Subsequent Acquire Prospect for Dogecoin: A Price Prediction for DOGE

<

div>

- Gurus forecast that Dogecoin’s potential trend could be motivated by two essential liquidity parts.

- Traders should not stress about the current decrease in social media engagement.

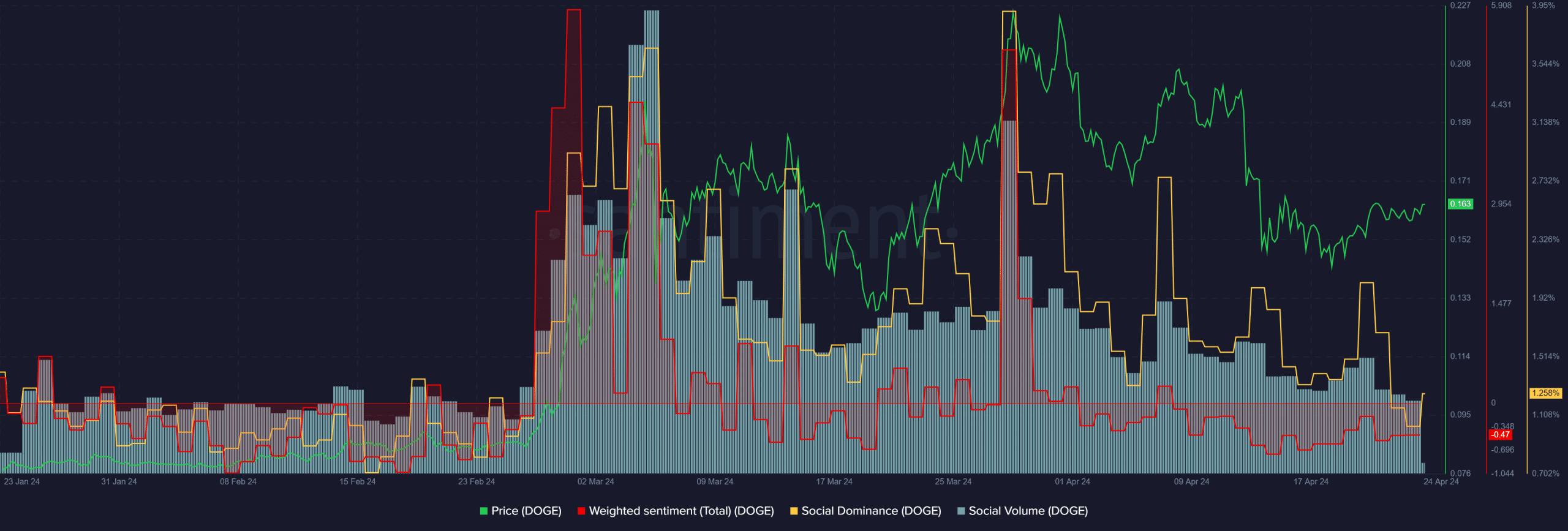

Around the past number of weeks, Dogecoin [DOGE] has seen a drop in social sentiment. Social media interactions have dropped, and consumer activity has diminished alongside with the prices.

Studies suggest that Dogecoin whales have been demonstrating desire in the Futures current market.

The meme coin may possibly knowledge a major surge, possibly achieving a new all-time higher one particular yr soon after the last halving. Traders are optimistic for a repeat of past functionality. On the other hand, alterations are required for the bulls to establish a new uptrend shortly.

Compared to other meme cash, DOGE has not demonstrated as solid bullish general performance. For occasion, at the latest second, its 7-working day gains are only at 4.1%, in distinction to Shiba Inu’s [SHIB] 20% or Pepe’s [PEPE] 53%.

