Buyers may well be in for a surprise from Bitcoin this 7 days

Discover extra:

Anticipating the Effect of Macro Situations

The US Federal Reserve’s Curiosity Amount Decision is scheduled for Could 1 at 18:00 GMT. Even though this function historically impacts forex trading marketplaces considerably, its result on the crypto market place has diminished. The expectation of desire fees holding continuous amongst 5.25% and 5.50% could be a cause why these events do not cause sharp movements in crypto rates.

Based on the FedWatch Resource, there is a 97.3% probability that interest costs will continue being unchanged right after the May perhaps conference, suggesting that Bitcoin is unlikely to knowledge key fluctuations.

FedWatch Instrument

The Nonfarm Payrolls (NFP) details, unveiled on May 3 at 12:30 GMT, is not anticipated to have a substantial impact on the crypto marketplaces.

Predicting Bitcoin’s Upcoming Moves

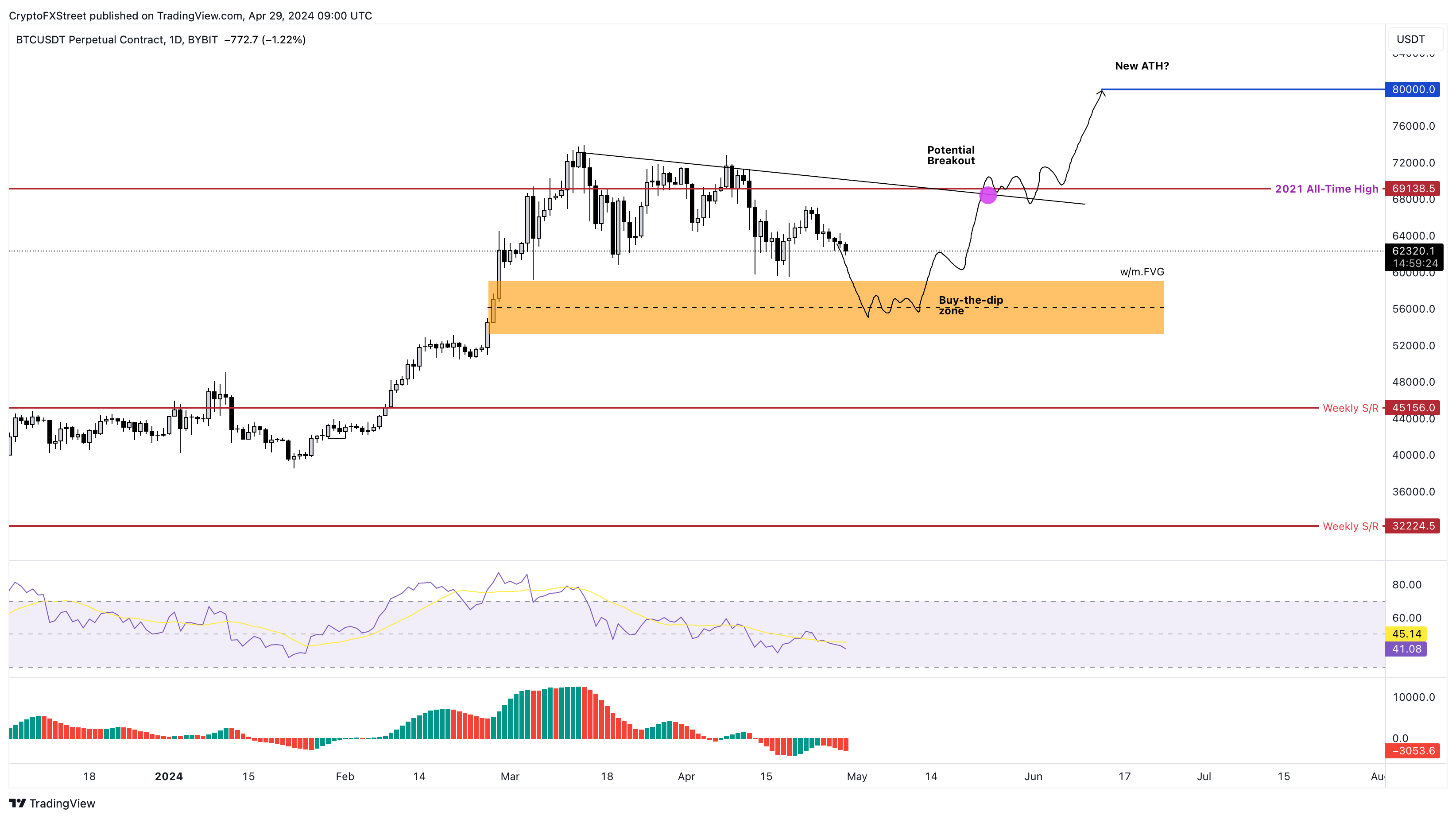

Bitcoin’s selling price is currently consolidating, forming reduce highs and equal lows previously mentioned the weekly imbalance zone ranging from $59,111 to $53,120. Market place analysts recommend that a dip into this zone offers a favorable buying prospect for a potential reversal situation.

BTC/USDT 1- 7 days chart

At the moment, no obtain signals are evident on lessen time frames like the one particular-hour chart. Normally, a bullish divergence emerges on decrease time frames prior to better time frames indicate a turnaround. Even so, this isn’t really the case for Bitcoin on the one-hour chart, indicating a attainable even further decline in advance of prospective buyers move in.

As the new 7 days commences, there could be a unexpected boost in advertising stress that drops Bitcoin’s cost into the pointed out imbalance zone, giving investors a opportunity to order BTC at a discounted rate. Traders should really be inform for a opportunity obtaining opportunity early in the week that transitions into a recovery rally later on.

Concentration on Altcoins

Meme cash have responded positively to Bitcoin’s recent security. Bonk (BONK) observed more than a 100% improve just after hitting a bottom in April. Shiba Inu (SHIB) also recorded significant gains.

A further standout altcoin from past week is Arweve (AR), a blockchain-dependent storage cryptocurrency, which surged by 10%. These major altcoins might spark a rally in the broader classification. Keep an eye on other storage altcoins like Filecoin (FIL) and Net Pc (ICP).

Apart from meme cash, it really is essential to keep track of the leading a few cryptocurrencies – Bitcoin, Ethereum (ETH), and Ripple (XRP).

Never miss out on these top rated reads!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!