Is Ethereum going through downward rate pressure? Analyzing on-chain knowledge offers insights…

- In excess of the previous week, the amount of addresses on the community has been lowering

- ETH supply on exchanges has dropped, decreasing the likelihood of a promote-off

Welcome, crypto fans! As we eagerly await the launch of Spot Ethereum [ETH] ETFs in the coming times, let’s just take a instant to delve into the current developments on the blockchain community. Our staff at AMBCrypto took a closer glance at the activity on the system.

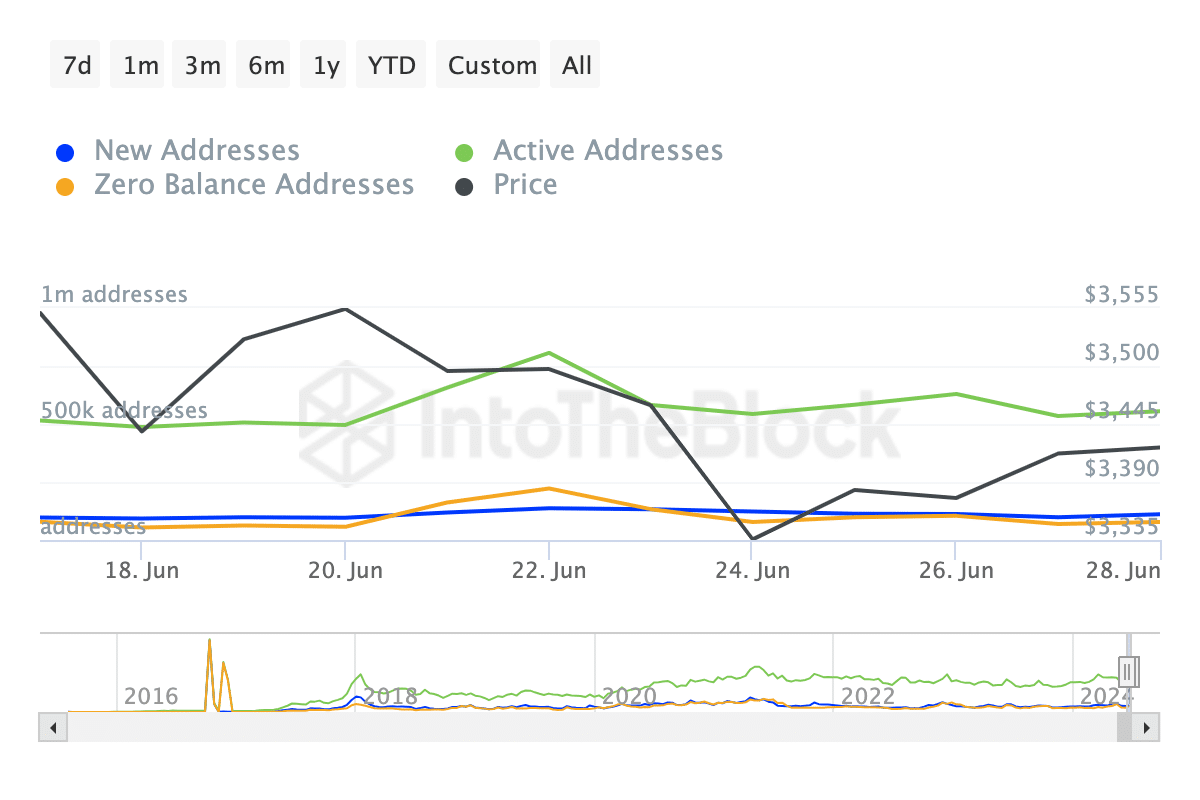

As of now, we’ve recognized a decrease in energetic, new, and zero-harmony addresses on Ethereum. New addresses depict unique customers initiating their 1st profitable transaction on the network.

Activity Shifts, but This is the Twist

This knowledge acts as a gauge of adoption and traction inside of the community. Conversely, energetic addresses point out the variety of consumers partaking in transactions. A surge in this metric indicators a rise in user engagement and network development.

Having said that, as of the most up-to-date update, active addresses have diminished by 15.45% in the earlier week. New addresses have also professional a 6.50% decline.

Picture Resource: IntoTheBlock

Inspite of the upcoming ETF launch, the fall in network exercise raises issues. A reduce in Ethereum’s network use could most likely affect the demand from customers for the cryptocurrency.

At the time of producing, ETH was priced at $3,379, reflecting a 3.35% decrease in excess of the past 7 days in accordance to CoinMarketCap.

