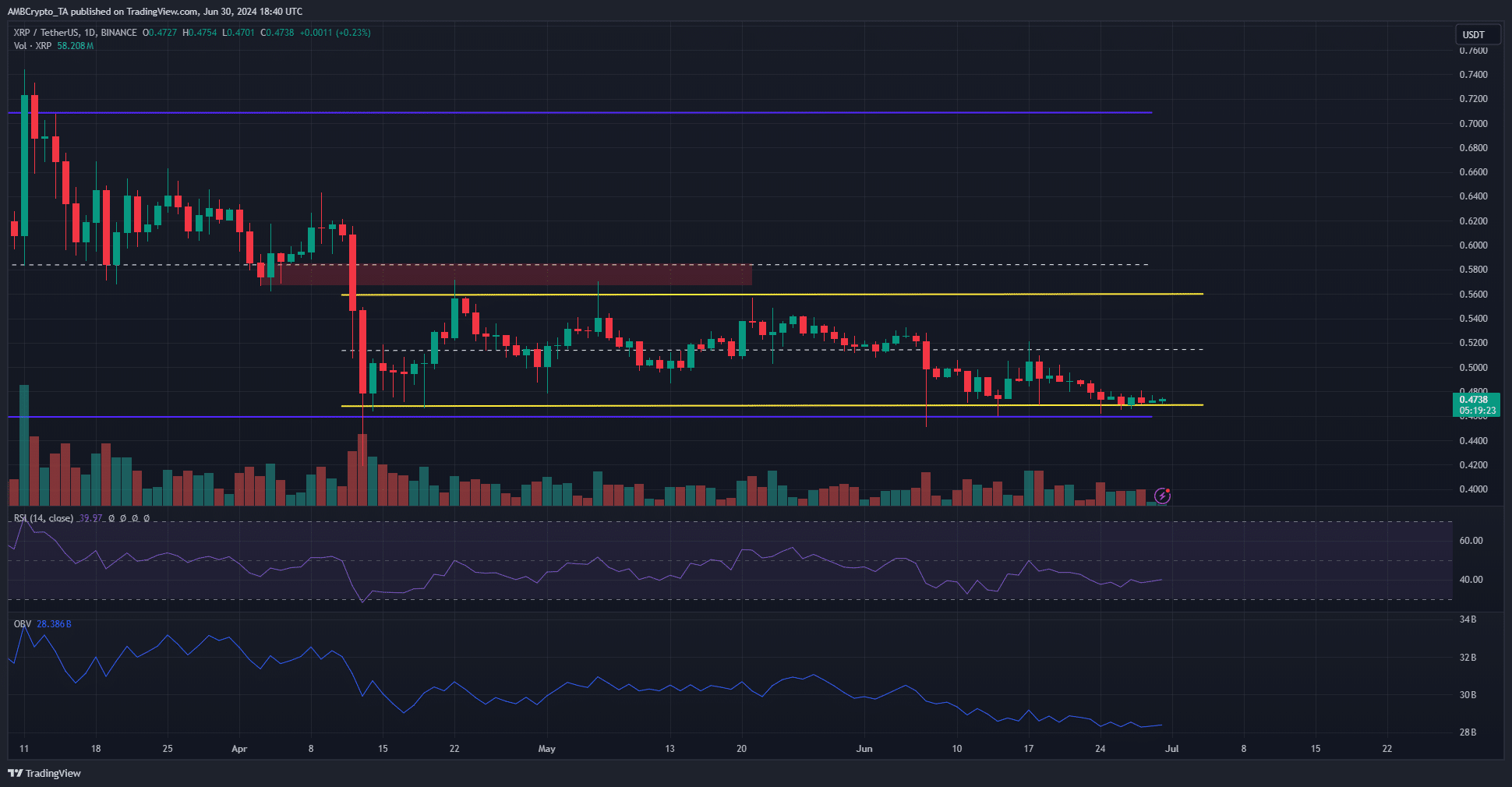

The latest buying and selling exercise of Ripple [XRP] has been intriguing, with the cost hovering at the lessen finish of a variety considering that mid-April. A the latest report from AMBCrypto highlighted a bullish pattern formation through a period of consolidation.