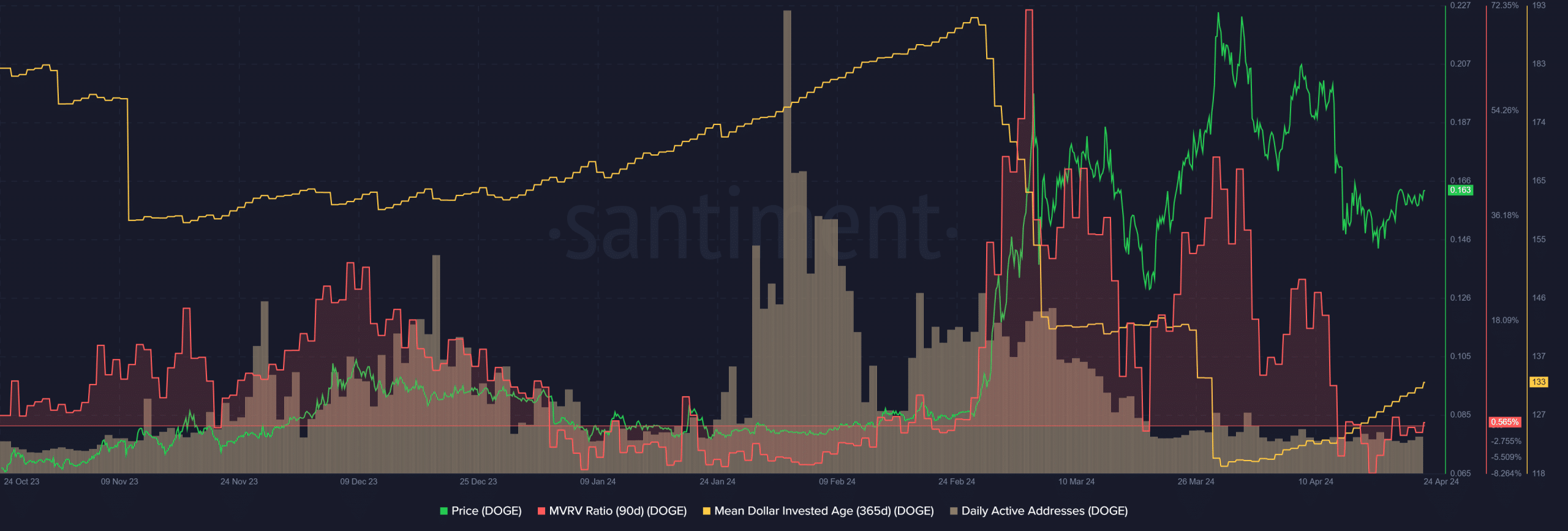

New social metrics not favorable for DOGE

Source: Santiment

Considering the fact that March 30th, the selling price of Dogecoin has been on a downward pattern. Pursuing the retest of the $.2 mark as resistance on April 8th, the drop even more intensified.

This drop coincided with a steady fall in social media mentions of Dogecoin.

Taking into consideration the adverse sentiment, it would seem that fascination in DOGE on social media has waned in latest occasions.

Additionally, the lower in Social Dominance considering the fact that the close of March indicated diminishing awareness towards the meme coin. This shift in dominance indicates a cooling off of desire in Dogecoin, which might transform based mostly on quick-expression selling price actions.

DOGE holders remain secure but not worthwhile

In February and March, the typical greenback invested age substantially declined as selling prices rose. Nonetheless, in April, this metric commenced to increase yet again, signaling accumulated fascination from DOGE holders. Furthermore, the 90-day MVRV dropped under but has considering the fact that recovered to +.565% at existing.

Whilst the MDIA and MVRV metrics shown a sturdy get signal for Dogecoin, the daily active addresses metric ongoing to decrease above the past thirty day period, indicating decreased person interaction and reduce demand from customers for the meme token.

