Solana big sells off resulting in SOL’s price tag to drop beneath $145 – What occurs upcoming?

- Current considerable transactions led to a drop in SOL’s cost to $143.86.

- Hold an eye out for a likely promote wall at $160, which could set off more downward movement for SOL.

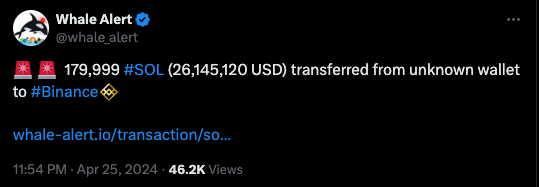

On the 25th of April, a big 179,999 Solana [SOL] transfer was designed to the crypto exchange Binance, creating the token’s price tag to dip underneath $145 from its steady posture.

According to Whale Warn, the transaction was valued at $26.14 million at the time. Analysts suggest that these types of moves ordinarily suggest an intention to market the tokens.

Source: X

Uncertainty persists despite rising optimism

Any significant transfer like this typically prospects to a drop in the token’s price. SOL has been experiencing providing tension, with lots of significant token holders cashing out income in the last month, causing a 24.03% dip and a value of $143.86.

If a lot more tokens are moved to exchanges, the price tag could keep on to slide, when a lower in these transfers might stabilize or direct to a possible rebound.

