Solana fails to break $160 resistance – Is a drop to $120 following for SOL?

- It truly is shocking that Solana failed to entice much more prospective buyers during its the latest period of variety consolidation.

- The wrestle at the $160 mark genuinely displays how sizeable that resistance stage has come to be in the the latest weeks.

Solana [SOL] had to phase again as soon as all over again from the $160 resistance space.

An before assessment from AMBCrypto indicated that SOL was probably to remain within the variety for the thirty day period unless it could convert the $165-$170 zone into a guidance level.

A further report pointed out that the on-chain activity was dwindling, signaling a decrease in the two use and demand from customers for SOL. As a end result, traders need to be geared up for the ongoing consolidation to persist.

Could the rejection at the selection significant direct to revisiting the lows?

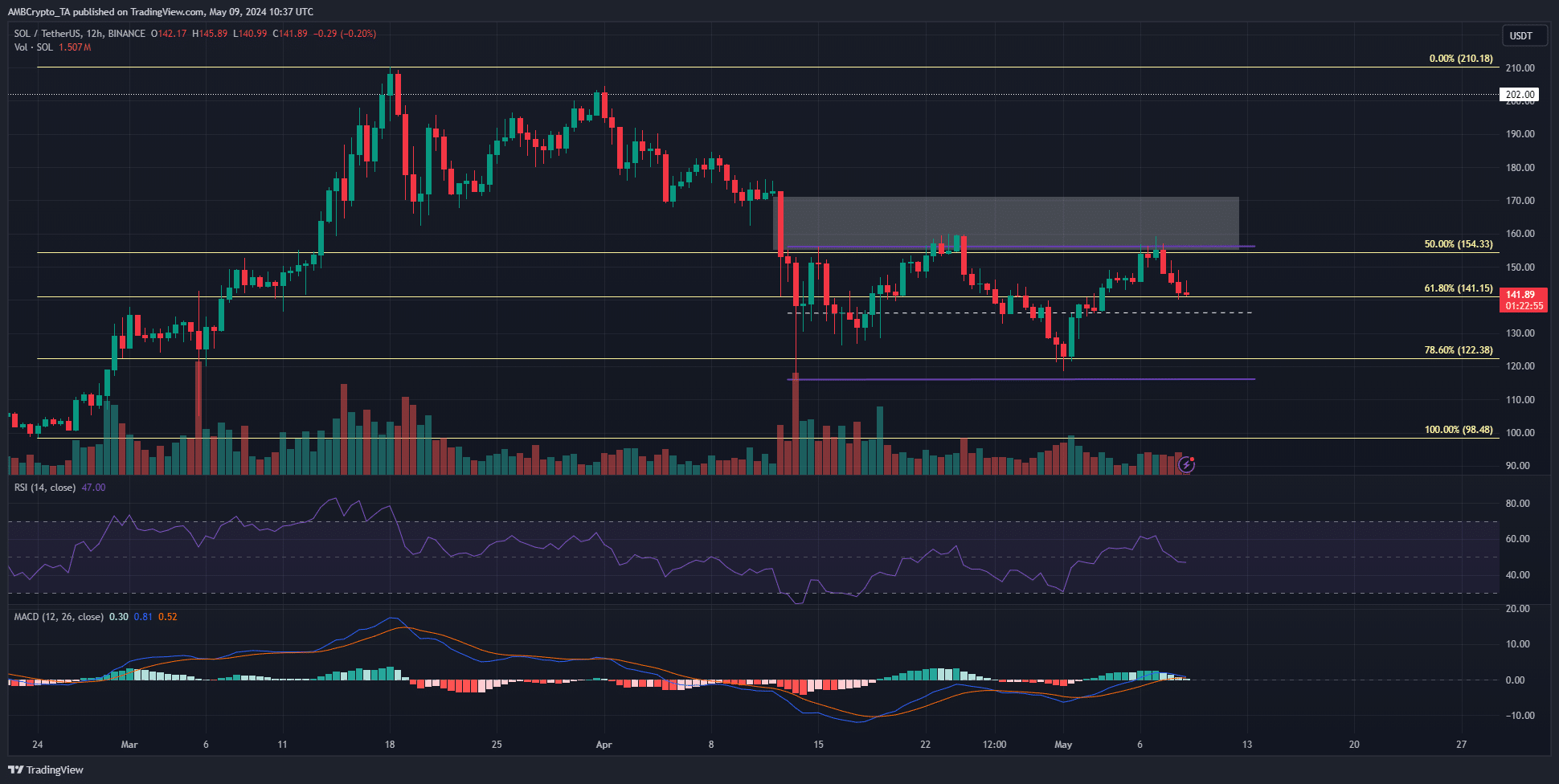

Source: SOL/USDT on TradingView

The selection (shown in purple) concerning $156 and $116 has its midpoint at $136. Moreover, the Fibonacci retracement amounts at $141 and $122 are also probably to present assistance.

Next the rejection on May possibly 6th, there was a 10.8% minimize.

Now, the $141 level is holding as help, but it remains uncertain if it can deter the bears for the relaxation of the 7 days.

