The prospective for JUP’s providing strain to spark a price uptrend

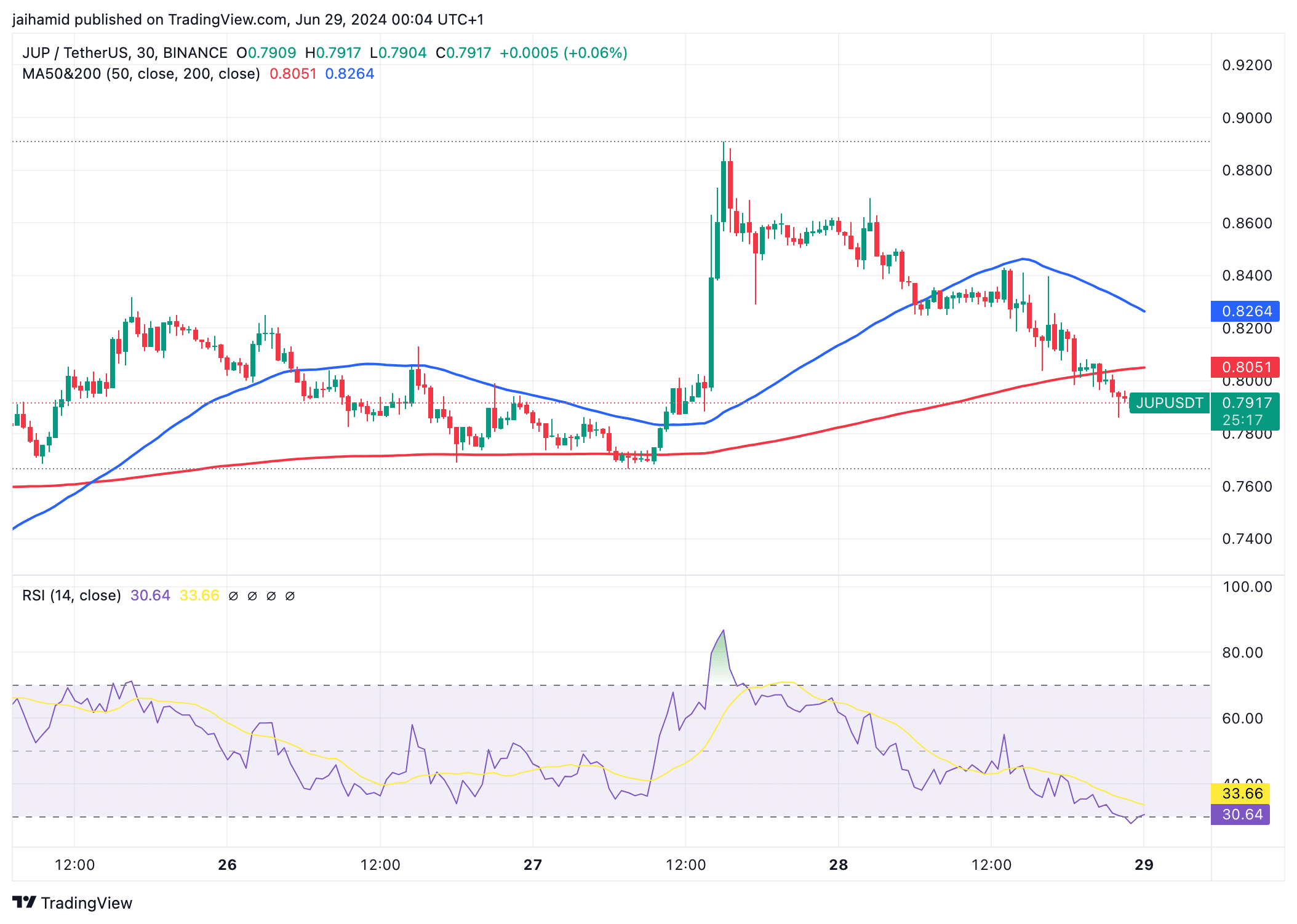

- The most current update on JUP: its quick-term MA undercuts the 200-working day MA

- RSI indicates a bearish pattern, nearing oversold territory

Let’s communicate about Jupiter (JUP) now! Recent knowledge shows a substantial wave of advertising tension impacting JUP’s general performance. This force would seem to have nullified any tiny gains JUP experienced created in the past week. The altcoin’s short-phrase relocating regular has now dipped under the longer-expression 200-day MA, marking a bearish flip.

