Influence of Bitcoin’s halving and Runes start on ORDI altcoin

- Exhilaration as ORDI sees a surge article Bitcoin halving!

- Nevertheless, analysts alert the rally could possibly be brief-lived

Wonderful information for the cryptocurrency globe! The ORDI token, intently related with the Bitcoin Ordinals protocol, skilled an remarkable double-digit rate boost in the earlier day, as documented by CoinMarketCap. This surge coincides with the the latest Bitcoin halving function and the launch of the innovative Runes Protocol.

The Runes protocol by Bitcoin Ordinals pioneer, Casey Rodmarmor, provides a fresh strategy to generating fungible tokens on the Bitcoin blockchain. With its debut together with the Bitcoin halving, transaction costs soared as customers enthusiastically minted new tokens on the network.

As per the latest info from Rune Alpha, above 1447 Runes have been developed on the Bitcoin network, with a total expenditure of $16.41 million in service fees.

What lies forward for ORDI?

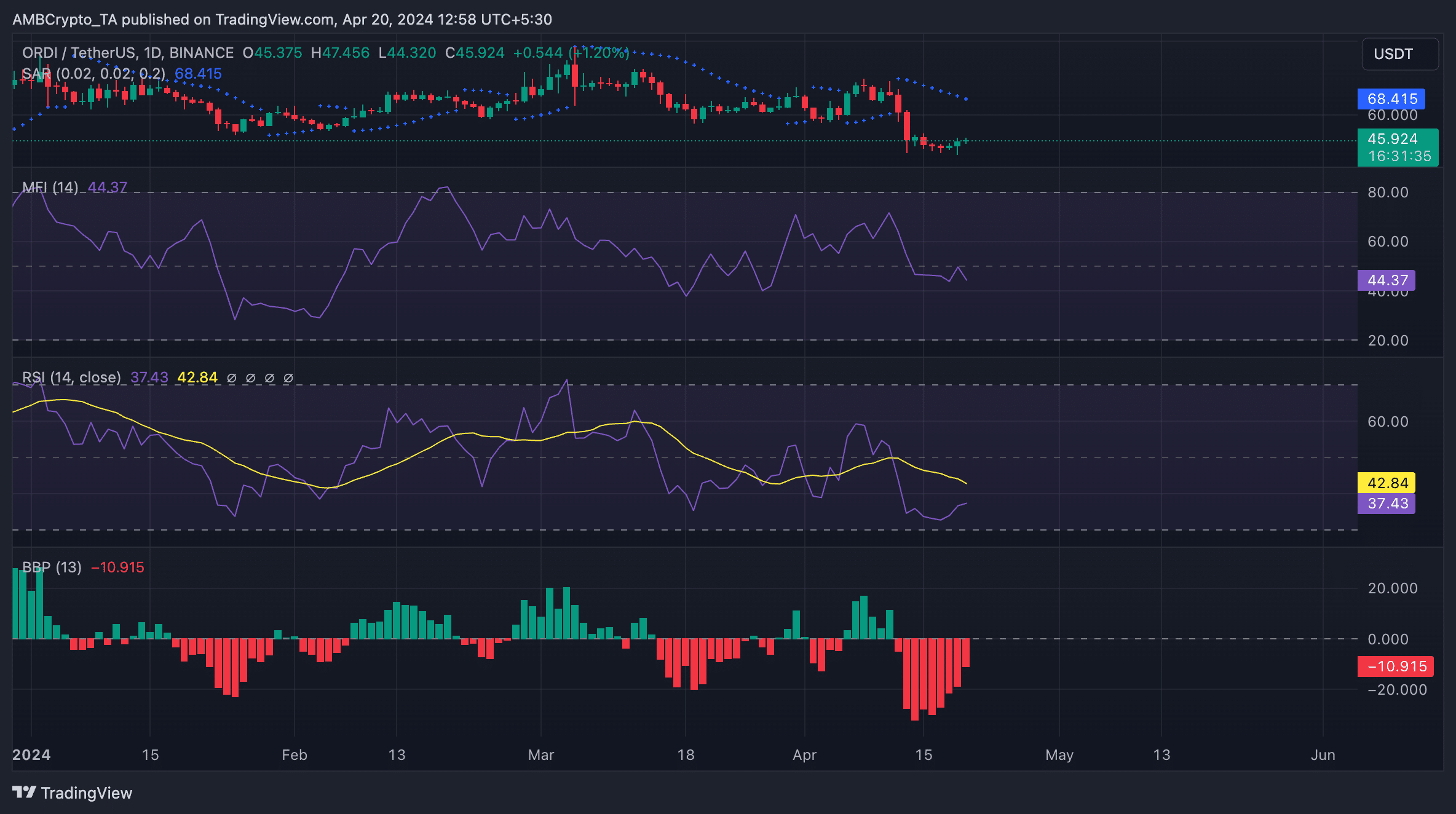

Diving into ORDI’s important indicators on the 24-hour chart implies a opportunity limited-lived rally owing to very low demand. Investigation of its momentum indicators reveals a powerful inclination toward token sell-offs above accumulation. For example, its Relative Toughness Index (RSI) stands at 37.46, whilst the Funds Flow Index (MFI) is at 44.36.

A downward development is evident, showcasing a important selling strain surpassing buying action.

What’s more, ORDI’s Elder-Ray Index, depicting bull/bear electric power, implies a widespread bearish sentiment. Continuously detrimental values since April 12 suggest a downtrend, most likely continuing.

Similarly, ORDI’s Parabolic SAR indicator positions its dots higher than the price, signaling a market decrease. This bearish craze indicates a attainable continuation of price drops.

Supply: ORDI/USDT on TradingView

Curious about your portfolio’s performance? Explore the ORDI Income Calculator

Sector sentiment: Shorters in motion

In the ORDI Futures industry, a notable 10% increase in open up fascination was noticed in the previous 24 several hours, as indicated by Coinglass. At existing, the Futures open desire for ORDI stands at $211 million.

Interestingly, the funding level in several crypto-exchanges was damaging within the very same timeframe. This alerts that when traders have entered trading positions in ORDI Futures, their bets are leaning toward anticipating a drop in ORDI’s price tag.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!