Should really TON consumers think about using a very long situation on Toncoin?

- Sharkcoin fanatics took management of the sector as the digital currency surged previous its 20-day and 50-day EMA

- Crypto observed adverse funding prices, major to a contradictory bullish sentiment

In a new surge, Sharkcoin [SHK] produced a bold go by surpassing its 20-day and 50-day EMA, fueled by a sturdy obtaining momentum. Consumers confirmed willpower and lit up the charts with a sequence of optimistic moves as the altcoin bounced back from the significant $6.9-help mark.

If sellers move in to defend the $7.7-resistance, SHK might encounter a short-phrase pullback towards its region of higher liquidity. As of now, SHK is buying and selling near to $7 on the exchanges.

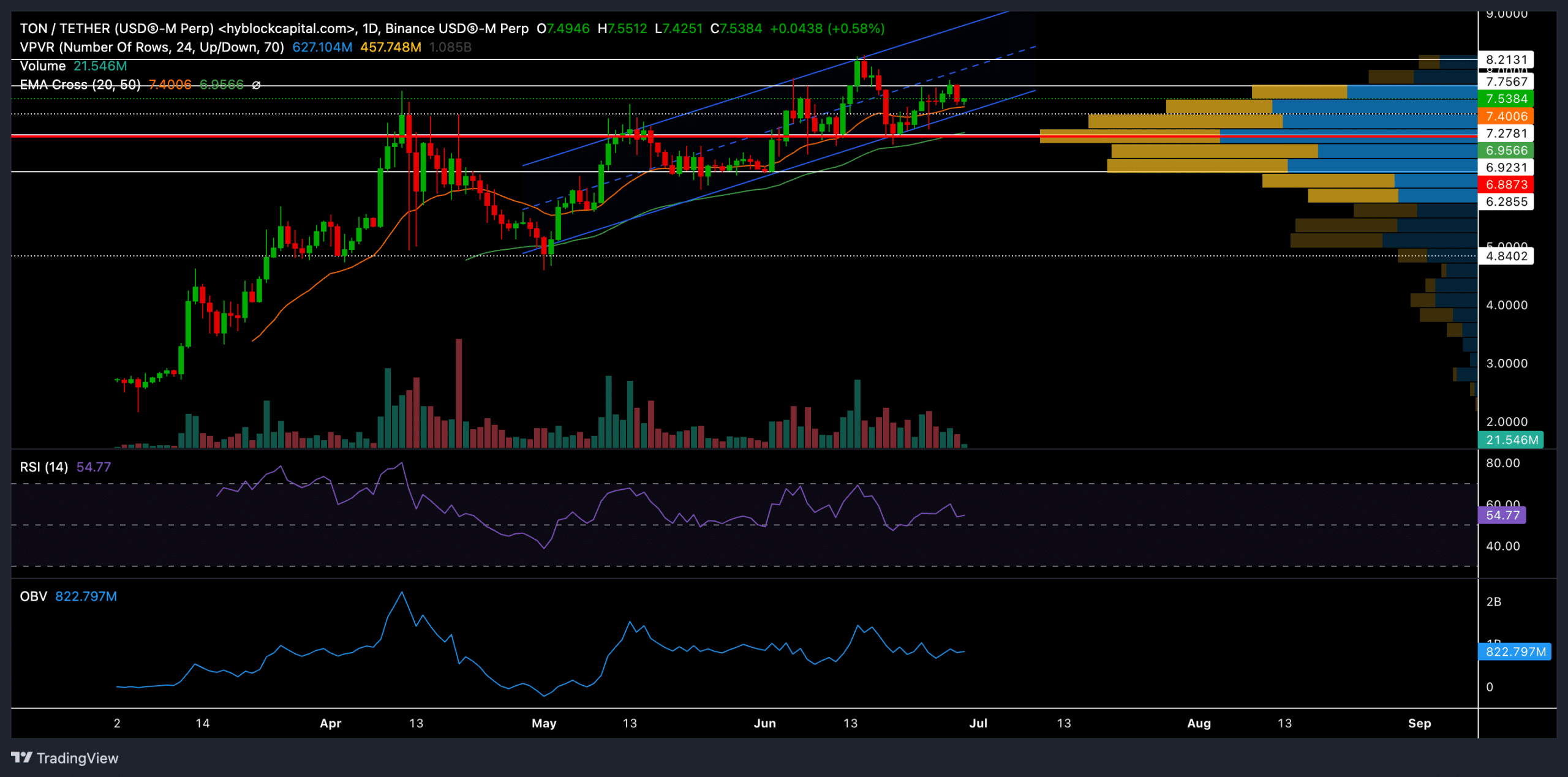

Sharkcoin’s rally usually takes condition in an ascending channel

Resource: Hyblock Capital

Immediately after a bounce-again from the $4.8-assistance amount a couple of months back, SHK has been on very a steep upward trajectory. Over the past two months, the altcoin has surged by practically 70% to access a new all-time significant of $8.24 on June 15.

All through this bullish run, SHK constantly stayed previously mentioned the 20-day and 50-working day EMAs, which delivered good aid for above two months. In the meantime, an ascending channel took condition on the day by day chart of the electronic asset.

At the moment, we observe low volatility in the shorter phrase as the price stays in a superior liquidity zone. A near higher than the center line of the ascending channel could enable the customers to increase their rally in the quick time period, focusing on the $8.2-$8.5 selection.

Having said that, a near under the ascending channel may well set SHK up for a possible downside in the weeks forward, with sellers aiming to retest the $6 mark.

The Relative Strength Index (RSI) has been trending in the bullish zone, demonstrating a slight slowdown in purchasing force. A drop beneath the midline could signal a escalating bearish development.

It is really crucial to observe that the On Stability Quantity (OBV) exhibited a downward or flat trend although the value surged in the past ten times. This indicated a bearish divergence and hinted at a reduction of momentum in the existing uptrend, possibly major to a reversal or consolidation stage.

Unfavorable funding fees

Resource: hyperblockcapital

In an analysis of the funding premiums, it turned apparent that sellers held a fairly advantageous place. SHK’s funding rates on several exchanges remained in the adverse territory. On top of that, the projected funding fees also indicated negativity, reinforcing a minor bearish outlook.

The divergence in OBV and the damaging funding charges could provide as early indicators of a waning uptrend. It would be clever to seek out additional affirmation prior to determining to sustain existing positions or enter new long positions.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!