Who is getting and promoting Bitcoin ETFs as fascination surges?

- Exciting News for Bitcoin Traders!

- Contrasting Trends in the ETF Sector

Greetings, crypto enthusiasts! Right now, we celebrate a great milestone in the environment of Bitcoin [BTC]. U.S. location Bitcoin exchange-traded cash (ETFs) have professional a favourable transform with net inflows earning a comeback.

Even with a slight dip of 1.98% in Bitcoin’s value above the previous day, buyers keep on being optimistic. Soon after a four-7 days streak of outflows, a overall of $116.8 million flowed into these cash very last week, signaling a renewed religion in the cryptocurrency.

Surge in Trader Curiosity

As uncertainty looms in excess of the cost, trader curiosity proceeds to expand. Notably, Bracebridge Funds designed a important $363 million financial investment in place Bitcoin ETFs, as disclosed in a recent SEC filing.

On top of that, J.P. Morgan’s consumers added $731,246 to these ETFs in mid-May. The development would not cease there, with Wells Fargo holding a considerable volume of GBTC shares valued at $121,207.

Bloomberg’s senior ETF analyst, Eric Balchunas, shared useful insights on the rising fascination in X (previously Twitter).

Source: Eric Balchunas/X

In a milestone accomplishment, BlackRock’s iShares Bitcoin Belief (IBIT) surpassed its rivals with 250 corporate holders because its inception.

The discussion all-around Bitcoin ETFs has been buzzing in the crypto community. A tweet by @SirJonasz brought focus to the acquiring conduct of major banking companies.

“They FUD #crypto in public and get in personal.”

Another person, @Vivek4genuine_, shared his ideas on the unfolding circumstance.

“We are moving into a new period.”

Resource: Vivek/X

According to The Block, Grayscale’s Bitcoin Belief observed substantial outflows very last week, though Fidelity’s FBTC led with sizeable inflows. BlackRock’s IBIT also observed inflows, although at a slower speed than before.

