What AVAX needs to thoroughly reverse its bearish craze

- AVAX’s NVT ratio is indicating prospective undervaluation, signaling bullish potential customers forward.

- To see a bullish reversal, AVAX desires to surpass the Ichimoku cloud and witness the MACD line crossing above the sign line.

Remarkable news for Avalanche [AVAX] lovers as the marketplace exhibits optimistic symptoms of a forthcoming bullish reversal, driven by present-day marketplace dynamics and increased getting activity. What particularly is essential for the bulls to choose charge?

Our team at AMBCrypto delved into AVAX’s community price to transactions ratio and observed a downtrend. Generally, this downtrend is a beneficial sign that the token may be undervalued when in comparison to transaction volumes.

Supply: IntoTheBlock

Nevertheless, a lower in energetic addresses in the course of June hints at reduced community engagement, probably hindering bullish prospects except if reversed.

AVAX facing sturdy bearish force

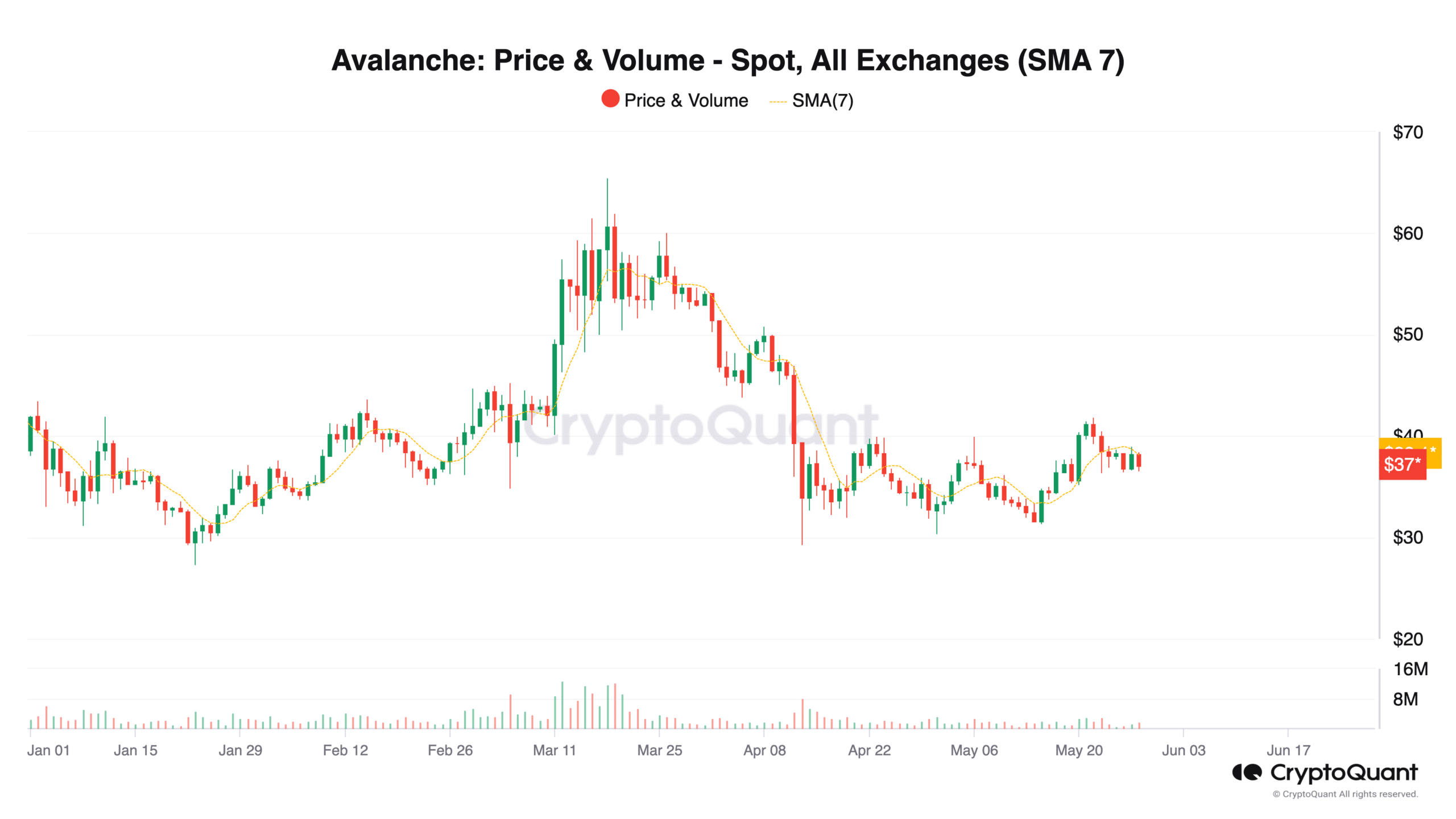

The trade netflow ratio for AVAX has risen, indicating a craze of greater volumes of AVAX entering exchanges not long ago.

