Retain an Eye on These Whales for Potential Bitcoin Reversal Under $64,000

<

div>

- Gloomy Outlook Proceeds for Bitcoin’s Current market

- Key Metrics and Whale Strategies Could Maintain the Crucial

Bitcoin’s [BTC] rate took a different dip beneath $64k, sparking problems of a additional drop. Even though numerous elements are at play, new steps by whales could be influencing the downward trend.

Whales in the Bitcoin Current market

In the earlier 24 several hours, market place bears managed the scene as BTC’s price dipped. In accordance to CoinMarketCap, BTC was down by around 2% at the time of composing, trading at $63,042 with a sector capitalization over $1.24 trillion.

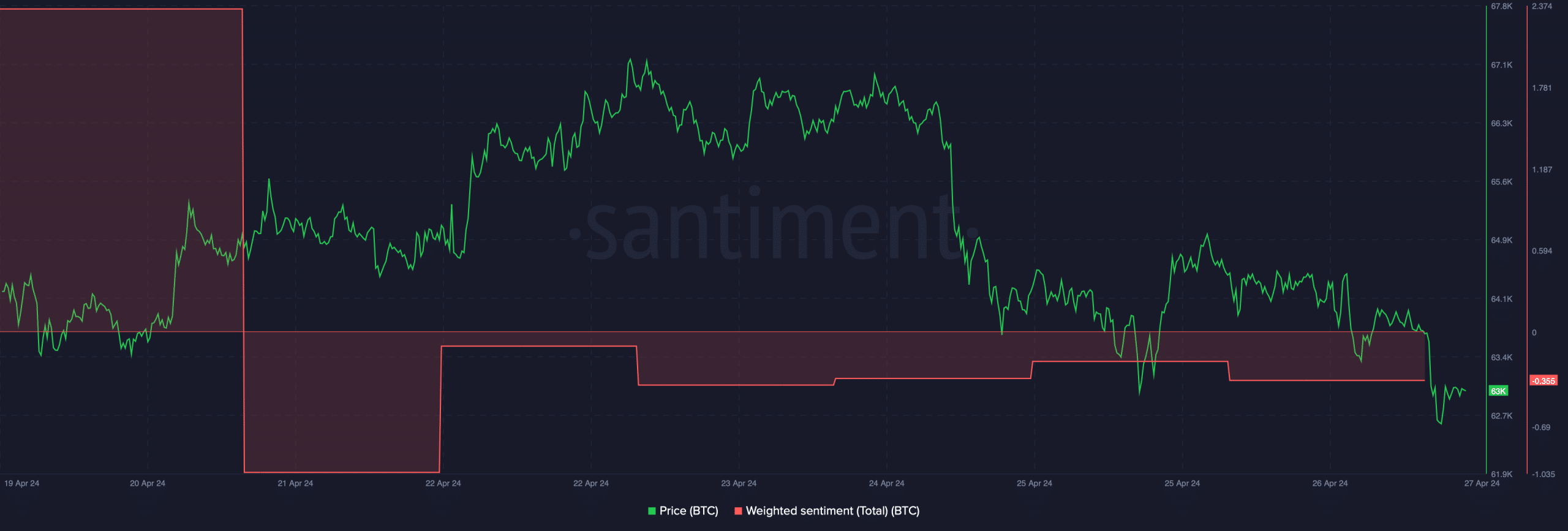

This drop also impacted the electronic asset’s social indicators. Santiment’s data analyzed by AMBCrypto disclosed that BTC’s weighted sentiment turned detrimental, indicating prevailing bearish sentiment in the marketplace.

