The Implications of Ethereum’s Increasing Demand on the Price of ETH

- The demand for Ethereum has surged recently, with decreasing put-to-call ratios.

- Although ETH’s price has been stagnant, bullish sentiment is on the rise.

Ethereum enthusiasts have witnessed the cryptocurrency hovering around the $3500 mark for some time now. Despite its lack of significant movement, optimism surrounding Ethereum has been gaining momentum.

Rising demand for Ethereum

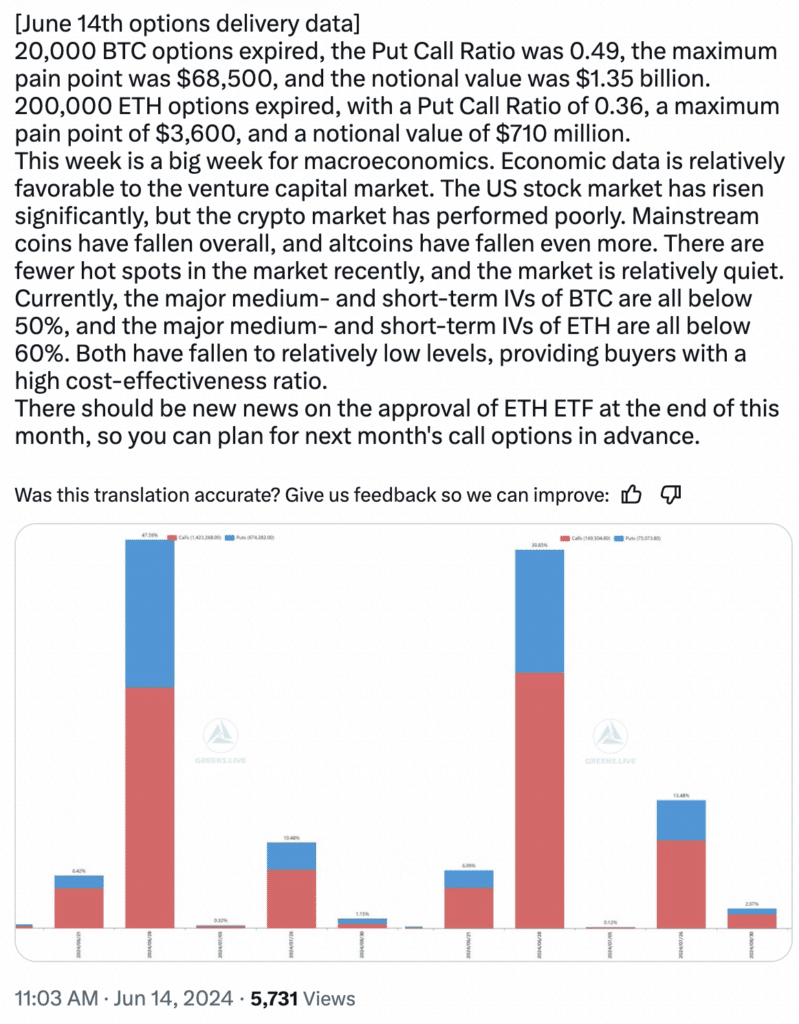

Recent data indicates that 200,000 Ethereum options contracts have expired, showcasing a surge in bullish sentiment within the Ethereum market. The Put-Call Ratio, a pivotal indicator of market sentiment, currently stands at a low of 0.36.

This ratio implies that there has been a noticeable preference for call options over put options, suggesting a collective belief among traders that Ethereum’s price is poised for an upswing. Additionally, the $3,600 maximum pain point further reinforces the positive outlook, indicating where the majority of options contracts will expire worthless.

If Ethereum manages to surpass $3,600 upon expiry, it would render most call options profitable, underscoring a bullish inclination in the market. The low implied volatility (IV) below 60% across short-term ETH options adds fuel to the optimistic fire, hinting at a stable or upward price trend in the near future.