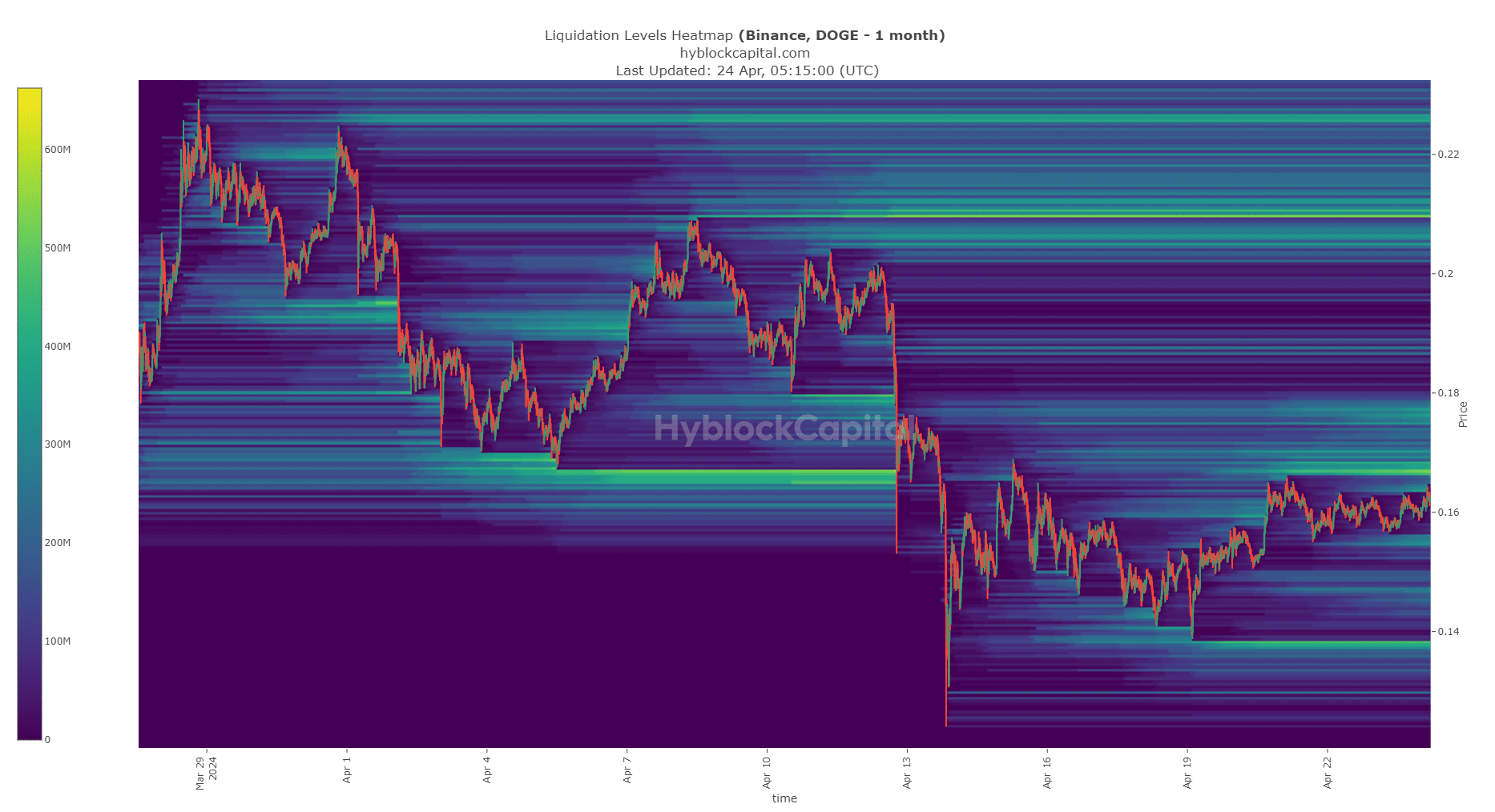

Prospective worries from liquidity overhead

An investigation of the liquidation heatmap about the past thirty day period reveals that rates are positioned just beneath a important liquidity zone. The $.166-$.168 array has served as a resistance area for practically ten times, accumulating noteworthy concentrations of liquidation over it.

A breach into this zone could result in small liquidations, ensuing in a temporary selling price surge from pressured sector buys upon liquidation.

Likewise, the $.155 assortment has also viewed significant liquidity accumulation down below it in the new week, indicating bullish speculation. Further more down, the $.136-$.138 lows are spots of interest as nicely.

If Dogecoin’s selling price breaks by means of the liquidity in the $.17 location, a bearish route may possibly emerge, leading to possible downtrends in the direction of $.155 and even $.136 in the in close proximity to future.

In spite of the buy signals from on-chain metrics, it is sensible for swing traders and investors to exercise caution and wait around for a lot more favorable circumstances.

If Dogecoin displays favourable signals, like turning the $.17-$.18 space into help, it would current a reduced risk for traders seeking to invest in the meme coin.

