With marketplace uncertainty, Stablecoin exercise decreases: What is the following step?

- Thrilling Times for Stablecoins!

- Market Dominance Shifts, Reflecting Sentiment Shifts

Bitcoin [BTC] has been experiencing some tough issues currently, specially from bearish pressures in the decreased timeframes. With the halving and a feasible consolidation section forward, the summer could verify to be really eventful for crypto enthusiasts.

As Bitcoin struggles, the altcoin industry has also found its truthful share of bearish traits a short while ago.

Even though some sectors like memes have stood out, the in general pattern appears to be leaning in the direction of the bearish side in the earlier thirty day period.

AMBCrypto has delved into stablecoin behavior to gauge how market place individuals are sensation about getting challenges in this present local weather.

Minimize in User Action Indicators Modifying Sentiments

Supply: CryptoQuant

AMBCrypto’s assessment of details from CryptoQuant reveals a downward pattern in stablecoin activity. The chart previously mentioned tracks the complete number of special lively addresses, indicating a decline in person engagement considering the fact that mid-April.

Pursuing a peak in early March when Bitcoin broke by way of the $70k barrier, the the latest downtrend implies a decrease in purchasing and selling things to do, reflecting a absence of bullish sentiment amongst individuals.

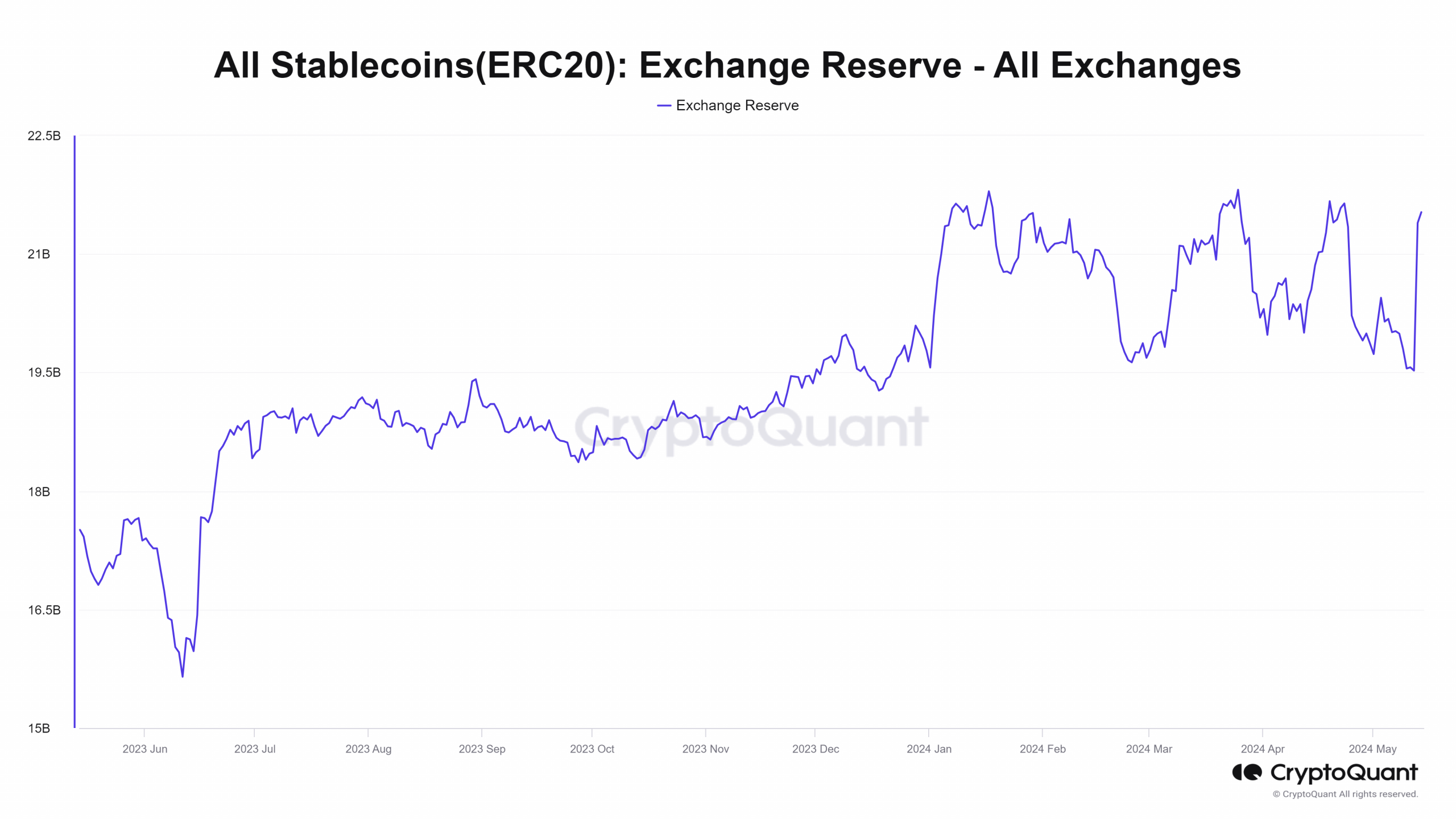

Source: CryptoQuant

The exchange reserve knowledge implies a important minimize in getting ability between stablecoin holders, limiting their capacity to commit in crypto property. Nevertheless, a current uptick in stablecoins on exchanges hints at a opportunity bullish change in the near long term.

Anticipating a Marketplace Rebound

Supply: USDT.D on TradingView

The Tether [USDT] Dominance chart presents insights into current market sentiments, showcasing a choice for stablecoins for the duration of uncertain occasions. With the opportunity for a bullish rally ahead, trying to keep an eye on the USDT.D amounts could provide useful insights for traders.

Even though the dominance chart is a valuable resource, conducting extensive specialized and essential examination stays essential ahead of generating any expenditure choices in the crypto market.

Wondering about your portfolio’s overall performance? Consider out the BTC Earnings Calculator

Let us maintain an eye on the current market for opportunity upward trends, and try to remember to request professional assistance just before creating any financial commitment moves!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!