The Relevance of Hong Kong in Bitcoin and Ethereum Investing – Why Traders Ought to Hope for its Achievements

- Thrilling Developments in the Crypto Current market!

- New Prospects Occur for Bitcoin and Ethereum!

Modern days have demonstrated a decrease in rate volatility for both Bitcoin [BTC] and Ethereum [ETH] just after months of major cost fluctuations.

What Lies Ahead?

This 7 days, Bitcoin expert a noteworthy lower in buying and selling activity, with volatility decreasing as investing volumes dropped from 70% to 50%.

While a lot of traders normally opt for lengthy positions during industry consolidation, the prevailing sentiment remains bearish in the direction of BTC and ETH.

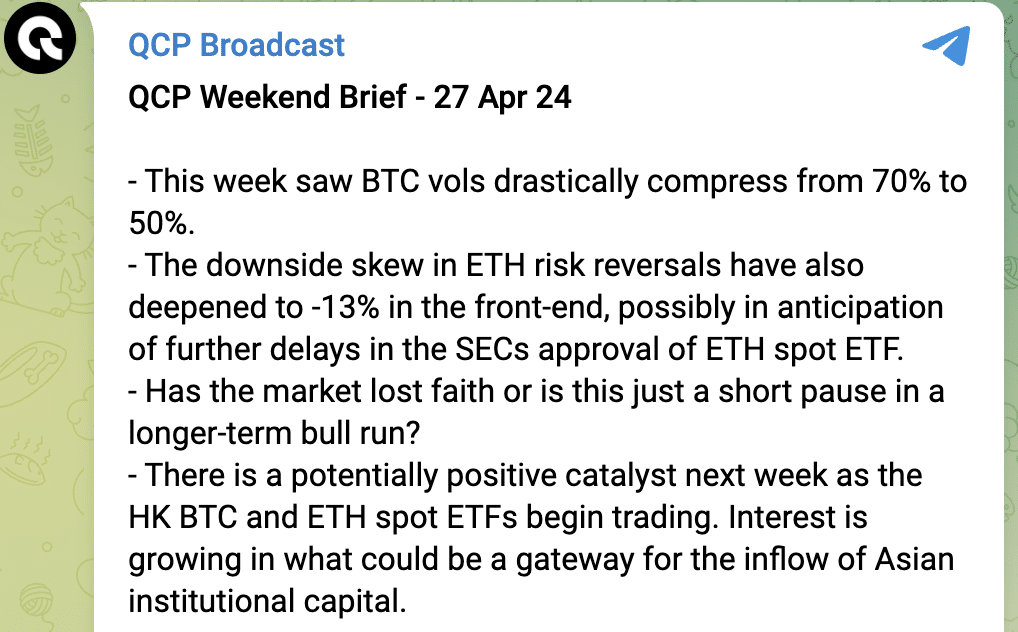

One particular motive for this unfavorable sentiment is the market’s anticipation of further delays in the SEC’s approval of a spot Ethereum ETF. This is evident in the -13% destructive skew of ETH chance reversals in the front-thirty day period deal, indicating a choice for place options over simply call choices.

The destructive skew of -13% in front-month contracts indicates a stronger inclination towards puts, reflecting investor worries about possible cost declines in the in the vicinity of long run.