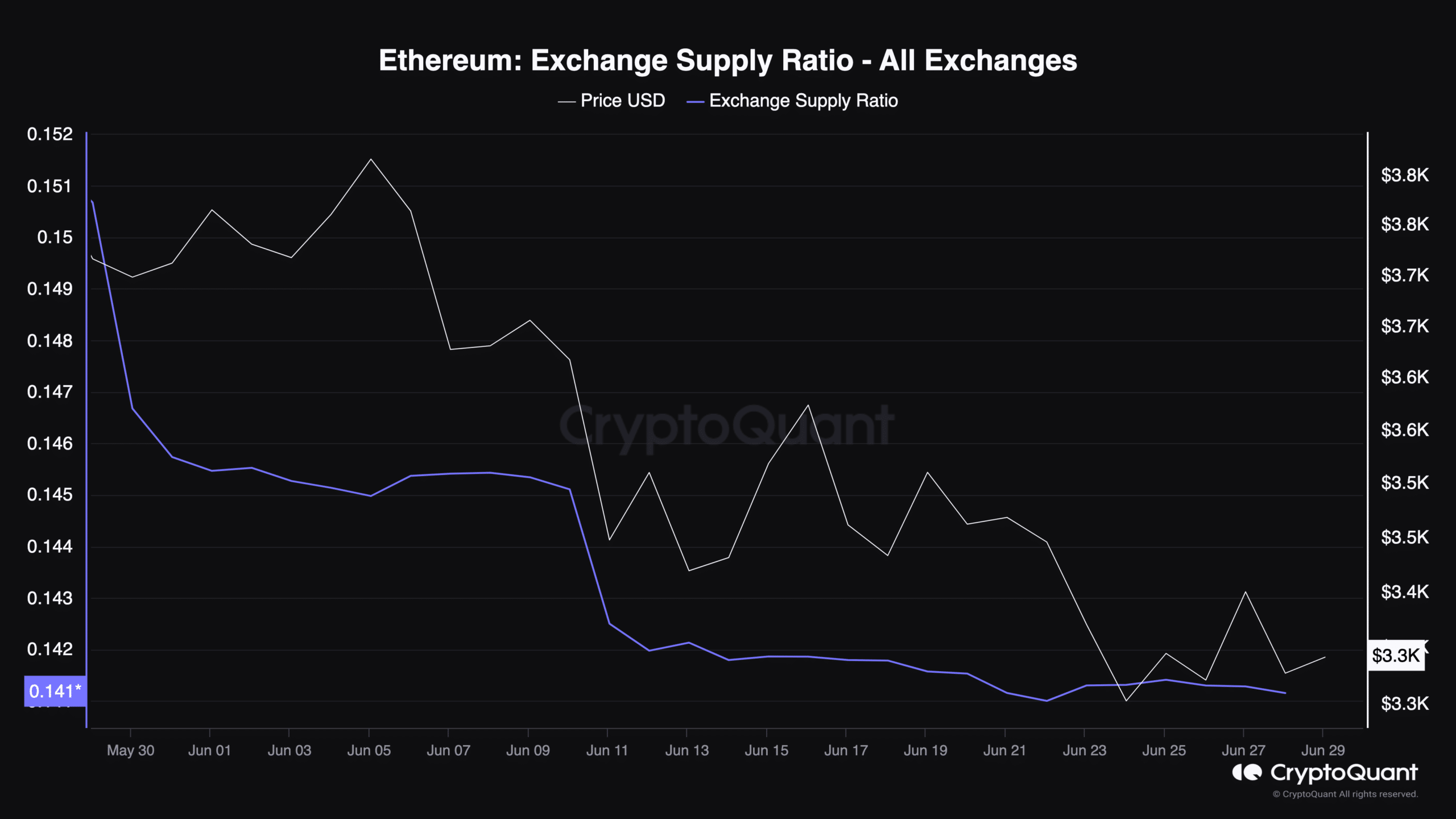

Yet another important metric we examined is the Trade Provide Ratio, which signifies the ratio of coins held on exchanges to the overall ETH provide.

An improve in this ratio indicates a rising variety of coins getting saved on exchanges, likely primary to greater marketing force and a subsequent rate drop.

Nonetheless, existing info from CryptoQuant indicates a lower in the ratio, reducing the danger of a offer-off as holders appear content to hold on to their assets.