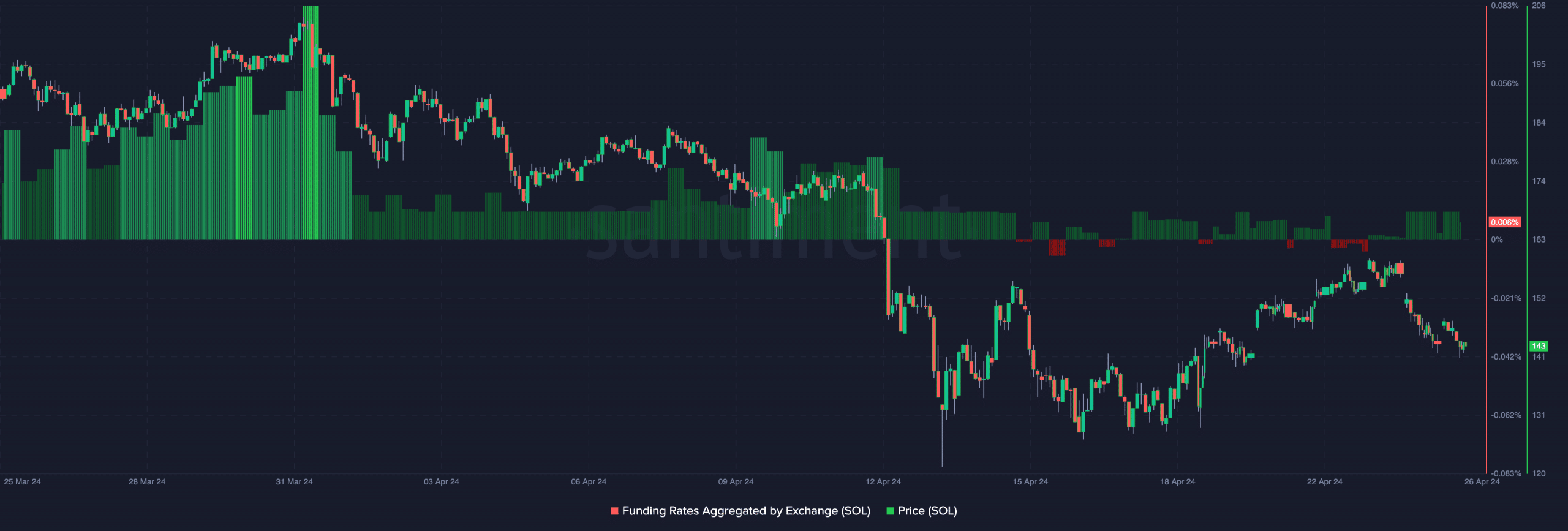

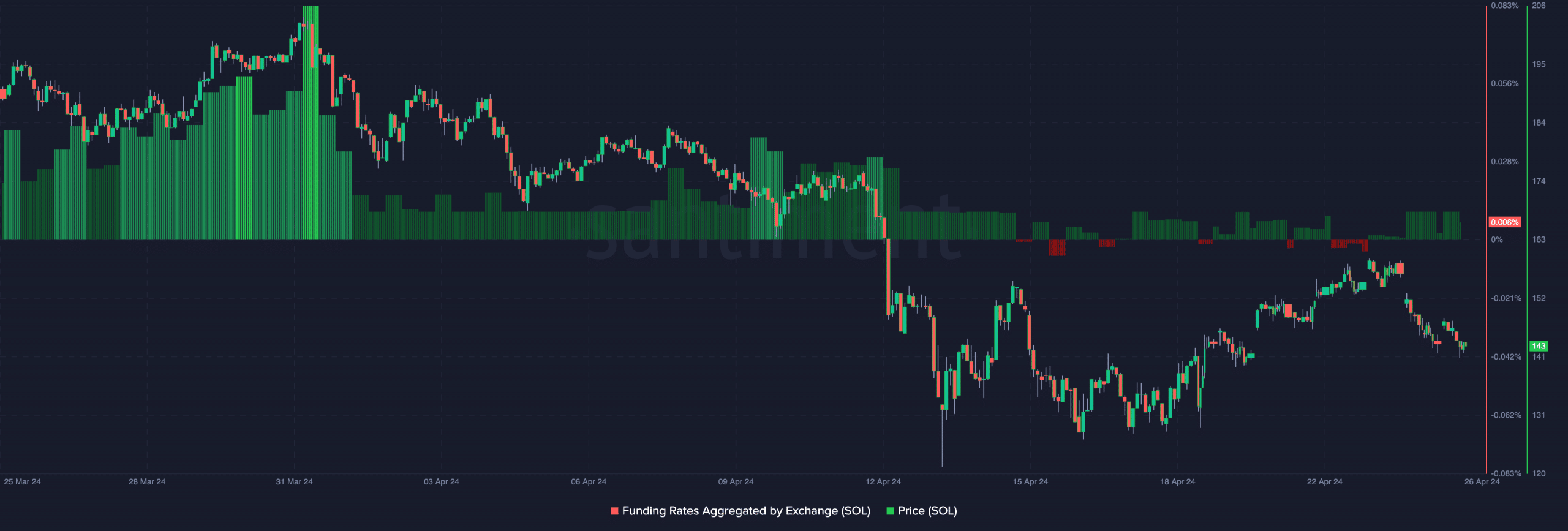

At this time, SOL’s aggregated Funding Price sits at .0006%. Although the metric was in the adverse zone lately, suggesting a recurring fee for quick positions, a recent shift to beneficial territory could show bearish trends for the token.

Resource: Santiment

Present current market sentiment suggests that location traders selling aggressively could drive the benefit of SOL down additional if funding will increase and SOL carries on to decrease, probably dropping below $140 in the coming days.

A rebound from these amounts could change the dynamics. But what do the technological indicators reveal?