Supply: CryptoQuant

If the NVT ratio continues to decrease together with increasing transaction volumes, it could direct to a much more sustainable progress driven by fundamentals, contributing favorably to a bullish sector swing.

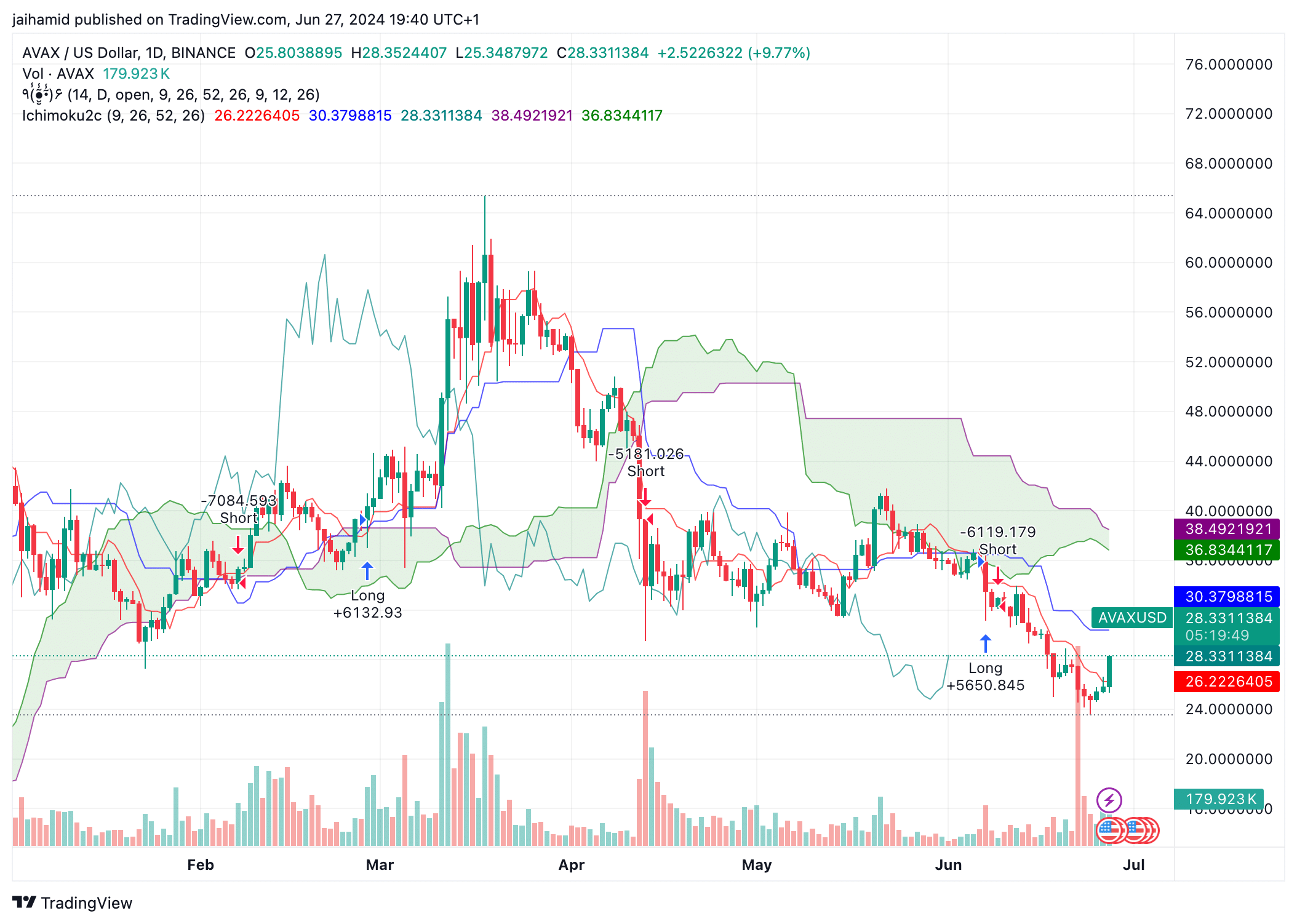

As for the Ichimoku Cloud, it at the moment displays a purple cloud, hinting at a probable bearish phase. The Tenkan-Sen (blue line) sits underneath the Kijun-Sen (pink line), additional confirming a bearish trend.