Resource: QCP

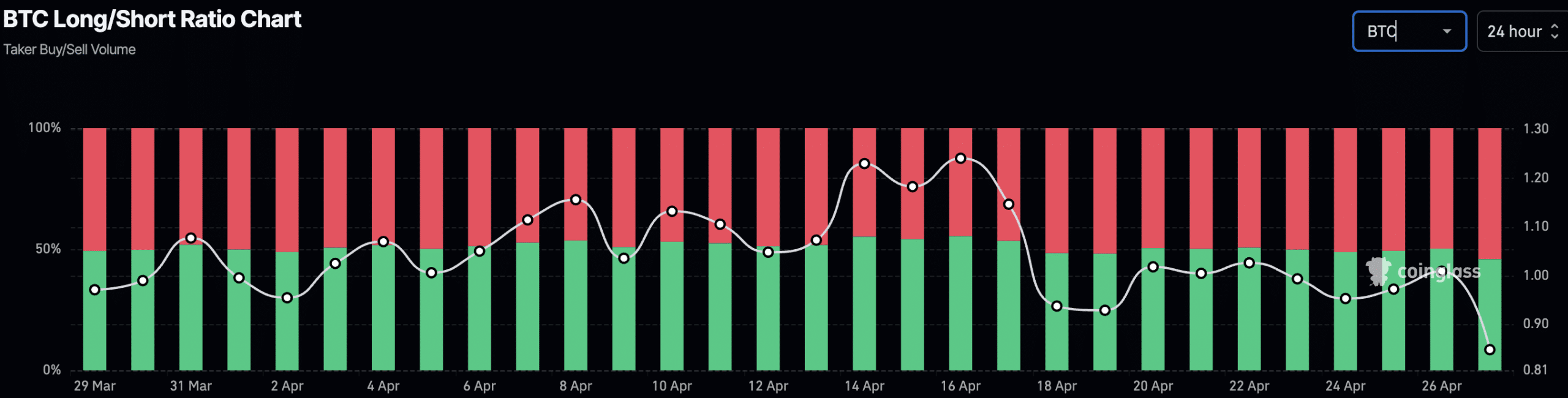

Now, brief positions against BTC have improved from 49% to 54% in the last 24 hours.

Resource: Coinglass

Searching in advance, the approaching launch of Hong Kong-based mostly location ETFs for BTC and ETH future week could draw in substantial institutional investments from Asia, possibly shifting the existing bearish sentiment.

This expected growth could lead to a optimistic switch for both equally BTC and ETH, alleviating the bearish outlook encompassing these cryptocurrencies.