Graphic Resource: CryptoQuant

ETH Traders Evaluate Current market Sentiment

With a reduce in ETH offer on exchanges, the chance of a bullish development grows. Nevertheless, for this prospective to be realized, purchasing tension wants to elevate.

If the stars align, we may possibly see ETH surge in direction of $3,600 in the early times of July. Conversely, a deficiency of momentum could final result in ETH consolidating amongst $3,200 and $3,400.

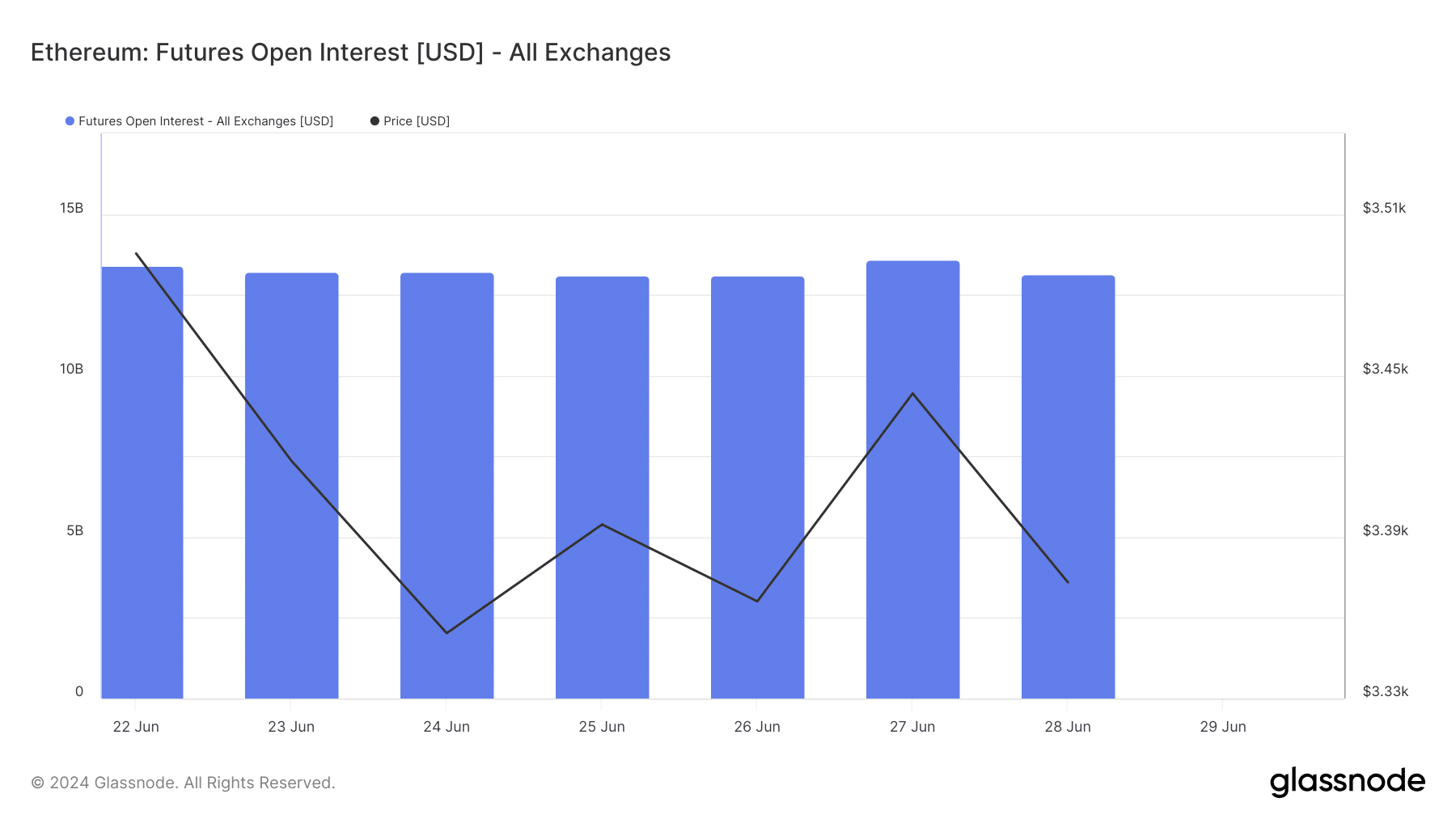

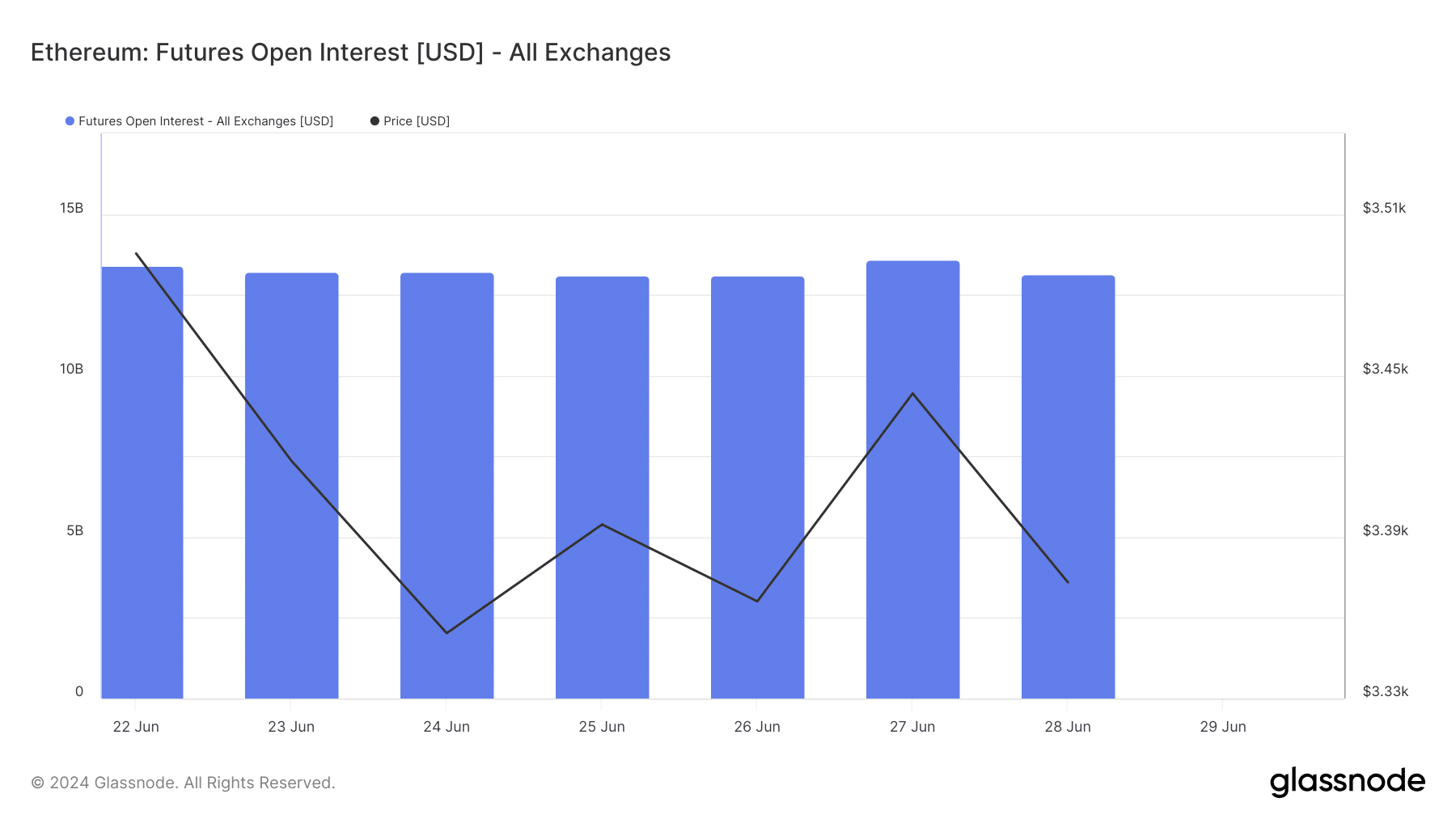

In addition, Ethereum’s Open Desire (OI) has fallen from its preceding stages. OI signifies the benefit of open positions in the derivatives sector.

An uptick in this metric implies heightened speculative action, when a lessen implies traders closing positions and withdrawing cash from the sector.

With an OI worth of $13.14 billion for ETH, it seems that market contributors are actively participating in cost movements and leveraging positions.

Picture Supply: Glassnode

Investigate Ethereum’s [ETH] Rate Prediction for 2024-2025

If the development carries on downwards, ETH’s selling price may stick to accommodate. Nevertheless, this state of affairs could change if open contracts maximize and obtaining exercise in the spot market picks up.

In these kinds of a scenario, we may possibly witness ETH’s journey toward $4,000.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!