Anticipate SOL’s Price tag to Surge If a Place Solana ETF is Permitted!

- 21Shares potential customers the cost for a Place Solana ETF

- Anticipate a surge in Solana inflows pending software approvals

The exceptional market place performance of Solana [SOL] in current many years has garnered the desire of several Wall Avenue entities. Therefore, it comes as no shock that some are now actively pursuing the principle of a place Solana ETF.

21Shares usually takes the initiative

Searching for to capitalize on the escalating fascination in SOL, the Swiss asset administration company 21Shares has officially submitted an application to list a Solana ETF in the United States. This go closely follows a identical application produced by its competitor, VanEck.

The good results of 21Shares’ software hinges on the regulatory classification of the altcoin. The submitting assumes that beneath U.S law, Solana is not considered a stability. This distinction retains importance as Protection ETFs face much more stringent regulations compared to normal ETFs.

If the SEC labels it as a protection, 21Shares might decide to retract its application. The potential withdrawal could be attributed to the extra registration specifications associated with stability ETFs, which 21Shares might be disinclined to satisfy.

What lies forward for SOL?

The arrival of a likely place Solana ETF is projected to positively impact the value of Solana (SOL), akin to Bitcoin’s rate surge next its place ETF approval.

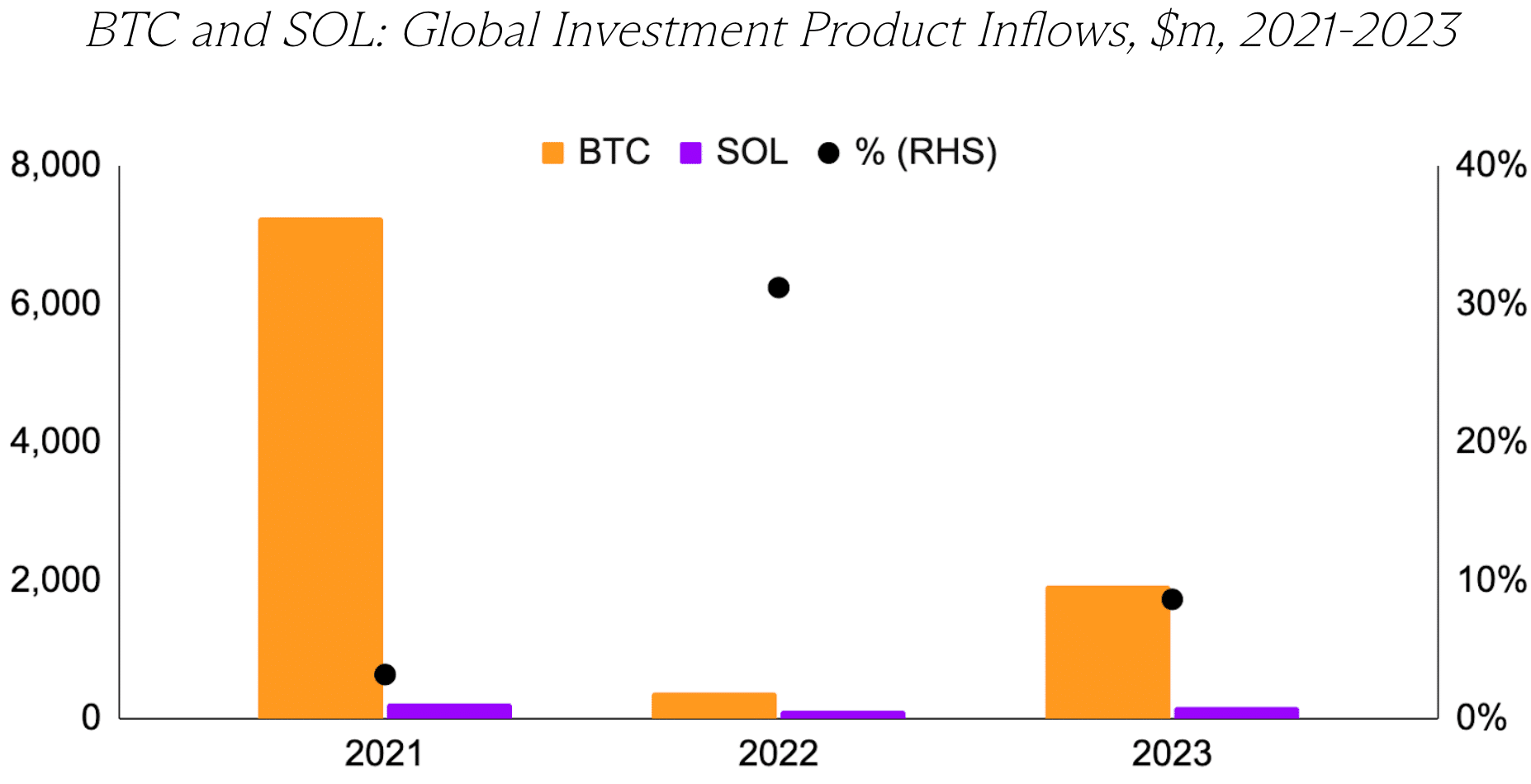

In a recent report by GSR Markets, they made reference to Bitcoin’s 2.3x cost improve as a beginning stage. It is noteworthy that they acknowledged the chance of Solana ETFs not attracting the similar level of financial investment. To tackle this, GSR explored three scenarios dependent on likely financial commitment inflows relative to Bitcoin ETFs.

In the Bear Circumstance scenario, they projected a 2% improve in SOL’s inflows, indicative of minimum fascination in Solana ETFs as opposed to Bitcoin.

Next that is the Base Circumstance, exactly where 5% of the inflows when compared to Bitcoin are anticipated. This circumstance is based mostly on genuine financial commitment traits in Solana products and solutions from 2021 to 2023, excluding 2024 to eliminate the affect of Bitcoin ETFs.

In the most bullish circumstance, GSR factored in SOL’s bigger relative inflows in 2022 and 2023. They estimated that the altcoin could capture 14% of the inflows when compared to Bitcoin on ordinary.

Supply: GSR

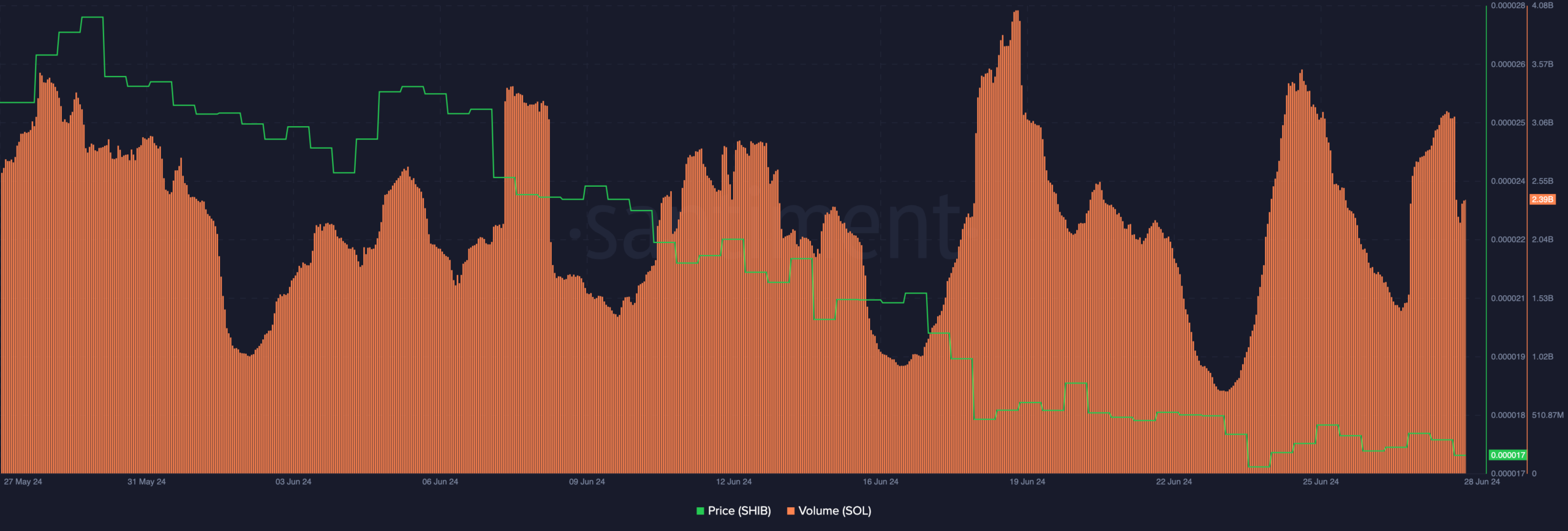

At this time, SOL is buying and selling at $141.80, with a 2.53% lower in selling price over the past 24 hrs. Moreover, its buying and selling volume has dropped by 33.23% all through the similar time period.

Is your portfolio flourishing? Find the SOL Income Calculator

Resource: Santiment

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!