The factors behind Ethereum’s $30 million inflows in modern months: Defined.

- $30 million invested in Ethereum merchandise

- Bitcoin sees outflows, risks for ETH value

The latest details from Coinshares uncovered that digital asset financial commitment merchandise confronted a lot more outflows than inflows for the fourth week in a row. This facts was shared in a write-up printed on Could 7th.

Outflows totaled $251 million, with Bitcoin [BTC] accounting for $284 million. Despite this, Ethereum [ETH] managed to offset some of the outflows with $30 million in inflows.

The Increase of ETH

In a surprising change, Ethereum experienced inflows for the initial time in 7 weeks. The modern launch of Bitcoin and Ethereum location ETFs in Hong Kong was cited as a critical issue at the rear of this boost, according to AMBCrypto.

Resource: CoinShares

CoinShares also emphasised that,

“The brilliant spot last week was the productive start of spot-based Bitcoin and Ethereum ETFs in Hong Kong, which noticed US$307m inflows in the initial week of buying and selling.”

Yet another prospective explanation for these inflows could be the looming decision by the U.S. on Ethereum ETF apps.

Past content on AMBCrypto had highlighted some experts’ doubts about the approvals, but there have been also voices of optimism. In the prior week, Litecoin [LTC] and Chainlink [LINK] dominated the inflows, but they were overshadowed past 7 days. For Ethereum, an approval could deliver a substantially-desired increase.

Conversely, a rejection could prompt a correction in the cryptocurrency’s value. At this time, ETH is investing at $3,067.

The Route Ahead for ETH

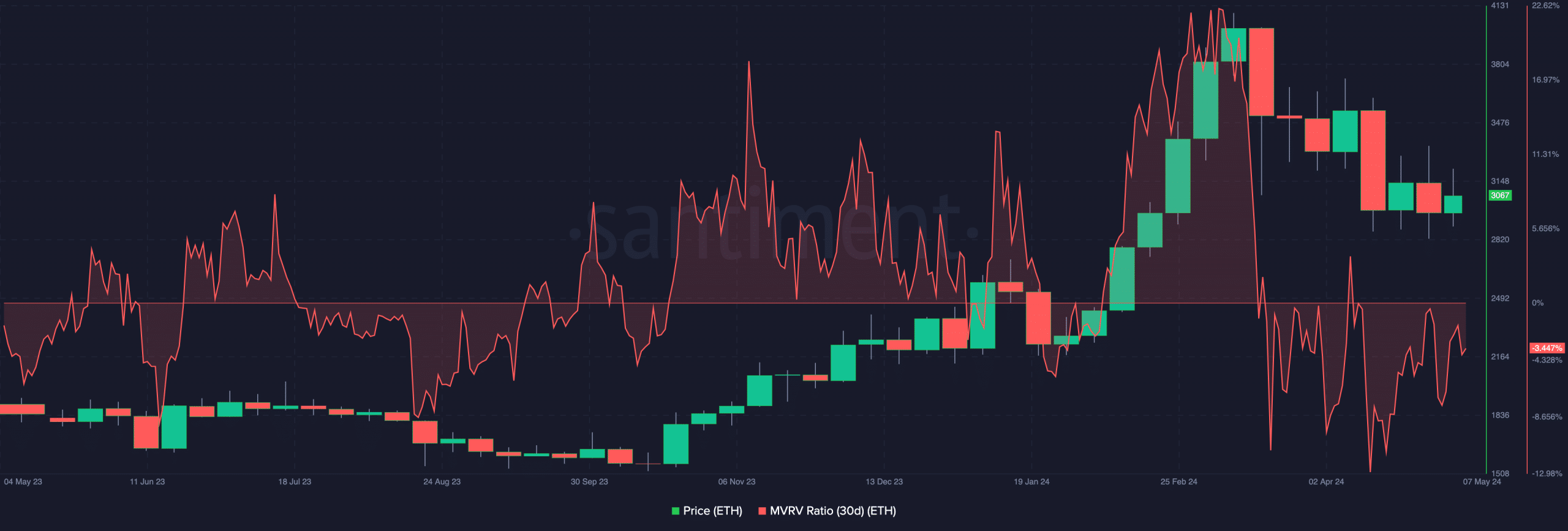

Forecasts show a potential selling price drop, with a slide down to $2,800 as a likelihood. Nevertheless, some traders remain optimistic, aiming for a return earlier mentioned $4,000. To consider these predictions, the Marketplace Worth to Realized Benefit (MVRV) ratio is viewed as.

This ratio provides insights into holders’ profitability status, indicating regardless of whether a cryptocurrency is undervalued, good, or overvalued. As of now, Ethereum’s 30-working day MVRV ratio stands at -3.447%, suggesting potential losses for sellers at the recent price.

Source: Santiment

Historically, optimum getting chances come up when the MVRV ratio is among -7% and -18%. Regardless of the destructive looking through, the recent place may not be favorable for accumulation.

Those people eyeing ETH for probable entries may need to have to workout endurance and hold out for extra perfect conditions.

Pondering about your ETH portfolio performance? Attempt the ETH Revenue Calculator

No matter of the unique entry points, a significant uptick in obtaining pressure is needed for ETH to reward buyers. Whilst the timing continues to be unsure, market individuals continue to be hopeful for Ethereum’s foreseeable future prospects.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!