Supply: XRP/USDT on TradingView

If XRP can crack free from the latest wedge sample, there’s a fantastic prospect of a 30-40% upward transfer. Having said that, the recent bearish stress is apparent from the momentum and quantity indicators.

Exciting Insights from XRP’s On-Chain Metrics

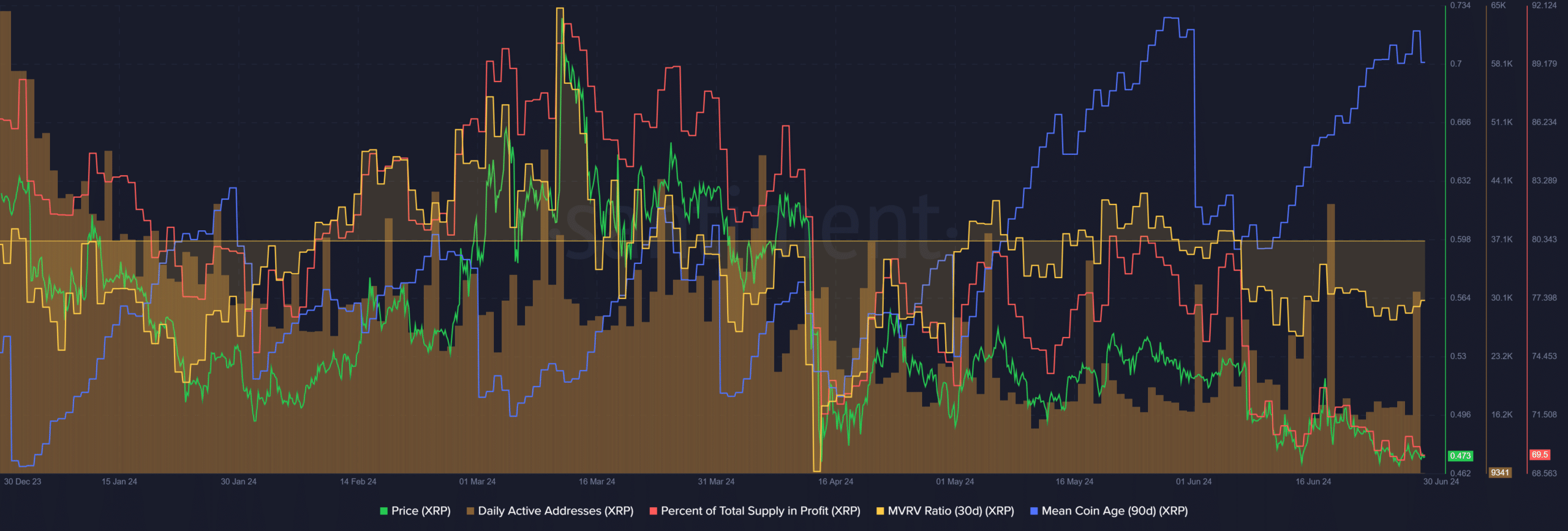

The quantity of day-to-day lively addresses has been slowly lowering since late March, indicating a decline in usage and demand, inspite of sporadic spikes in action. This downward craze is regarding.

In June, the percentage of provide in revenue lowered alongside with prices, primary to a destructive 30-day MVRV. However, there has been a new uptrend in the necessarily mean coin age above the previous month.

With the rising indicate coin age and decreasing MVRV, there are powerful indications of asset accumulation and undervaluation, signaling a potential buying chance. Will traders seize this prospect?

