The Impression of SEC’s Newest Lawsuit on Staking: Lido and Rocket Pool

- SEC declares staking tokens of Lido and Rocket Pool as securities

- LDO’s price can take a hit on the market, though RPL’s rate stays continuous

Hey there! The Securities and Exchanges Committee (SEC) in the United States is making headlines as soon as all over again, but this time it truly is for categorizing Lido [LDO] and Rocket Pool [RPL] as securities.

SEC’s Newest Shift

In accordance to the SEC, Lido and Rocket Pool’s staking packages are getting categorized as securities due to the fact they run similarly to investment contracts. Buyers pool their ETH into a frequent pool, anticipating to receive revenue primarily based on the efforts of the program managers somewhat than their personal actions.

This labeling by the SEC could carry about many adverse results. The procedure of registering and complying with securities restrictions can be high priced and time-consuming. Lido and Rocket Pool may possibly encounter sizeable troubles in conference these requirements.

The lawsuit has instilled fear in the marketplace, quite possibly ensuing in lowered person engagement and a lessen in the worth of their tokens (stETH & rETH).

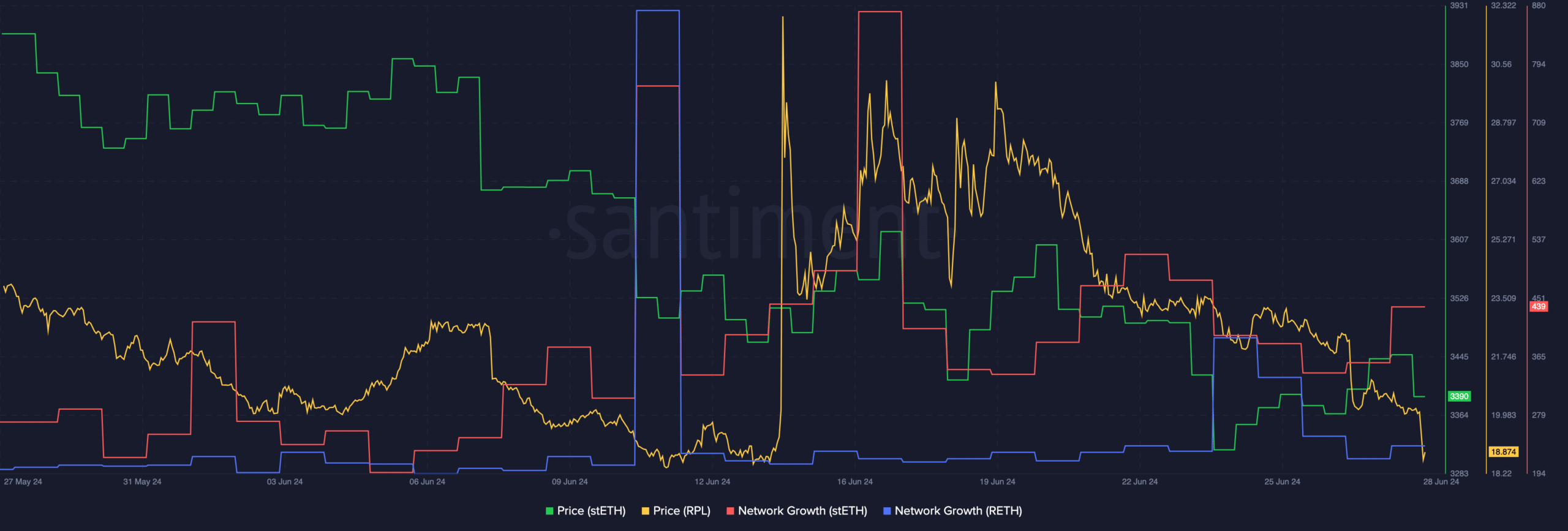

The latest information from Santiment disclosed a sizeable drop in network growth related with both stETH and rETH over the previous few months. This suggests a major minimize in new addresses exhibiting interest in these staking tokens.

If the drop in curiosity from new buyers persists, both of those protocols could confront problems.

Source: Santiment

Furthermore, working as a protection can probably limit Lido and Rocket Pool’s independence to give their companies. They may well face constraints on their assistance recipients or software buildings.

History Repeats By itself

The SEC’s legal motion from Ripple Labs sheds light on the troubles Lido and Rocket Pool could come upon. In Ripple’s case, the lawsuit led to a major rate fall in XRP as exchanges eradicated it thanks to uncertainties surrounding its lawful position. Equally, LDO and RPL have experienced cost decreases adhering to the SEC’s announcement, with even more declines looming.

Presently, LDO has declined by 18.17% in the last 24 several hours, when RPL noticed a decrease of 1.08%.

No matter whether realistic or not, here is LDO’s market cap in phrases of BTC

Having said that, it really is crucial to notice that the core argument in the Ripple circumstance was that XRP by itself was a safety sold through an unregistered supplying.

On the other hand, Lido and Rocket Pool’s circumstance is slightly distinctive. The SEC sights their staking plans as investment contracts, not the tokens on their own, possibly impacting stETH and rETH. For that reason, the implications for LDO and RPL’s upcoming keep on being unsure for the time being.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!