Examining the Long term of the Crypto Industry Through Bitcoin and Ethereum Exchange Flows

- Modern assessment indicates that BTC and ETH could be bottoming out domestically.

- In spite of a lack of bullish sentiment, checking holder habits at significant help degrees will be very important for identifying the up coming price tag motion.

The bulls of Bitcoin [BTC] and Ethereum [ETH] faced a difficult endeavor in altering the current market dynamics in their favor. With important losses in excess of the final 10 times, the prices have retraced to a aid spot exactly where buyers normally move in to counter the advertising force.

ETH’s MVRV and NVT ratios implied that the asset could possibly be undervalued. When there is opportunity for a small squeeze at the $3500 liquidity pocket, the prevailing momentum remains bearish.

In a different assessment focused on Bitcoin [BTC], it was disclosed that mining activity experienced reduced, main to miners advertising off their Bitcoin holdings. Nevertheless, the depth of the marketing pressure has shown indicators of diminishing in excess of the earlier two times.

Our investigation at AMBCrypto took a closer seem at the movement of BTC and ETH on exchanges, shedding light on the sentiment prevailing in the industry and signaling careful optimism amongst the bulls.

Comprehension the Exchange Netflow Metric

The trade net flows metric presents worthwhile insights into market place dynamics. Optimistic flows point out bigger inflows, suggesting probable marketing tension as participants shift crypto to exchanges for promoting.

In contrast, damaging values signify better outflows, a constructive signal for prospective buyers. This suggests that marketplace members are withdrawing their assets from exchanges, maybe for safer storage top to accumulation.

