Will Ethereum’s recovery have a major effect on Lido’s long term?

- Remarkable News: Lido’s Accomplishment Boosts Liquid Staking Marketplace Cap!

- Breaking: LDO is presently buying and selling at $2.13

As the earlier week arrived to an close and a new a person began, Ethereum [ETH] saw a slight increase in worth. Similarly, Lido Dao skilled a related upward motion.

Current data shows that whilst the amount of staked Ethereum ongoing to climb, the influence of the DAO remained potent.

Lido’s Surge Boosts Liquid Staking Marketplace Cap

Modern details from Santiment suggests that Liquid staking assets had a favourable weekend, with Lido being a single of the standout performers.

Studies show that the sector cap of liquid staking assets surged by far more than 5%. Exclusively, LDO shown an spectacular boost of around 5% through this period of time.

Tracking Lido’s Overall performance

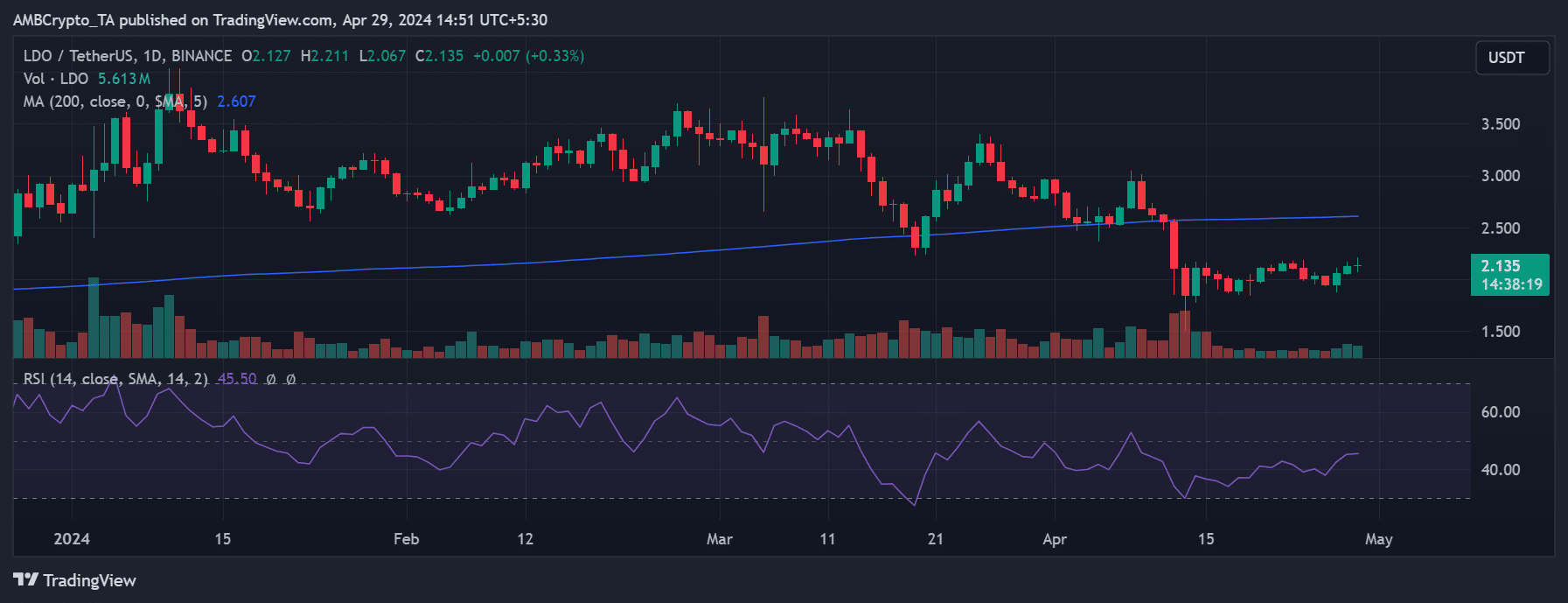

Analysis of Lido Dao’s cost development on a each day chart showed a constructive trajectory toward the conclusion of past week.

On April 27th, LDO noticed a considerable increase of above 5%, reaching a buying and selling benefit of around $2.05. The next working day, April 28th, the upward development continued with a different 3% raise, pushing the rate to around $2.12.

At current, it is buying and selling at about $2.13, with a slight boost of considerably less than 1%.

Resource: TradingView

If this constructive development continues right until the close of April 29th, it will mark the first a few consecutive times of advancement for LDO this thirty day period. Prior to this, the very last these upward movement was famous in March, occurring only the moment.

Whilst recent actions have been positive, an investigation of its Relative Energy Index (RSI) signifies that LDO is nevertheless in a bearish stage.

At current, the RSI continues to be beneath the neutral zone. Even more investigation reveals that considering the fact that February, LDO has not maintained a extended period of time above the neutral zone, symbolizing a prevailing bearish development in current moments.

Inspite of rate fluctuations, the platform proceeds to assert its dominance in Ethereum staking.

Lido Prospects in Ethereum Stakes

Knowledge from Dune Analytics reveals that above 32 million Ethereum have been staked, representing over 27% of the whole offer.

Notably, Lido performs a substantial position in this, contributing 28% of the overall staked ETH. This amounts to above 9.3 million ETH staked through Lido.

Is your portfolio experience the favourable affect? Learn the Lido Earnings Calculator

In addition, knowledge indicates that staking activity has grown by around 6% about the previous 6 months, showcasing the platform’s continued dominance in Ethereum staking.

Nonetheless, a nearer look at the knowledge also reveals a the latest lower in staking netflow in the past couple months, coinciding with drops in Lido’s native token (LDO) and Ethereum charges.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!