Miners careful as historic Bitcoin halving update strategies

- Bitcoin’s mining hash rate encounters considerable expansion submit-halving event

- The lower in BTC’s benefit has negatively impacted profitability for miners

It arrives as no shock that the charges associated with Bitcoin [BTC] mining have surged adhering to last week’s halving, posing problems for an sector by now facing diminishing income margins.

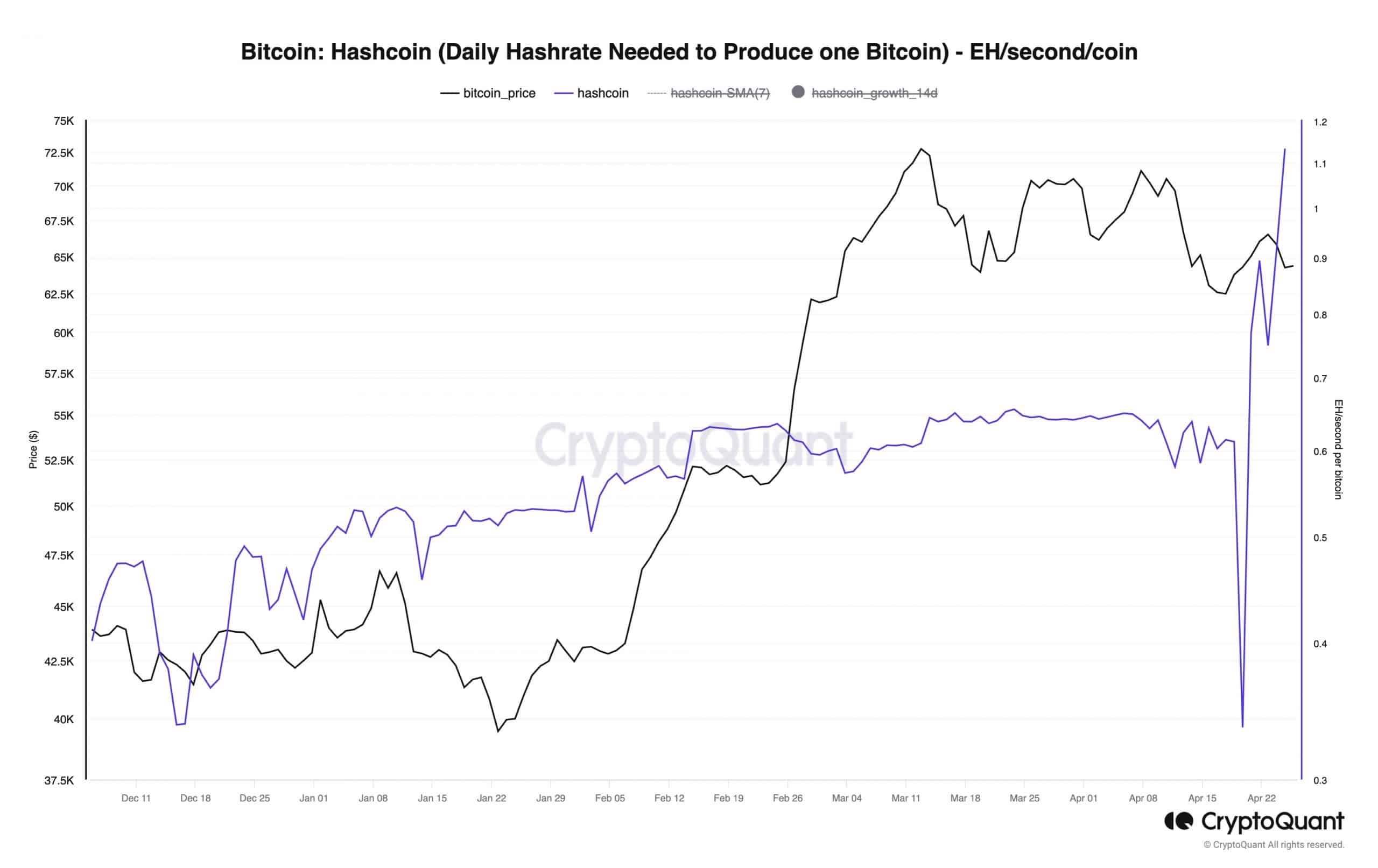

Julio Moreno, the Head of Analysis at CryptoQuant, a company specializing in on-chain analytics, observed that the hash electrical power required to produce one particular Bitcoin for every day has exceeded 1 exahash per second (EH/s) for the to start with time ever.

Resource: CryptoQuant

Worries arising from halving

The halving function impacts an critical component of miners’ income – the preset block benefits. The new halving dropped the incentives from 6.25 BTC to 3.125 BTC for every block. Fundamentally, miners now require to double their mining investments publish each halving to crack even.