A Exclusive Perspective on Bitcoin and Ethereum

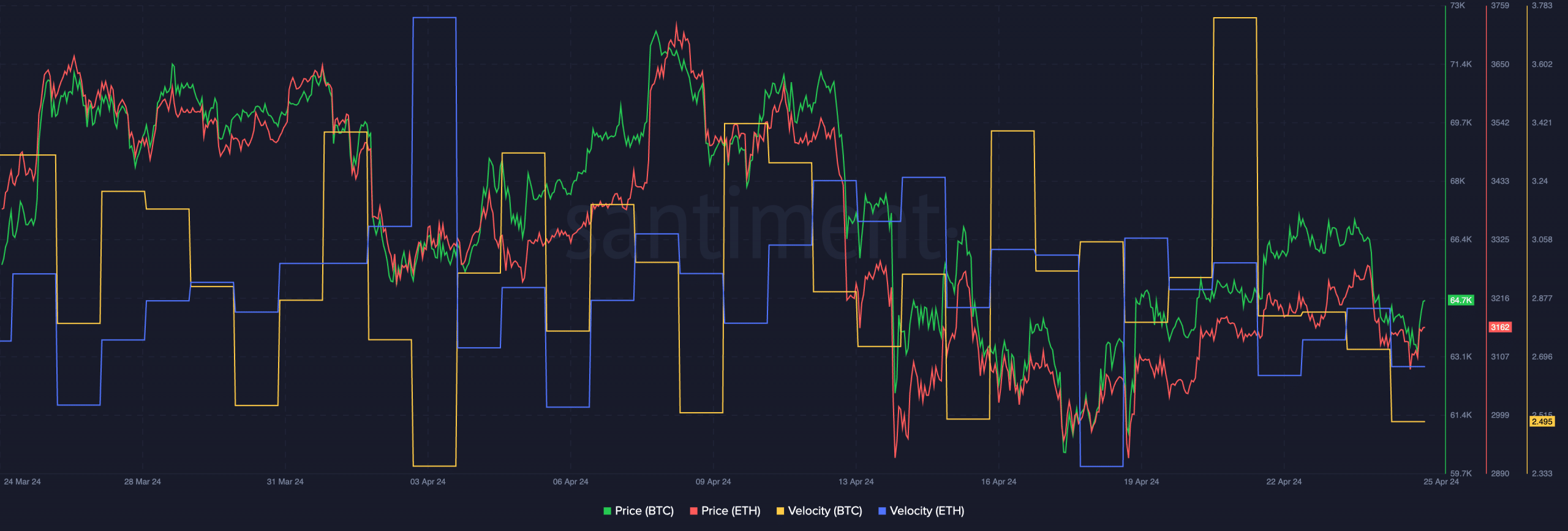

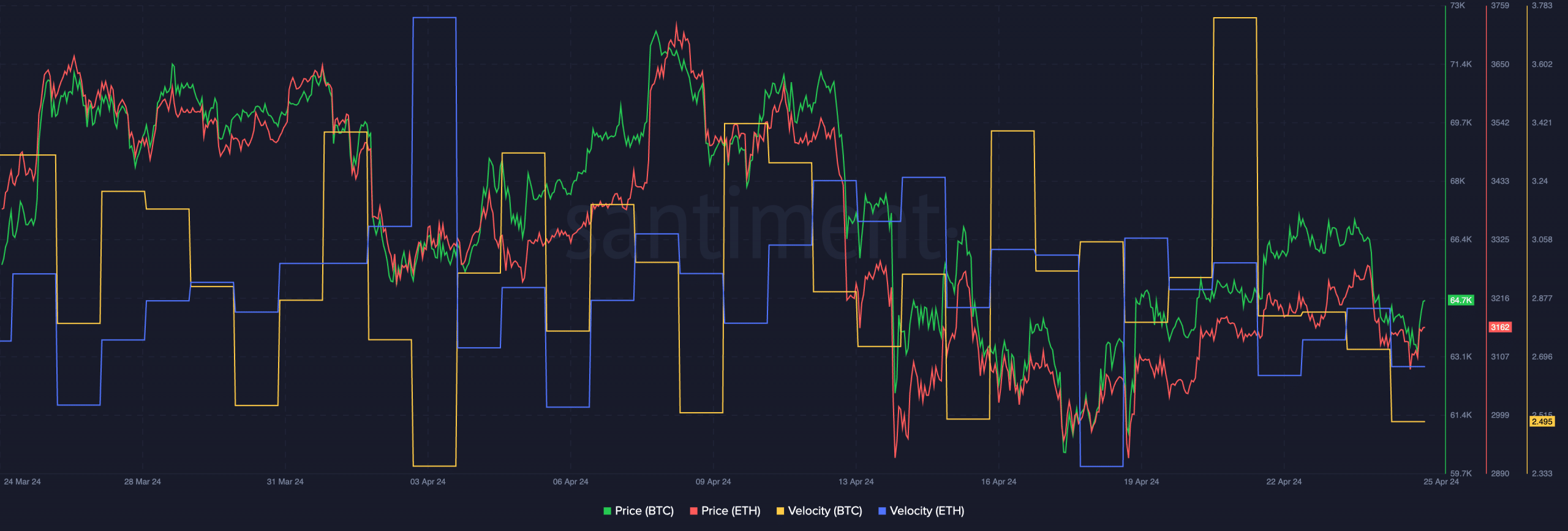

Modern weeks have proven intently aligned cost actions for BTC and ETH, with equally going through some corrections that have contributed to the prevailing pessimism towards these electronic assets. Moreover, the trading frequency of both these cryptocurrencies has lowered just lately.

In essence, the trading activity for both of those BTC and ETH has slowed down.

