Bitcoin miners start out selling off: Is yet another crash imminent?

- As cryptocurrencies face problems, Bitcoin miners may decide to market their belongings to offset declining revenues.

- These kinds of a transfer could have considerable repercussions on the electronic currency market place.

Irrespective of a slight dip of 2.3% in the earlier working day, Bitcoin [BTC] continues to be important, trading previously mentioned $60,000.

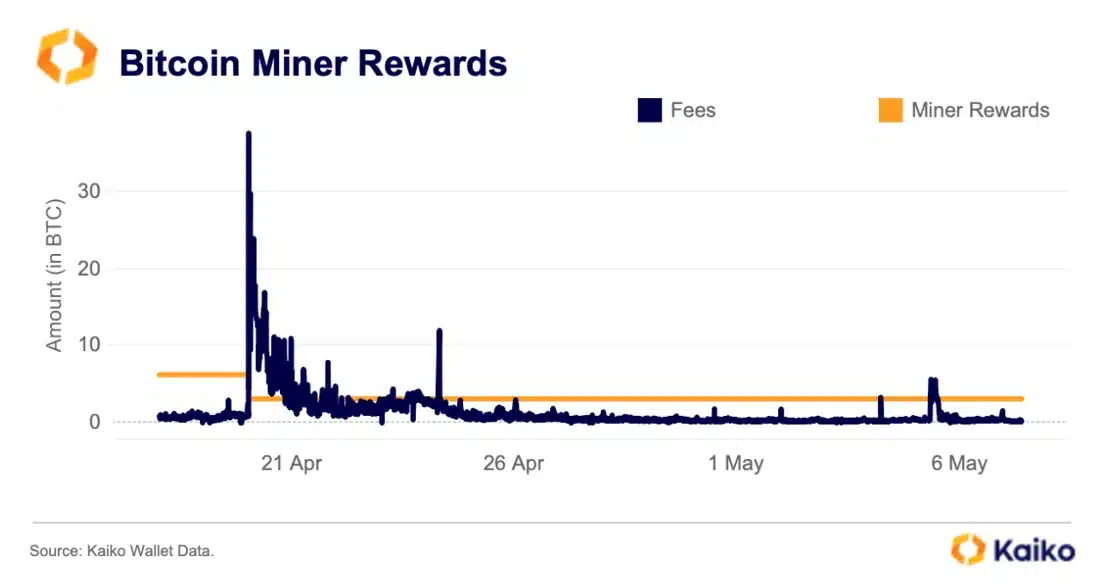

Even though BTC holds its floor, miners are sensation the pinch next a recent reduction in benefits post-halving, in accordance to facts from Kaiko.

Miners below mounting strain

Diminished mining benefits and slipping transaction service fees have put Bitcoin miners in a limited place.

The new halving function, chopping mining benefits to 3.125 BTC, has considerably impacted their earnings.

With transaction fees also dropping publish-halving, miners are observing reduced total returns on their investments.

Source: Kaiko

Kaiko’s study implies that miners are facing diminished returns from both of those mining rewards and transaction expenses.

This economical pressure is prompting miners to contemplate promoting off their BTC to deal with operational expenditures, as highlighted by Kaiko analysts.

“Miners usually handle their BTC as existing assets, as they generally require to liquidate to meet prices.”

Source: Kaiko

The looming risk of a miner-bought Bitcoin dump could have considerably-reaching outcomes for the cryptocurrency industry, provided its existing minimal liquidity.

Really should important mining entities like Marathon Digital choose to liquidate even a small chunk of their vast Bitcoin holdings, it could bring about substantial current market fluctuations.

This is highlighted in Kaiko’s report.

“Bitcoin miners generally classify their BTC holdings as existing belongings due to their potential to liquidate these holdings to fund functioning expenses.”

With sector giants owning huge quantities of Bitcoin, any enforced selling could have a noteworthy effect on the marketplace.

