Examining the consequences of DMM Bitcoin’s $321M buyback on the price of BTC

- Exciting news! DMM Bitcoin has announced a buyback plan to recover 4,502.9 BTC lost to hackers.

- Curious about how this move will impact the Bitcoin market? AMBCrypto has the scoop!

On May 31st, DMM Bitcoin, a well-known Japanese cryptocurrency exchange, faced a major security breach resulting in the loss of around 48 billion yen ($305 million) worth of Bitcoin [BTC].

The breach saw 4,502.9 BTC moved out of the exchange, as noted by security experts at Blocksec. The stolen funds were divided into 500 BTC batches across ten different wallets.

DMM Bitcoin’s Bold Move

To offset this substantial loss, DMM Bitcoin has initiated a strategic recovery plan to reimburse affected users without disturbing the broader Bitcoin ecosystem.

The platform has revealed its intention to secure 50 billion yen ($321 million) to repurchase the lost Bitcoin, a step towards rebuilding trust and stability.

This incident, ranked as the seventh-largest crypto theft by Chainalysis, prompted immediate regulatory intervention.

Japan’s Financial Services Agency has mandated a thorough investigation into the breach by DMM Bitcoin, along with a report on the incident’s origins and customer compensation strategy.

Finance Minister Shunichi Suzuki has also pledged to enhance security measures to prevent future breaches in the crypto industry.

Currently, the company has secured a 5 billion yen loan and is working on a significant capital raise totaling 48 billion yen.

Potential Impact

Although the idea of a crypto exchange buying millions in Bitcoin is attention-grabbing, DMM’s planned $320 million investment is unlikely to cause major market disruptions.

This purchase represents only about 0.023% of the current circulating supply, as per Coingecko data.

In contrast, U.S. spot Bitcoin ETFs are making purchases exceeding $500 million, significantly impacting Bitcoin’s price dynamics.

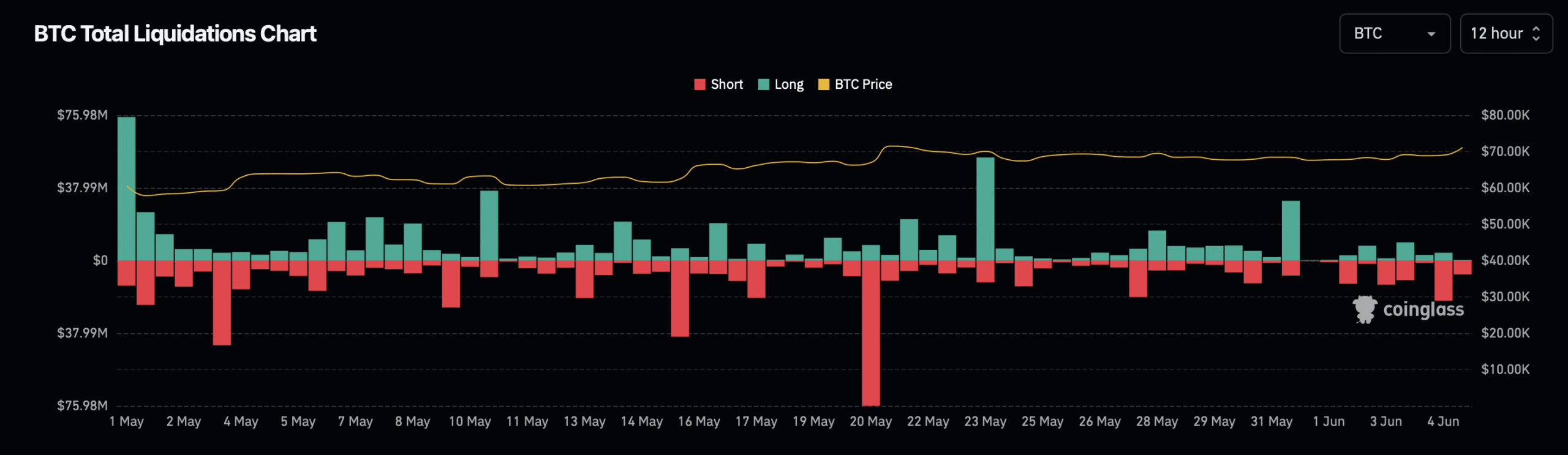

Presently, Bitcoin is valued slightly above $71,000, showing gains over the past day and week. However, these gains have led to market liquidations exceeding $30 million, according to Coinglass.