Source: X

Analyzing the price movements

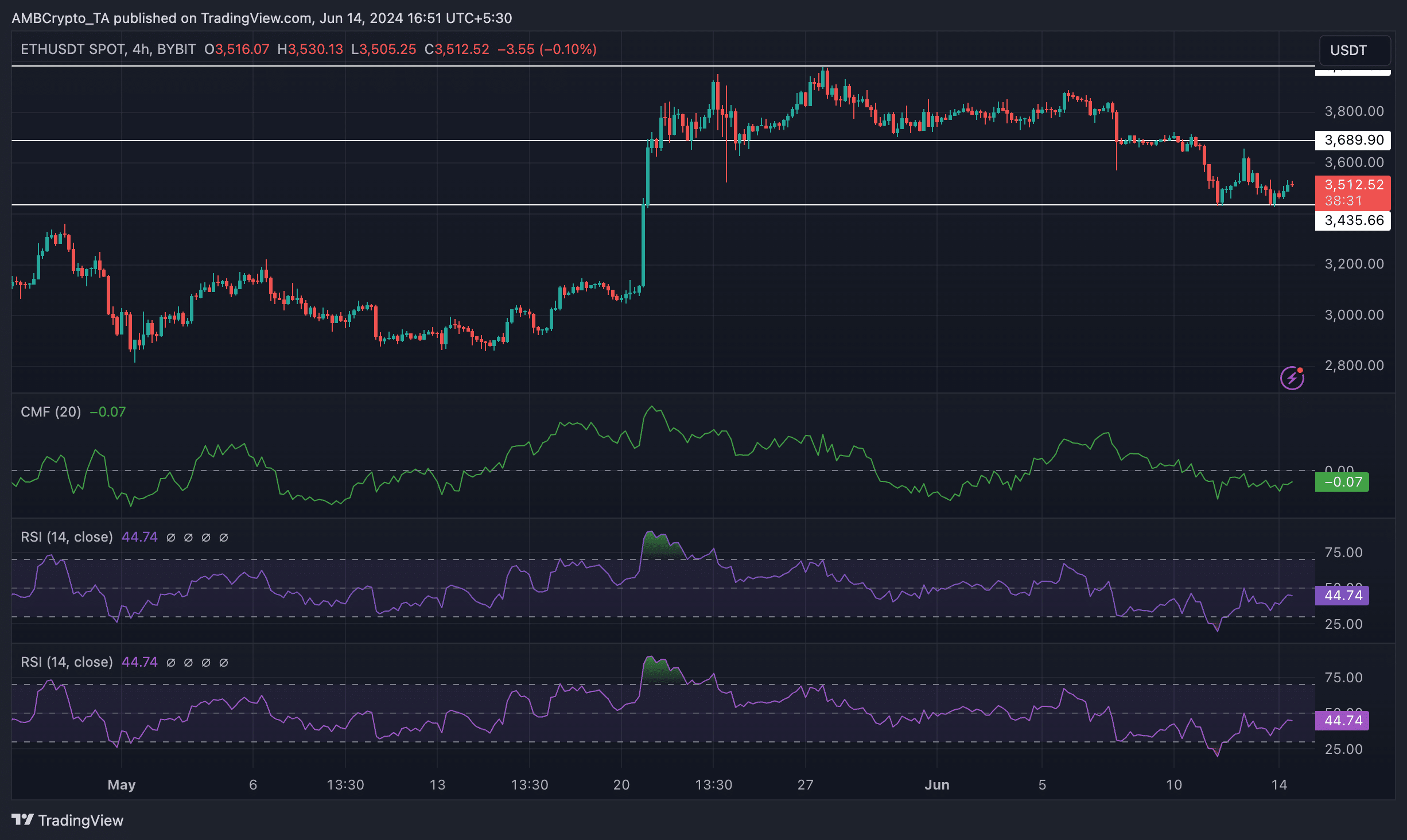

Currently, ETH is trading at $3,512.52. Despite a significant price surge post-20th May, the bullish sentiment around Ethereum started dwindling over time. As ETH’s price dipped again after 27th May, the market trend also started to reverse.

If the bearish sentiment persists, Ethereum’s price could potentially drop to the $3,000 level. The Chaikin Money Flow (CMF) for ETH experienced a noticeable decline during this period, suggesting a substantial decrease in money flow. Moreover, the Relative Strength Index (RSI) for ETH was relatively low, hinting at a decline in the cryptocurrency’s bullish momentum.

