What’s Next for Microstrategy Stock as it Considers More Bitcoin Purchases?

- Exciting news! MicroStrategy is diving into the world of Bitcoin once again with a fresh convertible notes offer.

- Why choose between MicroStrategy and BTC when you can have both? MSTR’s looking like a solid short-term contender against BTC.

Just recently, on 13th June, MicroStrategy [MSTR] unveiled its plan to expand its Bitcoin [BTC] horizons by utilizing funds from a new private offering of $500 million convertible notes. These senior notes, set to mature in 2032, mark an innovative debt strategy for the company. For more details, check out the official announcement here.

“MicroStrategy is gearing up to employ the proceeds from the notes sale to enhance its Bitcoin reserves and for general corporate applications.”

MicroStrategy has been boldly utilizing debt to fuel its Bitcoin aspirations.

In a notable move back in April, the company acquired an additional 122 BTC coins valued at $7.8 million, pushing its total holdings to 214,400 BTC, currently valued over $14.5 billion based on prevailing market rates.

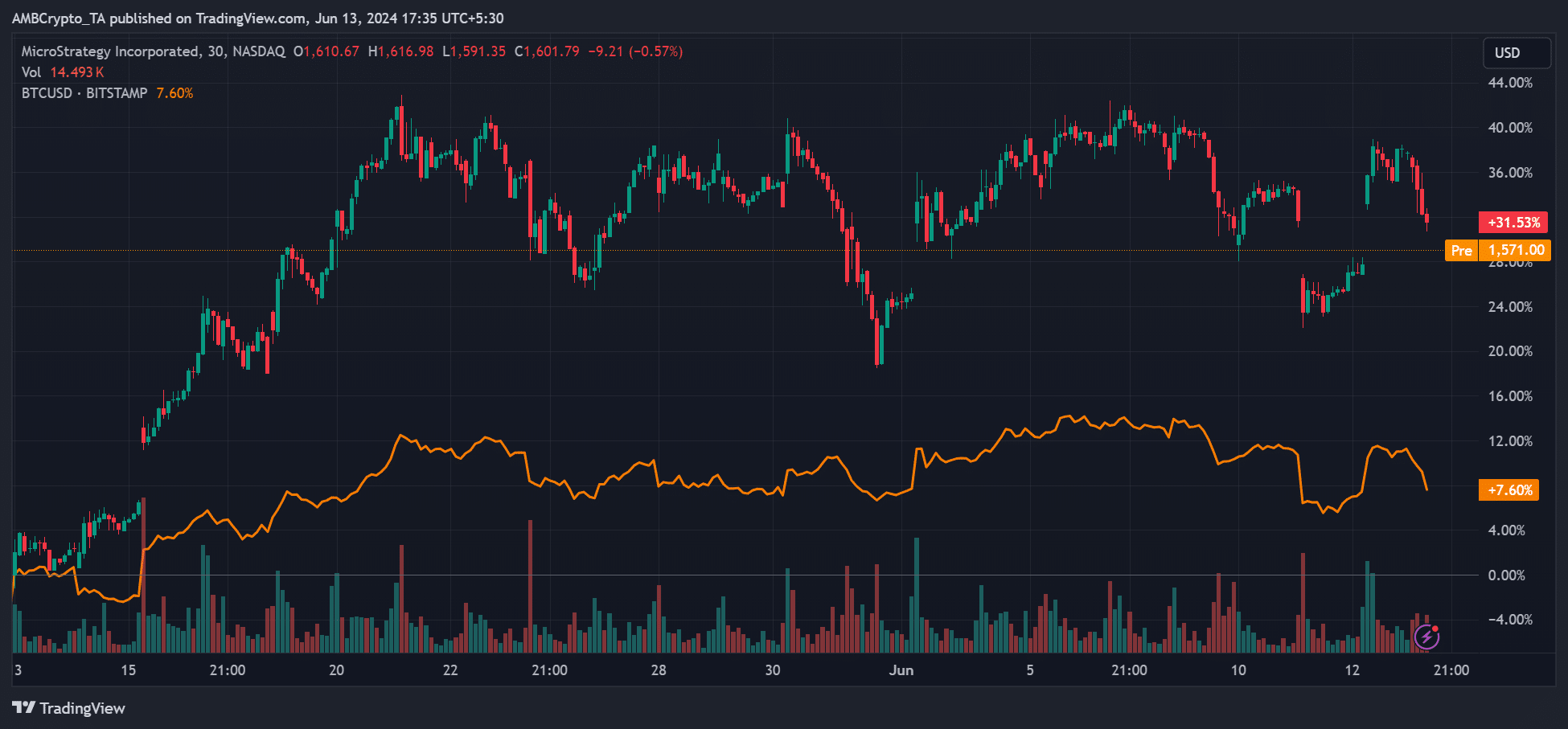

Despite various factors affecting its performance, such as inclusion in the MSCI Index and the upcoming addition to the Russell 1000 Index on 28th June, MSTR stock has closely mirrored BTC’s trading patterns.

But hey, here’s a twist! The stock has cemented its position as a more favorable short-term option than BTC, consistently outperforming the giant coin on multiple occasions.

