Institutional Traders Increase Crypto Allocations Owing to Bitcoin ETFs in the US

Fascinating news from the globe of institutional buyers and crypto! The initial quarter of the year saw a surge in desire from major players hunting to get a piece of the digital asset pie. Thanks to the introduction of US-centered spot Bitcoin trade-traded money (ETFs) in January, these investors have been flocking to boost their digital asset allocations, now achieving as high as 3% in their portfolios. This is the greatest level we’ve viewed given that 2021 when this survey commenced.

What is actually driving this newfound curiosity? Perfectly, many buyers are pointing to dispersed ledger technology as the critical element. They’re also observing digital assets as a terrific price proposition, with an elevated need to use BTC as a diversification software.

Bitcoin: Nevertheless King of the Hill

Unsurprisingly, Bitcoin remains the best alternative for institutional investors’ portfolios, with about a quarter of them now keeping exposure to BTC by way of location ETFs. Ethereum arrives in next, nevertheless its popularity seems to have dipped a little bit considering the fact that the last survey.

Investors are confident that both equally BTC and ETH have the most promising development probable in the digital asset globe.

On the rise is Solana, attaining reputation and attention from investors who are intrigued by its remarkable growth and adoption charges. Its allocation has soared to 14%, thanks to some massive players who are ramping up their investments in this dynamic blockchain community.

On the other hand, XRP would seem to be dropping favor, with none of the surveyed traders mentioning holding it.

Worries Ahead

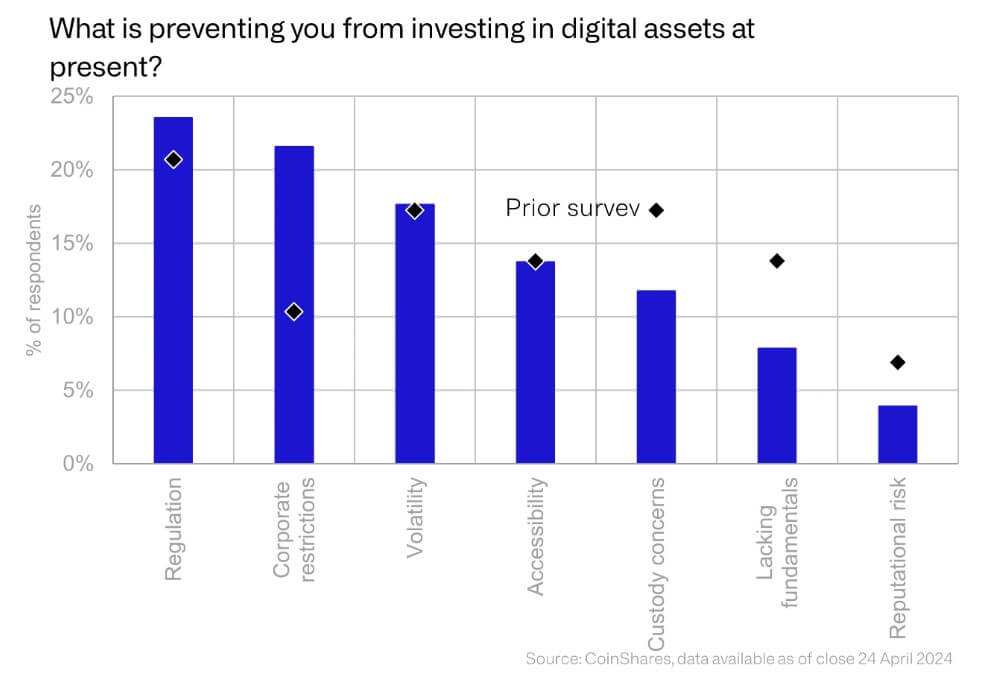

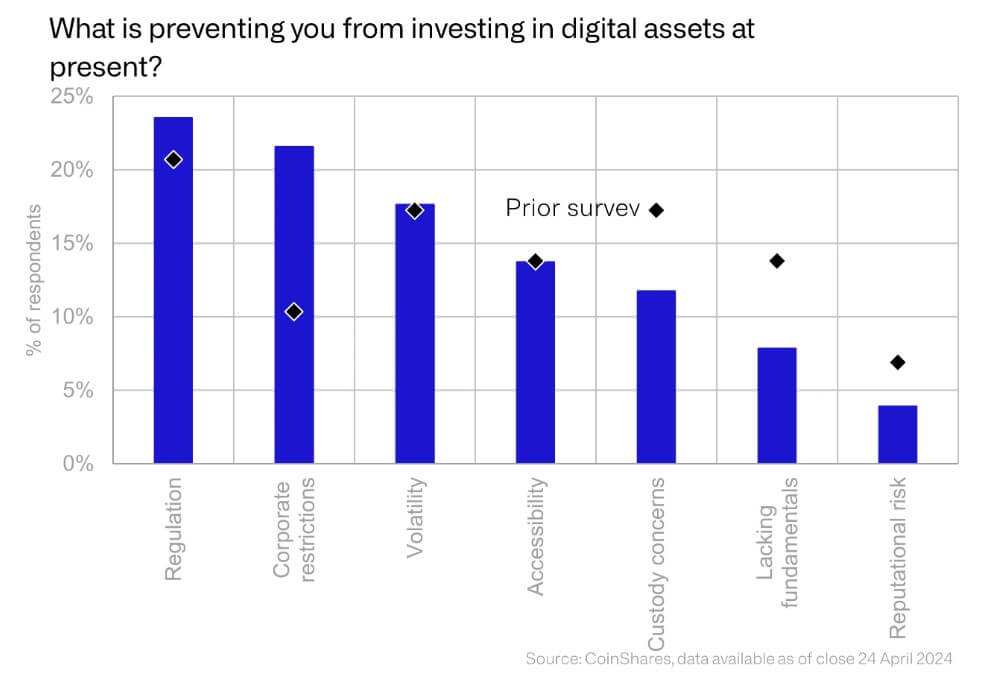

Irrespective of the enthusiasm for digital property, a lot of buyers are nevertheless grappling with obstacles to entry. Regulatory problems are topping the list, specially in the US wherever fiscal watchdogs like the SEC are cracking down on key players in the crypto space.

Volatility in the current market stays a worry for some traders, along with issues associated to custody and popularity pitfalls. Nonetheless, the superior information is that these fears appear to be to be steadily fading absent, paving the way for far more traders to sign up for the crypto revolution!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!

Flat 50% off on trading fees for the first 1500 early birds: Click here to join now & claim your reward!