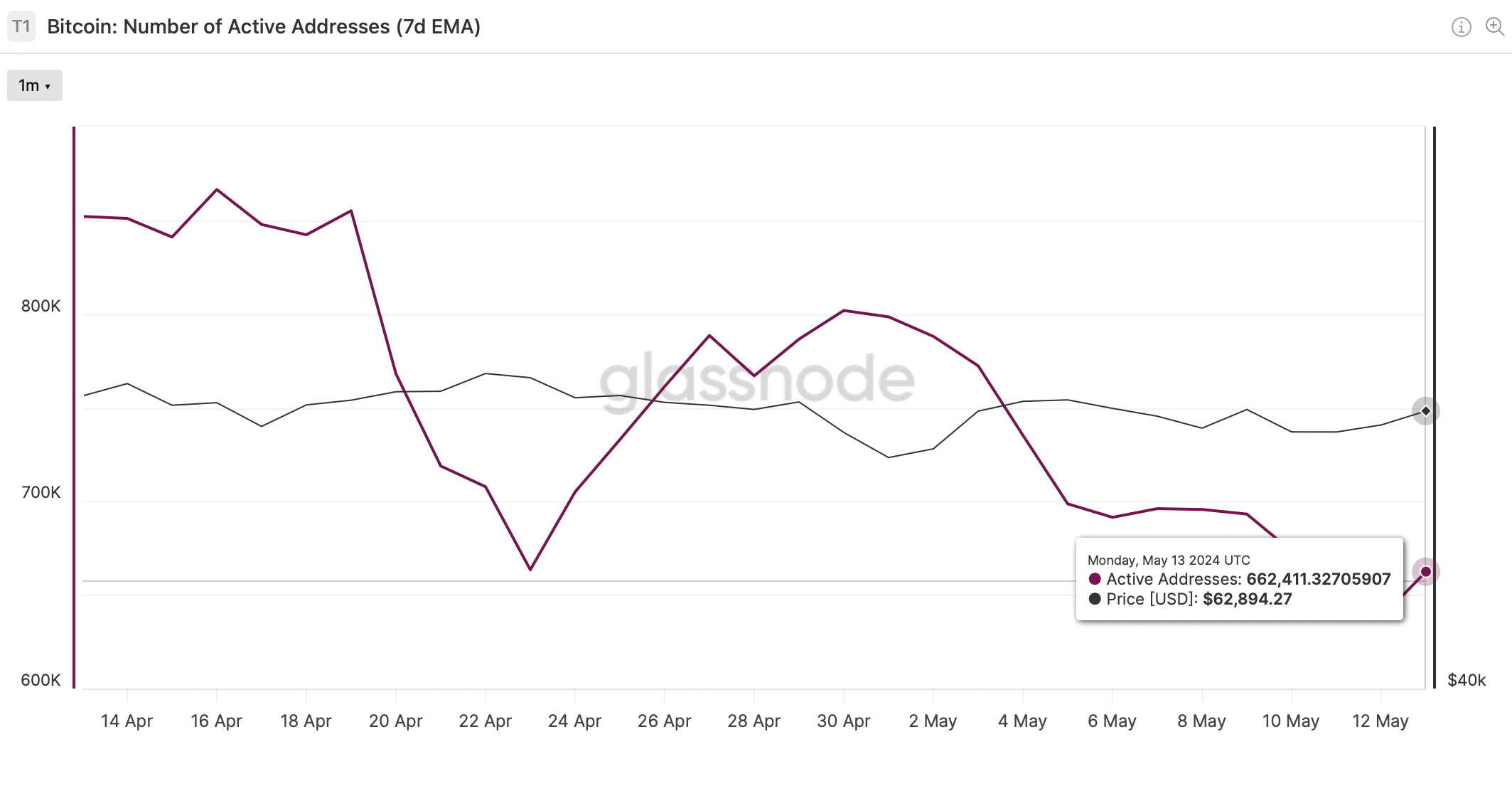

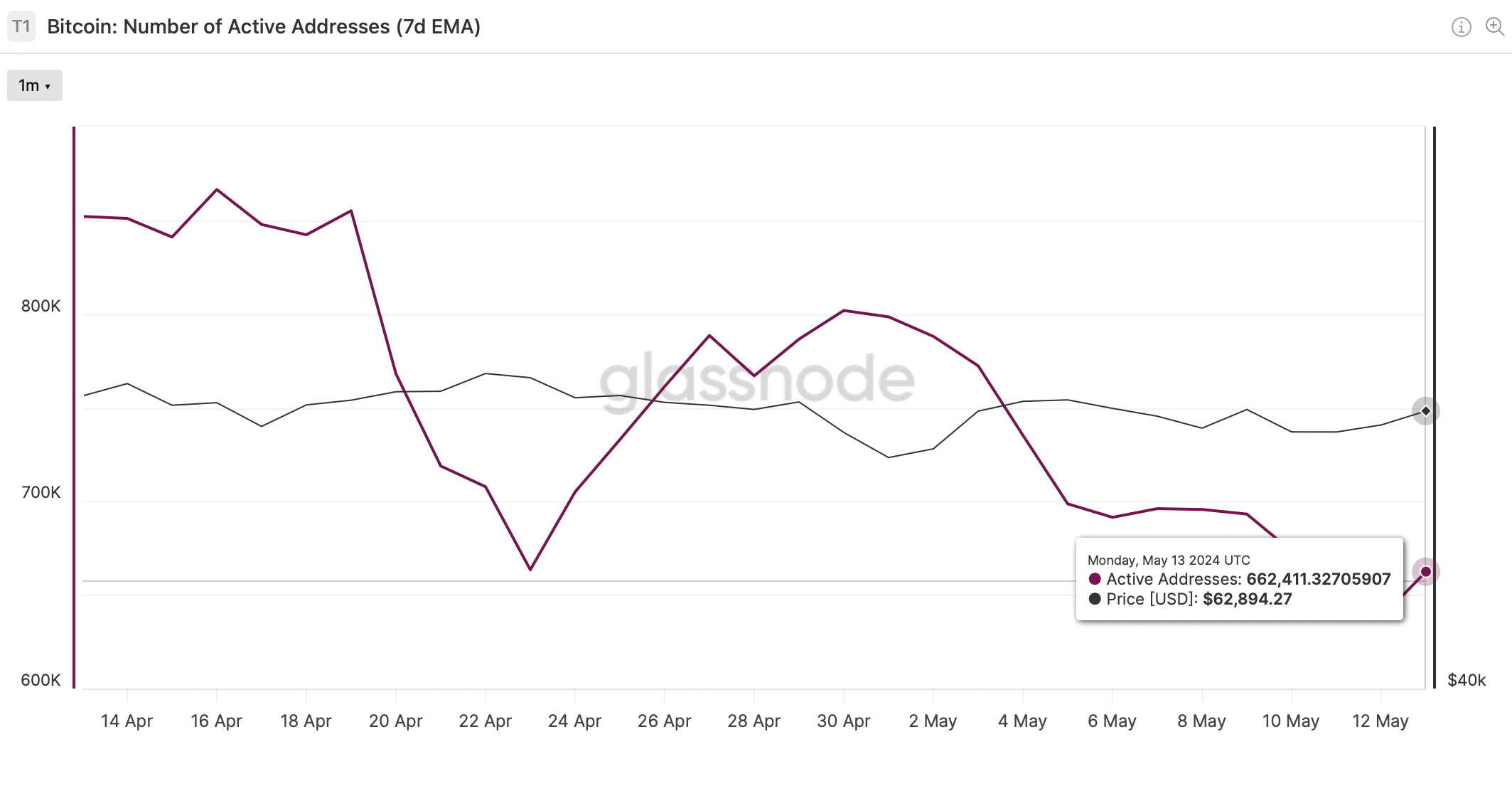

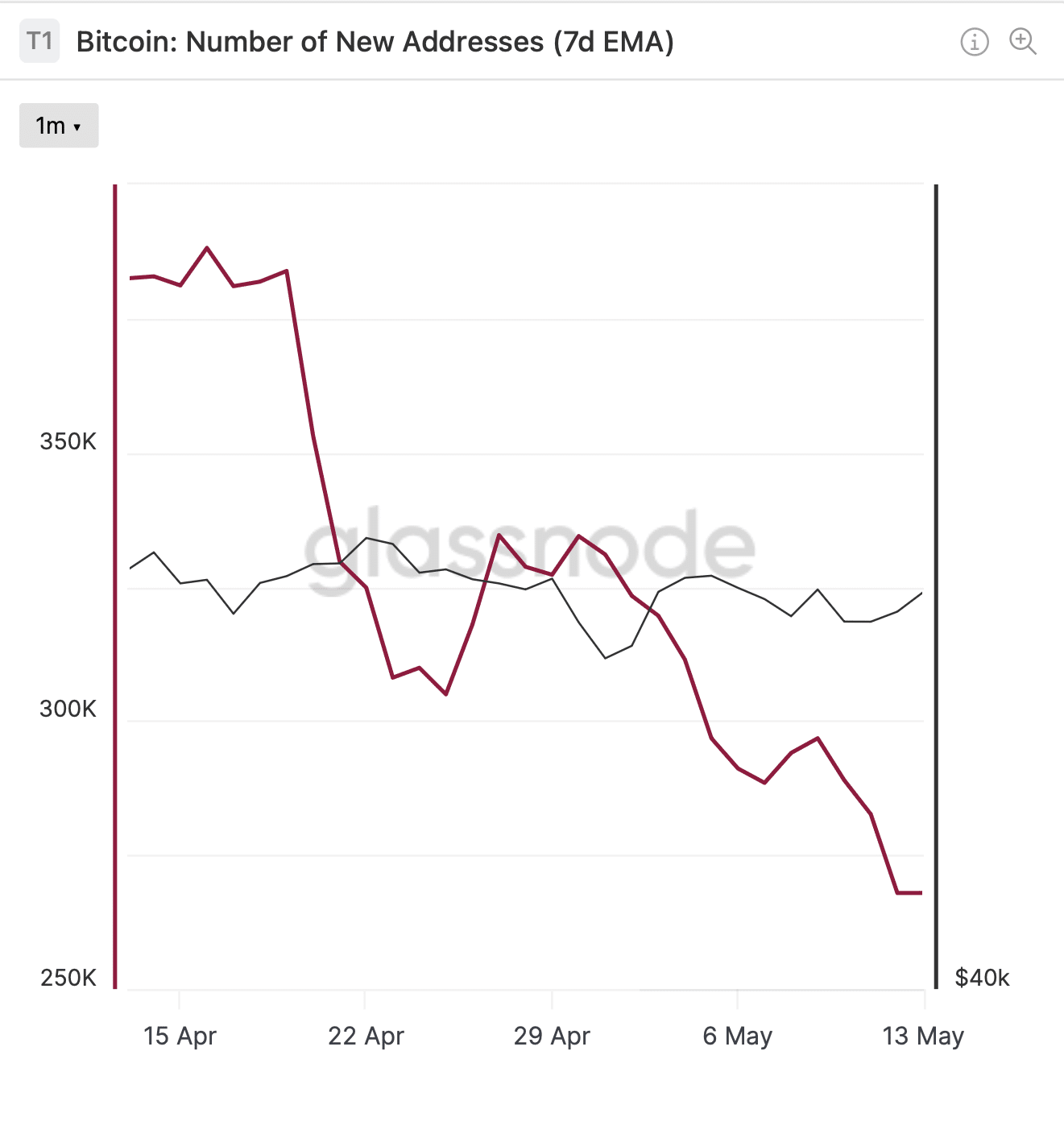

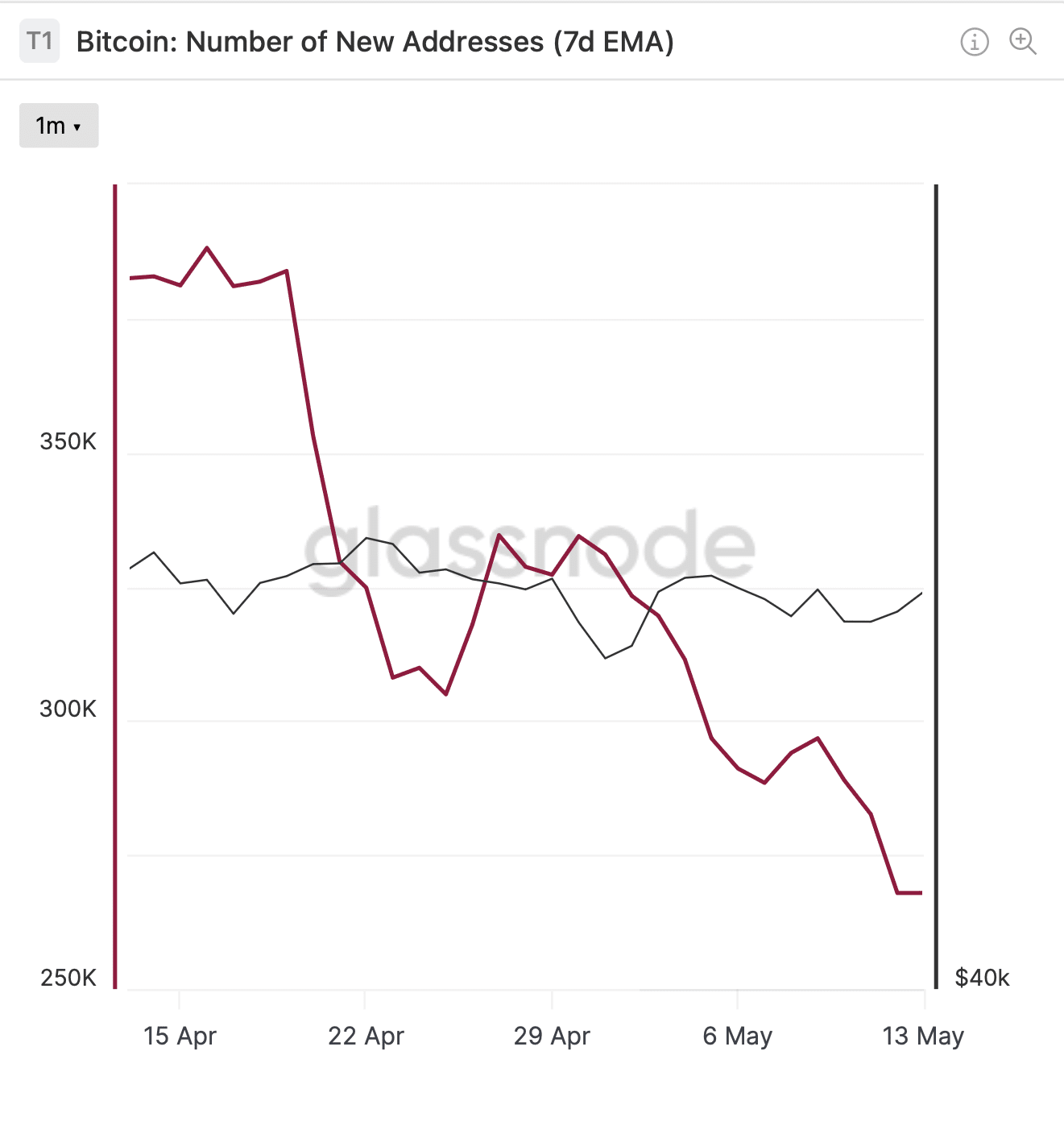

Decrease in Bitcoin community exercise

On the flip facet, the Bitcoin network’s exercise appears to be slowing down.

Glassnode’s information signifies a fall in the variety of energetic Bitcoin addresses (7d EMA) from over 800,000 to under 700,000 recently.

Supply: Glassnode

Additionally, the number of new addresses (7d EMA) has dropped from around 388,158 to 267,925, signaling a probable lower in user involvement.