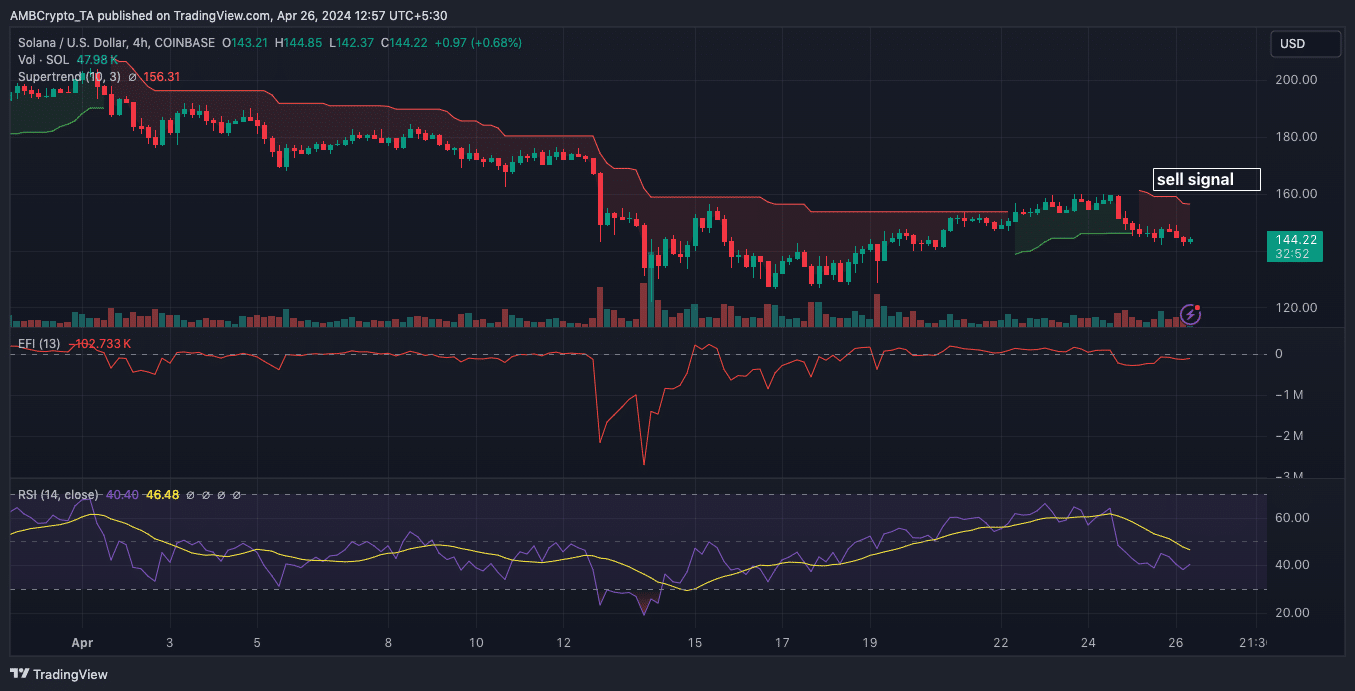

Bears stay dominant

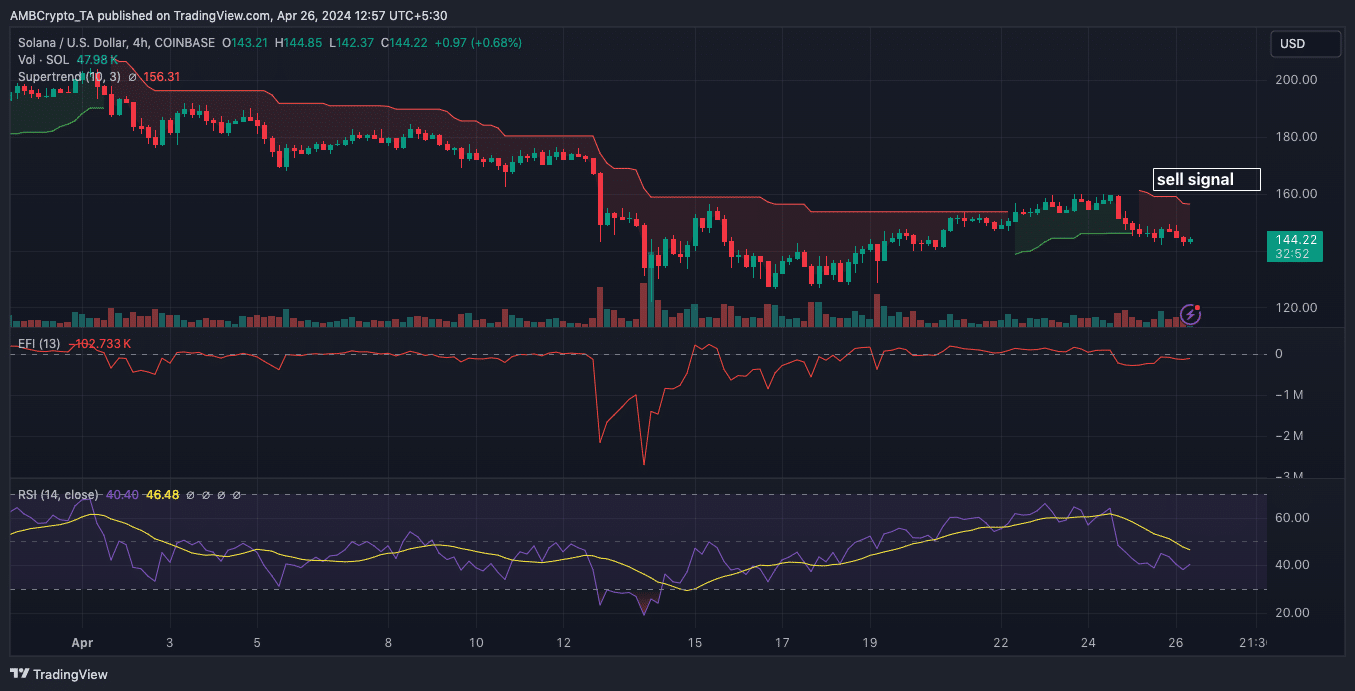

The SOL/USD 4-hour chart reveals the Elder Drive Index (EFI) dipping into destructive territory, indicating bearish dominance, generating it complicated for SOL to break totally free from marketing stress.

The Relative Power Index (RSI) is nearing oversold levels, signaling a opportunity rate drop if it techniques 30. On the other hand, if it falls under, a rebound may perhaps be on the horizon. The Supertrend indicator is presently signaling a sell at $162.

Source: TradingView

As SOL’s native token ways likely rejection amounts, a increase could trigger another downward transfer. Breaking previously mentioned this stage could see the benefit climb back again to $175.

Test out Solana’s [SOL] Cost Prediction 2023-2024

But acquiring this level would need a substantial inflow of acquiring strain, which is presently missing in the market place.

For now, hope SOL’s cost to fluctuate in between $137.66 and $147.57 unless marketplace sentiment undergoes a extraordinary shift.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!