Resource: Santiment

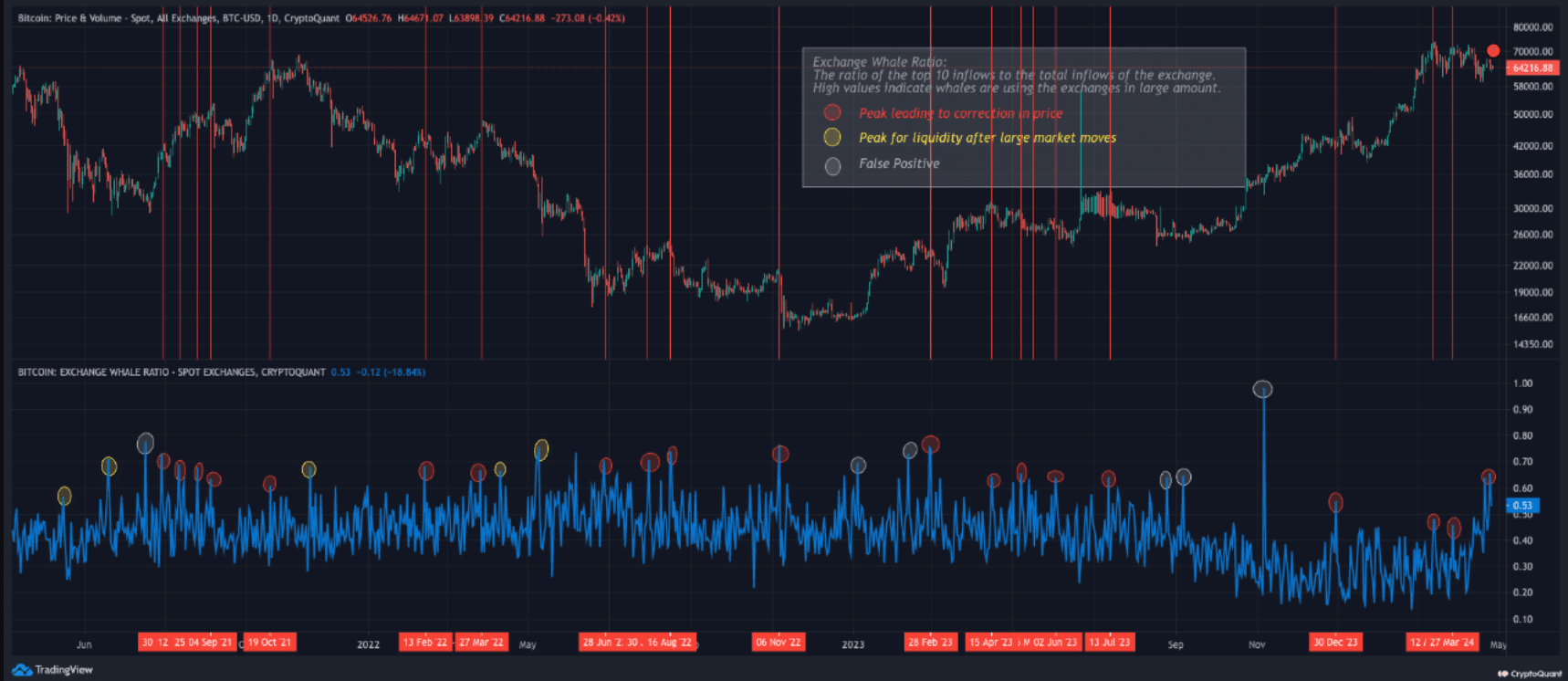

What’s more, CryptoQuant’s writer Phi Deltalytics highlighted a major increase in whale Bitcoin exchange inflows, most likely contributing to the current price tag fall.

This raise in whale action signaled considerable earnings-having in the course of the ongoing Bitcoin bull run. Historically, a surge in this metric usually preceded rate corrections, hinting at possible further more declines.

Supply: CryptoQuant

Additional Price Decline Ahead?

With BTC showing bearish alerts, AMBCrypto analyzed the information to forecast attainable long term developments. Based mostly on CryptoQuant’s insights, U.S and Korean traders exhibited weak purchasing sentiment, mirrored in purple Coinbase and Korea Premiums for Bitcoin.