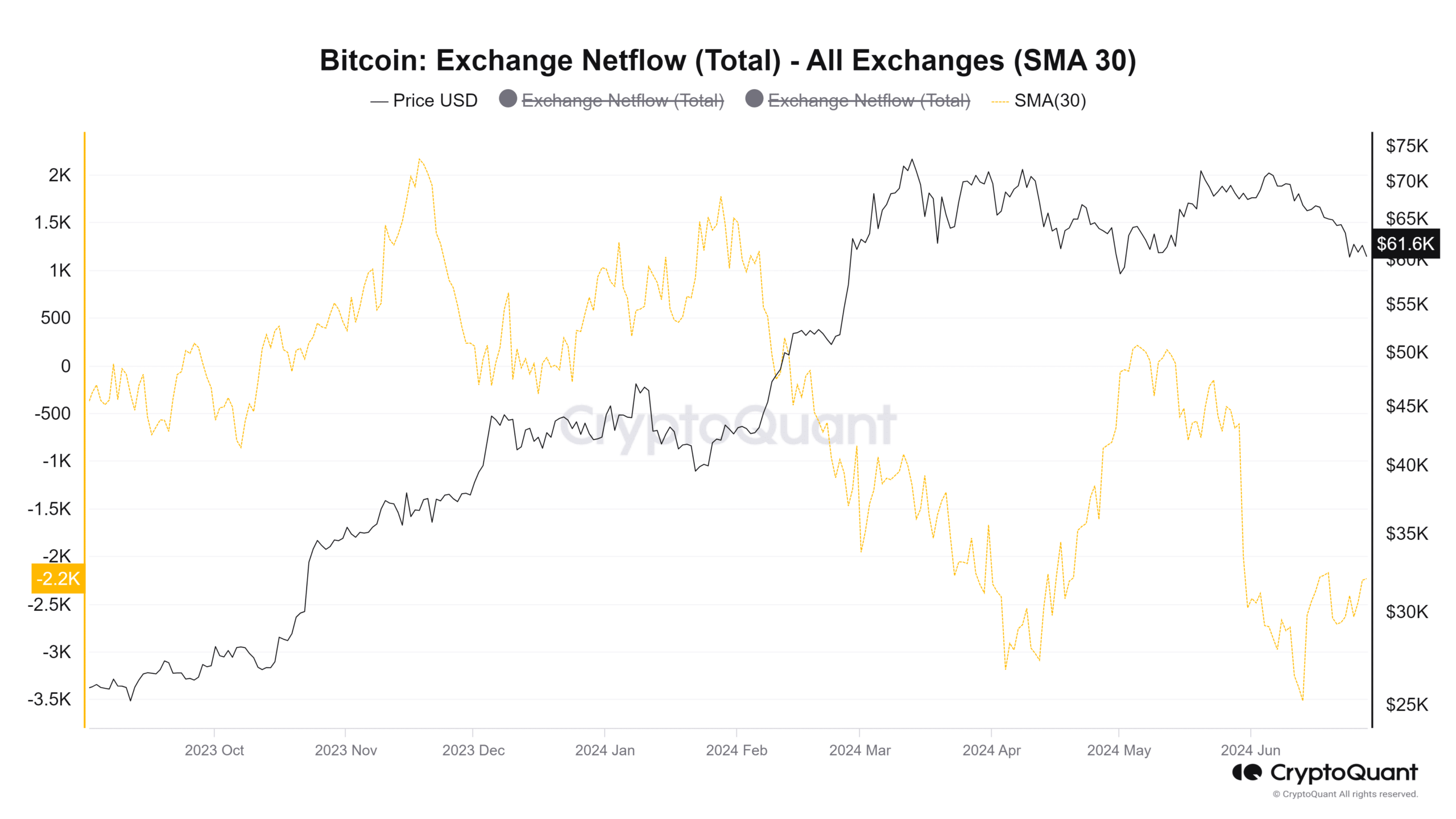

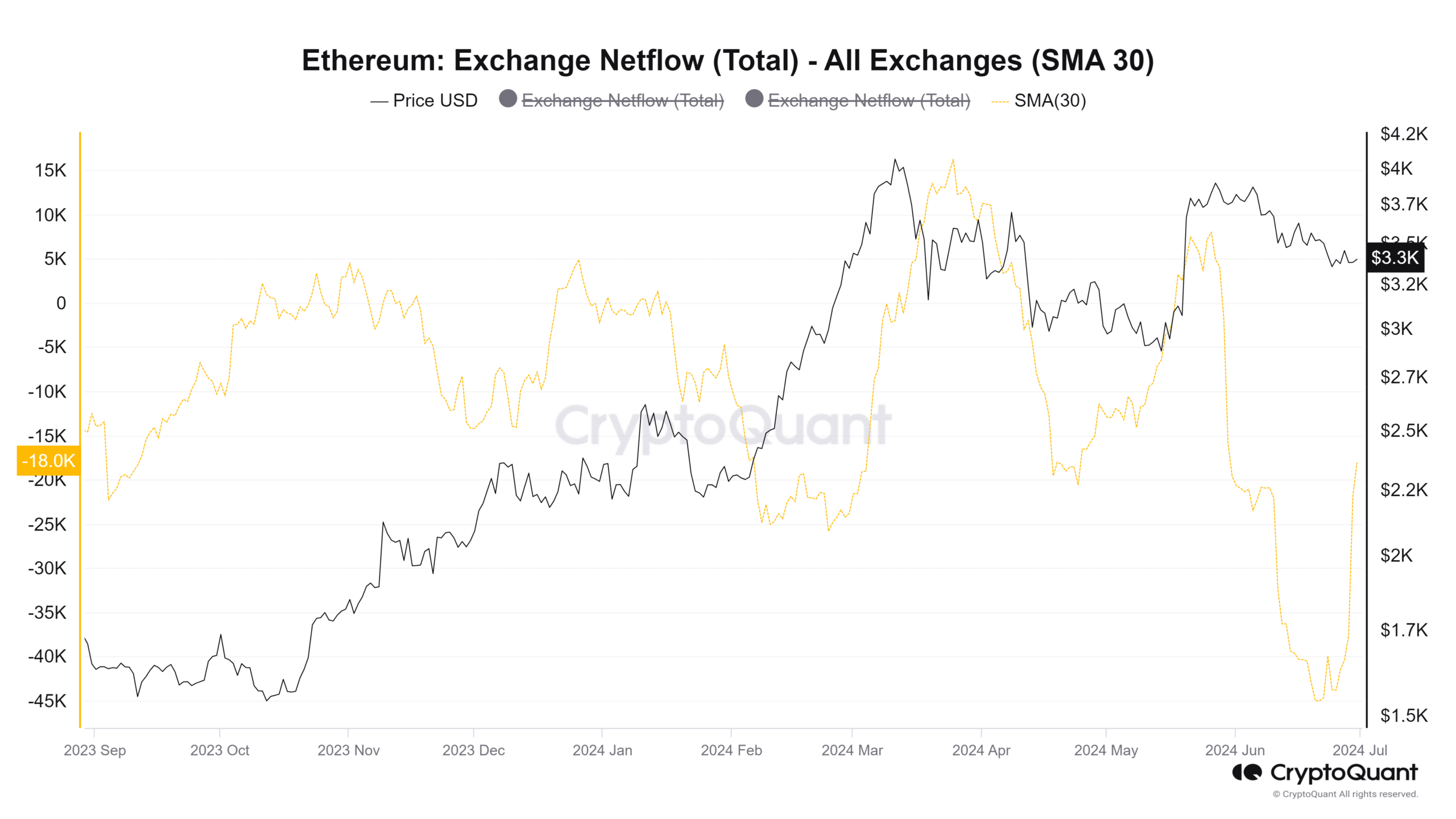

Source: CryptoQuant

Examination utilizing the 30-day uncomplicated transferring averages indicated important ETH inflows in mid-March and late Might, coinciding with neighborhood selling price tops.

The latest trends show a intensely unfavorable web stream for ETH in the earlier thirty day period, suggesting accumulation. While outflows have slowed more than the past eight days, the 30DMA web movement stays unfavorable.

Concerning Bitcoin, reliable accumulation was observed in February and March, with BTC outflows from exchanges dominating the craze, other than for spikes in influx in late April and on May 21st.

Could Bitcoin and Ethereum be heading in the direction of a consolidation period?

