Solana’s bulls put up with a setback – How will it affect you?

- Remarkable Update: SOL contracts surge previous $5 million with longs dominating the current market

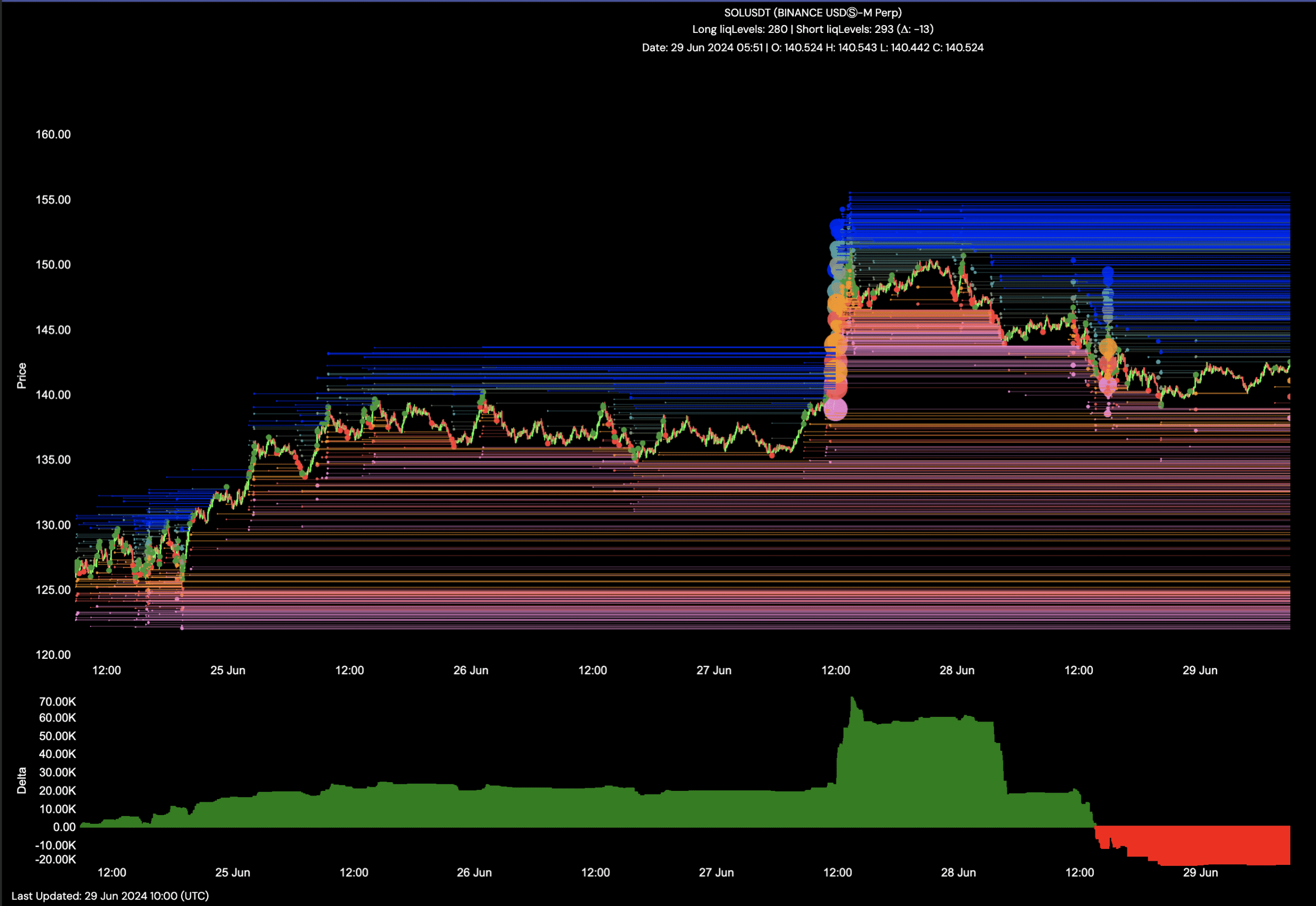

- Trading Tip: Maintain an eye on the liquidity amounts in between $138 and $140 for prospective value movement