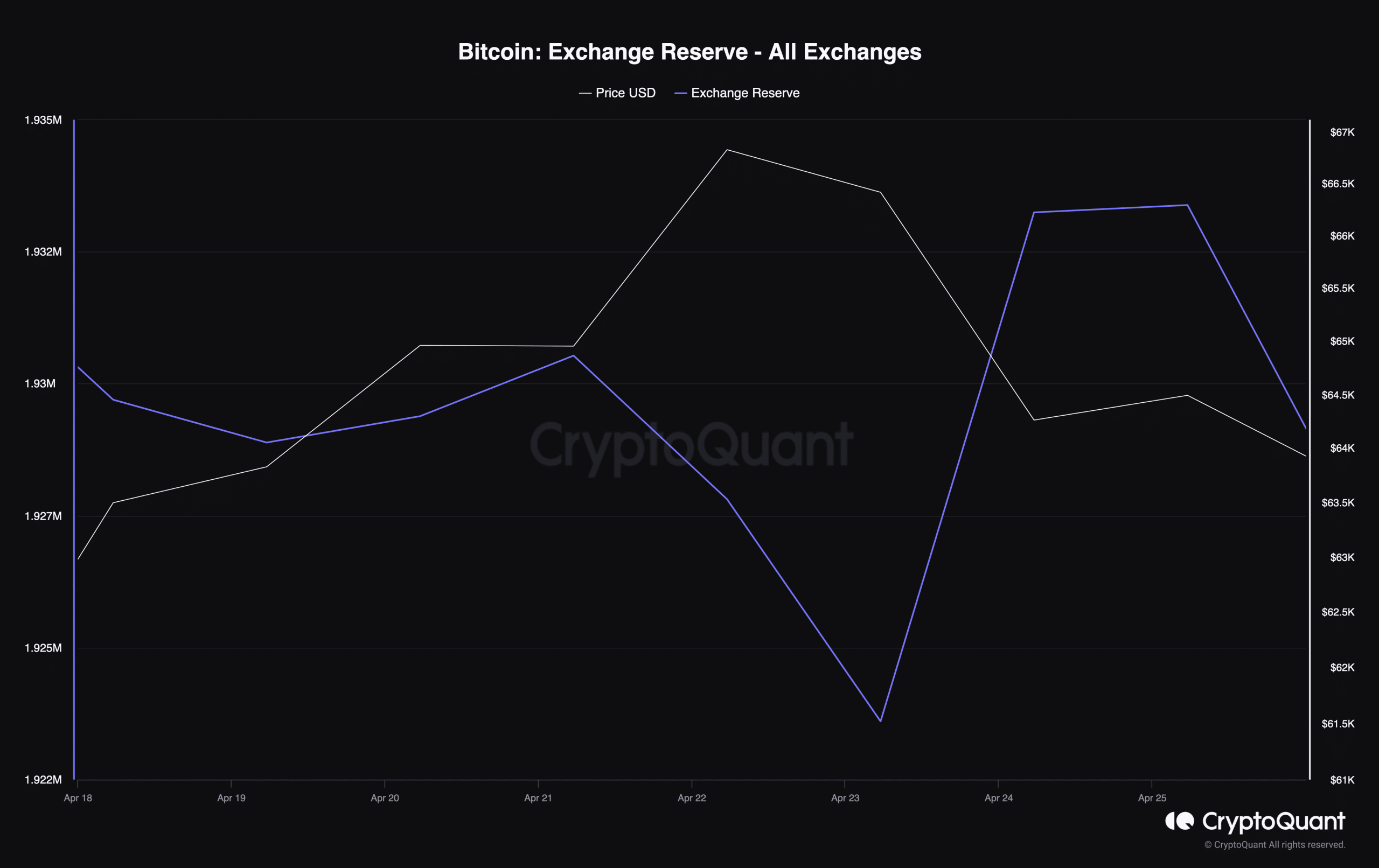

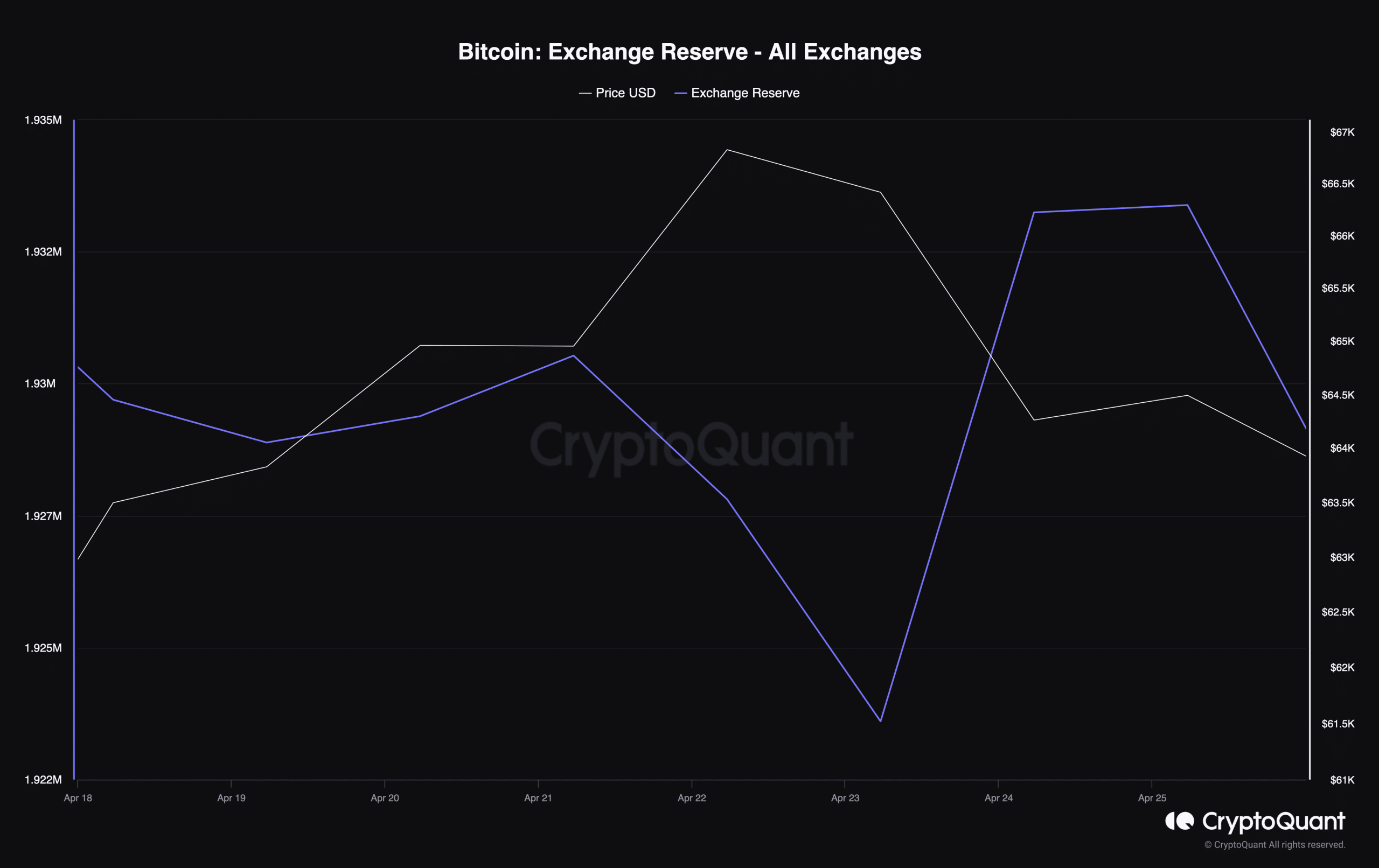

The optimistic news will come from the declining BTC exchange reserves submit a spike on April 24, suggesting diminished offering pressure on the king of cryptocurrencies.

