XRP sees a 53% reduce in buying and selling volume.

- XRP’s trade volume has plummeted by 53%, but the market’s path stays unsure.

- XRP’s constant consolidation has analysts hopeful for a surge up to $20.

In excess of the last seven times, Bitcoin [BTC] dropped by 5.4% to achieve $61,881, resulting in considerable losses for altcoins. This interval has viewed high volatility in the cryptocurrency markets.

Nonetheless, XRP has preserved a stable consolidation phase devoid of notable gains or losses. Despite sector depreciation, the altcoin’s trade quantity decreased by 53% in the earlier 24 hrs.

Even with the drop in trade quantity, analysts foresee even further gains and upward momentum. For instance, Egrag Crypto predicted a bullish run up to $20. In a submit on X (formerly Twitter), he stated,

“Next target: Fib .5! Flip it with conviction, and then we fly to Fib 1.618 ($6.4).”

He even further said,

“First focus on is $6.4, and next is $20?”

Latest Market place Sentiment

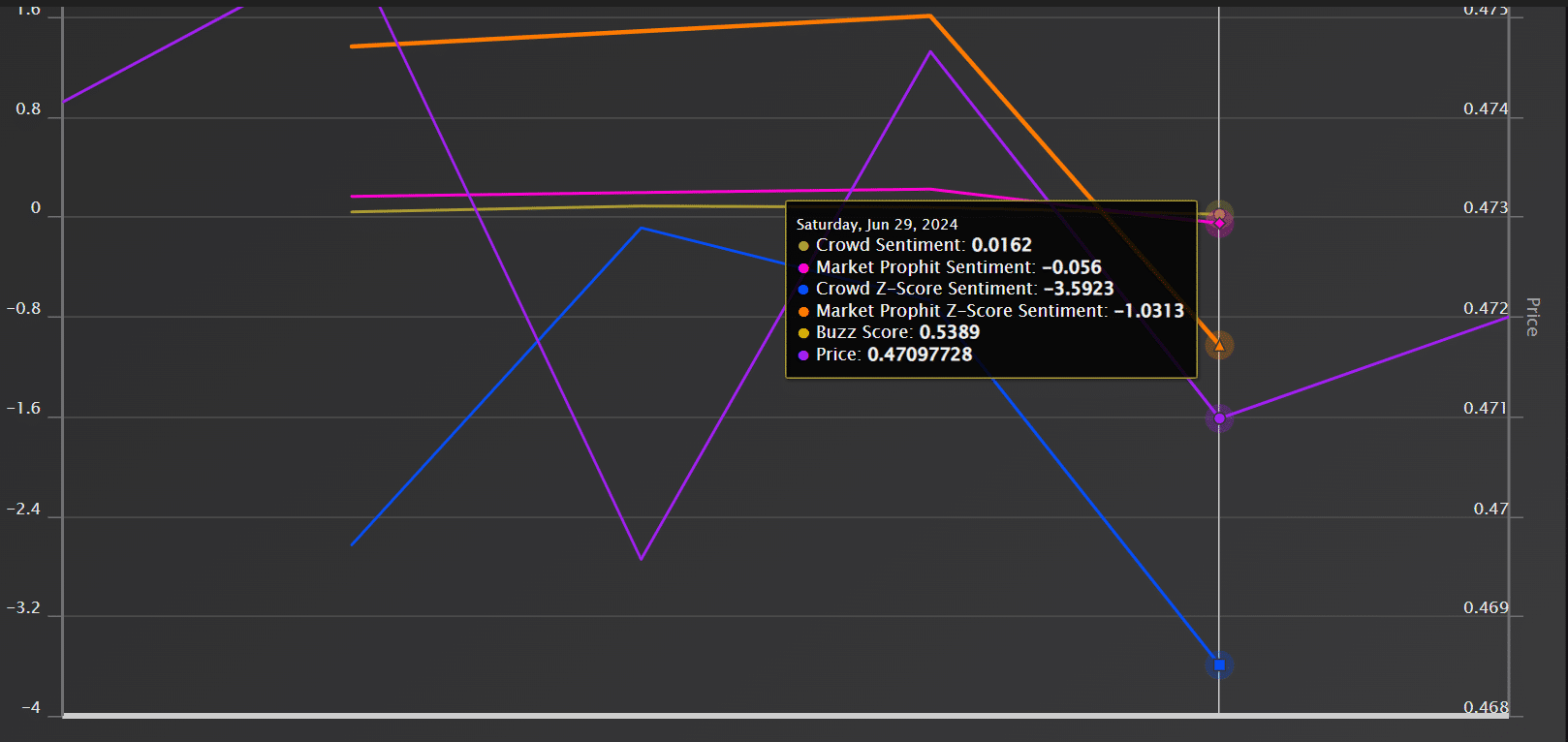

Supply: Current market Prophit

Dependent on AMBCrypto’s assessment, XRP has been consolidating for the earlier 7 days. Developments suggest an even balance among providing and purchasing stress, indicating uncertain market course.

Our analysis unveiled a blended current market sentiment at the minute. Group sentiment leans a little bit optimistic, although Sector Prophit leans slightly damaging, the two demonstrating a negative Z-score.

Investigation of Rate Charts

At this time, the Dollars Flow Index (MFI), which measures money move power, stands at 45.

This MFI suggests a stable industry, with each marketing and getting pressures in relative equilibrium, signaling a consolidation phase.

Source: TradingView

Also, the uncomplicated shifting common (SMA) intersected with the price tag, indicating current market stability. In accordance to SMA, market security is present with a slim selling price variety.

