USDT Usually takes Guide in Stablecoin Sector with 70% Dominance

<

div>

- Thrilling news! The stablecoin marketplace capitalization is on the rise when once more!

- On the other hand, one metric is hinting at negative sentiment and opportunity advertising stress in the sector.

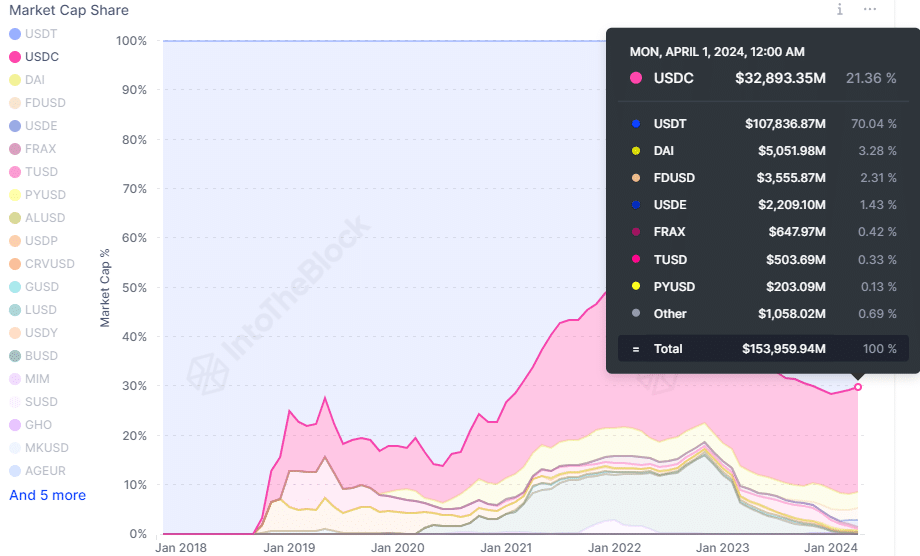

Stablecoins engage in a critical job in the crypto earth. These tokens are usually linked to a fiat forex, established on the blockchain, and supported by a reserve of the respective fiat by an external entity. A single of the most well-regarded stablecoins is Tether, known for its USDT token.

Tether is backed by a significant reserve of USD in the variety of cash or cash equivalents, producing it a fiat-backed stablecoin.

Other noteworthy stablecoins consist of USD Coin [USDC] and Dai [DAI]. DAI, for occasion, is backed by USDC alongside with other cryptocurrencies like Ethereum [ETH] and Bitcoin [BTC], distinguishing it as a crypto-collateralized stablecoin.

Stablecoins provide as a safeguard in opposition to volatility, supplying holders with the alternative to change their crypto into stable belongings, ensuring essential liquidity. The benefit of stable tokens is commonly stable even throughout periods of heavy promoting.

An Overview of Market Share

Resource: IntoTheBlock

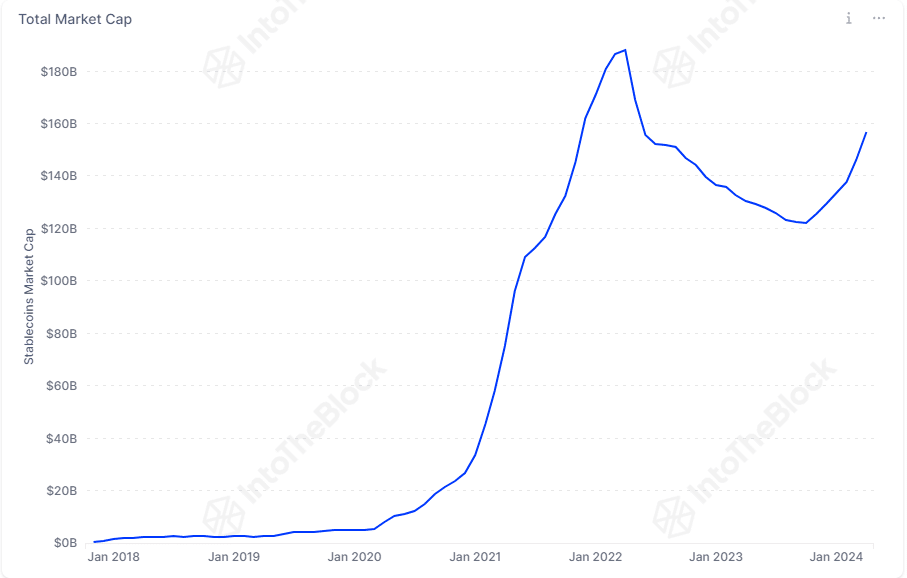

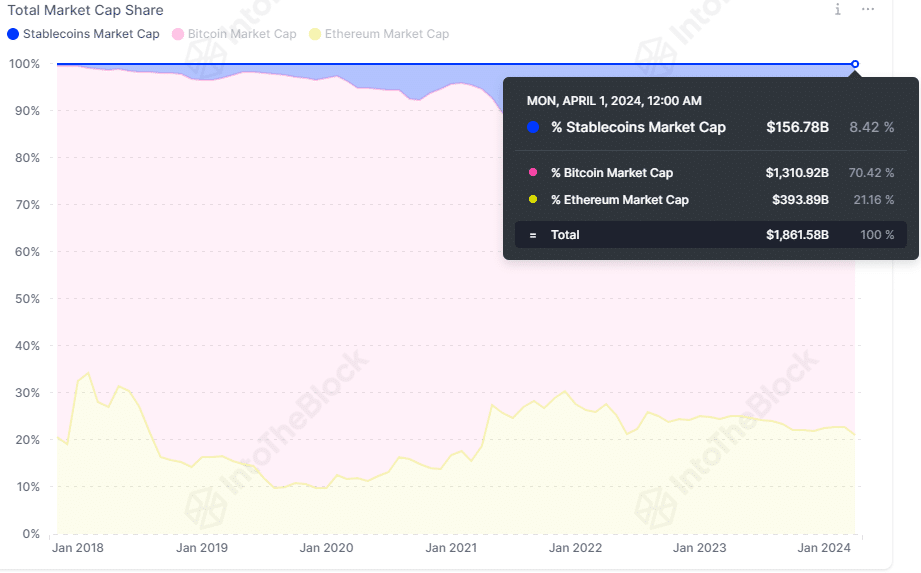

Stablecoins at this time make up 8.42% of the whole crypto industry capitalization, amounting to a complete of $156 billion.