Source: CryptoQuant

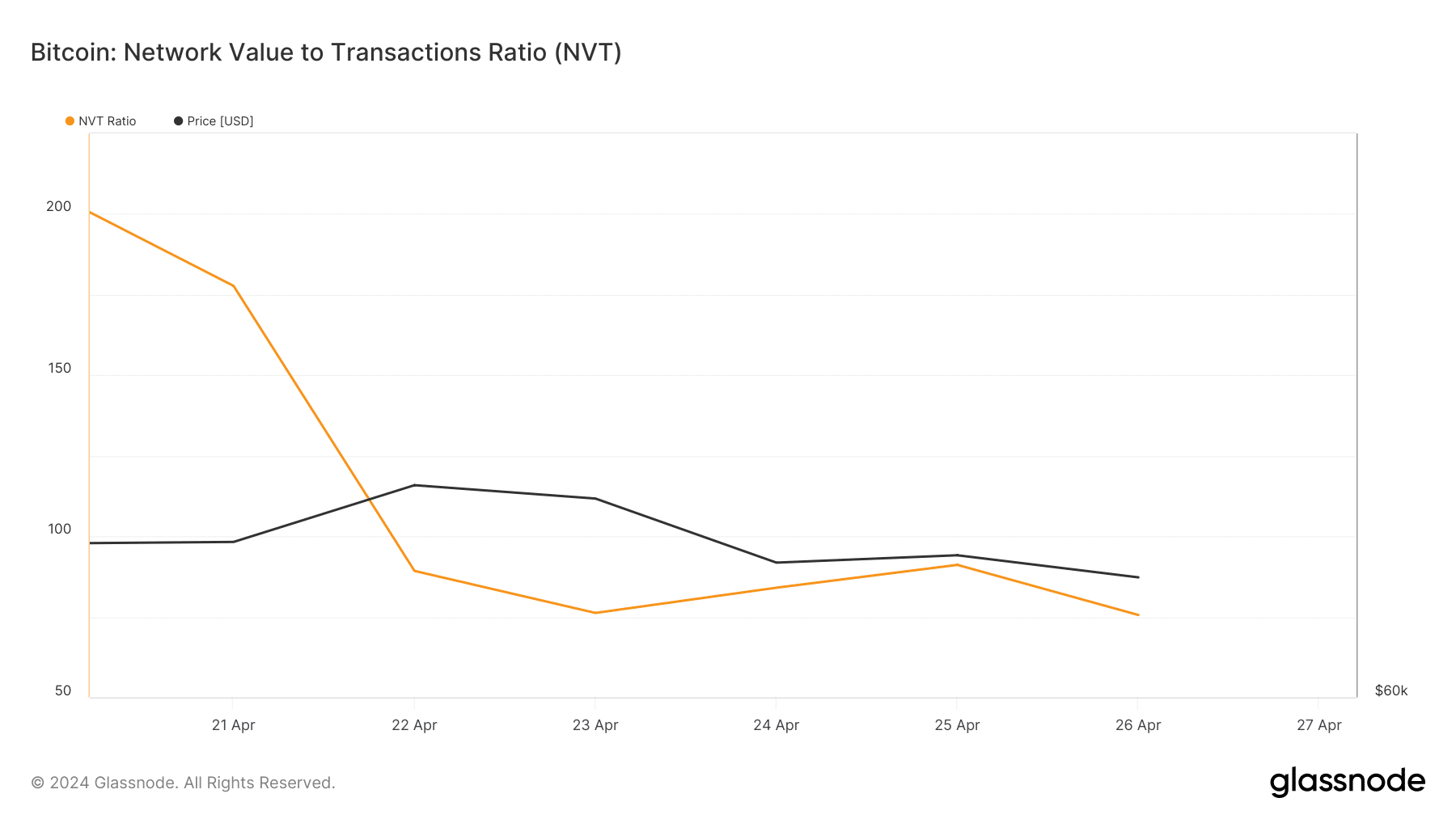

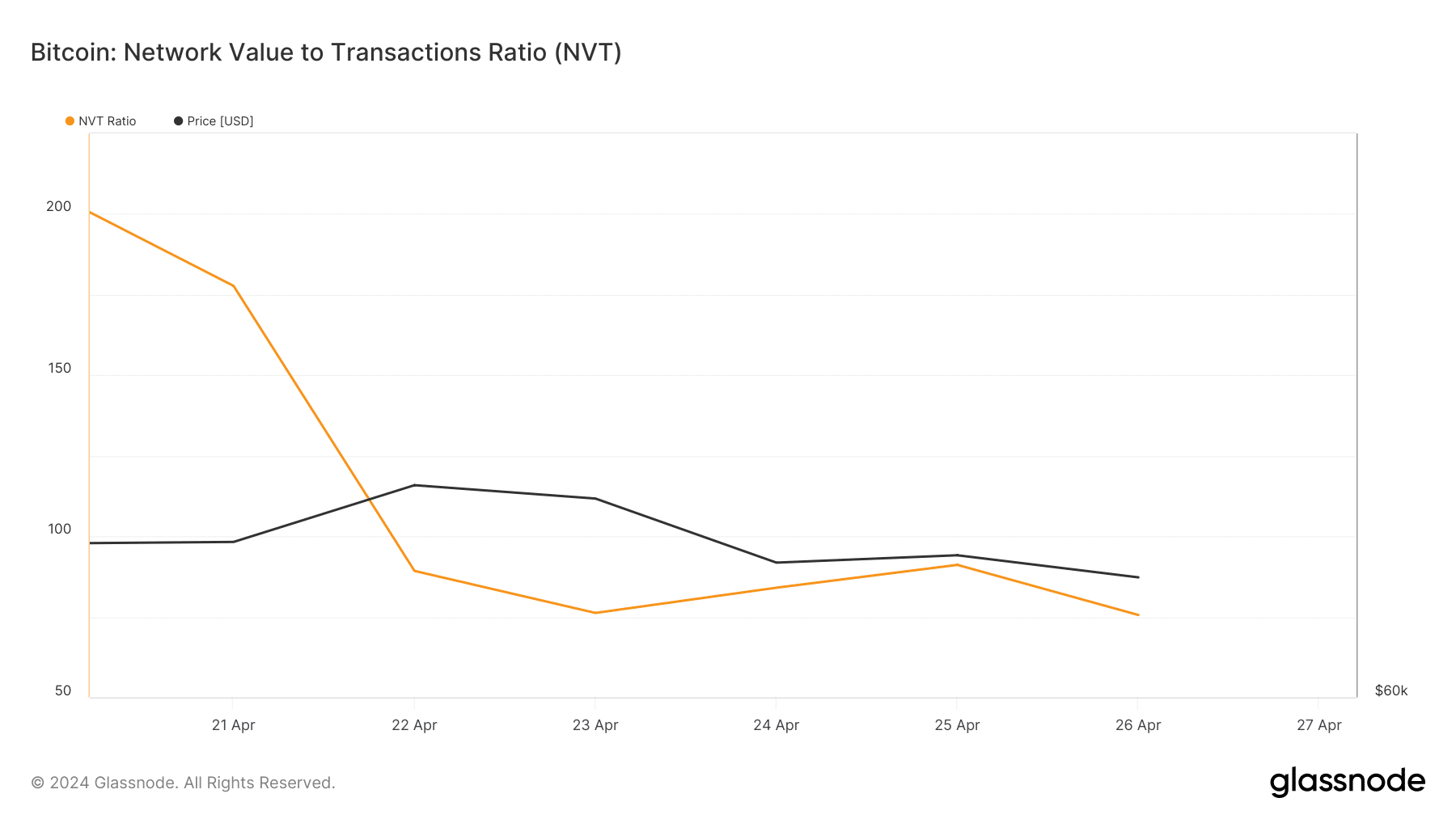

Additional delving into Glassnode’s info, AMBCrypto discovered a constructive indicator.

The Network To Worth (NVT) ratio for BTC noticed a notable reduce. This ratio is calculated by dividing market cap by the on-chain volume in USD.

Resource: Glassnode

When this ratio drops, it frequently suggests an undervalued asset. In this occasion, it advised a opportunity increase in BTC’s rate.

Just lately, a nicely-trained AI design predicted a Bitcoin selling price of $77K within the upcoming 30 days, as noted by AMBCrypto.

Test out the Bitcoin [BTC] Rate Prediction for 2024 -2025

AMBCrypto then looked into Bitcoin’s everyday chart to gauge likely current market movements. BTC’s Money Movement Index (MFI) showed an upward trend, whilst the Chaikin Funds Move (CMF) continued to keep previously mentioned the neutral level. Nevertheless, the Relative Power Index (RSI) painted a bearish picture by heading downward.

<div id=”attachment_387577″ style=”width: 2570px” class=”wp-caption align

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!