A crossover below the cloud would critically undermine the existing bullish momentum.

Source: TradingView

To solidify a bullish turnaround, AVAX have to convincingly surpass the Ichimoku cloud. Furthermore, a Tenkan-Sen crossover previously mentioned the Kijun-Sen in or above the cloud, accompanied by heightened quantity on favourable investing days, is necessary for the ideal reversal.

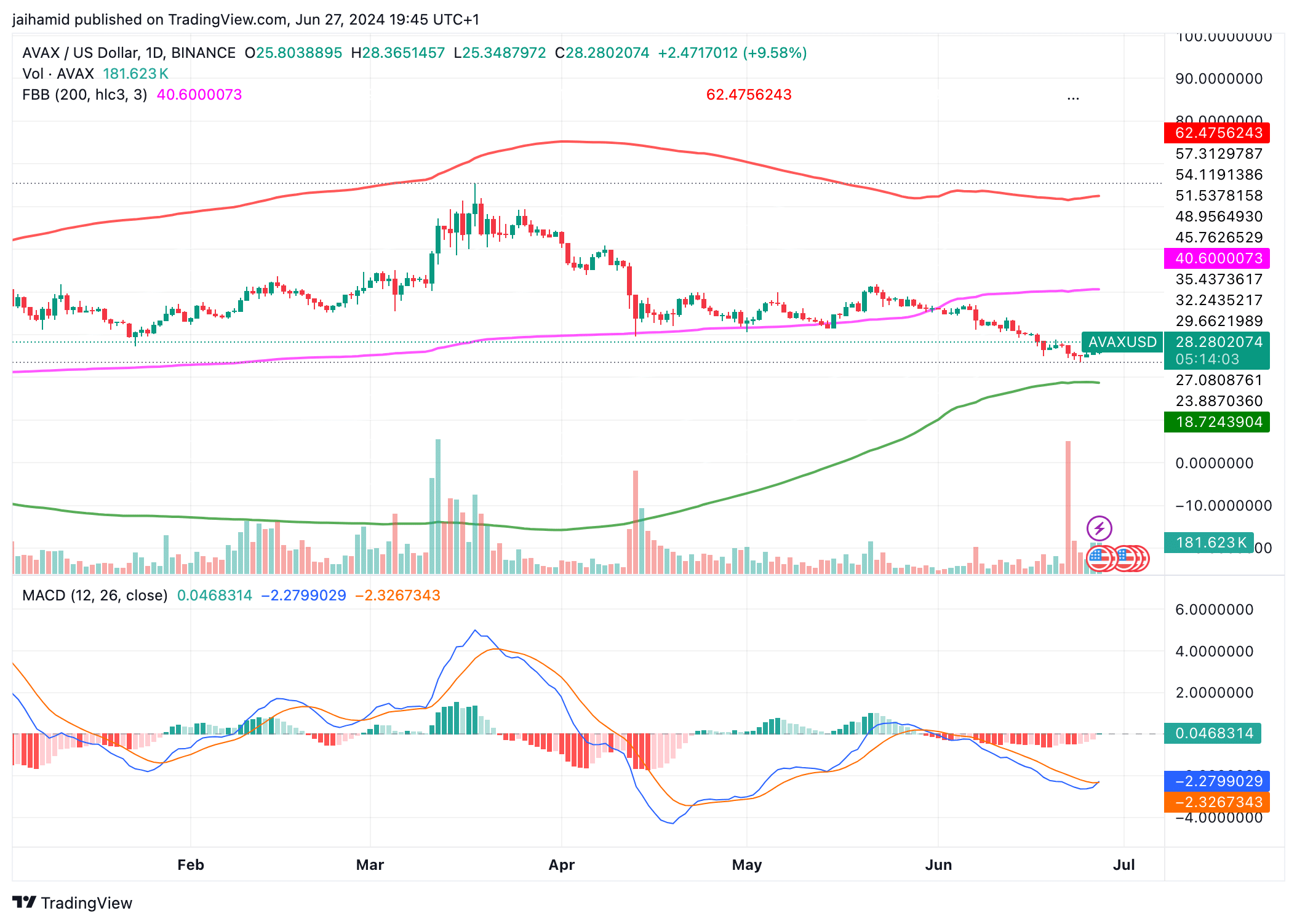

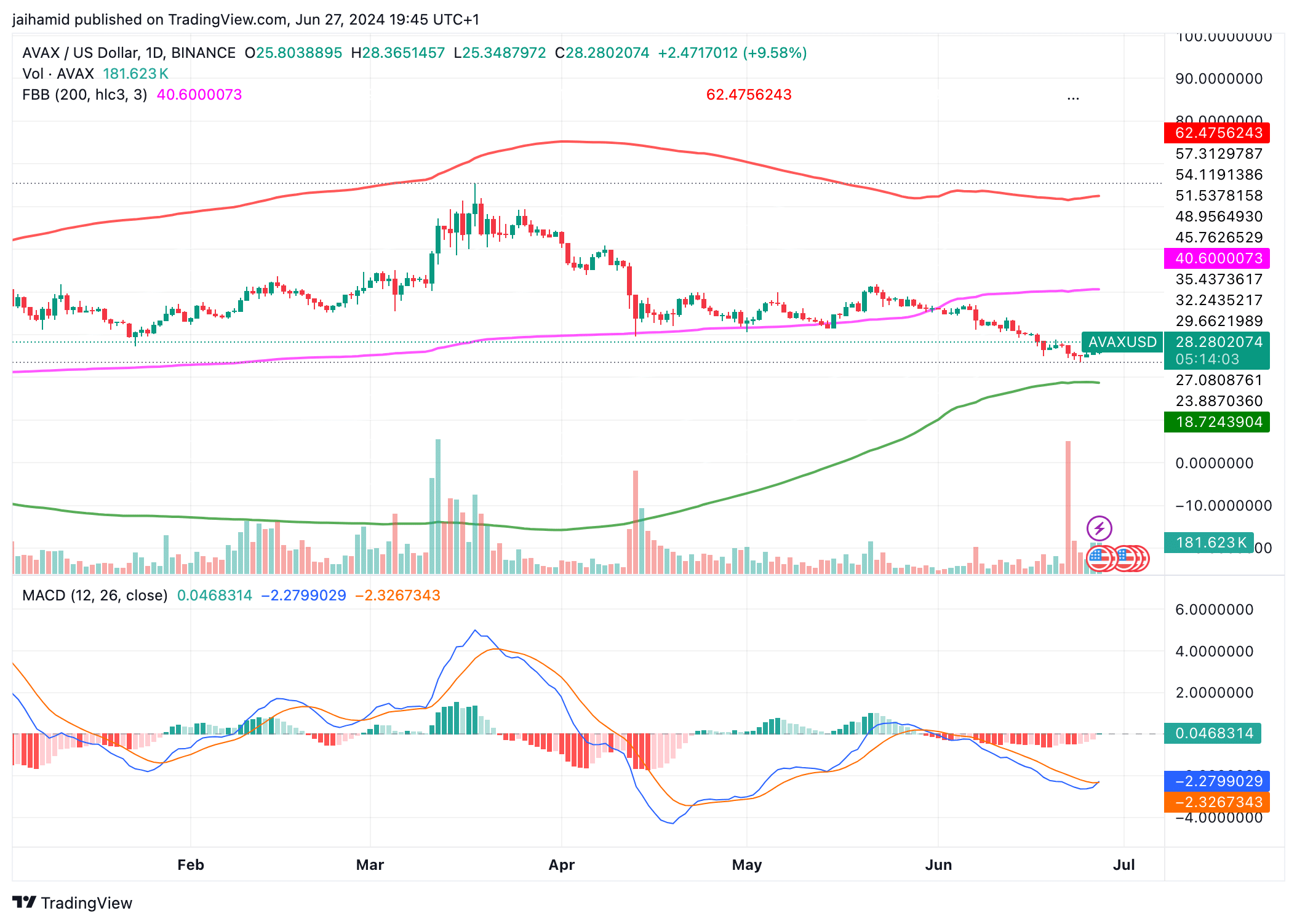

Curiously, the 200-day MA reveals a robust lengthy-expression bullish pattern, now positioned nicely beneath the recent selling price level. The MACD line is now underneath the signal line, each exhibiting a downward trajectory led by the bears.

If the cost makes an attempt a restoration, the inexperienced MA (200-day) could serve as a crucial assistance amount. A reversal from this stage would show a bullish change.

Resource: TradingView

Examine out how AVAX’s current market cap steps up in terms of BTC

Nevertheless, a convincing shift to a bullish pattern necessitates the MACD line surpassing the sign line and the value breaking over the center pink Bollinger Band.

Sad to say, the present-day situation leans towards bearishness, maybe indicating even further downtrends in the around potential.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!