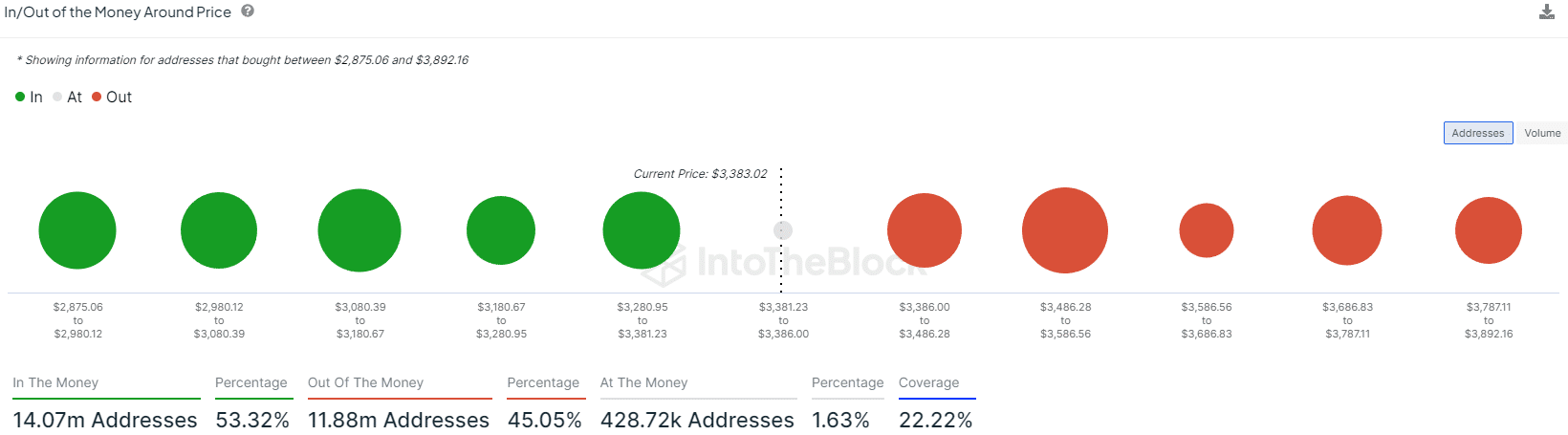

Our investigation of the in/out of money facts from IntoTheBlock indicated considerable assist zones for Ethereum, including $3080-$3180, $3280-$3381, and resistance at $3486-$3586.

Test out Bitcoin’s [BTC] Price tag Prediction for 2024-25

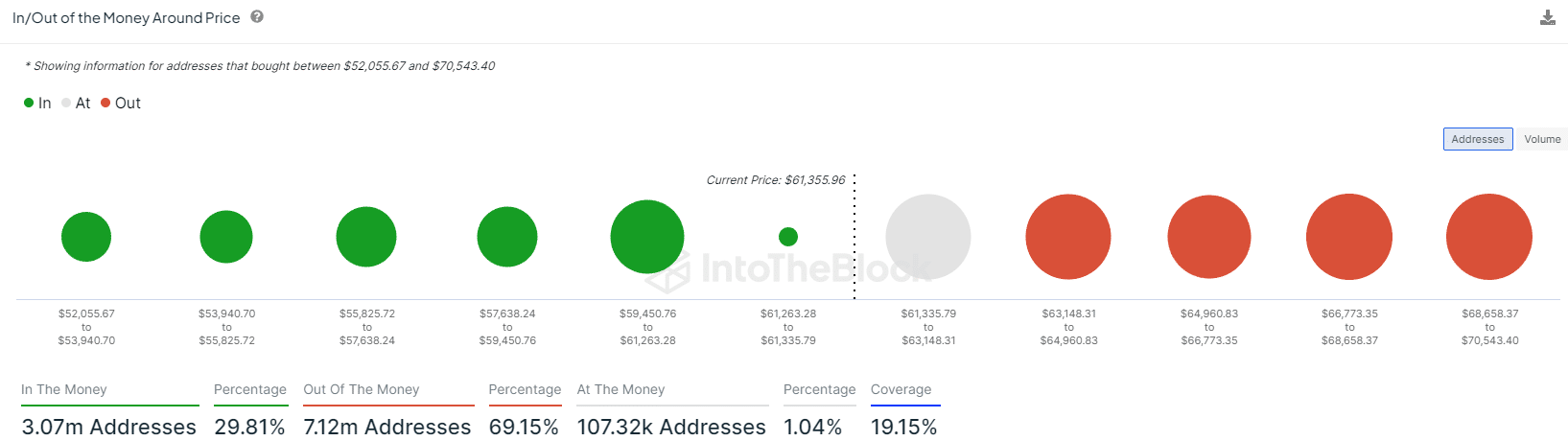

Key guidance stages for Bitcoin mirror at $59,450-$61,263, while resistance lies at $63,148-$64,960.

This signifies that the two BTC and ETH are at present consolidating, with prospective selection-bound movements inside of these assistance and resistance ranges.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!