The significance of checking Dogecoin’s cost for potential breakout tendencies

- Breaking News: Dogecoin rises earlier mentioned $.13 threshold, shaking off bearish trends on the every day chart

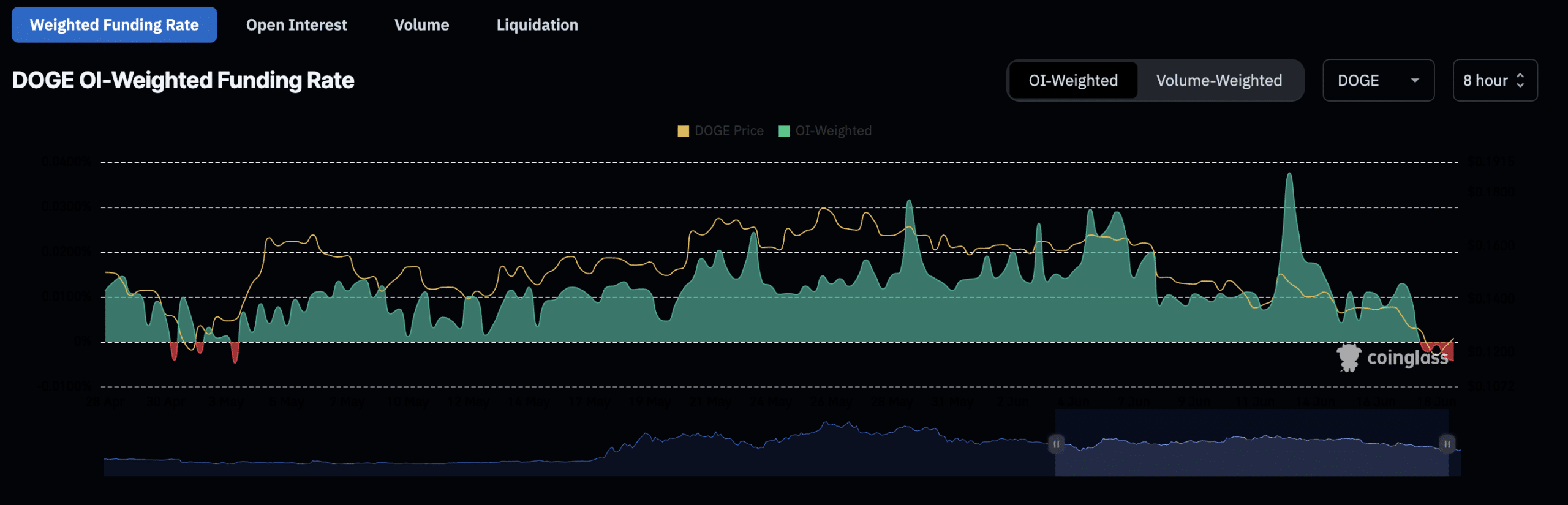

- DOGE’s funding level sees a drop amidst escalating bearish sentiment

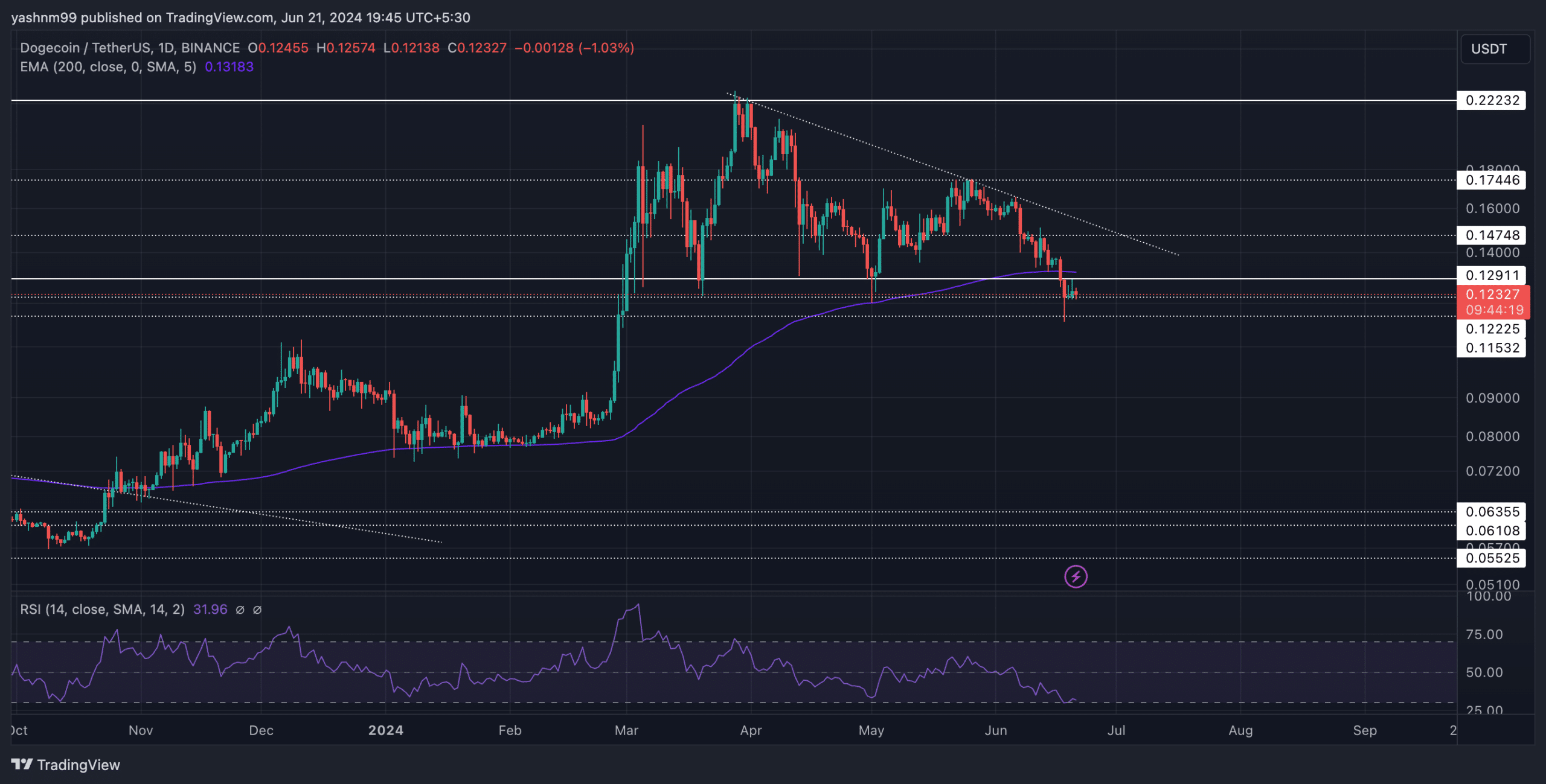

Enjoyable news for Dogecoin [DOGE] lovers as the meme cryptocurrency surged earlier the $.13 resistance, signaling a crack from its earlier descending triangle pattern on the every day chart. Following this breakthrough, DOGE slipped beneath its 200-day EMA, confirming an extended time period of bearish action.

Also, the altcoin’s funding amount took a detrimental transform amid bearish pressures, coinciding with a important DOGE transfer of around $10M from an undisclosed wallet to Robinhood, as reported below.

Investors are now eyeing a probable reversal previously mentioned the $.13-stage to shift the momentum positively. Current trading price ranges for DOGE hover all around $.0122.

Calling all DOGE fans: Can a rally be in the cards?

Impression Source: TradingView, DOGE/USD

Following a remarkable 150% surge just a month in the past, Dogecoin’s earlier peak in March pushed previous the $.22 degree ahead of a swift downturn, reflecting broader marketplace uncertainties.

The modern dip beneath $.13 activated a consolidation stage and unveiled a basic descending triangle development on the daily timeframe. DOGE’s subsequent fall marked a new reduced for the coin because mid-June.

A turnaround earlier mentioned the 200 EMA around the $.13 threshold could pave the way for a limited-phrase rebound, aiming for around $.147.

Conversely, a reversal down below the 200 EMA would nullify bullish prospective clients, with initial help anticipated at $.11.

With the Relative Toughness Index (RSI) nearing the 30-stage, a likely rebound from oversold circumstances is on the horizon for keen potential buyers.

Funding level will take a hit

Recent knowledge from Coinglass factors to a noticeable drop in DOGE’s funding level about the earlier several times, marking a small not seen considering that May possibly 2024.

Presented the historic influence of this metric on value actions, traders should really continue to keep this element in mind as DOGE’s benefit could mirror this downtrend in the days forward. Nevertheless, a reversal in this aspect could inject refreshing optimism among the buyers.

With DOGE exhibiting a 75% 30-working day correlation with Bitcoin at present, staying abreast of Bitcoin’s movements along with these critical complex indicators is very important for knowledgeable determination-creating.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!