Retaining an Eye on Developments

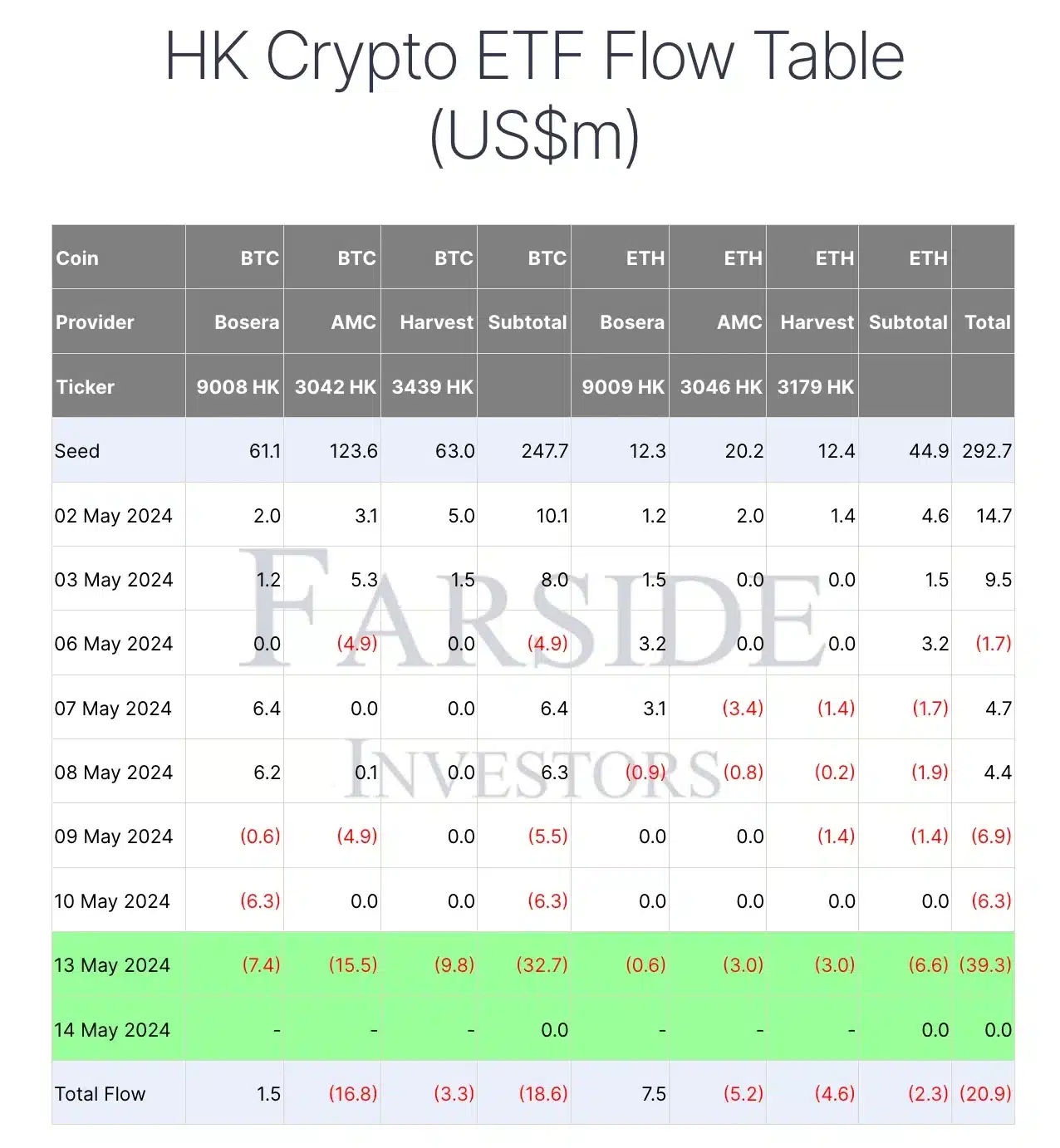

Apparently, while flows into U.S. Bitcoin ETFs surged, Hong Kong ETFs witnessed notable outflows in mid-Could. Reviews from Farside Investors highlighted the outflows in ChinaAMC, Harvest World-wide, Bosera, and Hashkey ETFs.

Resource: Farside Investors

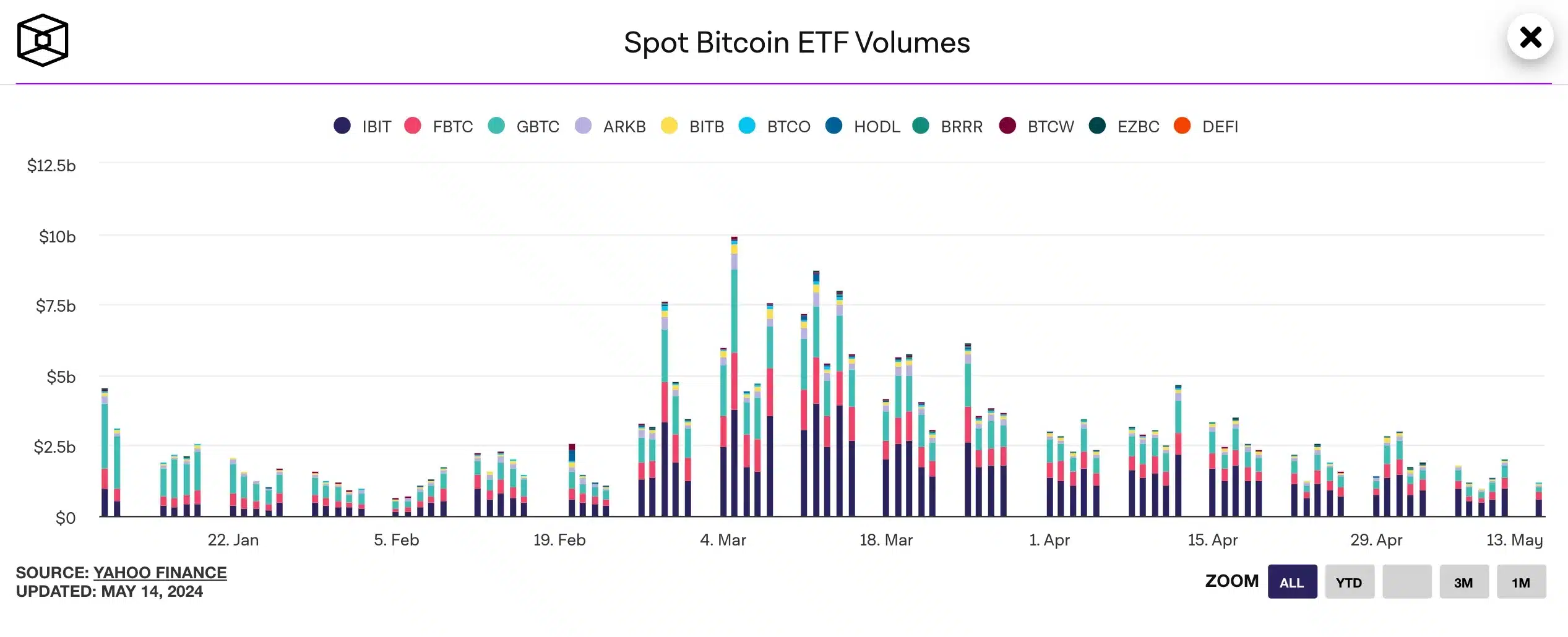

Also, despite the optimistic move trend, investing volume for U.S. spot Bitcoin ETFs took a dip past 7 days. The world wide crypto trade-traded products market also witnessed a drop, suggesting a shifting landscape.

Resource: The Block

As we navigate by means of these changes, a person dilemma lingers – Could institutional investments in Bitcoin ETFs redefine the entry stage into Bitcoin for a lot of?

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!