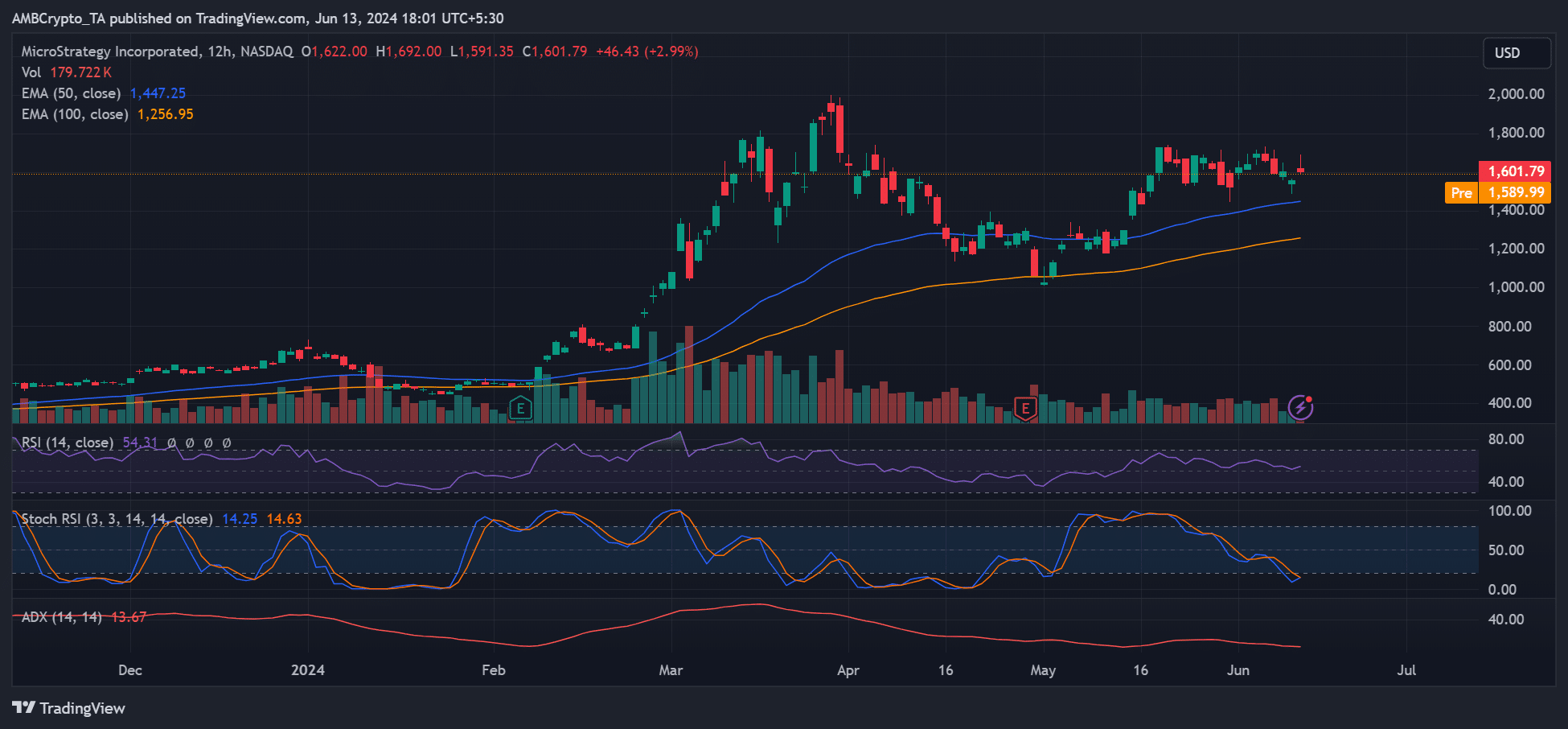

MicroStrategy stock price chart update

Despite the recent market turbulence following the ‘hawkish’ Fed rate decision, MSTR’s market structure seems sturdy and resilient.

Source: MSTR stock, TradingView

The price movements have maintained levels above the 100-day and 50-day EMAs (Exponential Moving Averages), indicating a persistent strength in both short and long-term trends for MSTR.

Furthermore, the RSI (Relative Strength Index) has stayed above the mid-range, hinting at moderate yet consistent buying momentum. It’s interesting to note that the stochastic RSI is flirting with oversold conditions, potentially signaling a bullish reversal on the horizon.

If all goes well, MSTR may soon rebound off the 50-EMA and aim for $1800 or even $2000.

However, should BTC face further declines, MSTR could slide towards the 100-EMA ($1256). The ADX (Average Directional Index) reading below 20 reflects a lack of a clear trend, urging caution among traders.

Despite the ups and downs in the market and the consolidation of prices in recent months, MSTR has consistently delivered superior returns compared to BTC.

Currently, at the time of writing, MSTR has yielded +30% gains on a monthly adjusted basis, overshadowing BTC’s +7% during the same period. This translates to MSTR offering almost quadruple the returns of BTC’s performance.

Source: MSTR vs. BTC performance

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!