In situations like this, a bearish craze could persist as the small-term momentum weakens in comparison to the for a longer time-expression route.

Supply: TradingView

What the technical indicators expose

As for the RSI, it now stands underneath 40, indicating a bearish momentum that’s edging nearer to oversold territory. Generally, an RSI beneath 30 implies that the asset may possibly be oversold, opening up a possibility for a price rebound or stabilization if purchasers intervene.

Write-up a recognizable spike, there has been a dependable downward trend in JUP prices, forming lower highs and lessen lows – a traditional bearish pattern.

At current, the selling price seems to be screening resistance at MA50 immediately after slipping below it before. If it struggles to surpass this degree, even more declines could be in shop.

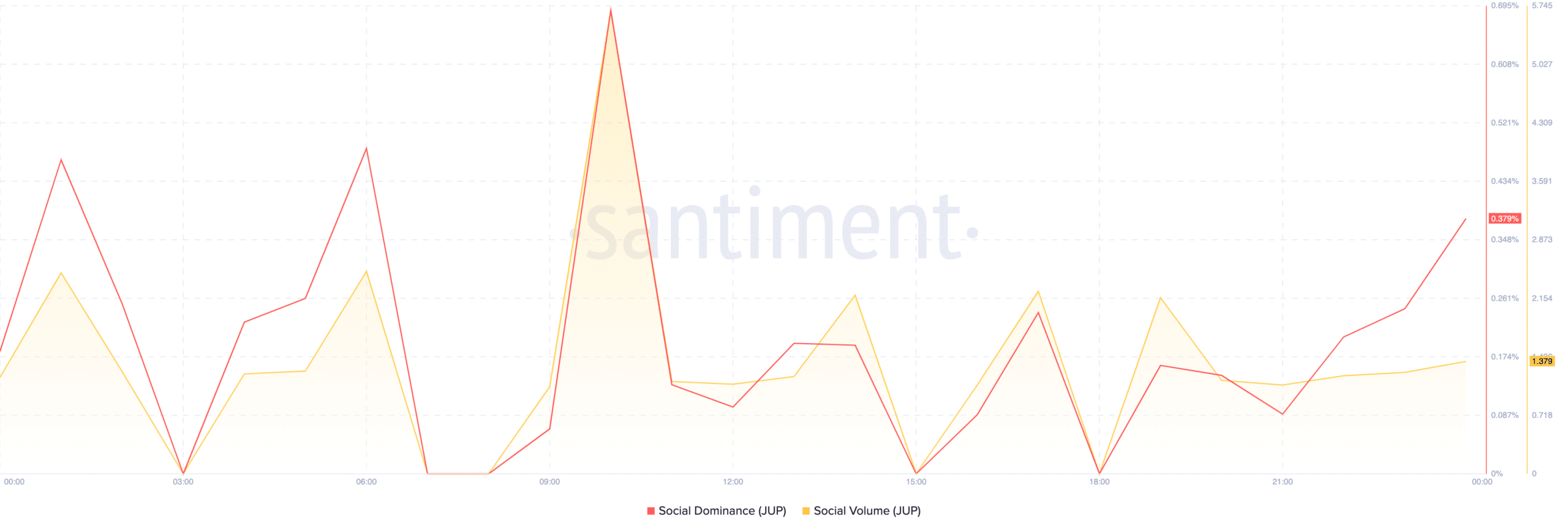

Supply: Santiment

You can find a visible improve in social dominance, aligning with a rise in social volume. These statistics propose that the latest selling price changes in JUP could be connected to traders reacting to new facts or market place shifts.