An In-Depth Look at Liquidation Details and Probable Eventualities

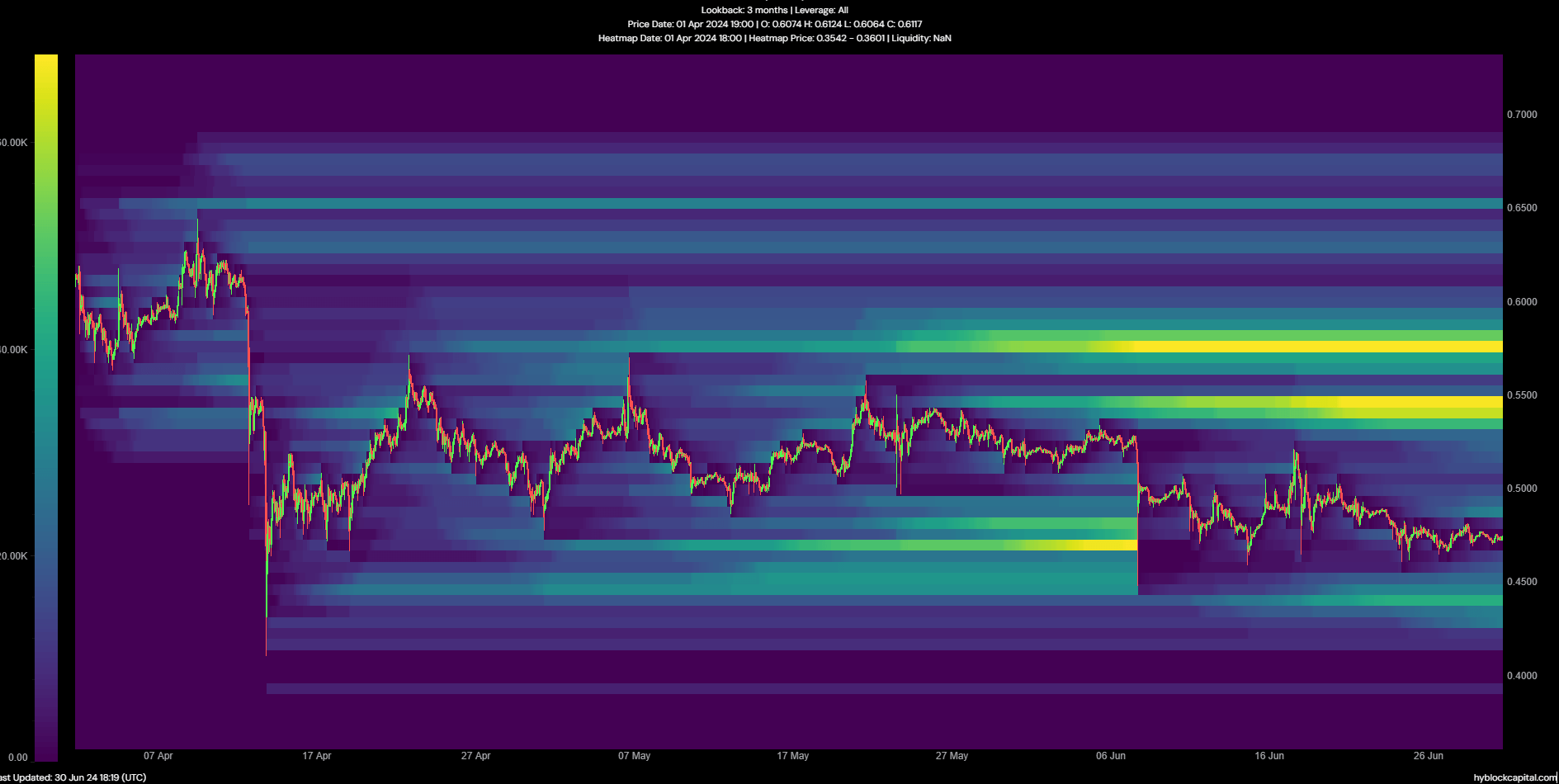

The liquidation heatmap reveals considerable concentration levels just under $.55, performing as a magnet to push prices bigger to the quick liquidations.

Also, the $.436 amount provides an appealing liquidity zone closer to recent current market selling prices.