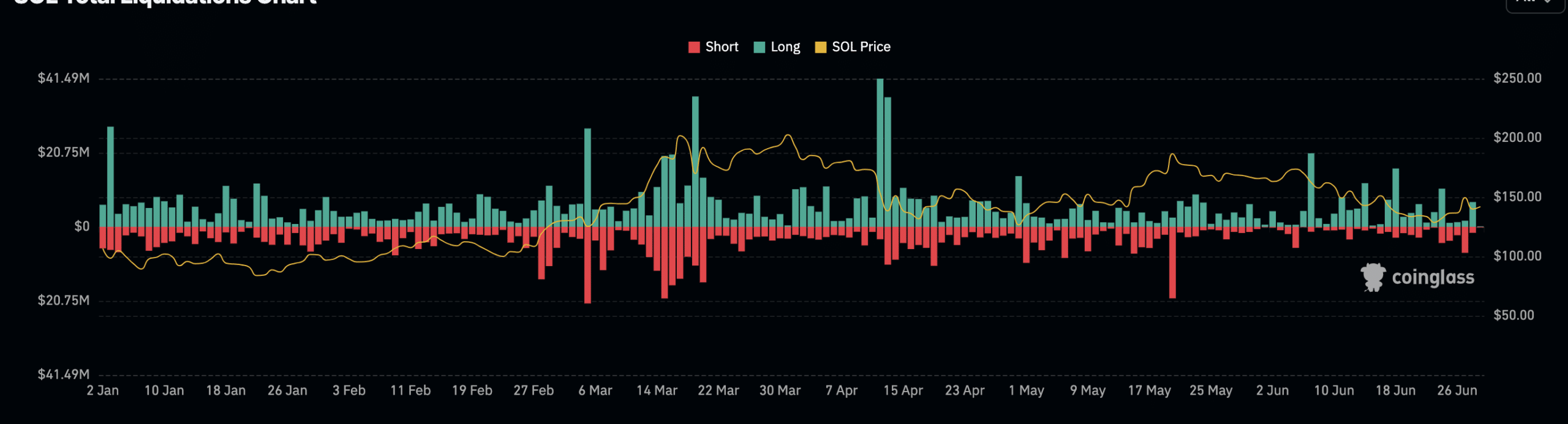

Hey there, crypto fanatics! The earlier 24 hours have been fairly eventful for traders diving into the earth of Solana [SOL] trading. Coinglass’s details on liquidations lose some light on the modern market tendencies.

In accordance to the latest information from the derivatives portal, full SOL liquidations achieved a staggering $5.47 million. Longs took the lion’s share with $4.3 million, whilst shorts settled for $1.11 million.

Turning the Tables on Positive Anticipations

When a trader’s margin requirements can no for a longer period fulfill the contract’s phrases, liquidation kicks in. This is a basic safety evaluate taken by exchanges to reduce more losses.

Inspite of the good sentiment and superior hopes for SOL’s price surge, modern developments suggest a different story. An uptick in lengthy liquidations was traced back to SOL’s price tag actions.

Resource: Coinglass

On June 27, the altcoin observed a surge to $150 after news of a prospective Solana location ETF filing hit the marketplace. The pleasure was palpable on social media, with lots of rooting for SOL to preserve its upward trajectory.

On the other hand, destiny had other options for the cryptocurrency as it began a gradual descent put up the price spike.

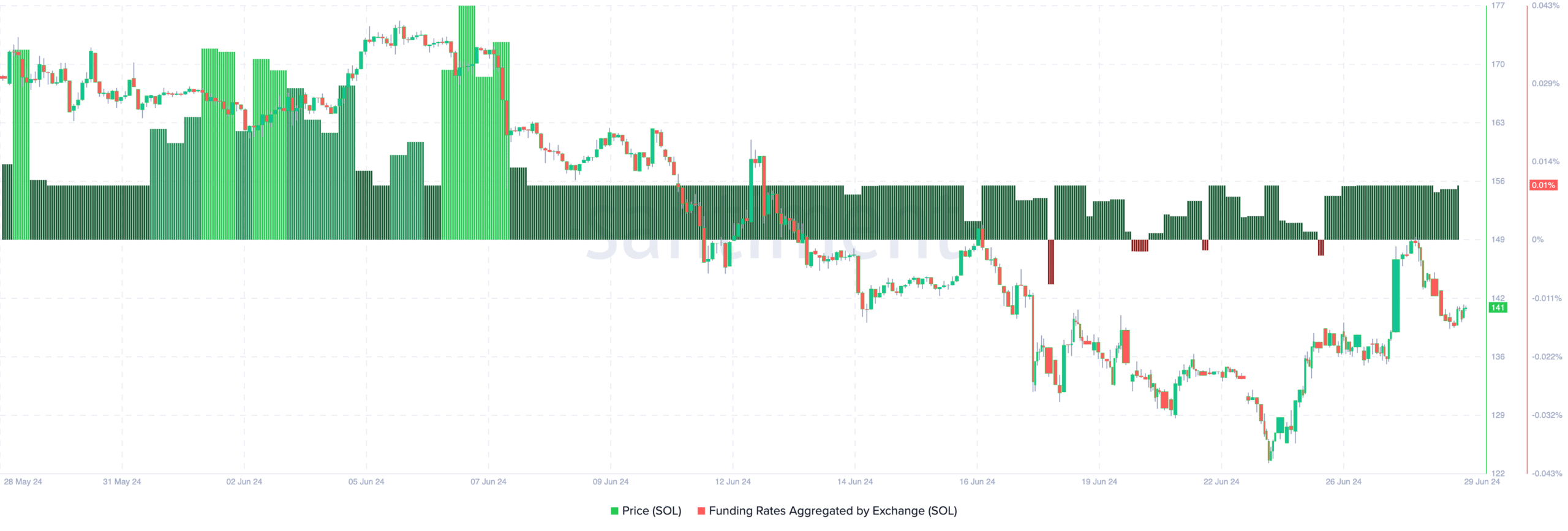

Presently, SOL is valued at $141.96, marking a 2.39% dip in excess of the last 24 hours. In spite of this, traders continue being optimistic, obvious from Solana’s funding level, showcasing unwavering bullish sentiments.