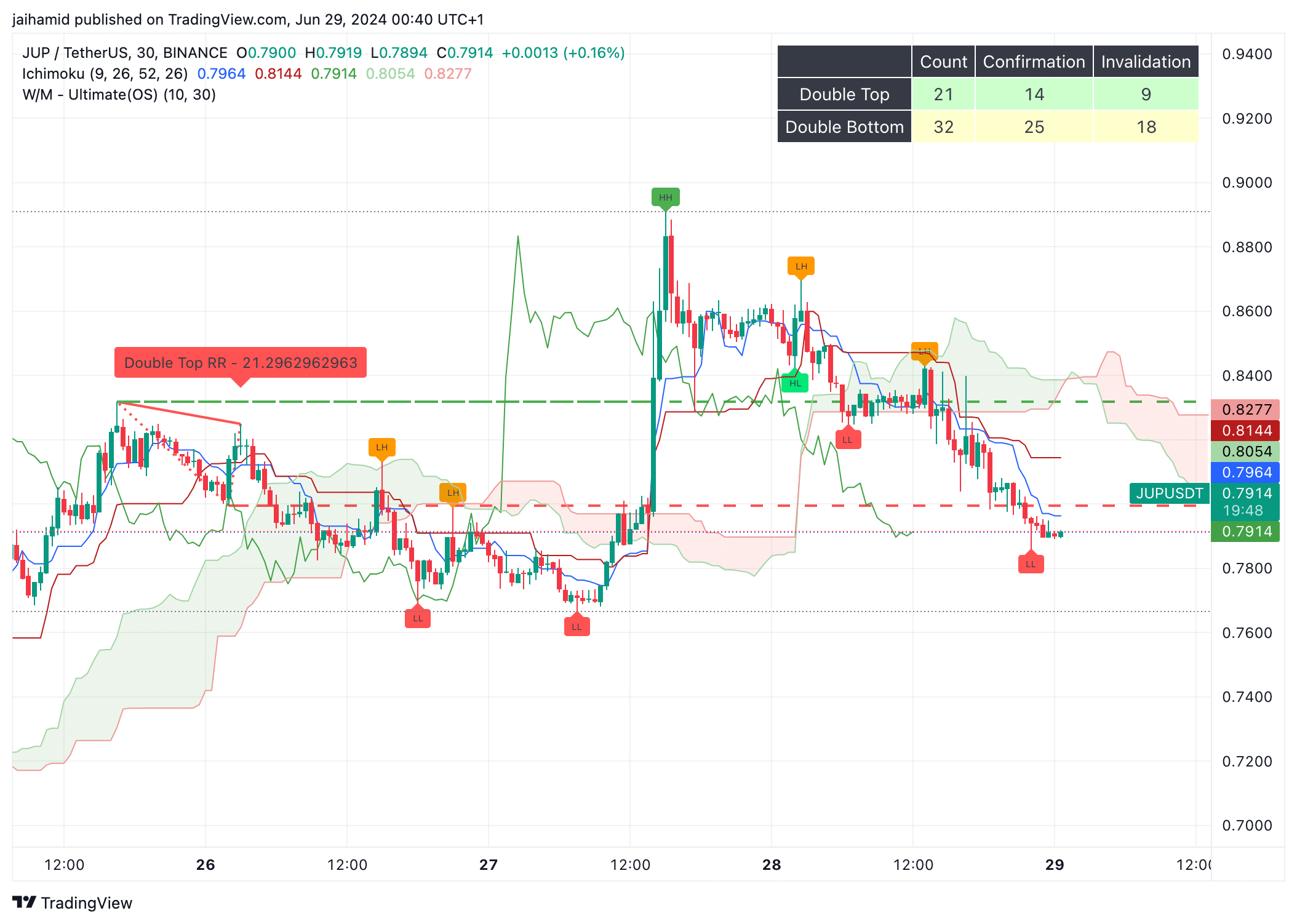

Analyzing patterns, we’ve viewed a double-best development 21 moments, confirming 14 situations. This formation typically implies a bearish transform subsequent unsuccessful attempts to breach resistance twice.

Conversely, a double-base pattern has appeared 32 moments, with 25 confirmations. This sample often indicators a bullish change immediately after failing to crack help concentrations twice.

While double bottom formations suggest initiatives to reverse developments, they have not held up on the charts due to existing sector ailments (Value down below Ichimoku Cloud and moving averages).

Resource: TradingView

Finally, preserving an eye on the supreme oscillator placed at the higher portion of the graph reveals very important momentum insights. With the oscillator dropping as prices fall below support concentrations, a solid providing development is evident.

If getting quantity encounters a substantial surge, JUP’s value could break earlier mentioned resistance ranges, probably reversing the recent downtrend.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!