Source: Coinglass

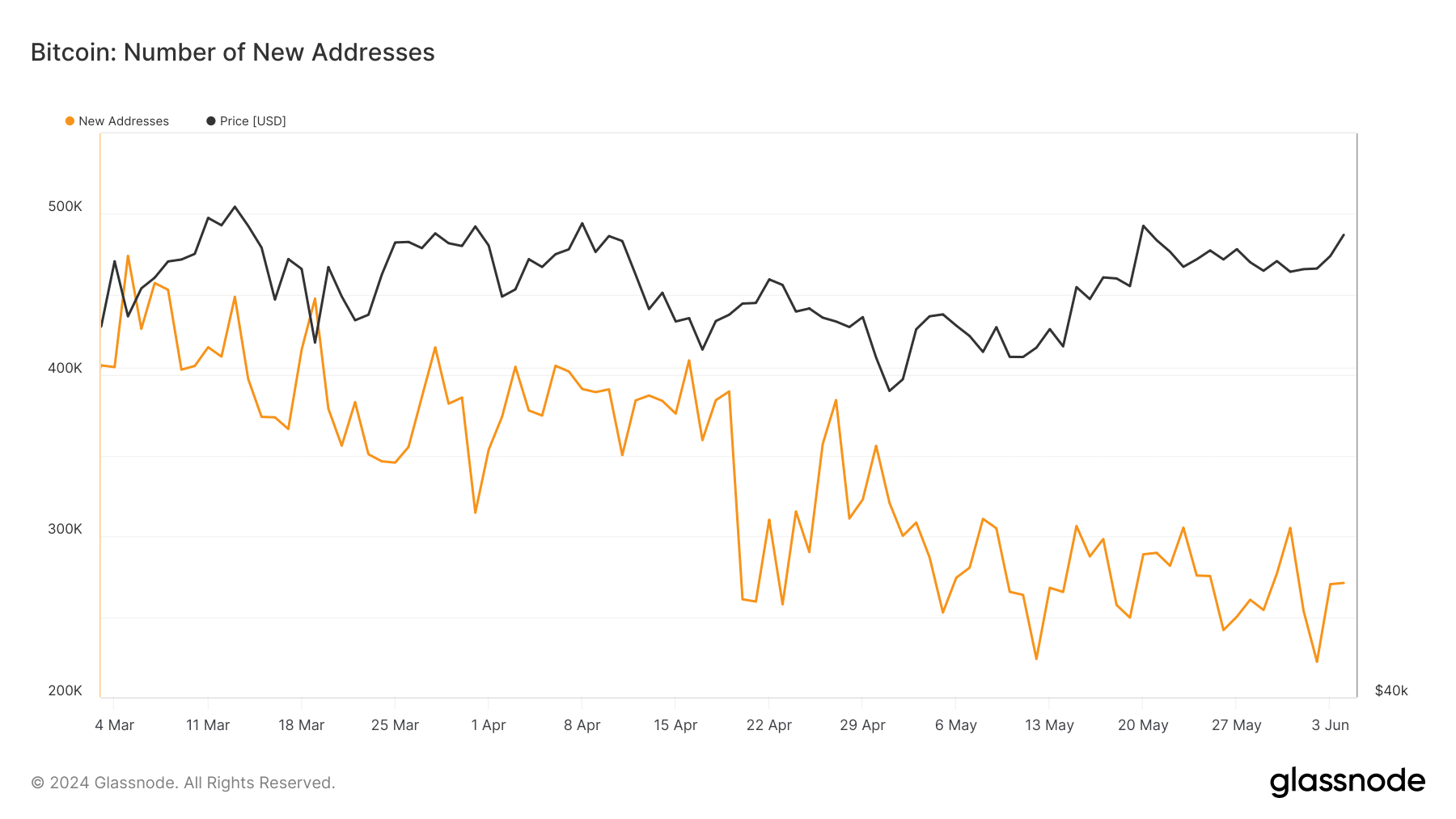

Recent data from Glassnode indicates a rise in new Bitcoin addresses, hinting at growing interest and potentially higher valuations in the future.