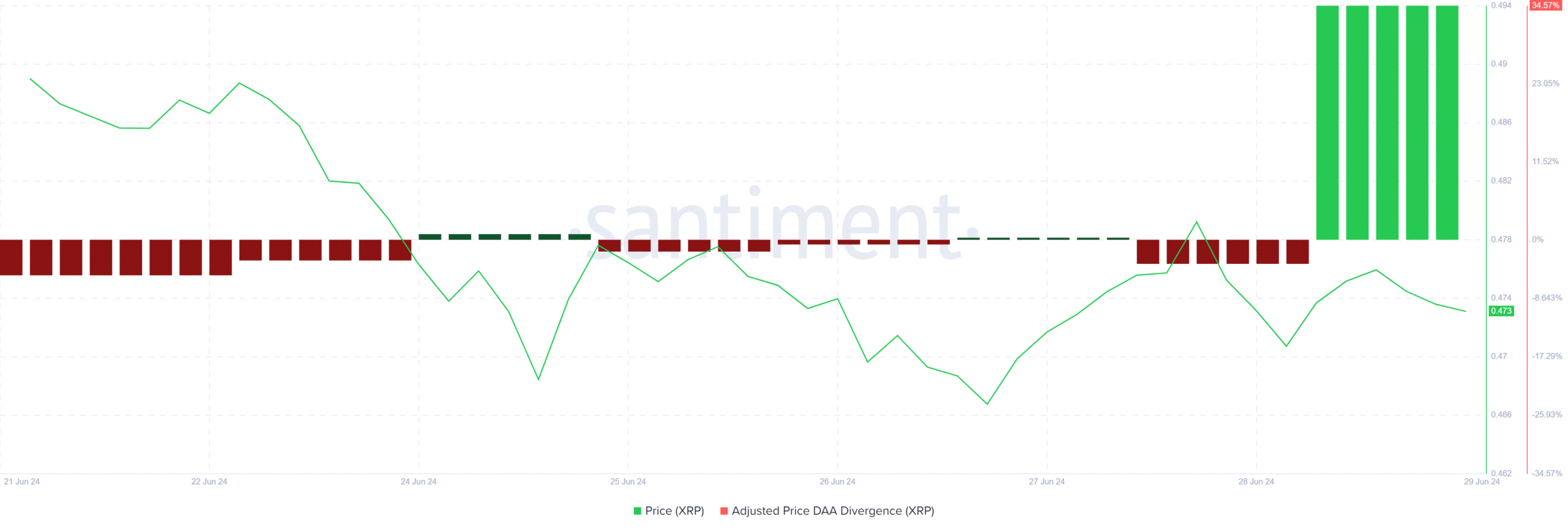

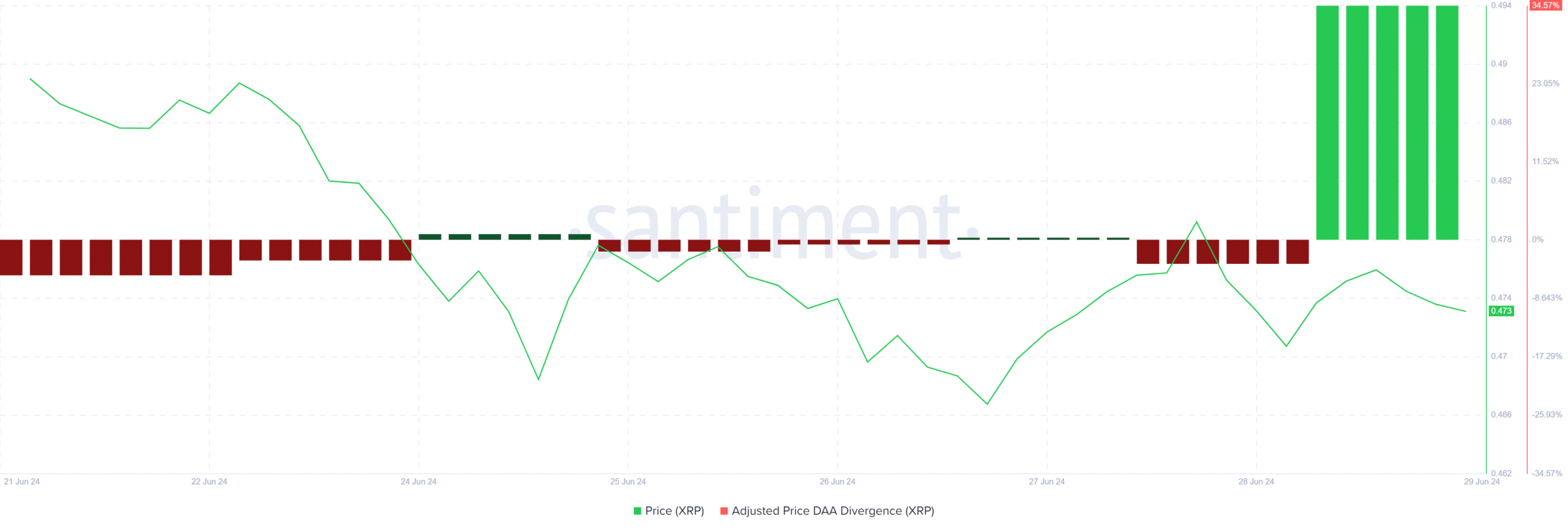

Source: Santiment

Moreover, XRP’s adjusted selling price DAA divergence stands at 34.57%, indicating a reasonable difference amongst rate raise and day-to-day lively addresses.

A increased DAA divergence indicates prices increase due to speculative buying, although a reasonable DAA divergence indicates a slight variance among every day functions and value surges.