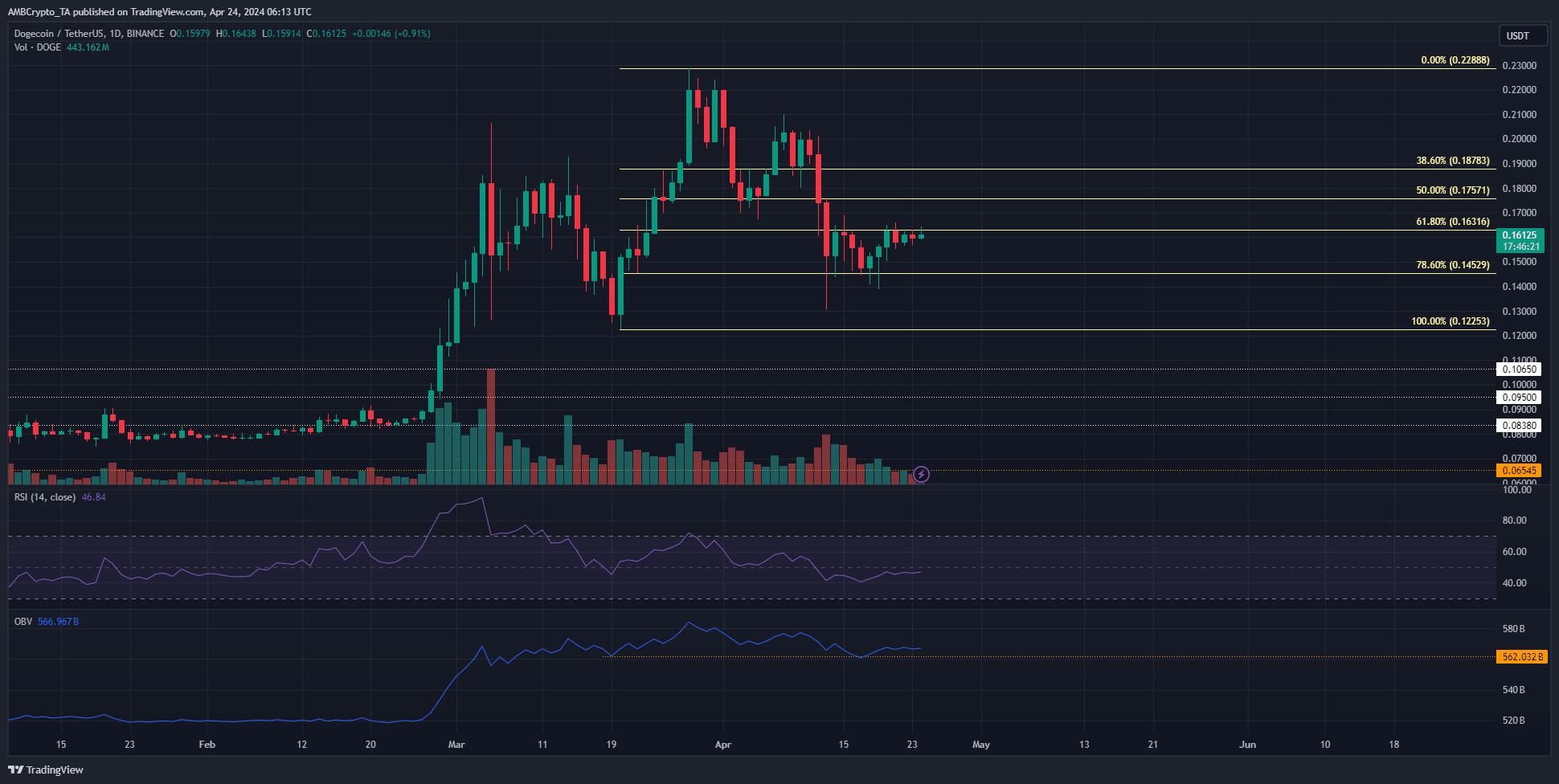

Discovering purchasing prospects with technical examination

Source: DOGE/USDT on TradingView

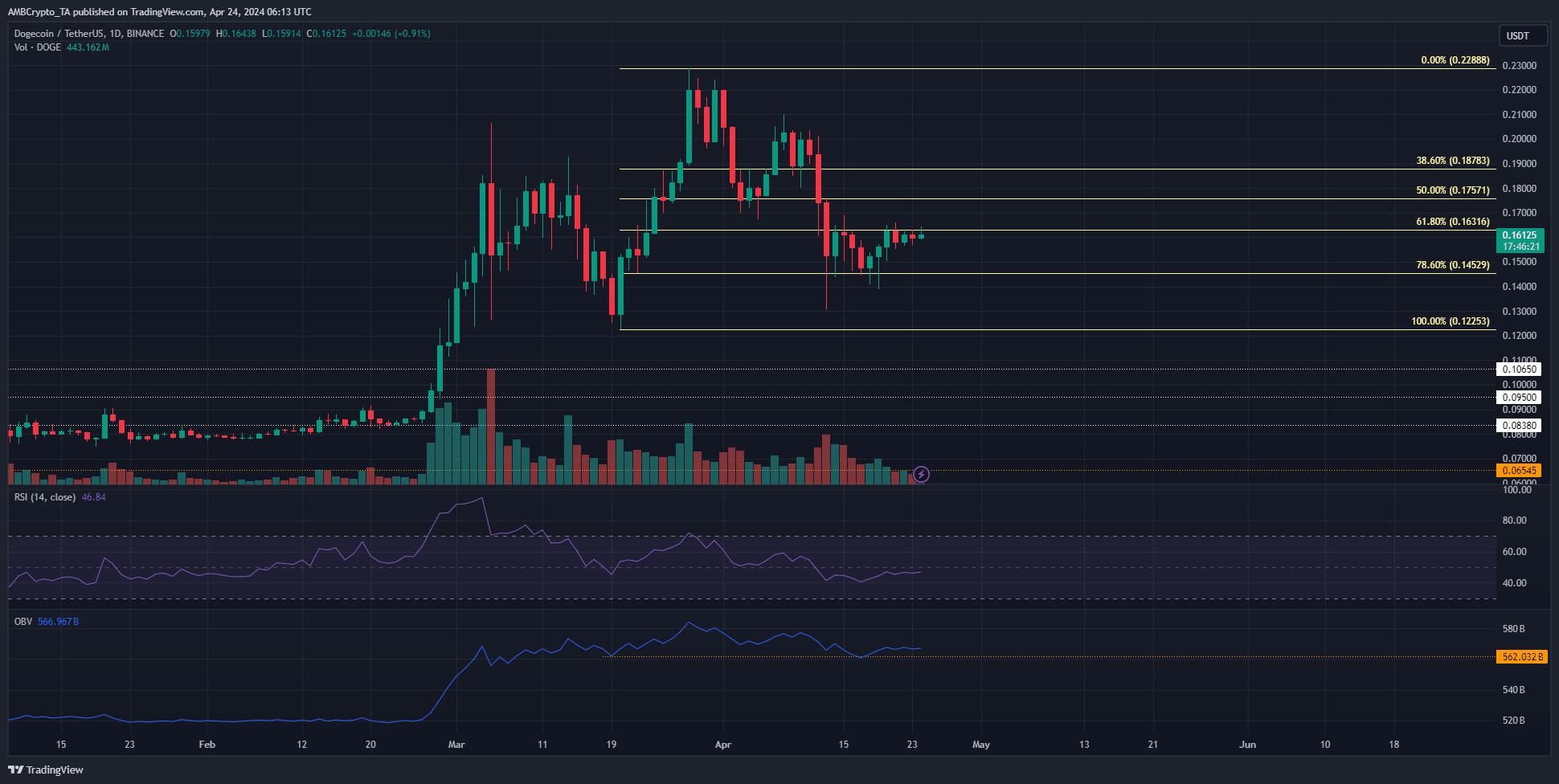

The 1-day price chart suggests that the upward trend for Dogecoin is continue to intact. Additionally, the 78.6% Fibonacci retracement amount (pale yellow) was defended during the recent price fall.

Even though the RSI implies bearish momentum underneath the neutral 50 mark at 46.8, it does not show robust downward force. On top of that, the OBV is previously mentioned a aid amount from mid-March, indicating extreme selling strain but not but dominant on extended timeframes.

Even though the decrease timeframe trend is at the moment bearish after tests $.2 as resistance, beating the $.163-$.17 variety and $.175 resistance stage could signal a shift to a bullish stance.

Read Dogecoin’s [DOGE] Rate Prediction 2024-25

In summary, Dogecoin’s extended-time period outlook remains optimistic. Despite subdued social media engagement, on-chain metrics suggest a getting signal.

To confidently anticipate a bullish craze for DOGE, conquering the brief-phrase hurdle at $.175 is critical for swing traders. The up coming focus on amount would be $.2.

<

div class=”post-nav”>

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!