Assessing Cardano’s in close proximity to-phrase prospective clients through the ongoing industry downturn

- Bulls brought pleasure to Cardano’s journey as the crypto dread and greed index shifted to the ‘greed’ zone.

- In spite of the strike to the altcoin’s Funding Rates, the extensive/short ratio paints a hopeful image for the bullish camp.

With the new downturn in the common sector sentiment, Cardano [ADA] continued its downward trajectory after forming a bearish sample in its day by day chart.

The bearish momentum acquired speed next the sample break and amidst overall market place uncertainties.

Even so, a prospective turnaround from the $.37 guidance level could spark some optimism among prospective buyers and help in surpassing the everyday EMAs.

Now, ADA is buying and selling all around the $.37 mark, showing a lower of about 2% in the past 24 hours.

Will ADA Bulls Turn the Tide?

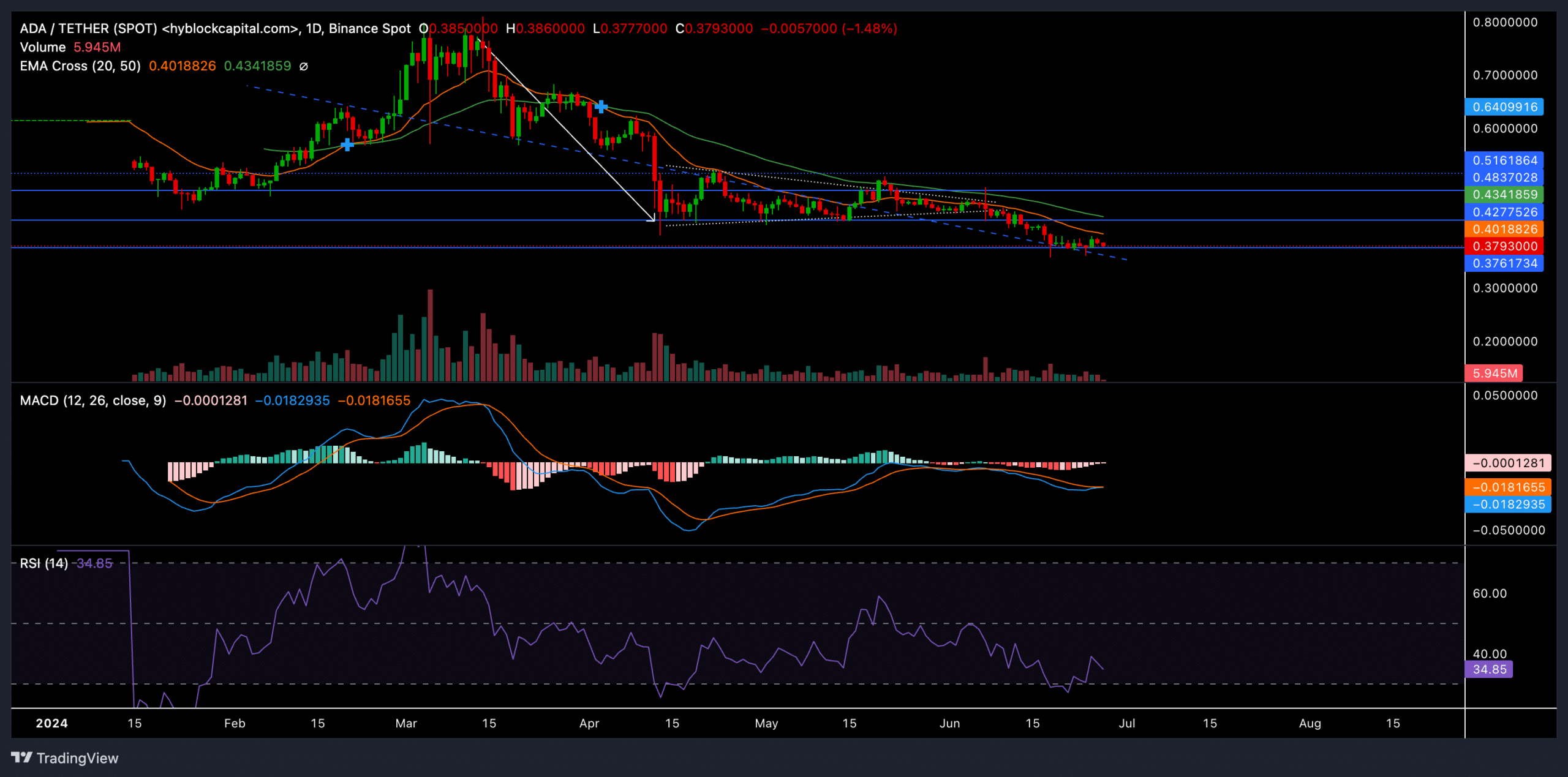

Resource: Hyperblockcapital, ADA/USDT

For nearly three months, ADA struggled to near outside of the 50-day EMA (eco-friendly).