Wondering what this usually means? A positive funding charge implies that traders foresee a selling price rise, with longs compensating shorts to maintain their positions.

Being Bullish Amid Bearish Signals

While a climbing funding charge typically indicates bullish conduct among the longs, the absence of selling price rewards can dampen spirits. This mismatch indicates a bearish outlook for the token, with spot potential buyers demonstrating reluctance to the uptrend.

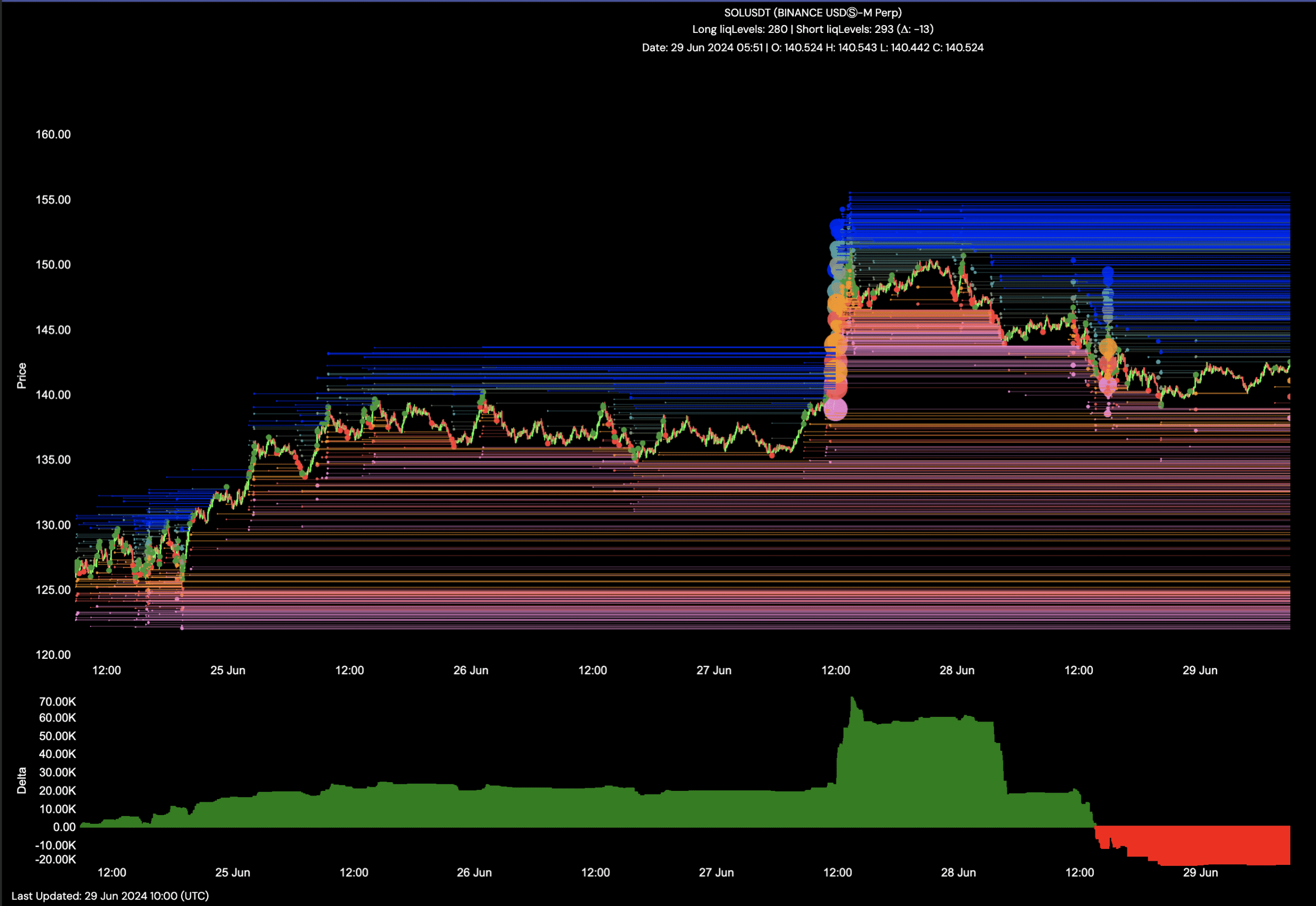

If this trend persists, SOL may see a drop beneath $140, as proposed by liquidation levels and current market assessment.

Resource: Santiment

As the funding prices climb greater, the dominance of longs gets to be additional obvious. However, the downtrend in costs paints a contradictory picture, hinting at doable marketplace shifts.

Remain vigilant, as liquidity clusters among $141 and $138 counsel a opportunity price tag retraction for SOL in the in close proximity to potential.

Supply: Hyblock

Curious about your investment gains? Dive into the Solana Gain Calculator

As of now, the absence of a liquidity powerhouse alerts a stagnant cost craze for SOL.

On the other hand, maintain a shut enjoy on the liquidity pockets amongst $141 and $138, hinting at a attainable downturn for the altcoin in the brief term.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!