Resource: Glassnode

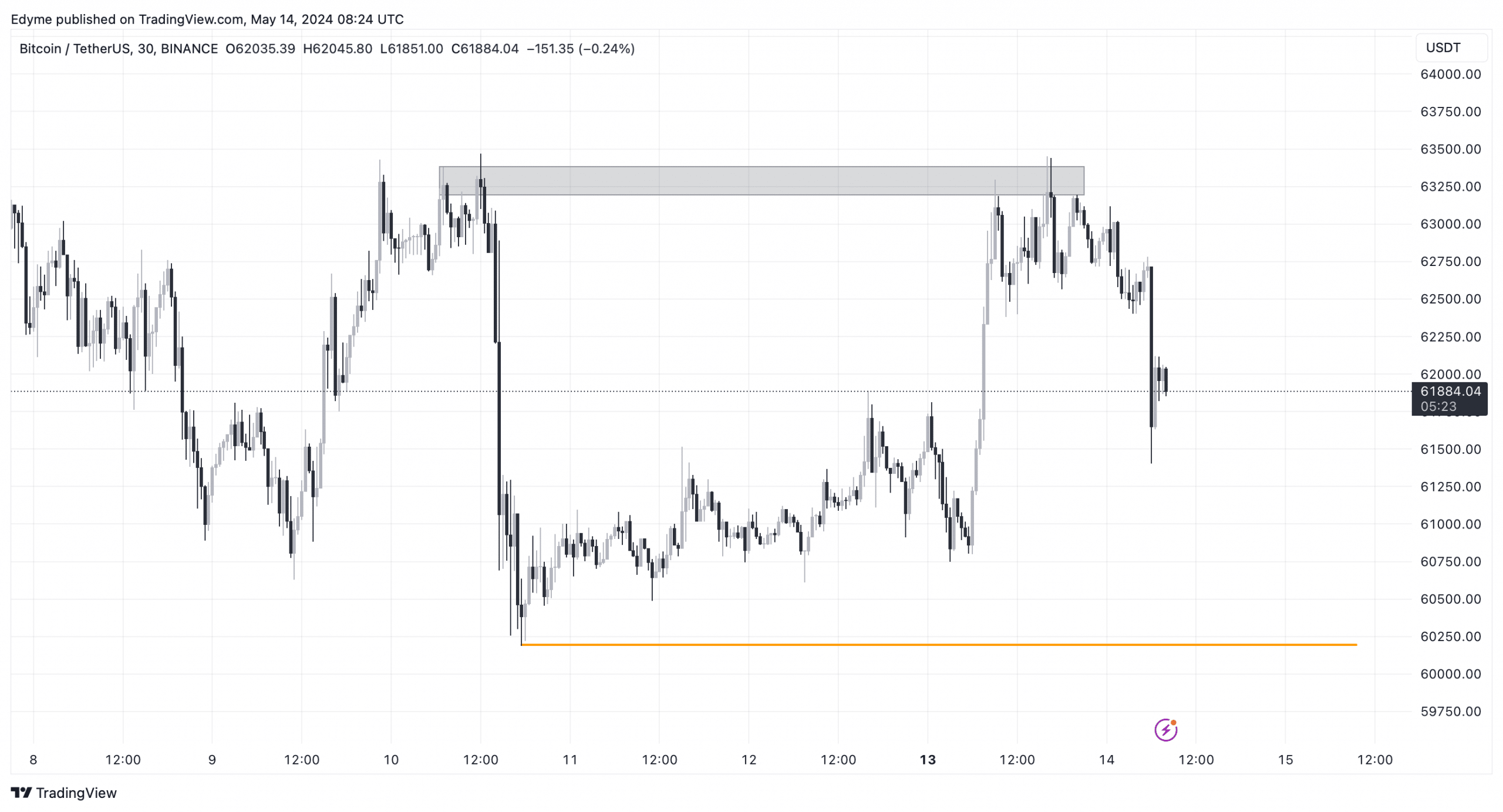

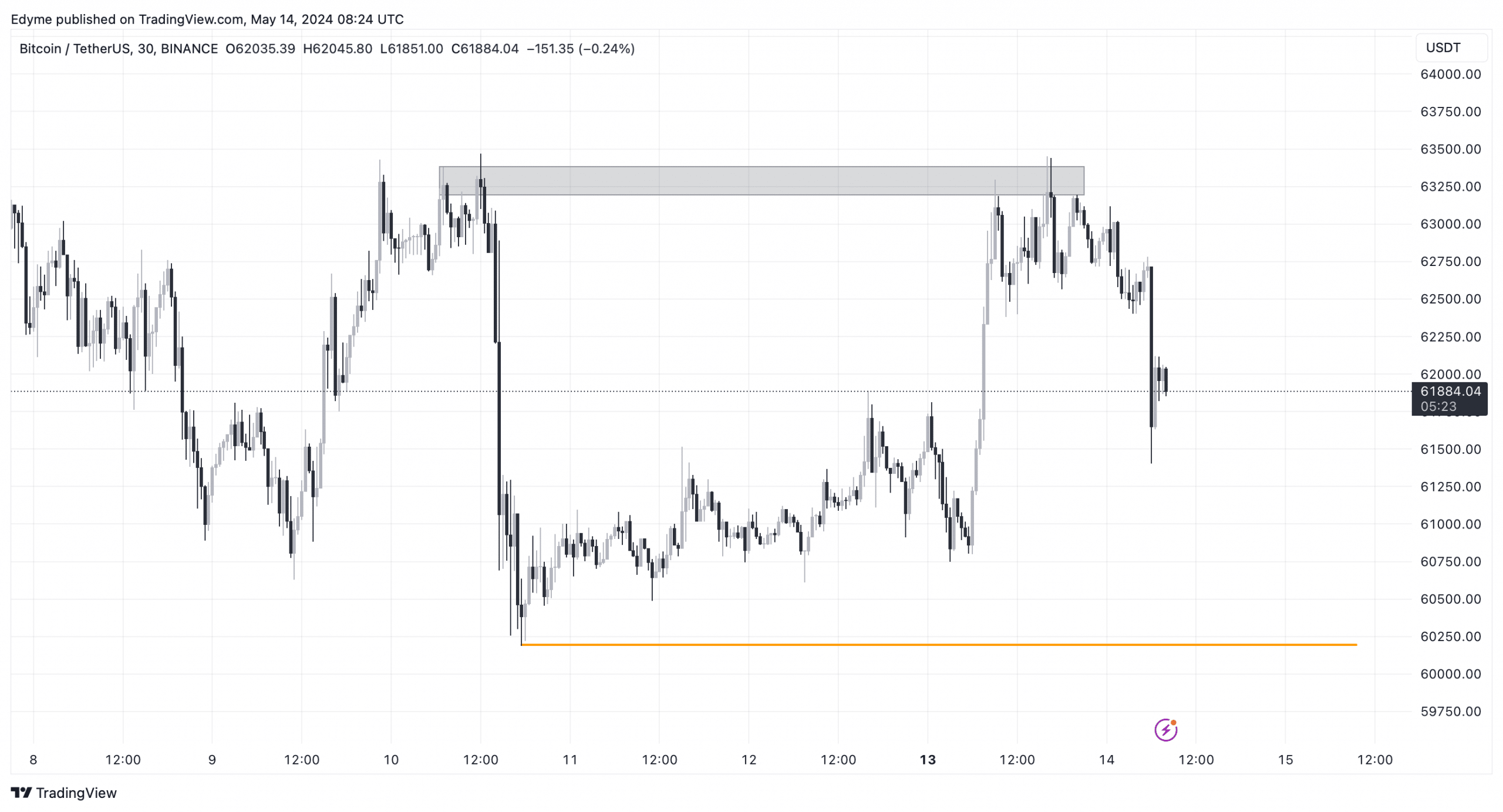

Limited-phrase assessment implies Bitcoin drew liquidity on the 30-moment chart on May well 14, hinting at a likely pullback to the $60,000 array right before a considerable upward movement.

Curious about your portfolio’s performance? Use the Bitcoin Financial gain Calculator to obtain out!

With the network’s slowdown and miner pressures, Bitcoin might be heading into a turbulent period in the current market.

Supply: TradingView

In a modern report, crypto analyst Ali Martinez implies that if Bitcoin can reclaim $64,290 as a aid amount, it could possibly pave the way for a bullish go toward $76,610.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!