Bitcoin spot ETFs did not change out to be the predicted catalyst in 2024.

- Fascinating News: Changes in Bitcoin ETF Outflows Shake Up Market Dynamics

- Beneficial Vibes: Bitcoin Current market Remains Resilient Amidst ETF Outflow Fluctuations

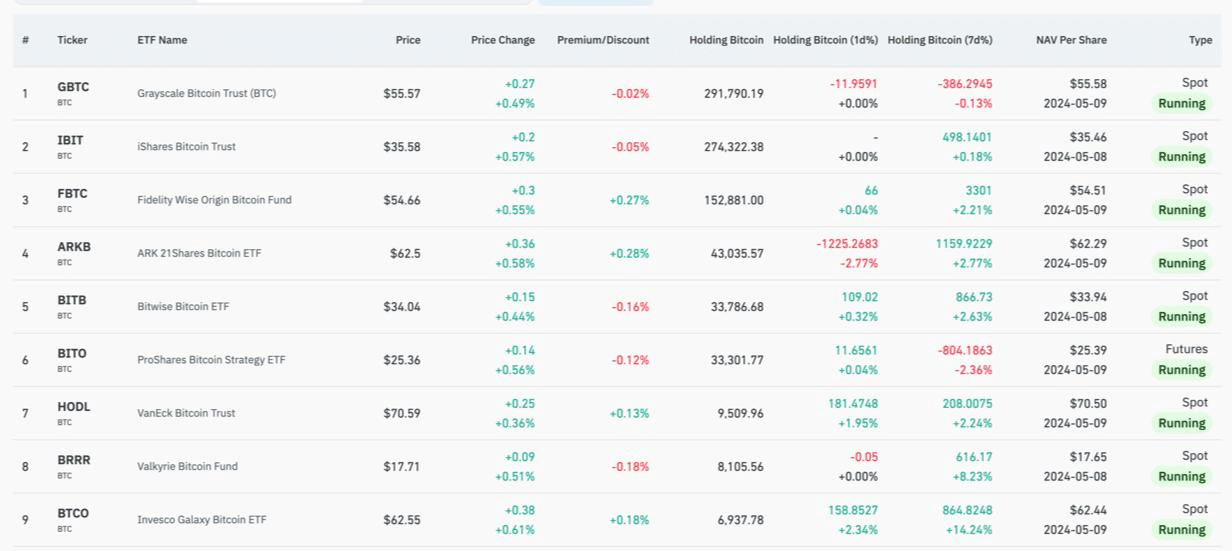

Let’s dive into the the latest developments in the U.S. location Bitcoin ETF landscape, where by sudden outflows have stirred up the marketplace. Yesterday, Grayscale’s Bitcoin ETF experienced a considerable $11.3 million outflow, sparking a series of variations throughout numerous items.

Shifting Trader Sentiments

Modern info from Coinglass highlighted the tumultuous journey of Grayscale’s GBTC, which witnessed a $43.4 million outflow. Irrespective of this setback, the fund professional a shocking influx of $60 million last Friday, showcasing its enduring market enchantment.

On the flip aspect, BlackRock’s IBIT Bitcoin ETF observed a considerable improve of $14.2 million, indicating increasing investor self-assurance. Fidelity’s Wise Bitcoin ETF also gained a raise of $2.7 million.

Bitwise’s BITB ETF captivated $6.8 million and stole the spotlight with $11.5 million in inflows on Thursday. Ark 21shares (ARKB) ETF also garnered a wave of guidance with $4.4 million. WisdomTree’s BTCO and Franklin Templeton’s EZBC Bitcoin ETFs professional a lot more modest gains of $2.2 million and $1.8 million, respectively.

Supply: Coinglass

Specific ETFs from Hashdex, VanEck, Valkyrie, and Invesco Galaxy professional no new flows, indicating a lukewarm reception from institutional buyers.

Given that their establishment, these money have collectively captivated $12.1 billion, with big gamers like BlackRock’s iShares and Fidelity major the pack. Inspite of identical returns all over 28%, trader responses have various considerably.

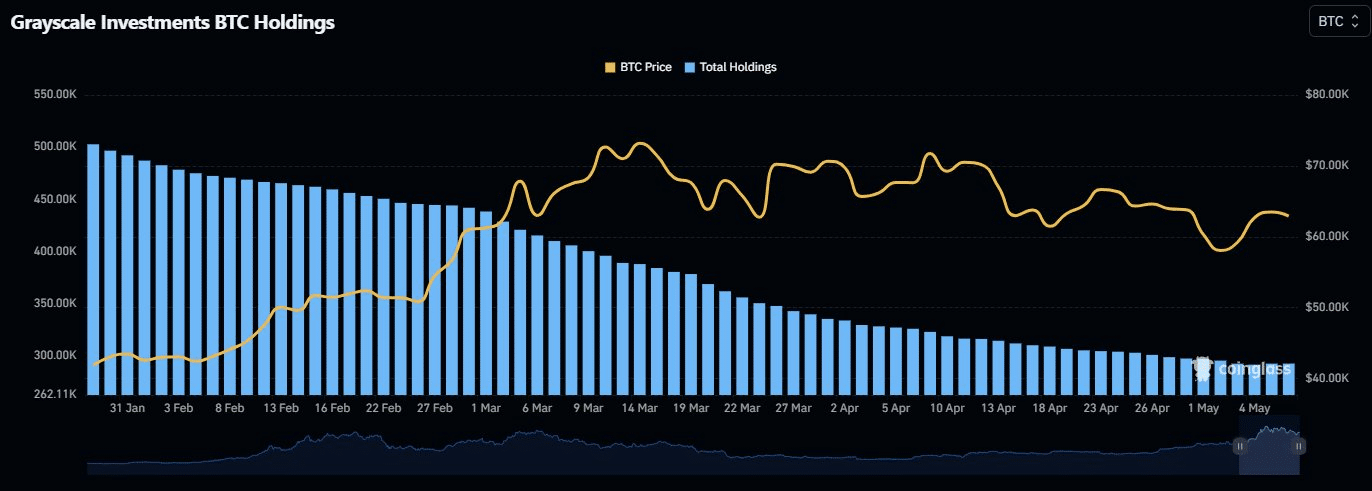

The standout underperformer? Grayscale. With a important $17.2 billion withdrawal considering that its inception, the fund’s higher expenses continue on to be a deterrent in contrast to competitors with reduce price ratios.

In addition, Coinglass reporte

Resource: Coinglass

Even with the problems in the crypto ETF place, Bitcoin continues to be resilient. At present buying and selling higher than $63,000 and savoring a 4% raise in the last 24 hrs, Bitcoin continues to appeal to bullish sentiment among the group customers, standing at 78%, as for each CoinGecko facts.

Put up the Bitcoin halving, the prime ten cryptocurrencies have skilled a predominantly bullish trend, motivated by investor sentiments and trading activity.

With sector uncertainties looming, the departure of smaller sized buyers may possibly pave the way for a prospective resurgence in Bitcoin and other cryptocurrencies as the summer time unfolds, hinting at a clean start out in the ever-evolving crypto market place cycles.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!