The RSI on the 12-hour chart has dropped beneath the neutral 50 mark, suggesting a expanding bearish momentum.

Though the MACD confirmed signals of bullish momentum attaining power, it immediately reversed in the final 48 hrs. At the second, the MACD is neutral but could perhaps convert bearish.

Traders can foresee a slight relief bounce at the $136 mid-variety assist. With buying and selling volume remaining constantly very low in the past two weeks, a different fall to the $122 stage would seem most likely.

Speculative exercise will come to a standstill

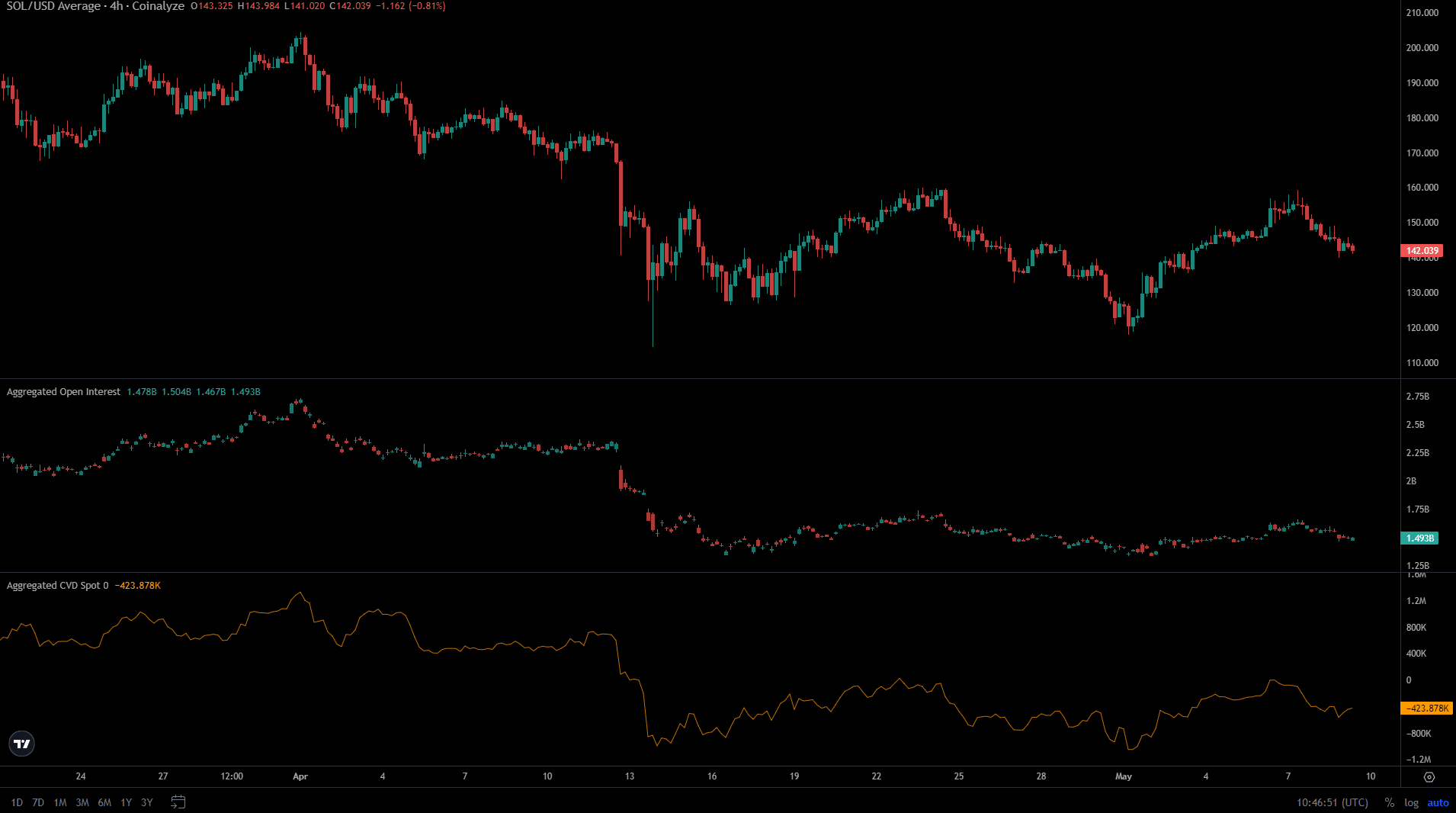

When Solana’s price tag remained in just a array about the previous thirty day period, the Open up Desire stayed comparatively flat, showing minimal fluctuations together with the price tag actions involving the vary boundaries.

This indicates a deficiency of solid bullish sentiment from participants in the futures marketplace.

A pleasurable simple fact: Let’s see SOL’s marketplace cap in BTC’s point of view

The place CVD also formed a selection, which is a good signal for long-phrase bulls, indicating a period of consolidation. Ideally, customers would hope to see the place CVD development upward for the duration of consolidation.

Presented the current current market uncertainty and dread, it truly is relatively comforting that the place CVD has not started off a downward trend.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!