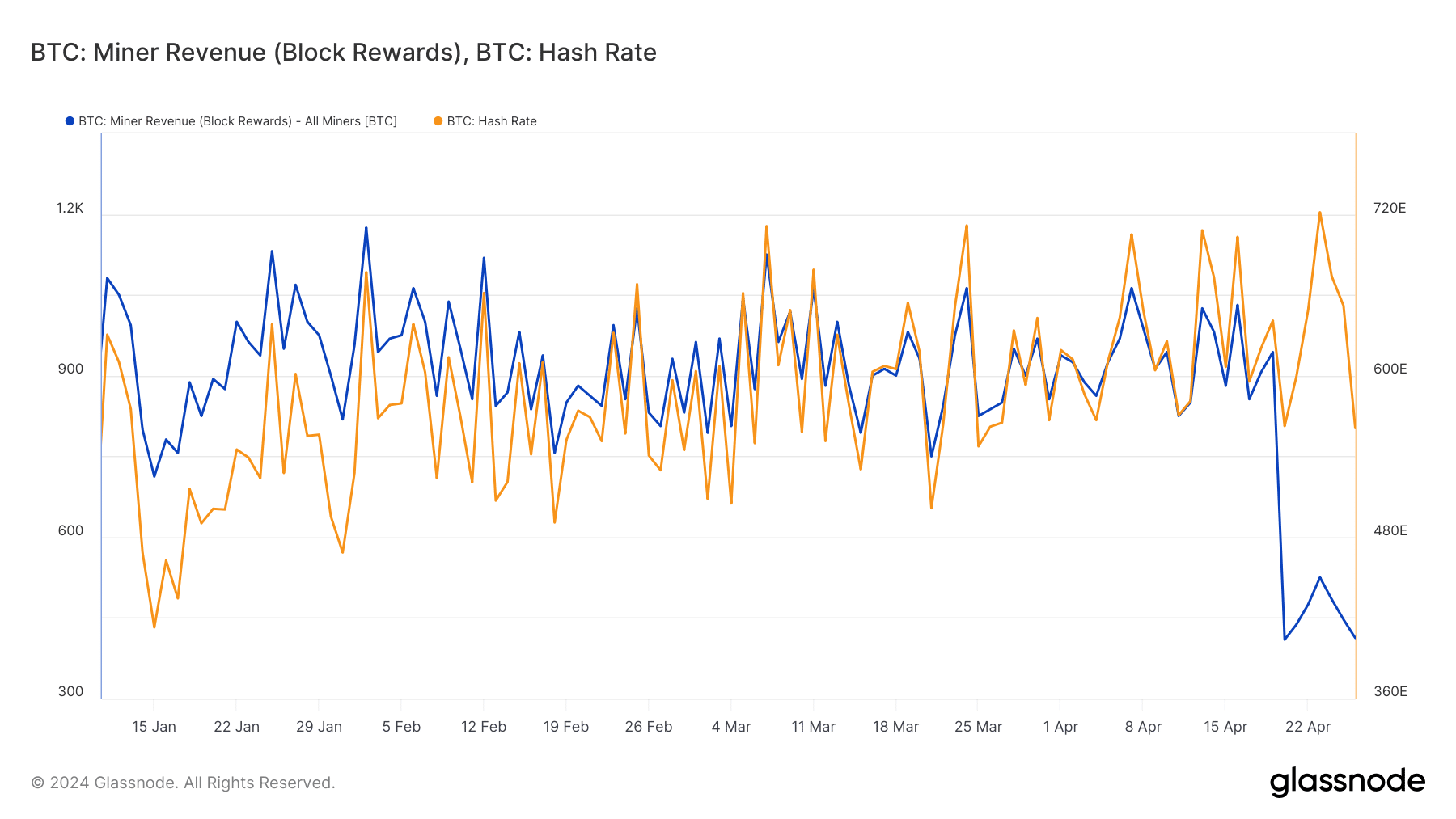

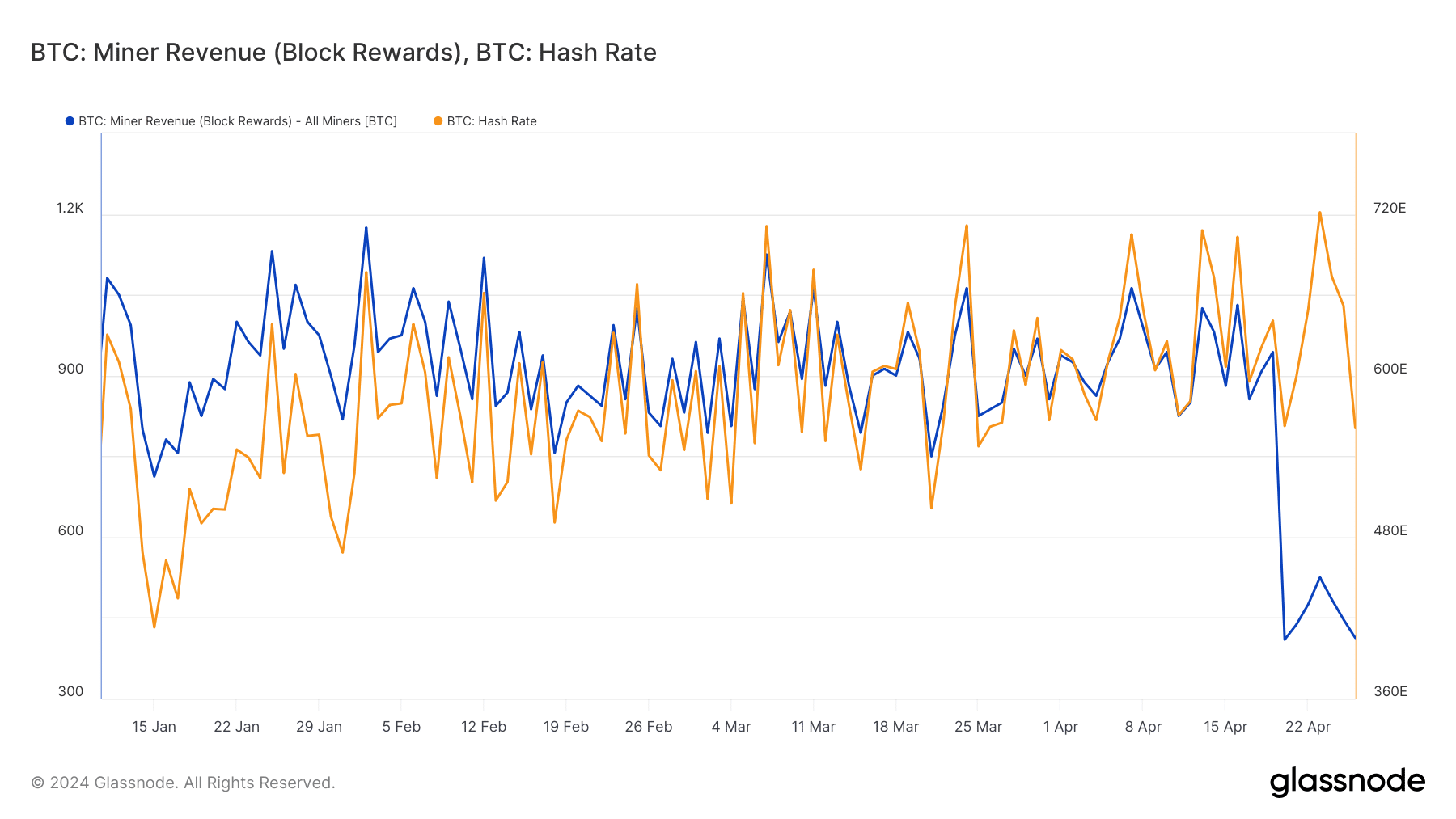

This examination was even further validated by Glassnode knowledge reviewed by AMBCrypto, showcasing a drop in the whole variety of Bitcoins made from an common of 900/working day pre-halving to a range of 400 to 500 post-halving.

At the same time, there was a substantial maximize in hash rate, reaching 721 EH/s before this week, highlighting the computational electric power necessary to produce new blocks and incorporate them into the Bitcoin ledger.

Supply: Glassnode

Impacts of Bitcoin’s cost fluctuations

The drop in Bitcoin’s market worth has additional to miners’ troubles. Following a transient surge, the cryptocurrency faced a decrease, with a 1.63% fall at the time of reporting according to CoinMarketCap.

In truth, due to this decline, the hashprice, an indicator of Bitcoin mining profitability, plummeted by 72% around the past 7 days.

Resource: Hash Charge Index

Is your portfolio eco-friendly? Investigate the BTC Financial gain Calculator

Will transaction costs present a option?

Even though block benefits might no lengthier be an effective revenue source for miners, there is optimism bordering transaction expenses.

Prior stories by AMBCrypto highlighted how the Runes protocol resulted in a significant surge in service fees promptly pursuing the halving, compensating for the losses incurred. In actuality, roughly 75% of the total miner earnings on the halving day were attributed to expenses paid by customers.

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!