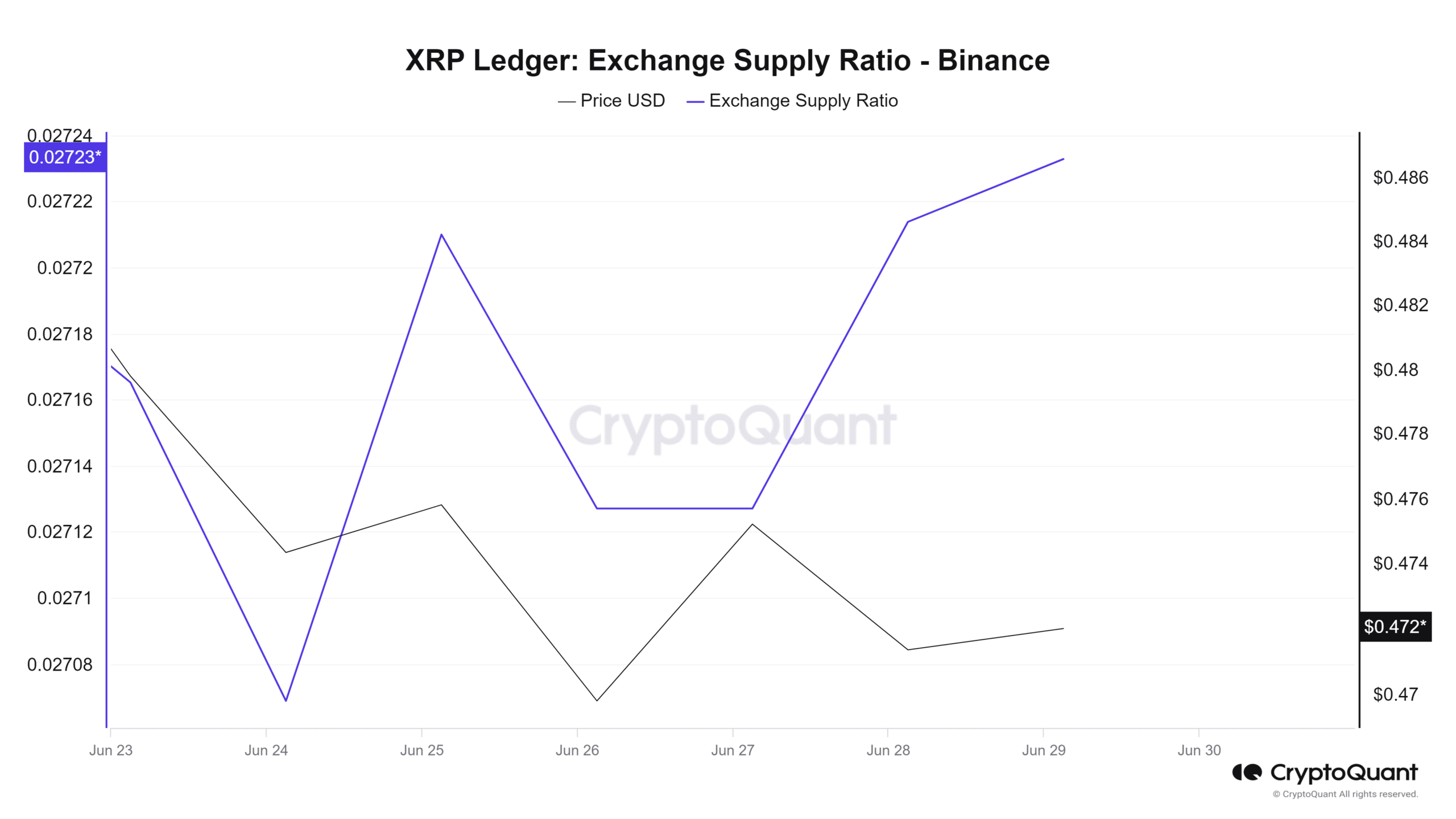

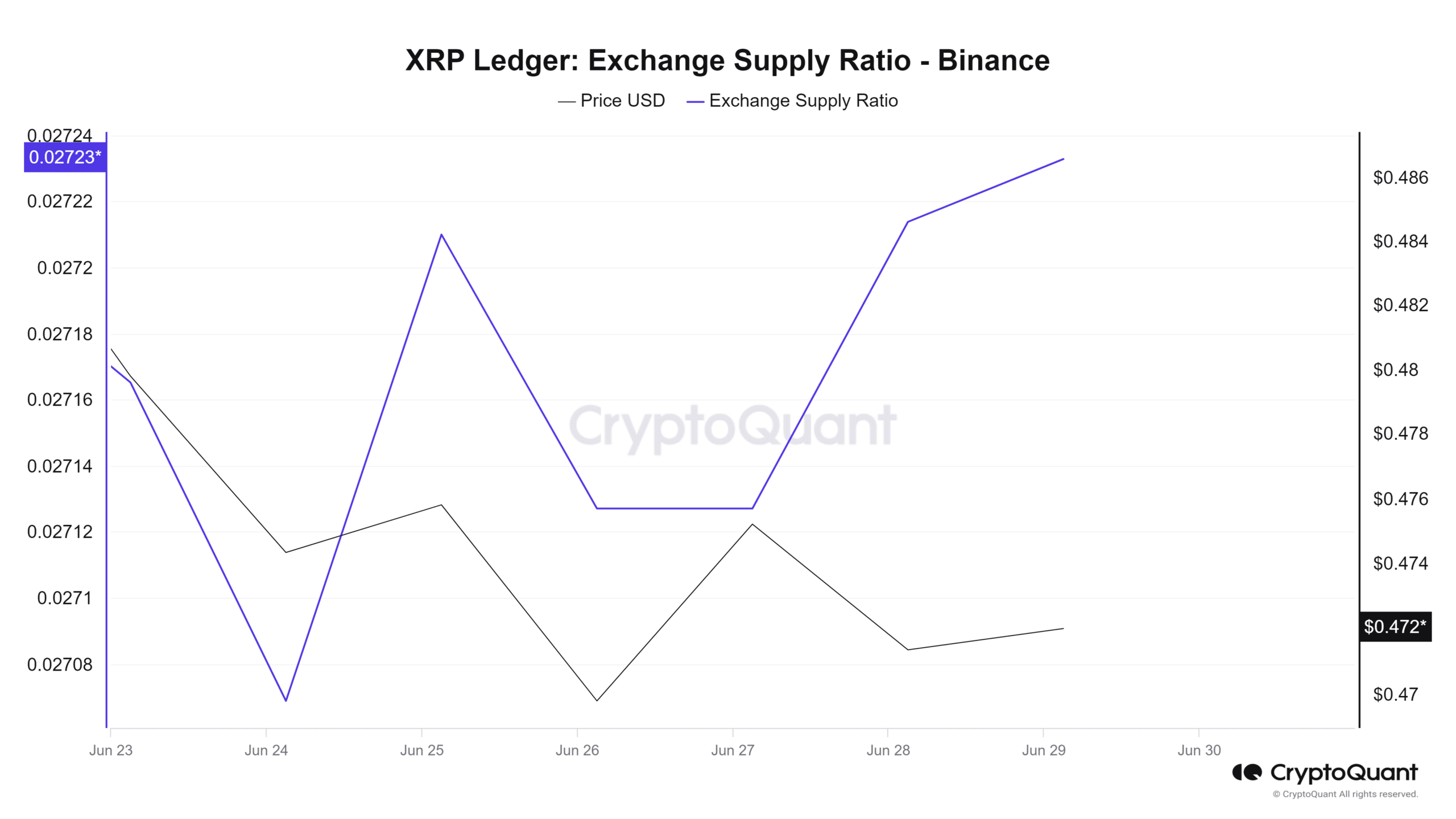

Source: CryptoQuant

Eventually, AMBCrypto’s evaluation of CryptoQuant illustrated a slight increase in the trade supply ratio more than the previous couple times. The exchange source ratio has inched up from .0270 to .0272 for the duration of this time.

The trade supply ratio demonstrates equilibrium with a steady supply and demand from customers for the altcoin.

XRP Experiencing a Determination Issue

Consolidation phases typically precede a breakthrough instant. XRP is investing at $.4721 now, marking a .75% lower in the past 24 hours.

Is your portfolio showing green? Discover the XRP Gain Calculator

Sellers breached the essential assistance amount around $.466, with $.47 performing as the support degree for the entire month, indicating prevailing desire and advertising force.

If bulls emerge victorious, a slight bullish reversal could propel prices in direction of the subsequent important amount close to $.499. However, a insignificant fall beneath this important level could trigger a substantial provide-off, driving costs to $.43.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!