Critical hazards to consider as LayerZero, Mog Coin, and Bonk price ranges keep on to enhance

Wow, the crypto industry was complete of exhilaration on Monday with Bitcoin surging above $63,000, bringing a sea of green as buyers jumped on the possibility-on sentiment!

Between the top performers have been Ethereum Title Assistance (ENS), gearing up for the ENSv2 up grade, and LayerZero, soaring to $3.6 just after a new airdrop start. Not to be outdone, meme coin Mog Coin strike an all-time higher of $.0000021, skyrocketing more than 200% from its June minimal. Bonk also noticed a 32% climb from last month’s minimal, declaring the spotlight as our chart to view. Other shining stars integrated altcoins like Dogwifhat (WIF), Immutable X (IMX), Fantom (FTM), and Bittensor (TAO).

Verify out the MOG vs ZRO vs Bonk rates chart!

The surge in Bitcoin and altcoins was accompanied by a surge in investing quantity. According to CoinMarketCap, daily volume spiked by above 45% to $53 billion, hitting the greatest amount considering that June 28th.

What was the driving force guiding this rally? Effectively, it really is thought that investors were being buoyed by a hazard-on sentiment following the French election results, the place Maritime Le Pen’s party secured a victory that surpassed anticipations.

This constructive sentiment was reflected in the marketplaces as the US greenback index (DXY) dipped by 15 basis points, although global stocks enjoyed a strengthen. The French CAC 40 index climbed around 2%, with the German DAX index also attaining .70%. Futures tied to the Dow Jones and Nasdaq 100 index in the US were being in the green as very well.

Could this be a dead cat bounce?

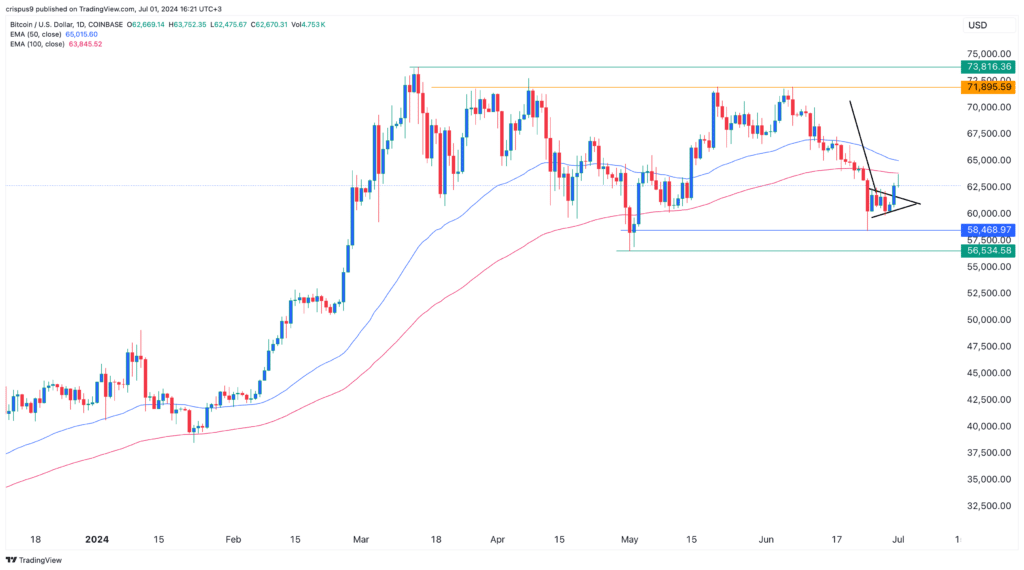

Get a seem at the Bitcoin rate chart!

Nevertheless, there is a looming chance that the rally in LayerZero, Mog Coin, and Bonk prices could possibly be just a lifeless cat bounce – a short-term restoration before a ongoing downward trend.

This problem is fueled by Bitcoin’s modern styles, such as a double-major formation at $72,000 and failure to surpass that degree since March 27th. Furthermore, Bitcoin is investing below the 50-day and 100-working day Exponential Moving Averages (EMA), indicating bearish momentum. The formation of a bearish pennant chart sample is also result in for caution.

With these variables in play, there is certainly a risk that Bitcoin could drop below $60,000 this week, perhaps triggering a bearish development for altcoins like MOG, BONK, and ZRO, which usually mirror Bitcoin’s cost actions.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!