Is Bitcoin About to be Risky? Should really You Have confidence in this Critical Indicator?

- Enjoyable insights into BTC’s on-chain metric!

- Let’s dive into the hottest technical indicators in the globe of cryptocurrency.

A short while ago, there has been a surge in Bitcoin’s [BTC] put in outputs for buyers who have held onto their coins for 1 to twelve months. This surge could suggest a opportunity value swing, as per CryptoQuant’s information.

Source: CryptoQuant

BTC’s spent outputs dependent on the duration of buyers keeping supply beneficial insights into their paying styles. For occasion, it can track if shorter-term holders are moving their cash, signaling improved revenue-having exercise.

Could BTC’s industry see volatility?

An uptick in used output for limited-phrase BTC holders often signifies higher sector volatility. A the latest report by CryptoQuant’s analyst Mignolet proposed the emergence of volatility shortly:

“The motion of this entity could be a sign of impending volatility relatively than rate fluctuations. It seems like volatility might be on the horizon.”

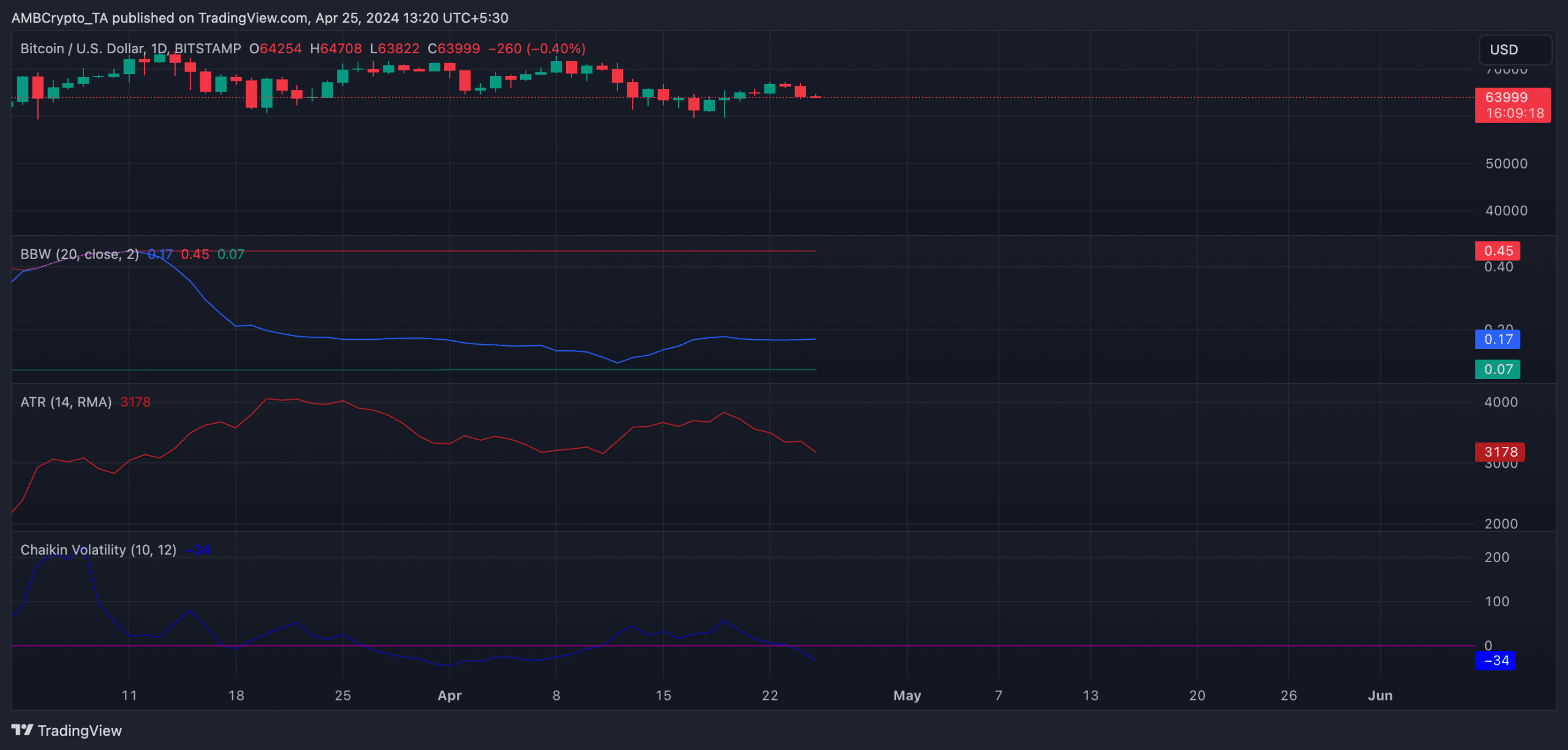

Nevertheless, an analysis of the coin’s crucial volatility markers on a every day chart showed nominal threat of important short-time period cost fluctuations.

BTC’s Ordinary Real Array (ATR) readings have been steadily decreasing considering the fact that April 19th. This indicator assesses the common price tag motion vary more than a particular time period. A drop in ATR signifies lessened market place volatility.

In addition, BTC’s Chaikin Volatility has been on a downtrend, dropping by 162% since April 19th. This indicator compares the latest cost vary to a earlier just one and a decrease implies reducing sector volatility.

On top of that, the flat Bollinger Bandwidth (BBW) for BTC supports the strategy of lower volatility in the sector.

Look at out our Bitcoin [BTC] selling price prediction for 2024-2025

A flat BBW indicates that the asset’s selling price is stable with small volatility, staying within a slender selection.

Source: BTC/USDT on TradingView

At this time, Bitcoin is trading at $64,241, exhibiting a 5% raise in worth around the previous 7 days in accordance to CoinMarketCap’s facts.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!