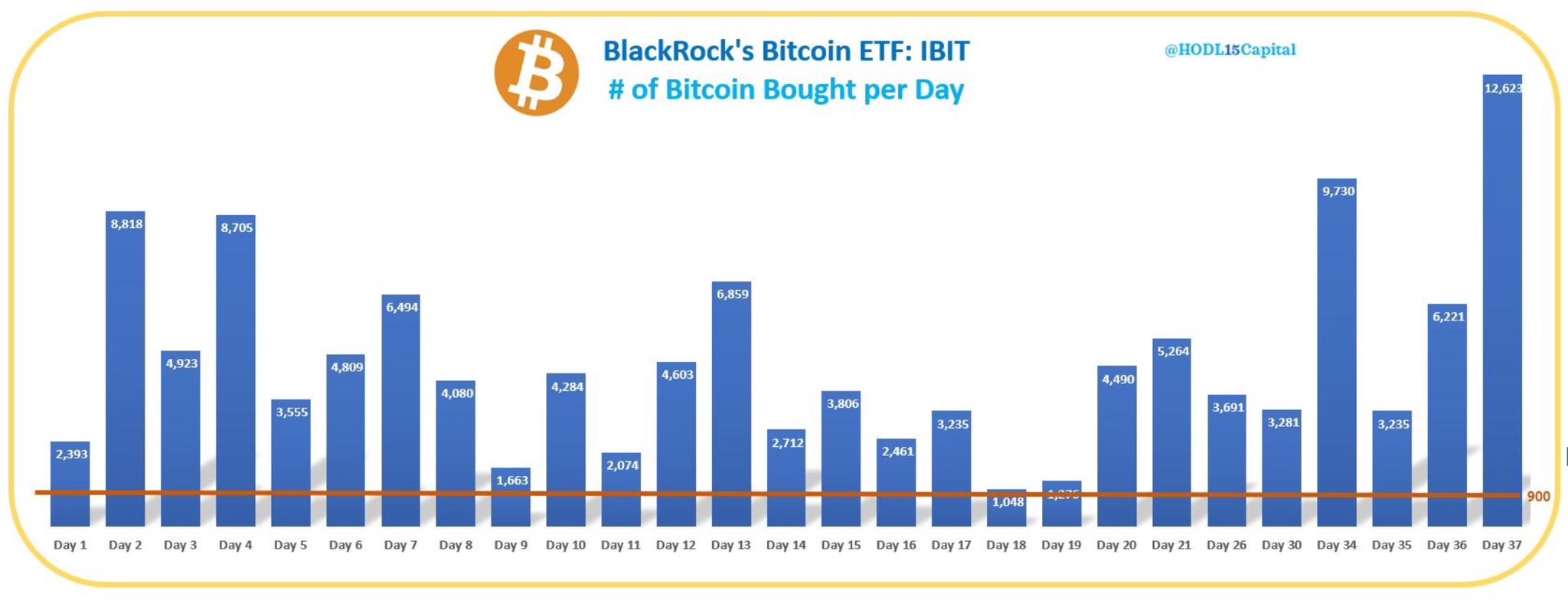

Blackrock Acquires 12,623 BTC for Bitcoin ETF in Largest 1-Day Buy Since Start

Blackrock’s spot bitcoin exchange-traded fund (ETF), the Ishares Bitcoin Trust (IBIT), has broken its record for the largest single-day bitcoin purchase since its launch. The world’s largest asset manager’s spot bitcoin ETF now holds 183,345 bitcoins.

Blackrock Bought the Bitcoin Dip

Blackrock’s spot bitcoin exchange-traded fund (ETF), the Ishares Bitcoin Trust (IBIT), amassed the largest single-day bitcoin purchase since its Jan. 11 launch on Tuesday. This buying surge coincided with a bitcoin price correction, following the cryptocurrency’s new all-time high set just hours earlier.

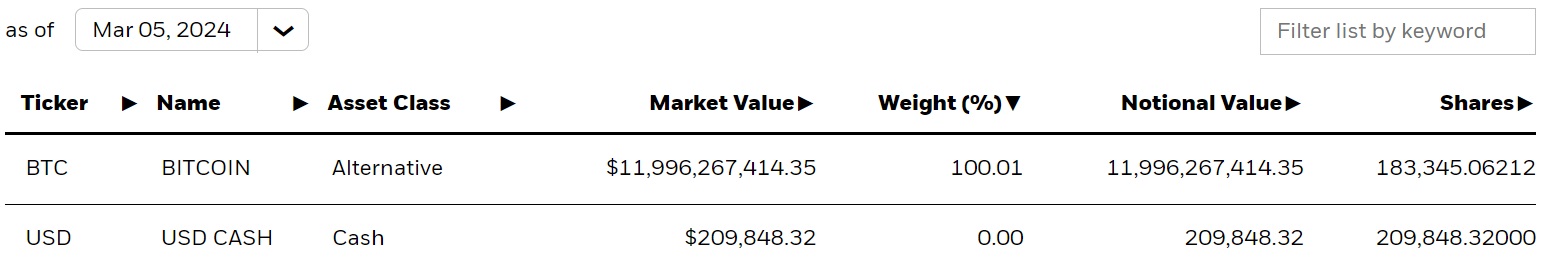

On Tuesday, IBIT saw a record inflow of $788.3 million, pushing the total net inflow for all 10 new spot bitcoin ETFs to $648.3 million. This positive inflow contrasts with a $332.5 million outflow from Grayscale Bitcoin Trust (GBTC). In terms of bitcoin acquired, IBIT raked in 12,623.18455 BTC on Tuesday, according to the Ishares website.

With the fund’s latest purchase, IBIT’s bitcoin holdings increased to 183,345.06212 BTC on March 5, up from 170,721.87757 BTC the prior day.

According to Bloomberg ETF analyst Eric Balchunas, IBIT’s cash haul ranks the ETF as the second-highest in one-day, one-week, and one-month flows among all ETFs. For year-to-date flows, IBIT’s haul ranks third, the analyst detailed.

The 10 new spot bitcoin ETFs — Blackrock’s Ishares Bitcoin Trust (IBIT), Fidelity Wise Origin Bitcoin Fund (FBTC), Ark 21shares Bitcoin ETF (ARKB), Bitwise Bitcoin ETF (BITB), Invesco Galaxy Bitcoin ETF (BTCO), Wisdomtree Bitcoin ETF (BTCW), Vaneck Bitcoin Trust ETF (HODL), Franklin Bitcoin ETF (EZBC), Valkyrie Bitcoin ETF (BRRR), and Grayscale Bitcoin Trust (GBTC) — broke their trading volume record on Tuesday.

Many expect the price of bitcoin to skyrocket due to massive demand for BTC fueled by high interest in spot bitcoin ETFs and the upcoming Bitcoin halving. Bitwise’s CIO sees potential for BTC to surpass $200,000 this year. Skybridge Capital’s founder believes it’s still an opportune time to invest in BTC, while Galaxy Digital’s CEO highlights strong global demand for the crypto. Veteran trader Peter Brandt also raised his price target for the current bitcoin bull market to $200,000. However, JPMorgan presents a contrasting view, predicting a potential drop in BTC price to $42,000 following the halving.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!