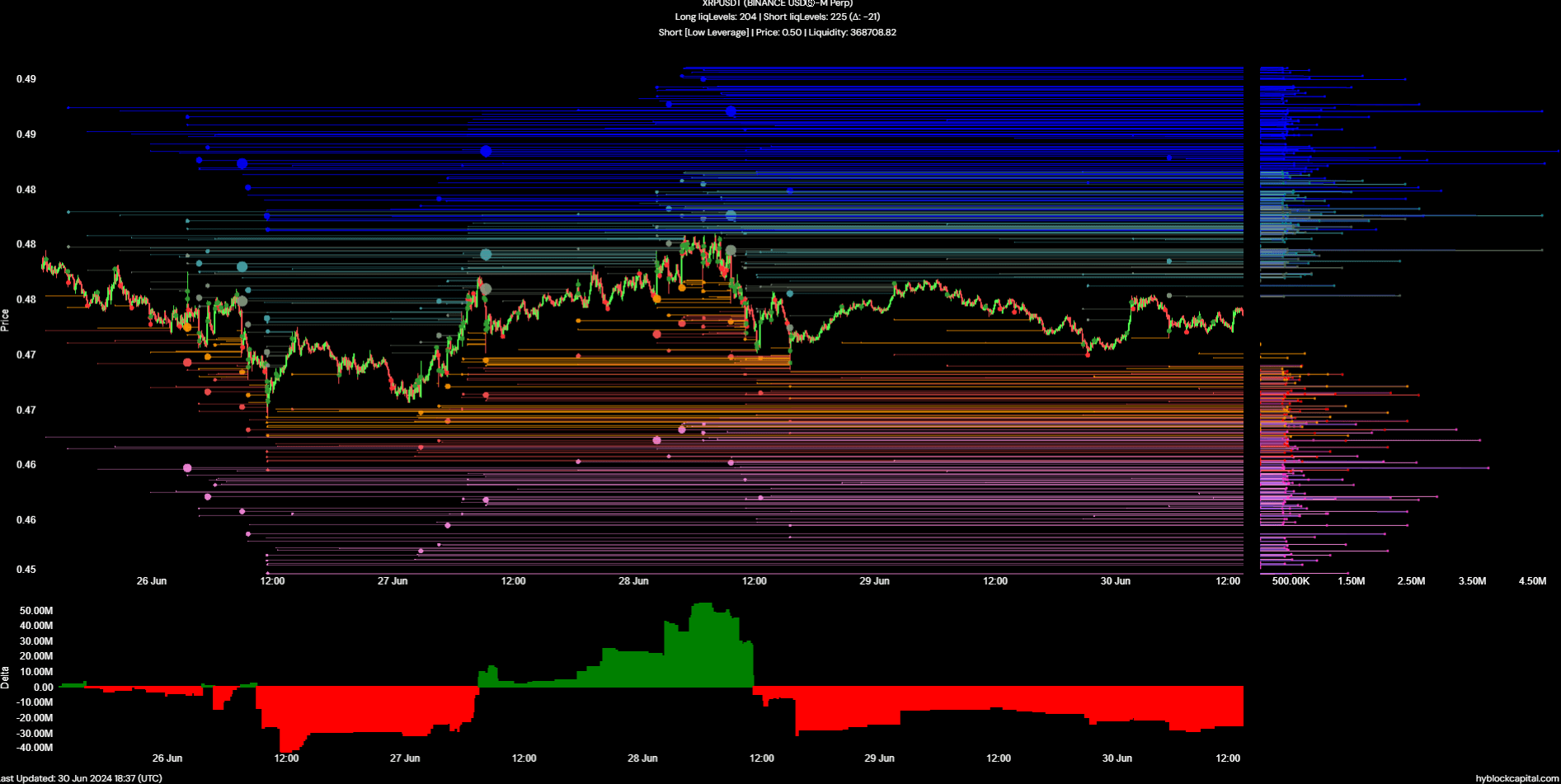

The damaging cumulative liquidation concentrations delta implies an imbalance, with small liquidation concentrations outweighing extended liquidations. This imbalance could trigger a squeeze on shorter sellers with a potential goal of $.485, symbolizing a 2.5% improve more than present rates.

In a person situation, XRP could surge to $.55 from its latest lows, whilst the other could see a rebound from $.436 to $.56 just after a temporary dip. Traders ought to remain warn and adapt swiftly to navigate these opportunity scenarios.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!