The bearish cross amongst the 20-working day EMA (orange) and the 50-working day EMA paved the way for a prolonged downward trend.

Regardless of attempts to initiate an uptrend, the failure to breach the $.48-$.51 resistance vary formed a symmetrical triangle sample on ADA’s day-to-day chart.

The the latest fall under the vital $.42 stage reaffirmed the bearish sentiments and verified the symmetrical triangle breakout.

As a outcome, the altcoin witnessed a 15% reduce in significantly less than 3 months, locating support about the $.37 mark at the time of writing.

A decisive shut higher than the fast assistance could established ADA on a recovery route, with prospective resistance at the 20-day and 50-day EMAs.

Only a split higher than these degrees can kickstart a shorter-expression uptrend, perhaps top ADA to retest the $.48 just before a probable reversal.

If bearish strain persists, ADA may possibly exam the future crucial assist at $.35.

With the RSI hovering around oversold territory, a possible bounce from this level could signify diminishing selling tension.

Notably, the MACD and Signal traces have taken care of a bearish placement for in excess of three months, hinting at an extended bearish craze.

A possible bullish crossover amongst these strains could briefly halt the series of pink candles.

Hopes Continue being Alive with Extended/Limited Ratio

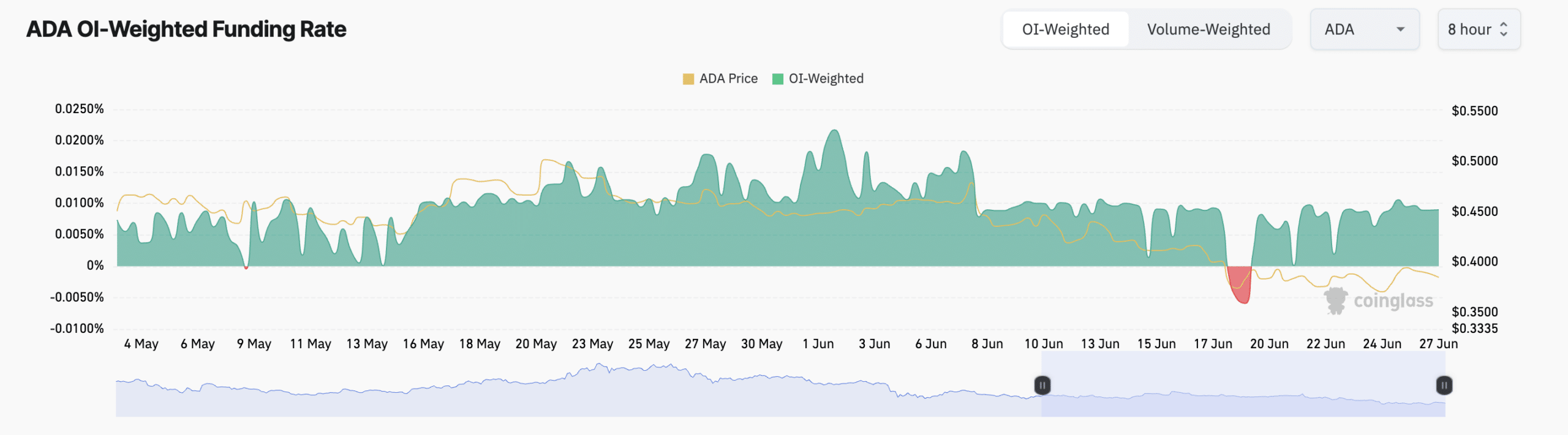

Source: Coinglass

All through marketplace uncertainties, ADA’s Funding Premiums on numerous exchanges observed a downtrend in new times. Nonetheless, the extensive/limited ratio for ADA/USDT on Binance stood at 3.7 in the previous 24 hours, indicating far more extensive positions than shorter positions.

Is your portfolio inexperienced? Check out out the ADA Gain Calculator

This indicates a attainable reversal from ADA’s fast help level. On the other hand, with ADA’s substantial correlation with Bitcoin, checking BTC’s actions is important in evaluating ADA’s shorter-expression prospective customers.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!