The highest current market cap for stablecoins was recorded in April 2022 at $188 billion, but it dropped through the 2022 bear current market, as disillusioned traders shifted back again to conventional belongings and still left the market place.

Regulation is also a important element. Paxos, the company powering Binance USD (BUSD), a USD-pegged stablecoin introduced by Binance and Paxos, confronted regulatory hurdles.

In November 2023, the New York Department of Monetary Expert services (NYDFS) instructed Paxos to stop minting BUSD, causing Binance to little by little withdraw aid, ensuing in BUSD dropping its marketplace charm.

<img aria-describedby="caption-attachment-388032" decoding="async" class="wp-image-388032 size-full" src="https://ambcrypto.com/wp-content/uploads/2024/04/MD-4-stables-market-share-in-percent.png" alt="Stablecoin market dominance" width="920" height="556" srcset="https://ambcrypto.com/wp-content/uploads/2024/04/MD-4-stables-market-share-in-percent.png 920w, https://ambcrypto.com/wp-content/uploads/2024/04/MD …

<img aria-describedby="caption-attachment-388032" decoding="async" class="wp-image-388032 size-full" src="https://ambcrypto.com/wp-content/uploads/2024/04/MD-4-stables-market-share-in-percent.png" alt="Stablecoin market dominance" width="920" height="556" srcset="https://ambcrypto.com/wp-content/uploads/2024/04/MD-4-stables-market-share-in-percent.png 920w, https://ambcrypto.com/wp-content/uploads/2024/04/MD …Tether dominates the stablecoin market with a share of 70.04%, followed by USDC at 21.36% and DAI at 3.28%. The market clearly favors USDT, possibly due to its longevity and transparent asset reserves that build trust.

If you’ve been following the changes in stablecoin market capitalization since October 2023, you’ll notice a positive trend. This coincides with the rise in Bitcoin and in general crypto charges, indicating enhanced buying energy and optimistic sector disorders.

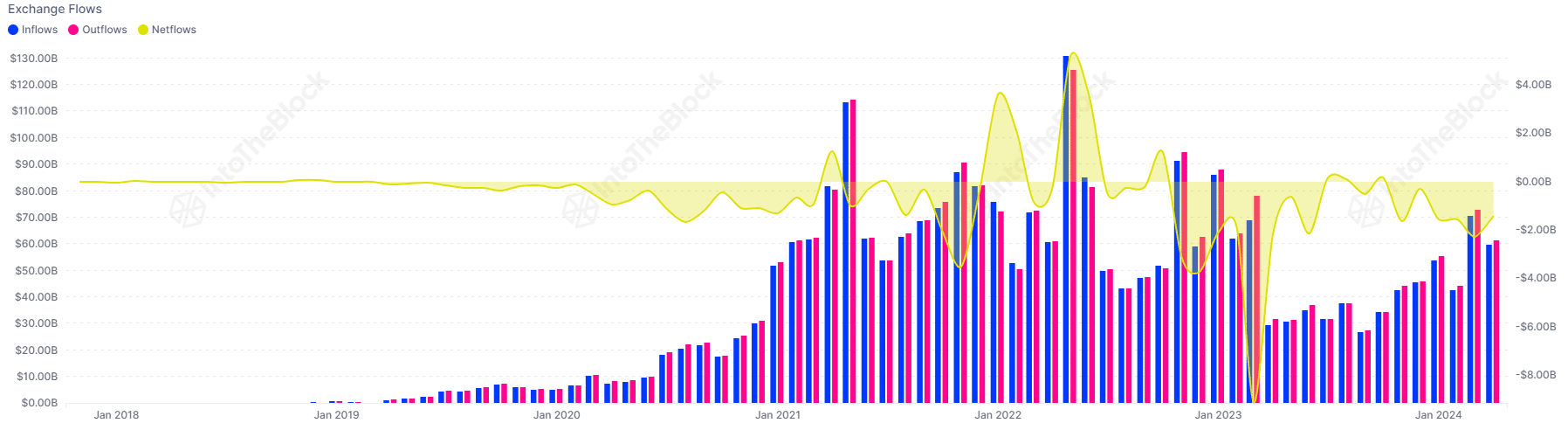

Conversely, the exchange netflow of stablecoins has shown a unfavorable trend given that Oct 2023, indicative of increased selling stress more than the earlier 18 months.

While this development may counsel a damaging sentiment in the current market, it’s important to take into account other elements. Huge inflows of stablecoins were noticed only in January and Might 2022, indicating that the situation is multifaceted and needs a detailed assessment.

Curious about Bitcoin’s [BTC] Rate Prediction for 2024-25? Look at it out right here!

Even though the information on stablecoin exchange netflow may perhaps suggest advertising pressure and negative sentiment, it’s just a piece of the puzzle. Market dynamics are intricate, and various components influence investing activity and total sentiment.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!