BNB Chain TVL will increase with hottest addition, but is it still the beginning?

- Even with the increase in locked assets, the total TVL observed a decline of 22%.

- The sentiment bordering BNB was optimistic, however desire in the coin lowered.

Just two days soon after BNB Chain manufactured acknowledged the addition of native liquid staking on the Binance Clever Chain [BSC], the price of assets staked on the network professional a surge.

For greater comprehension, BNB Chain capabilities as a sensible contract blockchain that is suitable with the Ethereum [ETH] Digital Device.

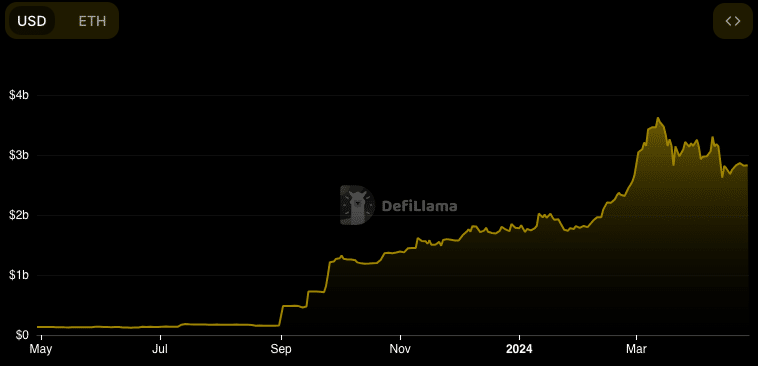

In accordance to DeFiLlama, the Whole Benefit Locked (TVL) of Binance [BNB] Staked ETH, the principal liquid staking protocol on the chain, rose by 2.75% around the last 7 days.

Rapid Improvements, but it’s Early Days

Currently, the price stands at $582.76 million. Concurrently, the TVL of Stader, a further liquid staking protocol on the network, saw a rise of 6.98% in the similar time period.

Supply: DeFiLlama

This enhance indicated that a lot more assets had been getting deposited on the BSC, reflecting a growing believe in in the protocol.

BNB Chain attributed the introduction to the approaching Beacon Chain sunset fork that is envisioned to be finalized in June. The chain mentioned,

“Through the issuance of liquid staking tokens that stand for staked BNB, consumers can participate in DeFi routines with no compromising asset utility. The LSDFi integration is scheduled amongst April and early May of 2024.”

With this improvement, delegators can compound staking rewards and quite possibly ease cross-chain migration among the BSC and BNB Beacon Chain.

Can BNB Maintain Up with BSC?

Even with the progress in staked belongings, the total TVL of the BSC plummeted by 22.16% in the previous 24 hours. Steady enhancement in staking on the network could guide to a favourable shift in this metric.

Usually, the chain may battle to make sizeable returns for contributors. Nonetheless, this staking exercise could effects BNB Chain’s revenue. In Q1, AMBCrypto described a 70% expansion for the chain.

Following a hard April with declining profits on several events, the network could see a turnaround with the comprehensive liquid staking integration anticipated by the end of Might.

