Bitcoin set to surge as Japanese Yen reaches historic lower

- Get completely ready for an thrilling boost in Bitcoin as the Yen weakens!

- Bitcoin will make gains in spite of a bearish outlook, hitting $62K and aiming for $64K.

Just a thirty day period back, Arthur Hayes, the brain guiding BitMEX exchange, was brimming with hope owing to the slipping Japanese Yen (JPY). He observed it as an chance to infuse liquidity into the market place and amp up Bitcoin [BTC] and the broader crypto house.

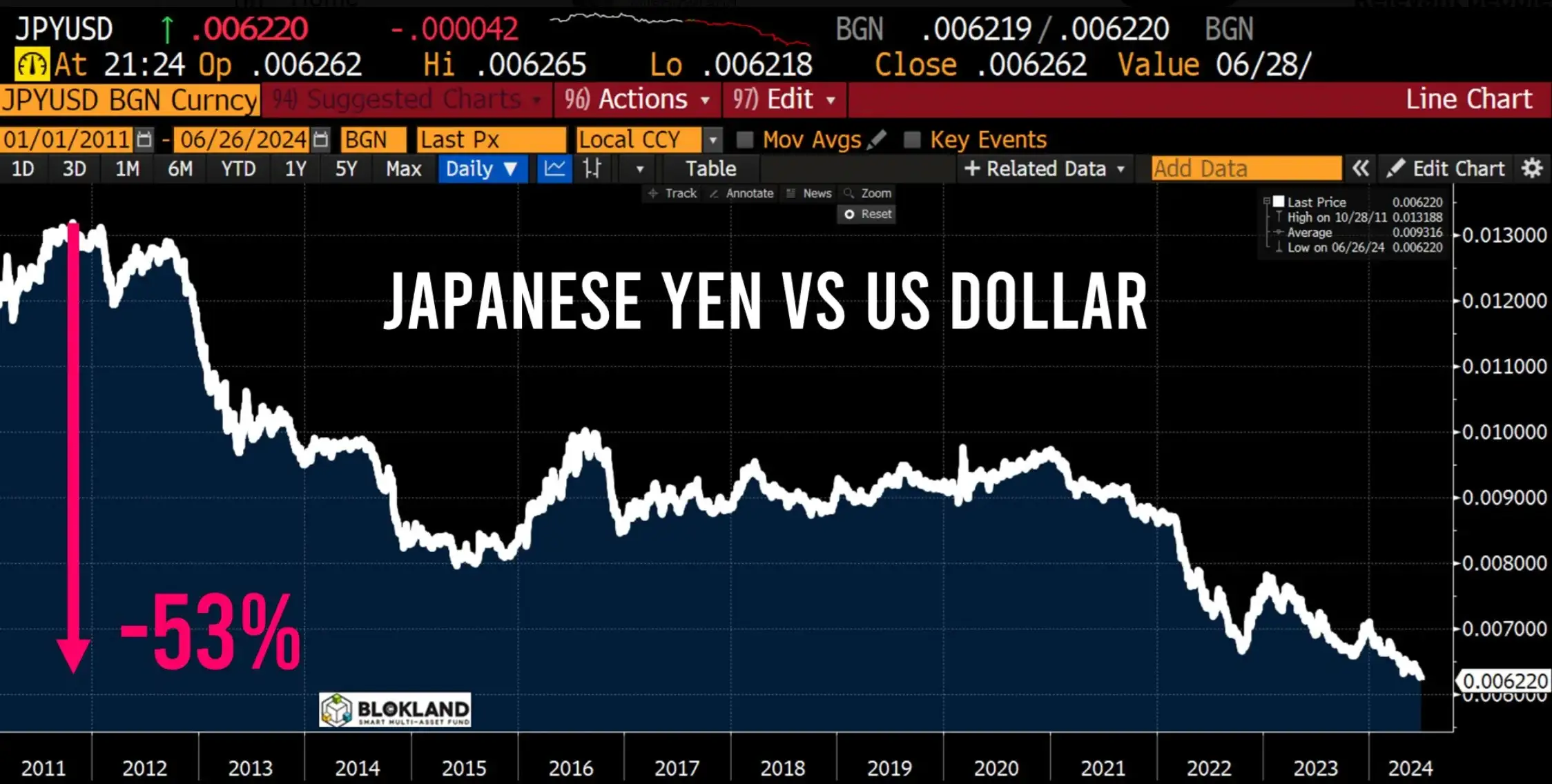

Japanese Yen hits all-time small versus the USD

Now, on 26th June, the JPY strike rock bottom from the U.S. greenback, plummeting to its least expensive degree in nearly four many years. This fast fall sparked chat of possible interventions by financial authorities.