Source: Glassnode

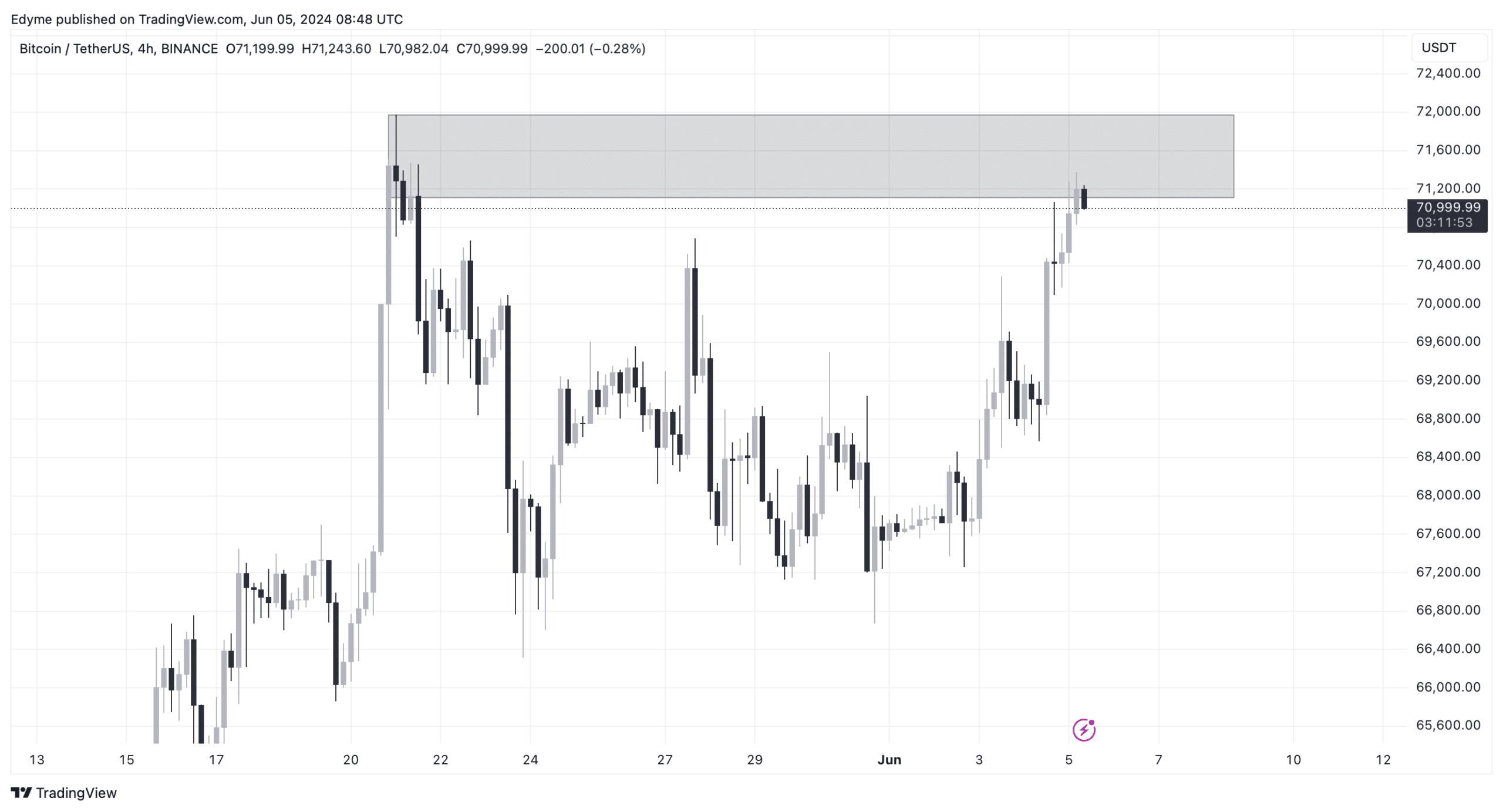

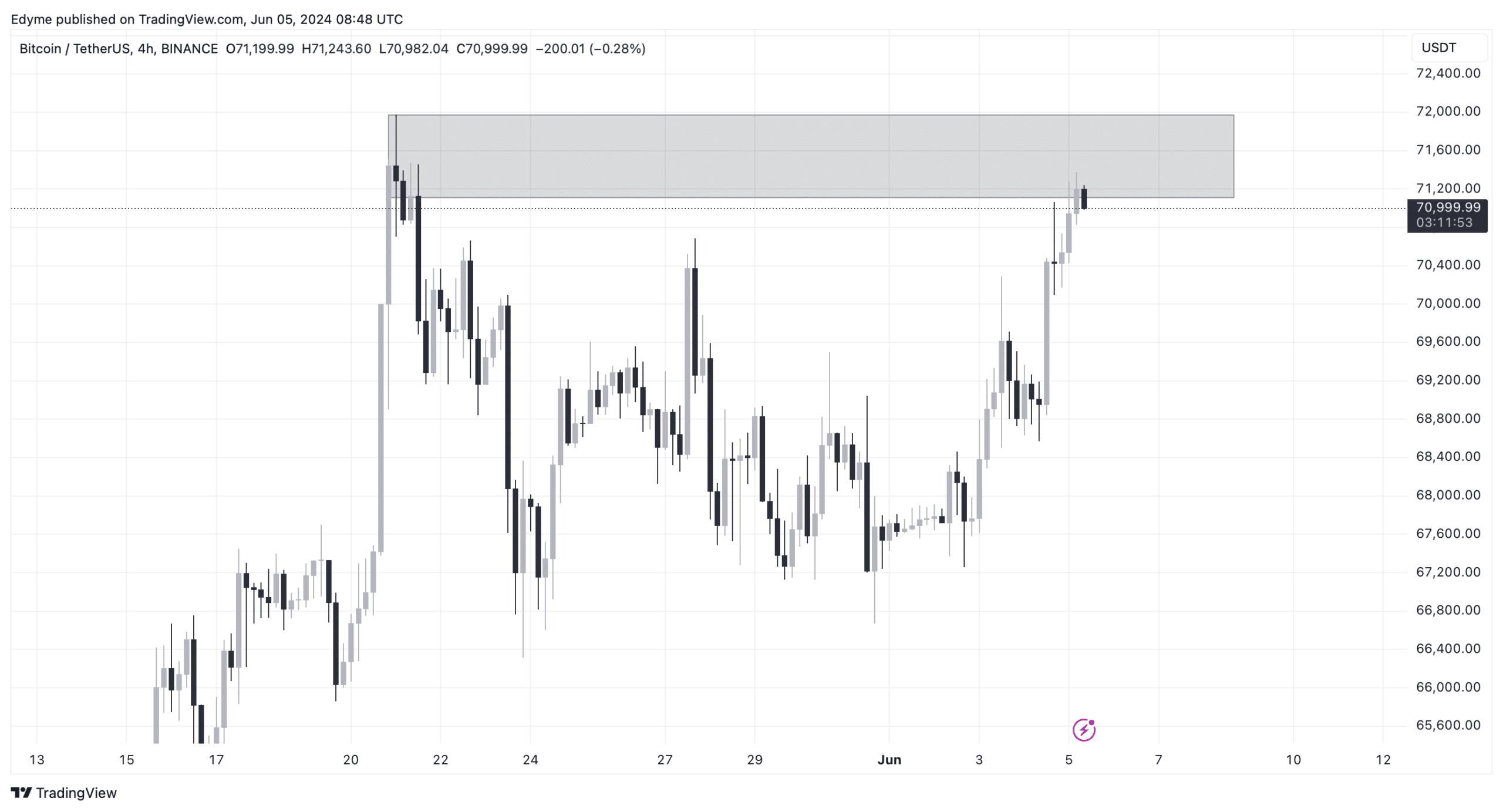

Additionally, technical analysis suggests that Bitcoin is on the verge of surpassing a crucial resistance level on the daily chart. A breakthrough could trigger a significant rally, propelling the asset to new heights.

Source: TradingView

Explore Bitcoin’s [BTC] Vibrant Future Predictions 2024-2025

In a separate review, AMBCrypto highlights the rising Network Value to Transactions ratio, indicating a possible overvaluation of BTC based on its transaction efficiency.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!