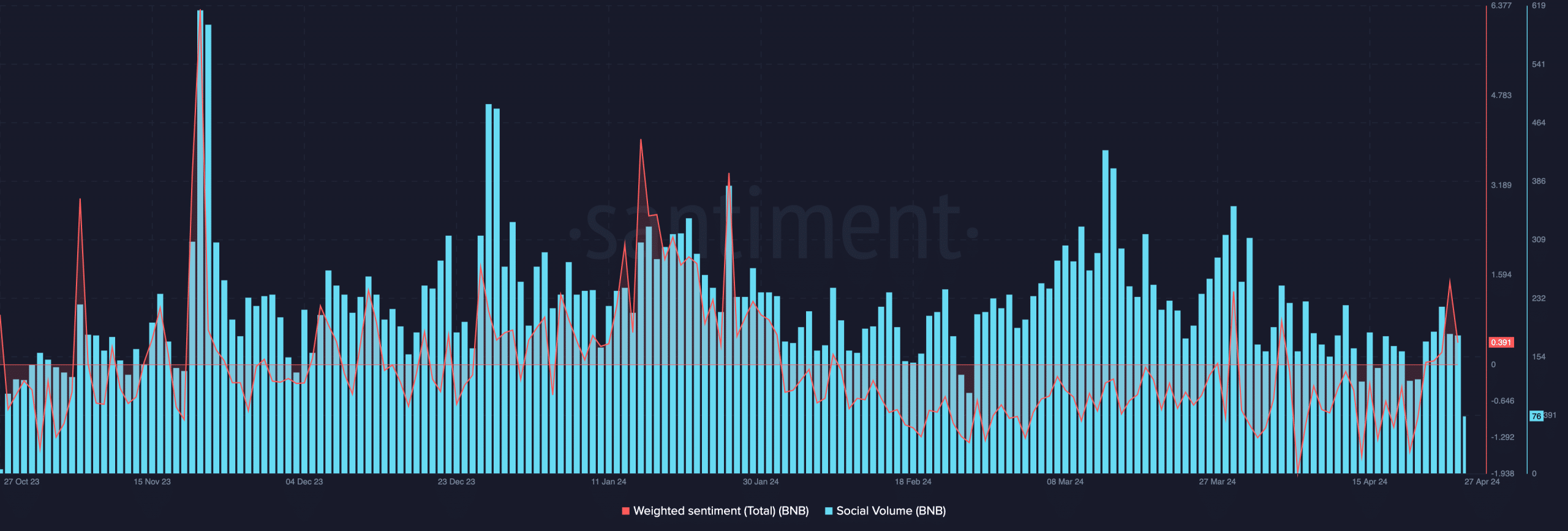

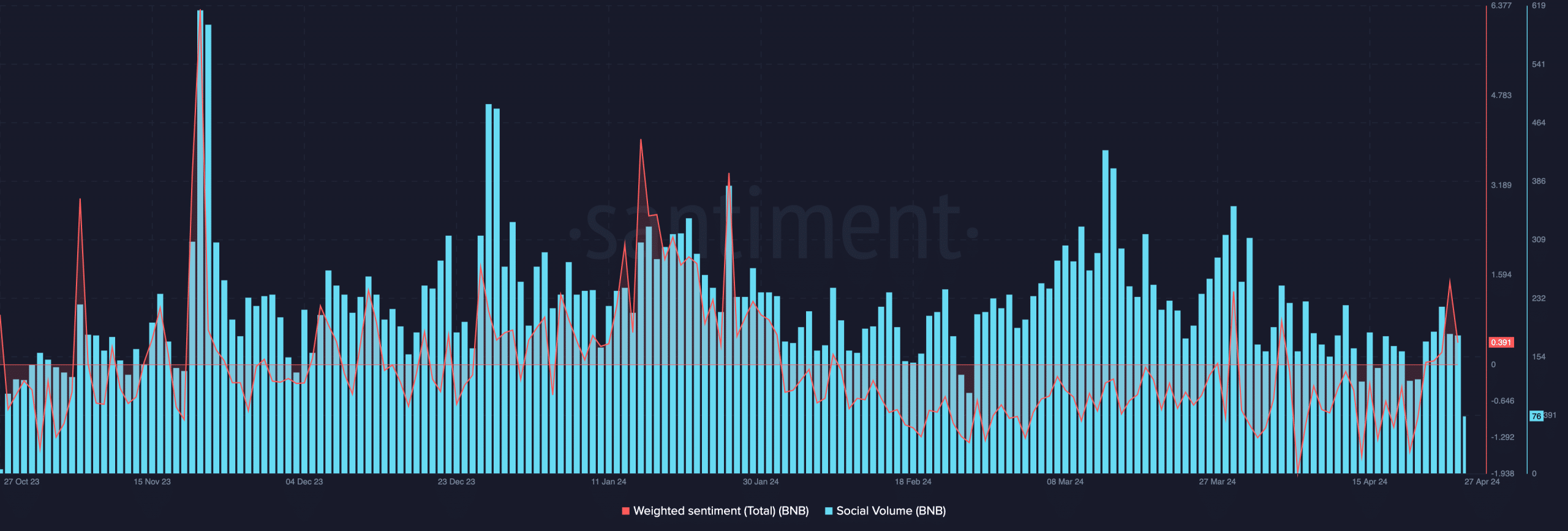

Observing other elements, we learned an enhancement in sentiment all-around the task. Santiment claimed that the Weighted Sentiment was as minimal as -1.631 on April 20.

As of now, the sentiment has turned beneficial, suggesting a additional optimistic notion of BNB when compared to a week ago.

Supply: Santiment

If this sentiment proceeds to rise, it could direct to much more assets currently being directed in direction of staking on BNB Chain. On the other hand, a stagnant sentiment may end result in asset stagnation or even withdrawals by individuals.

Is your portfolio flourishing? Try out the BNB Financial gain Calculator

What’s more, on-chain information indicated a lower in social quantity, signifying decreased interest in seeking for BNB as an asset.

Whilst this decrease could likely affect the desire for the cryptocurrency negatively, it does not automatically indicate a important fall in network activity.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!