Big Bitcoin Whales Gather $941M in BTC While Federal Official Suggests Rate Cuts to be Postponed

<

div id=”main-content” role=”main”>

<div class="content-mh">

<!–

<

div class=”ads” style=”width: 970px;height: 90px;background:transparent;margin: auto”>

–>

<!–

–>

<!–

–>

–>

Key Points

- High-value BTC wallets have acquired nearly $941 million in BTC, with 15,000 BTC accumulated.

- This shows faith in the market’s recovery by whales, despite a dip in price to $62,000.

- Federal Reserve official, Susan Collins, signals prolonged high-interest rates to combat rising inflation.

The recent downturn in spot and derivative trading volumes in the crypto market is driven by macroeconomic concerns. Federal Reserve officials taking a hawkish stance imply that interest rates will stay elevated for an extended period. Despite this, significant Bitcoin whales have bolstered their holdings with assets worth $941 million in the last day as Bitcoin’s price dropped.

Bitcoin Whales’ Big Purchase

Within the price range of $61K – $64K, large Bitcoin investors capitalized on a market dip to accumulate BTC, reports on-chain data platform Santiment.

Wallets with 1k-10k BTC have built a stockpile of over 15,000 BTC, valued at nearly $941 million. This accumulation suggests a positive outlook from whales, even amidst a price drop to $62,000. Whale activity is a key indicator for sustained optimism within the crypto market.

Whale holdings have surged to a two-week high, sparking speculation of a potential Bitcoin price uptrend. Despite this, Bitcoin remains in a state of consolidation post-halving, with market direction uncertainty prevailing.

Fed’s Stance on Interest Rates

Boston Fed president Susan Collins remarked that a longer time frame is necessary to tackle inflation effectively. She suggests a slower economic pace to counter inflation by reducing demand.

Hawkish sentiments from Fed official Neel Kashkari have unsettled the crypto market, contrasting with dovish remarks by Fed Chair Jerome Powell and favorable economic signals in the previous week.

CME FedWatch Tool projections foresee interest rate cuts by the U.S. Federal Reserve beginning in September, with additional rate reductions expected in November and December.

Potential Reversal in Bitcoin Price?

Bitcoin’s value dipped below $62,000 during U.S. trading sessions as traders locked in profits or closed long positions. This week alone, BTC has declined by over 5%, with a further 1% drop reported today, May 8. Trading volume also decreased in the last 24 hours.

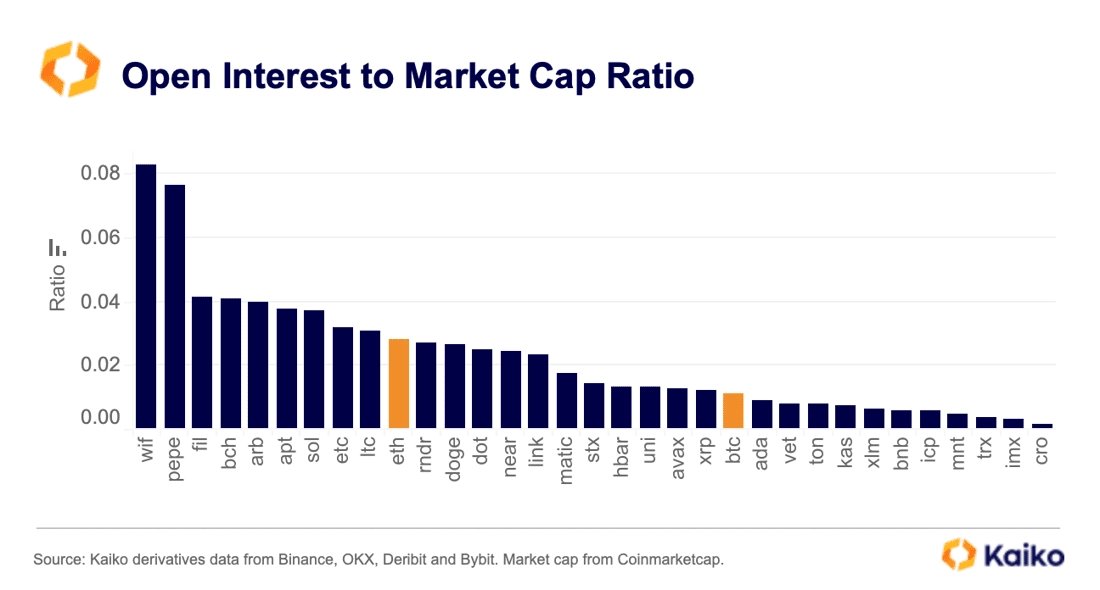

Market analysis by Kaiko revealed that meme tokens are leading in leverage among prominent altcoins, driven by substantial investments from whales and other traders. Investors are actively purchasing meme coins like dogwifhat (WIF) and Pepe Coin (PEPE) in anticipation of price rebounds during the current bullish phase.

Amid mounting macroeconomic uncertainties, analysts present varying forecasts, reflecting the prevailing market ambiguity. Bitcoin’s price remains constrained near $62,269.

<!–

–>

<!–

View all

–>

<!–

–>

‘);

// jQuery(“#quads-ad90952″).html(”);

// }

// });

// jQuery.getJSON(” function(result){

// if(result != null){

// var adsdata = result.placements.placement_1.image_url;

// var urlsite = result.placements.placement_1.redirect_url;

// jQuery(“.mobileAfads,.newsidebars”).html(‘

advertisement

‘);

// jQuery(“#quads-ad86063″).html(”);

// }

// });

}

function SidebarAdfirst(){

var htmlChkd2 = jQuery("#placement_489565_0").html();

jQuery("#placement_489565_0").html(htmlChkd2);

}

infScroll.on('append', function () {

let text = "";

// var max = 200;

// jQuery(“.authodes”).each(function

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!