Could Mt. Gox’s $9 billion Bitcoin reimbursement induce yet another value fall?

- Remarkable news for collectors of Mt. Gox as the bankrupt crypto exchange announces the return of $9 billion truly worth of Bitcoin.

- Desire in Bitcoin ETFs is on the rise, sparking enthusiasm in the market place.

Bitcoin’s recent surge in benefit has introduced a wave of positivity to the crypto planet. In spite of this, the upcoming continues to be uncertain.

Could Mt. Gox’s Return Affect Bitcoin’s Fate?

10 yrs right after struggling with a main cyber attack, Mt. Gox, after a notable Bitcoin buying and selling platform that crumbled underneath individual bankruptcy, is set to reimburse its consumers with billions in cryptocurrency.

Starting in early July, the exchange will start off repaying countless numbers of its people, with a whole sum of close to $9 billion in tokens. This is only a portion of the huge theft of 650,000 to 950,000 bitcoins back again in 2014, which would be valued at in excess of $59 billion in today’s market.

Right after a long and sophisticated process of individual bankruptcy, which was plagued by setbacks and authorized road blocks, the courtroom-appointed trustee has at last announced the initiation of repayments to all-around 20,000 claimants of Mt. Gox.

These repayments will be created in a mix of Bitcoin and Bitcoin dollars, an early variation of the authentic cryptocurrency.

Though the information of the lengthy-awaited reimbursement brings relief to individuals who lost their bitcoins in the hack, it comes at a precarious time for the crypto industry.

Past week witnessed a significant fall in costs to $59,000, marking the second-greatest decline found this calendar year. The likely effects of Mt. Gox’s return could additional weigh down prices, stirring unease between buyers.

Hope on the Horizon

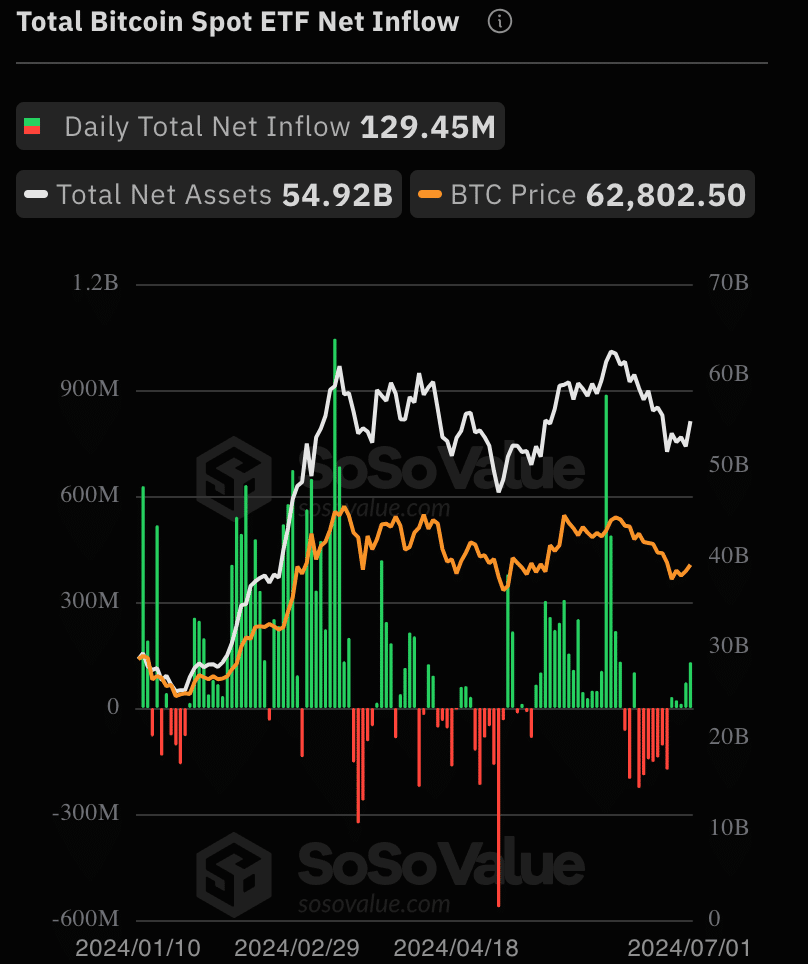

Regardless of issues more than how Mt. Gox’s pursuits could impact BTC costs in the small time period, institutional traders and main cryptocurrency gamers remain optimistic about Bitcoin. Proof of this can be found in the improved fascination in Bitcoin ETFs in modern times.

Bitcoin location ETFs have been obtaining constant investments for the past five times. On July 1st, the web influx reached $129 million.

Discover the 2024-25 Price Prediction for Bitcoin [BTC]

Fidelity’s FBTC ETF saw the highest everyday inflow with $65.034 million. Bitwise’s BITB ETF also recorded considerable inflows, bringing in $41.4022 million on the same day.

At the moment, BTC is buying and selling at $62,788.49, demonstrating a lower of .78% in excess of the previous 24 hours. The buying and selling volume has also improved by 5.5%.

Source: Sosovalue

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!