Bitcoin experiences surge in value as exchange withdrawals decrease: Are more gains ahead for BTC?

- Although BTC has experienced a significant price increase, withdrawals from exchanges have been relatively low.

- Bitcoin‘s ecosystem activity has shown a decrease.

Wow! Bitcoin [BTC] has been on a wild ride with its price shooting up unexpectedly in recent days, bringing a wave of excitement to traders and holders alike. It’s no wonder that addresses are holding onto their precious BTC in the midst of this positive surge.

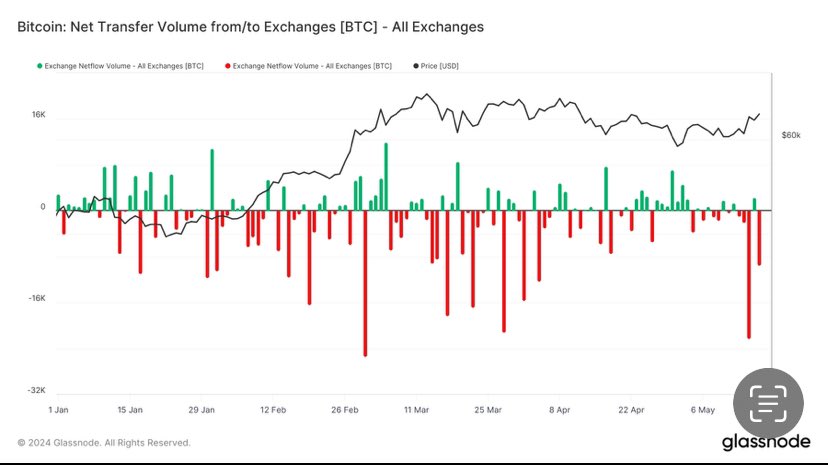

Decrease in Withdrawals

Yesterday, there was a slight withdrawal of Bitcoin as 10,000 BTC were moved out of exchange wallets, amounting to approximately $630 million. This uptick in Bitcoin demand hints at a potential comeback in the cryptocurrency market.

The consistent demand for Bitcoin hasn’t been this strong since late 2020, signaling a significant change in investor sentiment.

Source: X

As of now, BTC is trading at $67,049.74, showing a slight decrease of 0.74% in the last 24 hours. Most BTC holders are in profit, with BTC edging closer to its all-time high by just $6,000.

The trading velocity of BTC has also slowed down, reflecting a decrease in trading frequency.

While this might seem negative, the reduced velocity indicates that many addresses are choosing to keep hold of their Bitcoin and not sell.

In addition, the number of BTC holders has surged, showing that a significant number of addresses have amassed substantial amounts of the cryptocurrency.

In contrast to the increasing number of holders, miner holdings have experienced a decline, according to AMBCrypto’s analysis of Santiment’s data.

This shift could potentially benefit BTC in the long term. If miners struggle to generate high fees, they may need to sell their holdings to sustain their operations, putting downward pressure on BTC.

A decrease in BTC supply held by miners suggests that this segment of holders will have less influence on BTC’s price moving forward.

Source: Santiment

Curious to see if your portfolio is in the green? Try out the BTC Profit Calculator!

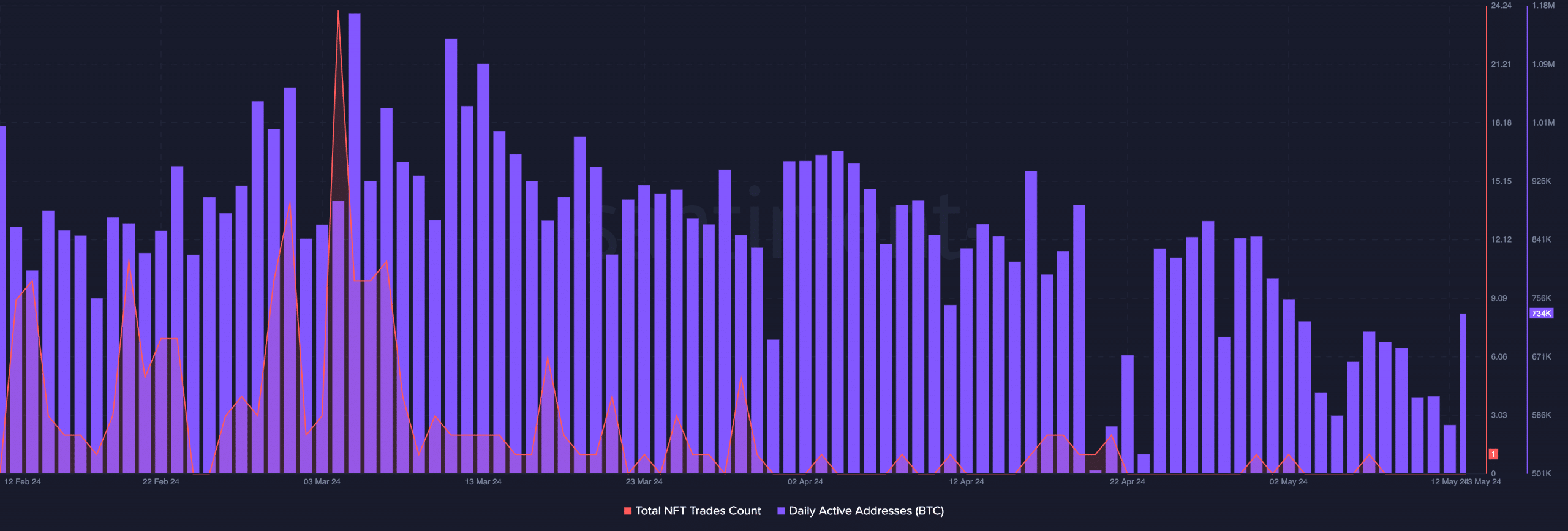

Decrease in Activity

One of the reasons leading to a decrease in miner fees is the lack of network activity. The daily active addresses on the Bitcoin network have been dwindling in recent weeks.

Moreover, the trading volume of NFTs on the Bitcoin network has also seen a decline, indicating a diminishing interest in Bitcoin’s ecosystem.

Source: Santiment

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!