Source: Trading View

Impact on new addresses

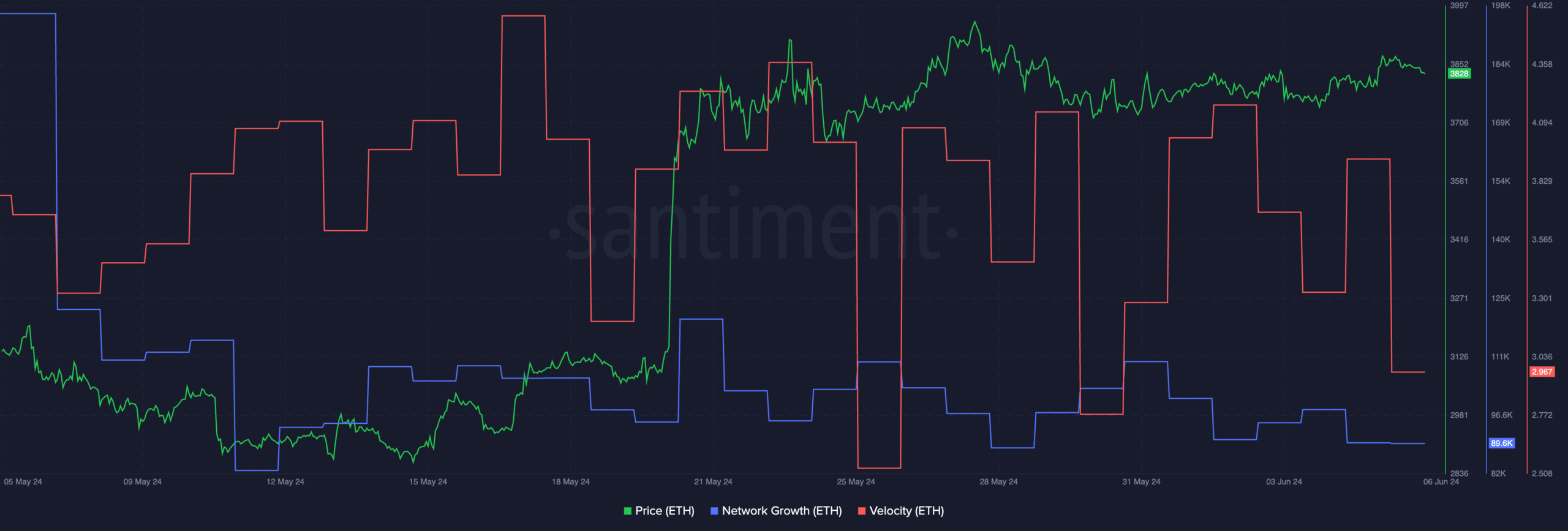

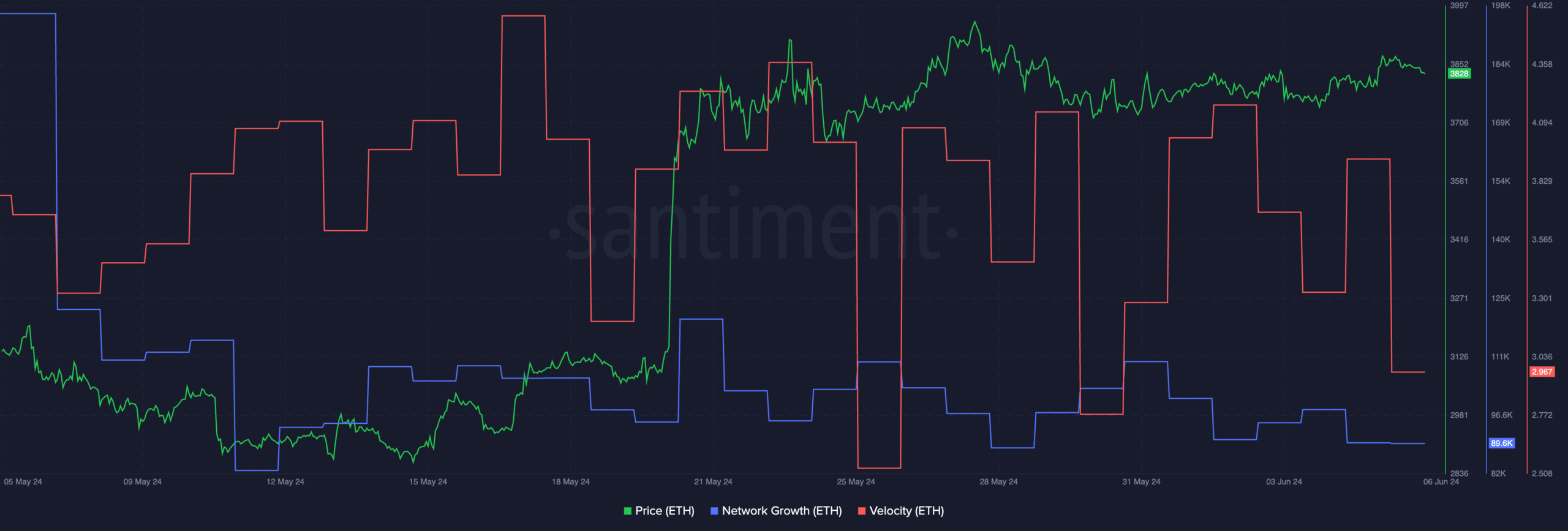

An analysis of Santiment’s data by AMBCrypto revealed a substantial decline in network growth for Ethereum as its price dipped. This decline in network growth suggests that new users are losing interest in Ethereum and are hesitant to purchase the altcoin despite its recent price decrease.

Read Ethereum (ETH) Price Prediction 2024-25

If this trend persists and new addresses continue to abstain from purchasing more ETH, it could further negatively impact the cryptocurrency’s price. Additionally, the velocity of ETH trades diminished during this period, indicating a significant decrease in trading frequency over the past few days.

Source: Santiment

However, as the popularity of ETFs continues to escalate, the interest in ETH is expected to surge, particularly as institutional investors from Wall Street enter the market.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!