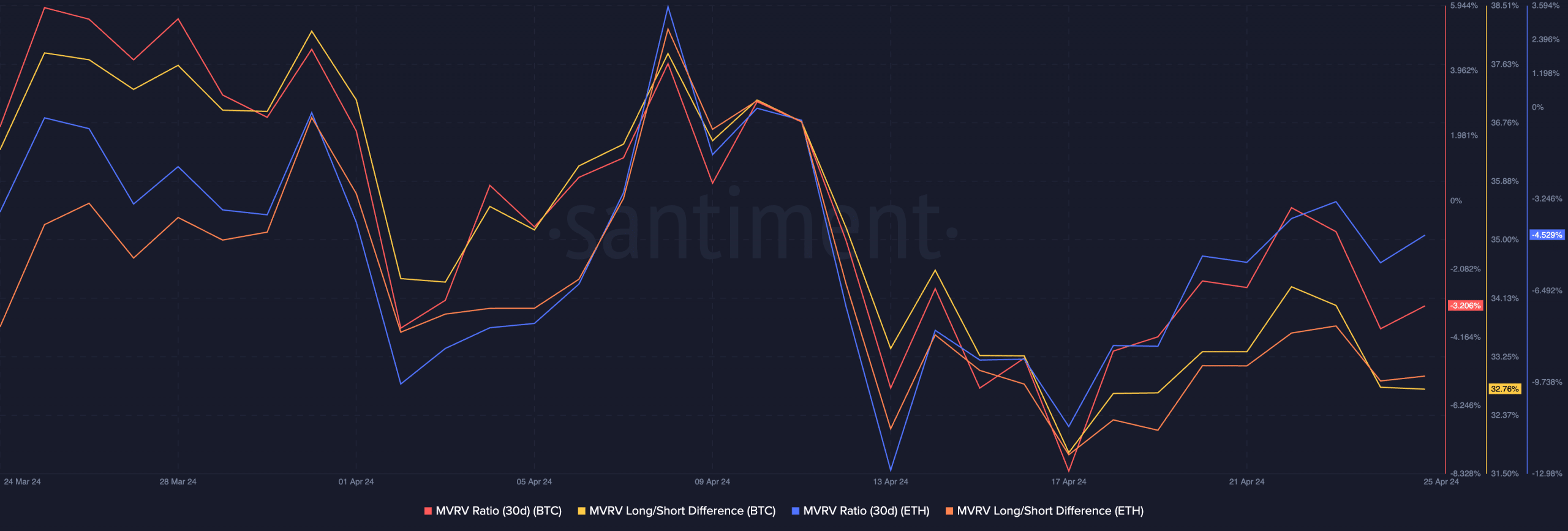

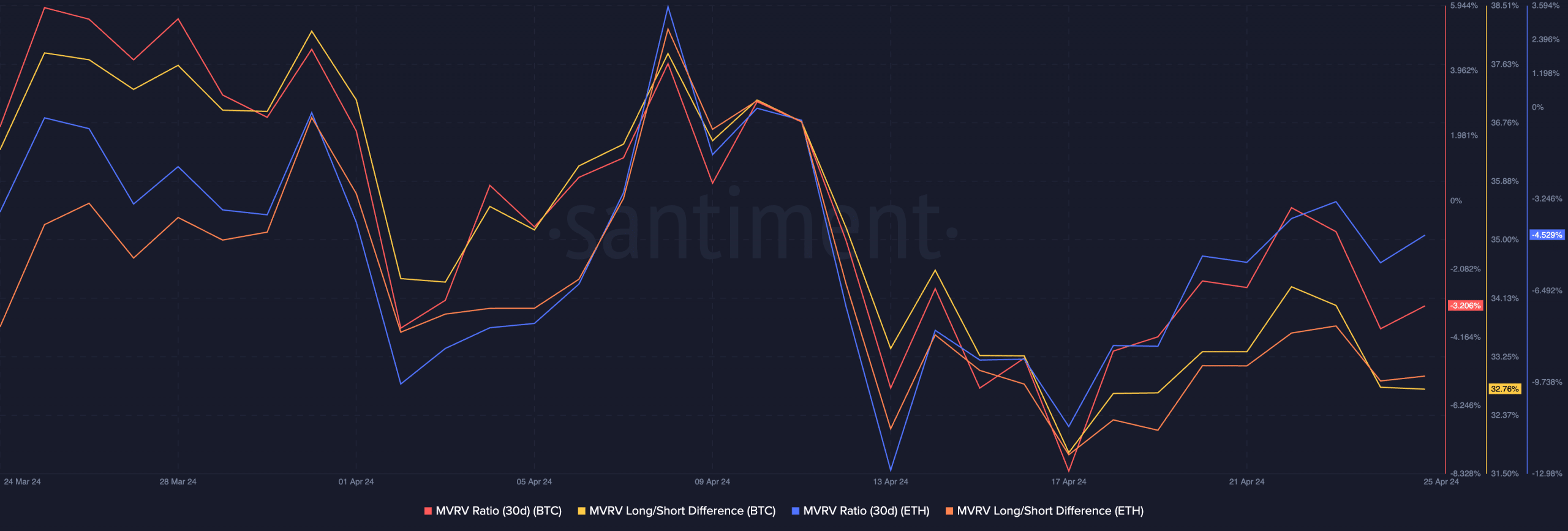

Source: Santiment

Additionally, the MVRV ratio for both equally BTC and ETH has greater, indicating substantial profitability for most addresses keeping these currencies.

On top of that, the Prolonged/Brief big difference has risen for both equally coins, suggesting a increasing amount of extended-expression BTC holders.

Are your investments prospering? Check out the BTC Revenue Calculator

Supply: Santiment

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!