Can the growing TVL of SUI make up for the lowering transactions?

Find out the planet of SUI! With a TVL of $625 million and a investing worth around $1.32, SUI is earning waves in the current market.

SUI gives a one of a kind layer 1 system that caters to the wants of scaling any task proficiently. Powered by the Shift language, SUI addresses inefficiencies in blockchain protocols, boosting stability and efficiency. This revolutionary platform features throughput and latency identical to Website 2 platforms, ushering in an period of innovation and experimentation.

In contrast to other protocols, SUI has the impressive capability to scale horizontally. Transactions on the community carefully mirror market place problems, creating it an attractive selection for many ecommerce brand names and industry players.

Assess the Drop in SUI Network Activity

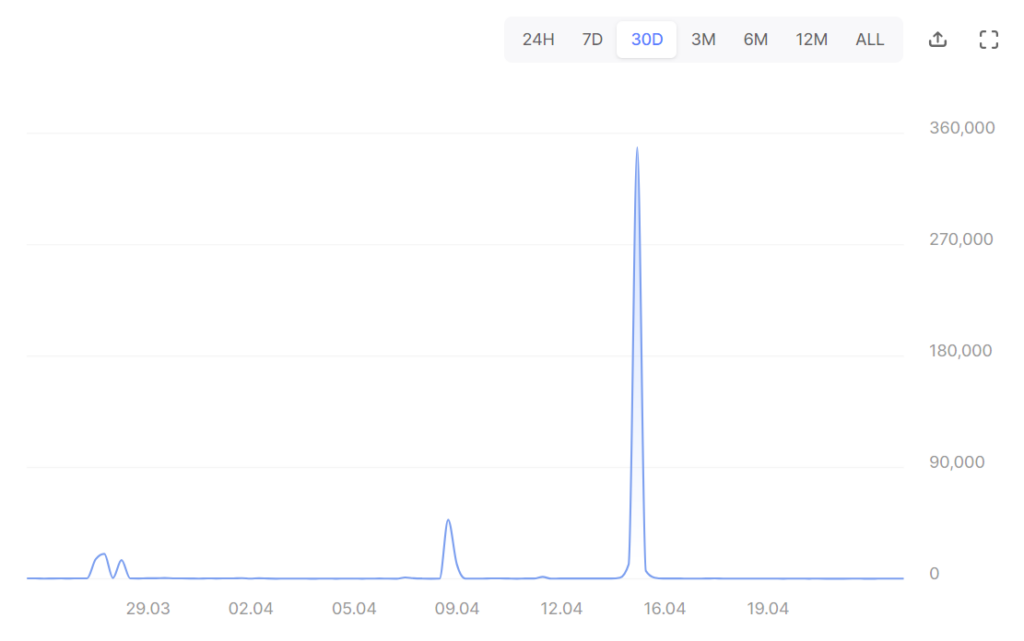

Currently, SUI commands a market dominance of around .07% with a full supply of 10,000,000,000 tokens, of which only 12.96% are in circulation. The whole staked tokens sum to $11,052,640,318, hosted by 106 validators. With a TPS of 71, symbolizing a 43% fall in the intraday session, SUI maintains an average fuel charge of .005233 SUI and offers 10,103,751 active accounts.

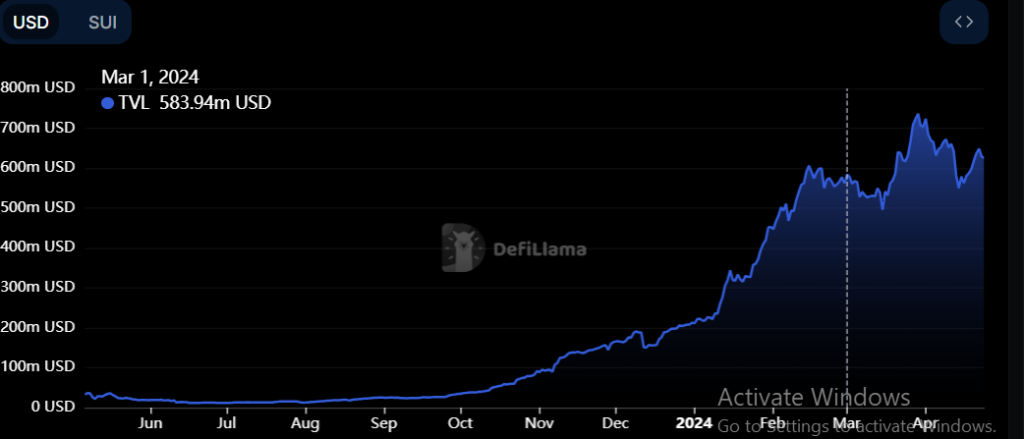

Witnessing a 300% progress in TVL because the starting of JAN 2024, SUI has reached a impressive milestone with a TVL of $625 million. In spite of this, the range of main developers has remained constant at 59, indicating balance inside the protocol. Having said that, the by-product volume has professional a drop from $158 million to $77 million in recent months. On the flip facet, the minting of new NFTs on the community has surged by 300% in the previous 30 times.

Unlock Opportunities with SUI Token Value Examination

Discover the opportunity of SUI token cost with in-depth analysis:

SUI at this time holds a current market cap of $1.71 billion, securing 61st placement on CMC rankings. Though the asset value is trading around $1.33, a 2.45% dip has been observed in the intraday session, indicating a doable consolidation section in the craze.

Really should the asset rate keep on to trend downwards, the upcoming support level could be around $1.02, even though resistance could be uncovered around $1.6. With the asset price investing under the 50 and 100 EMA lines, a adverse crossover could pose resistance in case of an uptrend.

Wanting at the complex indicators, the RSI stands at 43 with a neutral slope, signaling a bearish development in the asset rate. However, the MACD implies a weak bullish momentum in the around long term.

In Summary

Inspite of a decrease in full transactions, the SUI protocol has witnessed substantial expansion in TVL and NFT minting. The dormant development in token rate could pave the way for new highs in the long term. Maintain an eye on SUI for thrilling developments!

Critical Take note

Try to remember, the insights shared in this write-up are for informational uses only and need to not be deemed financial or expenditure guidance. Seek the advice of a expert ahead of producing any financial decisions.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!