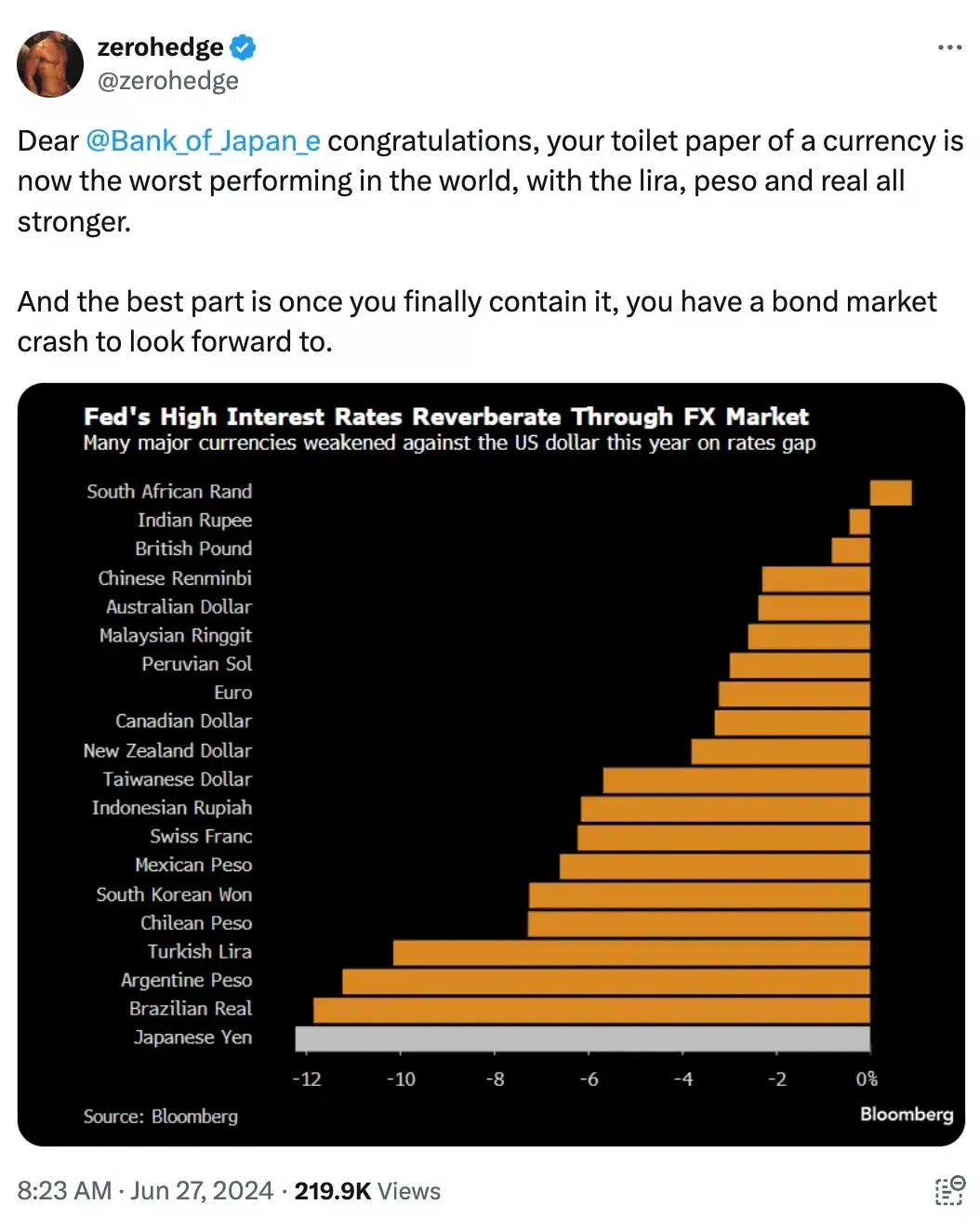

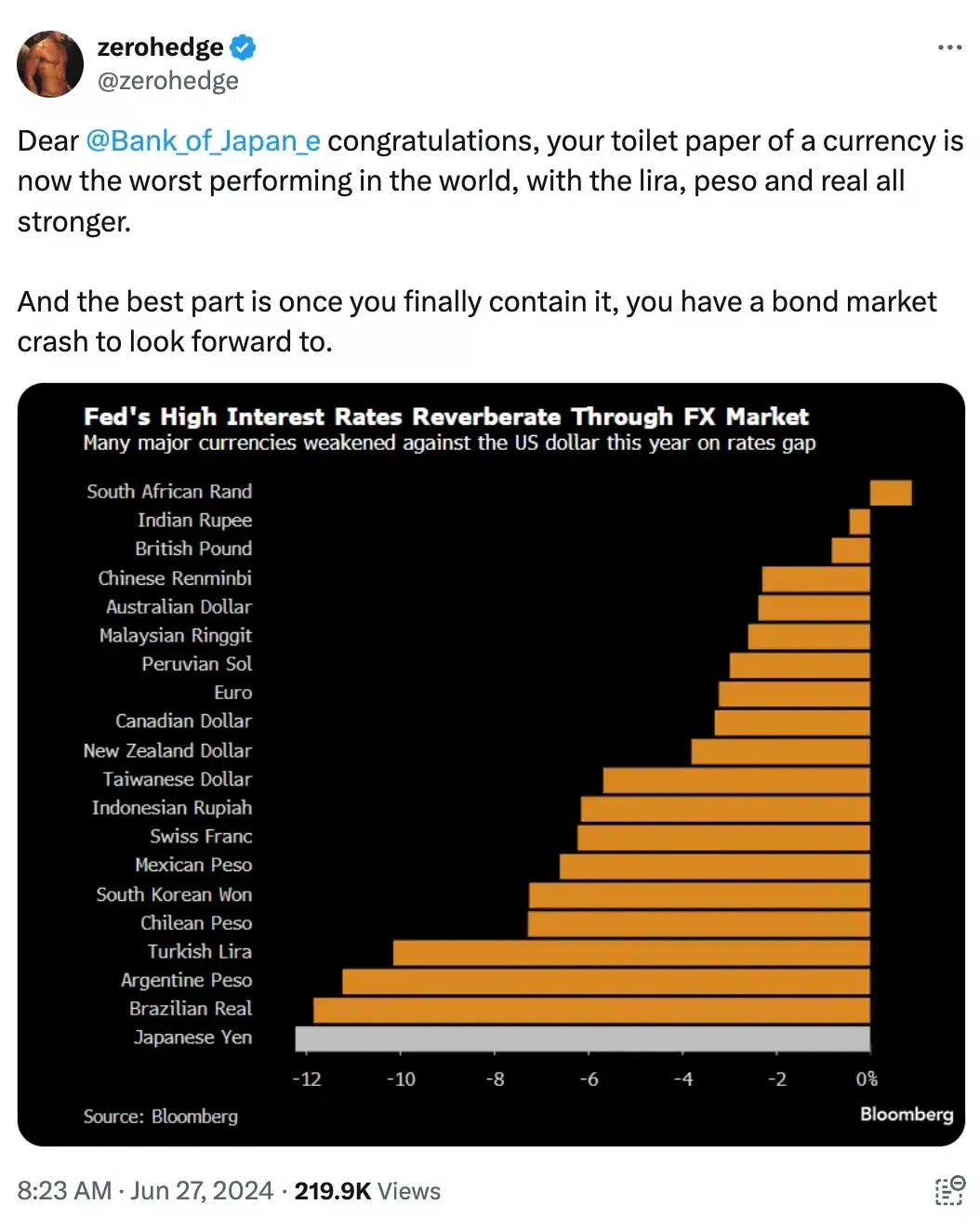

Specialists attribute this to the Federal Reserve’s option to sustain superior-desire premiums, earning the JPY 1 of the poorest-undertaking currencies globally.

Unveiling insights on the subject and echoing Hayes’ sentiments, The Bitcoin Therapist experienced this to say,

“Could Japan be secretly acquiring #bitcoin with printed Yen? If so, it’d be a genius shift in their record. If not, they might head toward 3rd-globe position soon.”

Stats from FactSet show the Yen slumping to 160.82 as opposed to the dollar, surpassing the prior document of 160.03 from April 29th and hitting its weakest point because 1986.

Including to this details, Jeroen Blokland, Founder & supervisor of the Blokland Intelligent Multi-Asset Fund, highlighted,

“In the last 12.5 a long time, the Japanese #Yen has missing a staggering 53% of its benefit against the US Dollar!”

Supply: Jeroen Blokland/X

The economic neighborhood stirred as converse of the weak Yen spread, as observed by ZeroHedge, who humorously remarked,

Supply: zerohedge/X

Remarkable Times for Bitcoin Forward!

Even with the Yen on a downward spiral, Hayes predicts greater competition in currency maneuvers in between significant economies like Japan and China. This could signify far more currency devaluations and a surge in liquidity injections (money printing).

As Bitcoin is thought of a hedge from fiat currency devaluation, it could prosper in this economic landscape.

Hayes foresees that Bitcoin would thrive less than these disorders, positioning it as a strong asset amidst the turbulence in world fiat currencies.

In his phrases,

“Cryptos prosper with greater dollar and yuan liquidity in the procedure.”

When the Yen confronted worries, Bitcoin observed a increase of .56%, hitting $62,130.05 in investing price.

But, inspite of this, the Relative Toughness Index (RSI) under the neutral mark indicators bearish sentiment. If Bitcoin breaks above $64,817 resistance, it could herald a transfer towards a bullish stage.

Resource: TradingView

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!